Also see:

- Airbnb by the Numbers: An Update for 2016

- How I Made an Extra $60K from Airbnb in 2015

- Airbnb: Us and Them

Thought it was time to do an update on my Airbnb hosting. And the state of it. Mostly because if the numbers look good, I might get another one.

Long ago, I started my Airbnb operation in New York, which was a smashing success. Until it wasn’t. I no longer have properties in New York, as of last month.

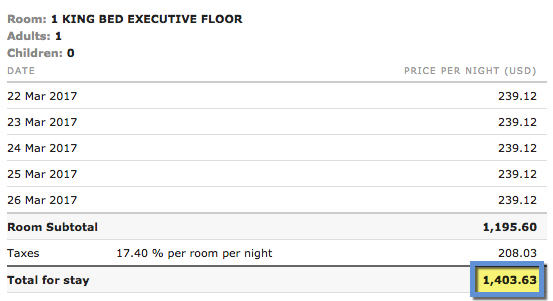

So far it’s going well in Dallas. I have two here. They’re easy to track and manage for what they are because they’re on two separate profiles.

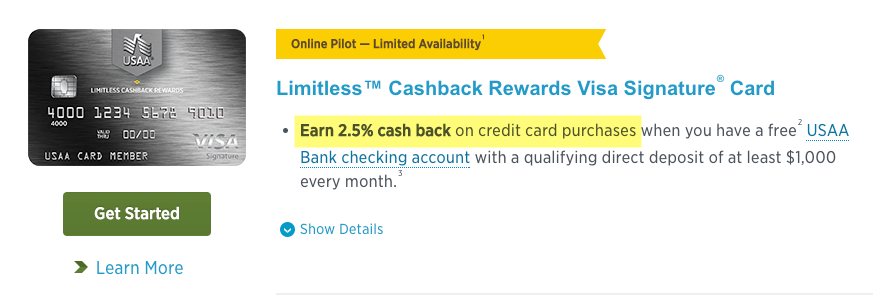

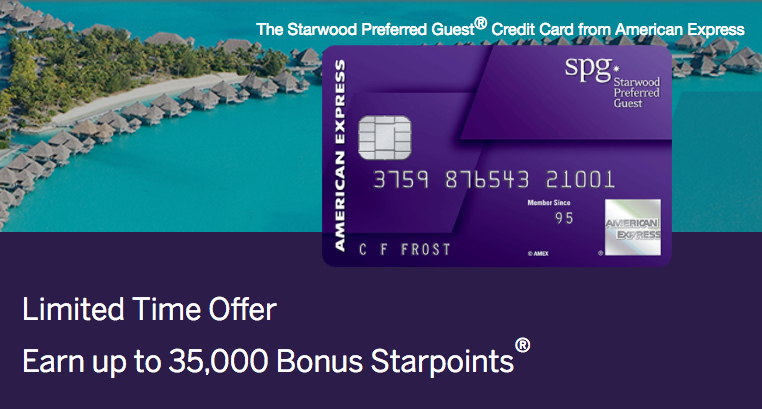

In my opinion, a side business is the best way to maximize credit card points these days. I easily put $6,000+ of expenses on my cards each month – and the bulk of that is in bonus categories.

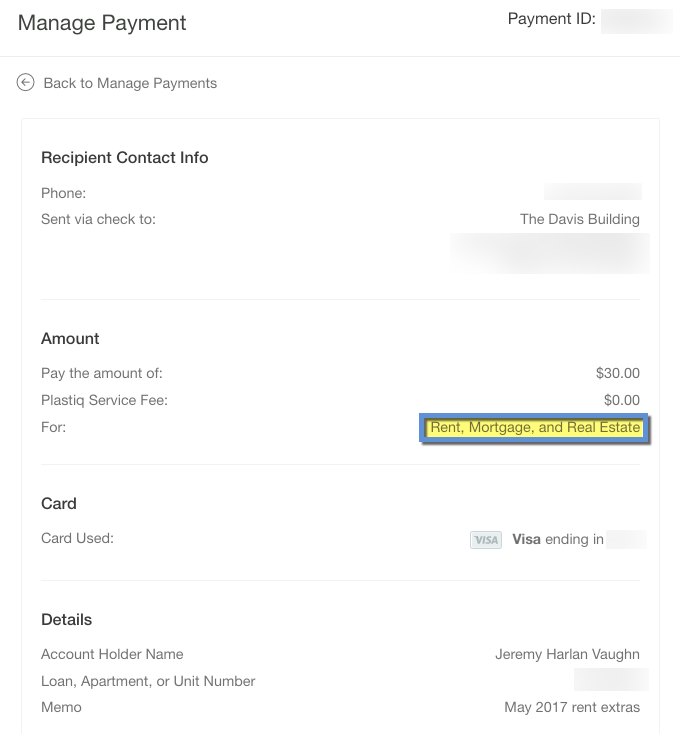

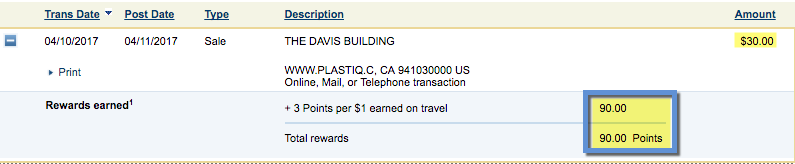

I recently found out some rent payments code as 3X for “travel” with the Chase Sapphire Reserve. So that’ll keep me with an extra ~20,000 Chase Ultimate Rewards points per month – a handy ransom (if they all code as 3X)!