Also see:

- I’m dumping the Chase British Airways Visa – and you should, too

- Loving Citi More Than Ever – Time to Cancel Other Cards?

- Update: Denied for Chase Freedom Unlimited – DIAF!

UPDATE 3/31: I was denied. 🙁

Chase will soon (in April 2016) extend their restrictive 5/24 rule to all their card offerings, including co-branded and small business credit cards. And presumably to the new Chase Freedom Unlimited card when it launches online.

The 5/24 rule means if you’ve opened 5+ cards within the previous 24 months, you’ll be instantly denied for a new Chase card. I’m suddenly no longer their target market.

It’s the last week of March, which means this is my last crack at opening up that Chase Marriott Premier card or a Chase Ink Cash, for example.

Instead, I went with the Chase Freedom Unlimited, which will be available for online applications on April 7th, 2016.

However, you can apply in-branch or over the phone right now. (Or at the bottom of this page.)

So today, I strolled over to the Chase bank 2 blocks away on my lunch break (I still haven’t grocery shopped since getting back from Vipassana) and applied in-person for the new Chase Freedom Unlimited.

I love how the acronym for this card is, endearingly, FU.

Why I applied for the Chase Freedom Unlimited (FU)

- Link: Chase Freedom Unlimited – Compare it here

| Chase Freedom Unlimited® | • Earn an additional 1.5% cashback on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cashback |

|---|---|

| |

| • $0 annual fee | After, earn unlimited 1.5% cashback on all purchases |

| • Great for everyday spending | • Compare it here |

In short:

1.5 Chase Ultimate Rewards points for all purchases, with no cap!

And, the points transfer 1:1 to Chase Ultimate Rewards transfer partners like United and Hyatt, if you have the Chase Sapphire Preferred, Chase Ink Plus, or Chase Ink Bold.

That’s the best earning rate on non-bonus spend of any card that earns Chase Ultimate Rewards points.

I’d value that earning rate for the long-term above any current (one-time) sign-up bonus because of how flexible Chase Ultimate Rewards points are.

Because I always make sure each of my points are worth at least 2 cents each, so that’s equal to 3% back to me. Which is great for a card with no annual fee.

Even better, it seems that phone and online applications for the Chase FU are immune – for now – from the 5/24 rule. But I fully expect this rule to be enforced by the time it launches online April 7th, 2016.

So if you’re interested, apply in the next couple of weeks!

Not instantly approved

The Chase banker I met with was very up-to-date about the new Chase FU card.

He was, of course, more than happy to process my application.

I’ve heard of many peeps getting approved instantly in-branch, which gave me hope.

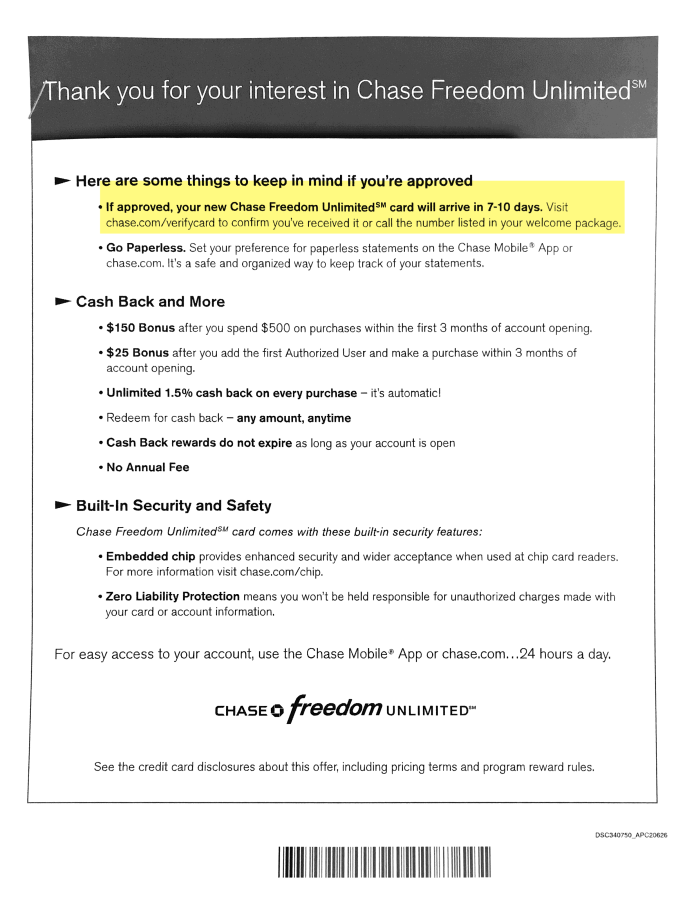

But, I was told I’d hear back in 7-10 days regarding a decision. Drat!

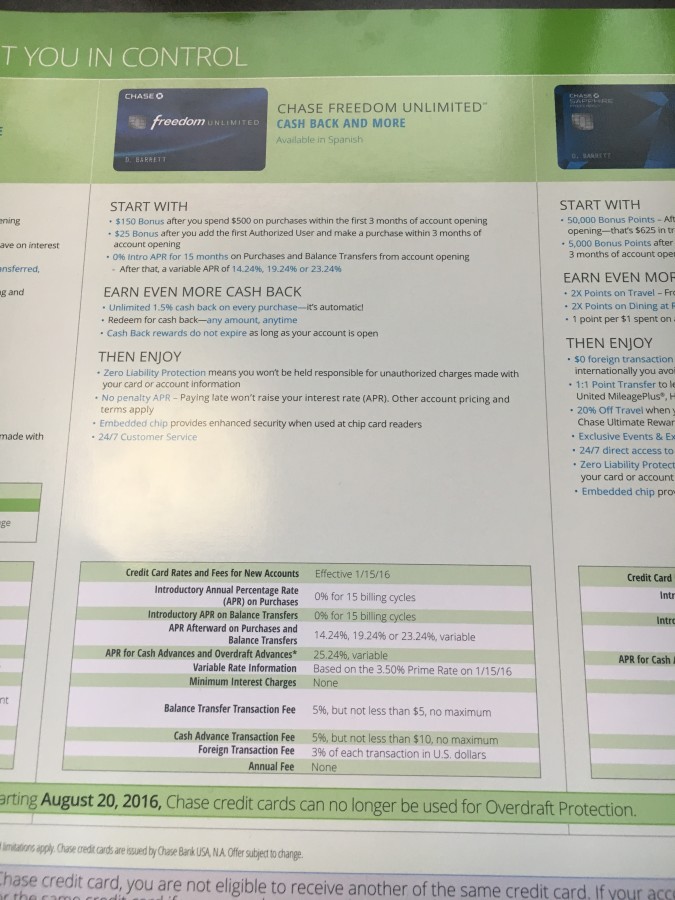

I did, however, confirm the sign-up bonus of 15,000 Chase Ultimate Rewards points ($150) after spending $500 within the 1st 3 months.

I was really hoping for an instant approval so I wouldn’t have to worry about it. Plus, it’s a Freedom card, which doesn’t require an excellent credit score – and mine is well over 750 at the moment. So theoretically, I should’ve been a shoo-in.

I called the reconsideration line to see if I could usher this toward approval, and the rep was ice cold. Told me the same line about “wait for a decision.” Which is probably better, because at least they didn’t deny me.

Chase really does seem to be tightening up fast.

With that thought, I do believe right now is your best chance to get this card if you’re interested. Call a Chase rep from one of your current cards, or visit a branch to apply. They are definitely aware of this card, and of the new rules.

Bottom line

- Link: Chase Freedom Unlimited – Compare it here

Really starting to rely on Citi more and more for my spending and credit needs.

Chase is erecting a wall a mile high. AMEX has a once per lifetime rule on all cards now. And even with Citi, I had no luck getting a $350 annual fee on Citi Prestige by applying in-branch.

I’ll let you guys know if I end up getting the Chase Freedom Unlimited card – cross your fingers for me!

Either way, this last dance with Chase is aptly named, for both of us: FU.

FU, too, Chase. 😉 I love Ultimate Rewards, but this is just getting gross.

Let me know if you have’ve had any experiences with Chase lately, or the new Chase FU card! And here’s the link if you want to compare it.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I have applied IHG, Southwest premier & Southwest Business within the past 40 days. Do you think I can apply for Freedom Unlimited also? I have 7 Chase cards currently.

Were you approved for all of them?

That might be pushing it. But if you can spare a hard pull, this might be your best/last shot.

Yes, I got approved for all of them. IHG & SW premier were instant approved. SW business took 1 day to be approved and I didn’t bother to call the recon. With both SW premier & business, I only need additional 6000 points for Companion Pass.

I can spare a hard pull to apply Freedom unlimited next week in branch. The worst thing is I can convert my existing Freedom to Freedom unlimited after I completes $1500 grocery spend in the first week of April.

Congrats, that’s awesome!

That sounds like an excellent plan. I plan to keep both versions of the card, assuming I get approved. They play nicely off each other.

I think it’s worth a shot by applying in-branch (or on the phone). Whatever you decide, try to get in before April 7th.

If you think of it, let me know what happens! Fingers crossed for you!

What’s the number to call to apply over the phone?

Oh! I just called the number on the back of my CSP. You could also try 888-245-0625 to speak with a credit analyst.

What makes you think its exempt from the 5/24 rule? I haven’t sen that anywhere else, i’ll be ecstatic if that’s true

Not forever, but it seems to be exempt for now. Probably because it’s still so new. Lots of reports from peeps who’ve had luck, even with several new cards in the past couple of years.

Definitely not exempt. Applied for 2 chase cards today–instantly denied for Freedom, got the other cobranded card. My credit score is 824 with flawless history. So disappointed in Chase–particularly because the person on the phone was not customer service oriented and I’ve heard other reports of this. Are they trained to be curt? Will focus on other banks now even though I really liked Chase.

Congrats on getting the co-branded card! And yup, focusing elsewhere now. Bye, Chase!

I have 2 southwest cards, (for the companion pass) does anyone know if I can pc one of them into the new Feeedom unlimited. I know I wouldn’t get the $150 sign up bonus but would I get the 0% interest? I am well over the 5/24 so I don’t want to take the chance of applying. Thanks.

I don’t think that would work because it’s a co-brand card and the Freedom Unlimited is an UR card. But you can always try to call and ask. Worst they can say is no.

So if I previously have a Freedom CC and got the new FU card this time, the new FU card won’t give the $150 start-up bonus?

They’re considered totally different card products, so you CAN earn the sign-up bonus on the Freedom Unlimited card. Even if you already have the Freedom.