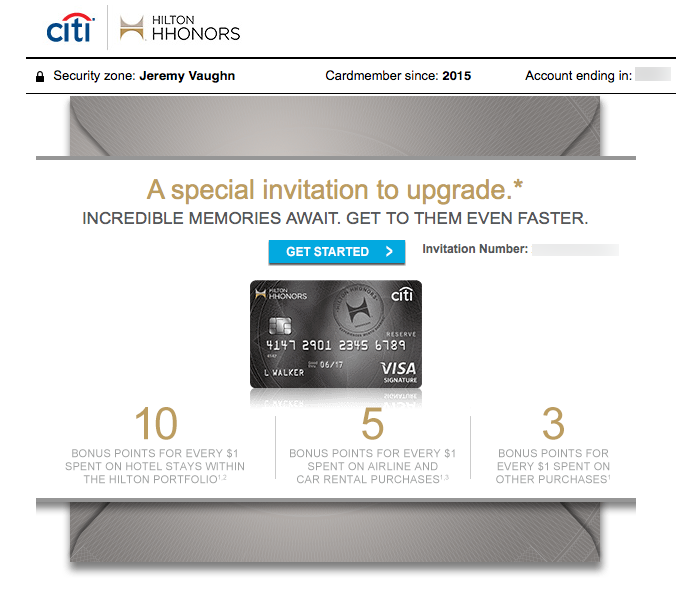

This morning, I got an email from Citi with an offer to upgrade my no annual fee Citi Hilton Visa to a Citi Hilton Reserve with a $95 annual fee.

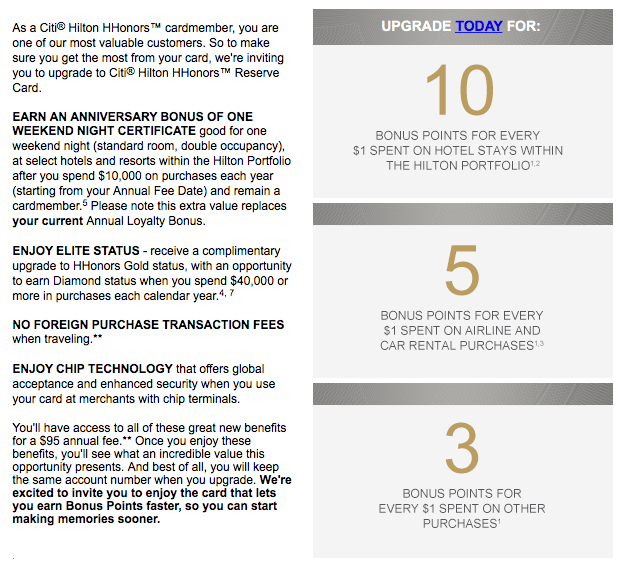

The email subject was, “Upgrading your card means enhanced benefits.” I was excited because I’ve never seen an offer from Citi like this. So I was hoping to score some bonus Hilton points in the process. But, all you get with this offer is “One Weekend Night Certificate Opportunity and Gold Status.”

Ya know, nah

Thanks but no thanks. This isn’t a good deal with no bonus points involved. But I’m glad Citi is trying new things.

I also don’t know if they’re sending out targeted offers with this card or others, so it’s worth checking your email and junk folder to see if anything is in there.

Upgrade Citi Hilton Visa

I’ve long said you need at least one card without an annual fee. Because they’re free to keep forever, they essentially sit around and help to increase the overall age of your accounts, which can boost your credit score. If you don’t use them, they also help reduce your debt to available credit ratio on your other cards.

Plus, if you have a no annual fee card you actually enjoy, like Discover it or Chase Freedom, even better.

So right away, it would take me some convincing to ditch a no annual fee card for another with a $95 annual fee. The incentive I was looking for was, of course, pernts!

All this offer does is extend the existing perks of the card without any type of bonus.

I don’t want to spend $10,000 to earn one free night. And I already have Hilton Gold elite status through other avenues. And telling me there are no foreign transaction fees isn’t a benefit, it’s an expectation.

Also, if you upgrade this way, you will lose the ability to earn the sign-up bonus on the Citi Hilton Reserve card, which is 2 free weekend nights at most Hilton hotels. And, Citi will treat this as a newly opened account which will reset the “family of brands” 24-month clock if you want to earn another Citi Hilton sign-up bonus in the next 2 years.

Overall, it’s kind of a bad and sneaky offer with little benefit unless you want to spend $10,000 to earn a free weekend night. Hard pass.

Bottom line

I like to see card issuers try new things. Some of them work, some don’t. We’ve seen a craptacular offer from Amex recently. And Citi blew its chance to compete with Amex Offers.

However, other (hopefully better) offers might be out there, so it’s worth checking your email or Citi account. A step in the right direction, but no dice. I hope Citi works out their growing pains because Chase and Amex are currently duking it out. And there was a time I was spending almost exclusively on Citi cards. But I’ve spread it out a lot with the current category bonus environment.

If you got a similar offer, please share! I’m curious if Citi is sending out other versions of this offer, particularly with other cards.

- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply