Sorry for the hyperbole slash clickbait-y title. I thought I was being on trend.

But seriously, I love this card. I’m close to being obsessed with it:

- Cut the Crap: The Fidelity Investment Rewards Credit Card is THE BEST cash back card!

- The 10% Plan: Save 10 Percent of Everything You Make

- One More New Credit Card: Fidelity Investment Rewards American Express

We all love our points and miles. But I’ve been reading about straight cashback cards for a sec now, and the poor Fidelity Amex always gets swept under the rug.

Well no longer. This card is a gem. It has so much going for it. And it might just be the ace in the back pocket of cashback cards, which by default makes it the best cashback card in the universe.

Let me extoll the ways

Here are a few things this card has going for it.

It’s an American Express card not issued by Amex

That’s pretty rich right there because you can use it to load up your Serve account. There are no cash advance fees and Serve reloads code as a purchase. Load up $1,000 a month and get a smooth $20 for free. After a year, that’s $240 for a few minutes of effort.

Now that REDbird is dead, take the free money!

The fact that it’s an Amex also makes it eligible for Sync offers, Small Business Saturday, and Amex purchase protection.

It’s a fascinating little card

An American Express card issued by a Bank of America subsidiary and linked up to Fidelity? What?! I’d love to know how this card was born.

I’m pretty sure that Bank of America will eventually manage this card. They have a few other Amex cards that they issue, so that’s not news. What is puzzling though is that Bank of America offers many of the same services that Fidelity does (brokerage accounts, IRAs, checking accounts). By having this card, they would essentially deflect business away from their own products, which is bizarre. I don’t claim to understand it, but I do find it fascinating.

It doesn’t have an annual fee

The Barclaycard Arrival Plus is $89 per year. It’s a fine card, has a portal whereas the Fidelity Amex no longer does, and the redemption is mad easy, which is great. But for me, not having an annual fee and being able to earn an easy $240 far outweighs the portal and the points redemption in 1 category.

I won’t even mention the Discover It cards, or the Citi Double Cash. There’s really no comparison as they are straight cashback cards whereas the Fidelity Amex has something far greater.

Rewards are tax-free and can grow tax-free… forever!

Really think about this. This really blows my mind. This is the ace in the hole right here.

You are earning free money that you never pay tax on when you contribute it to a Roth IRA, which you also never pay tax on. Roth IRAs are supposedly funded with post-tax money, meaning you’ve already paid the taxes to the government, and then you don’t pay taxes when you withdraw it.

But that’s the kicker. You never pay any sort of tax on the Fidelity Amex rewards. It’s free money, unfettered by taxes, and the rewards can be auto-swept into a Roth IRA, which will also grow tax-free for perpetuity (until you withdraw it).

That has got to be the single biggest and most valuable draw for this card.

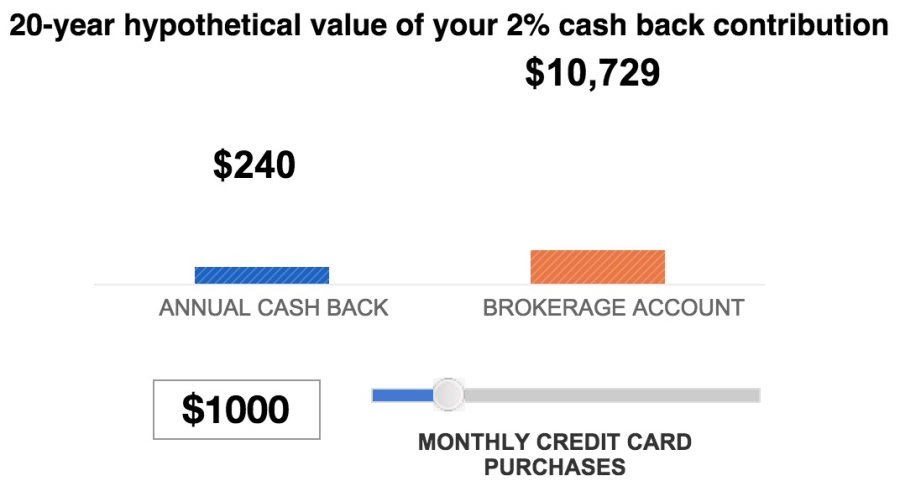

Even if all you do is load up your Serve account, you’d have over $10,000 after 20 years @ 7% growth, which is really realistic actually.

$240 a year for 20 years is $4,800. But by investing it, you come out with nearly $11,000. That’s more than double the cash that can be withdrawn tax-free. Assuming these calculations all hold, this 2% cashback card suddenly comes a lot closer to being a 5% cashback card, which is awesome. The catch is that you have to wait 20 years. So you really have to think about Future You vs You Right Now, which is hard for some people to conceptualize.

But also consider that if you’re maxing out your Roth IRA this year, $240 for free and untaxed is a nice extra – especially if you’re funding it with mostly post-tax money.

And that’s only assuming $1,000 per month with Serve reloads. You can obviously spend more on the card and can add up to $5,500 this year to a Roth IRA.

It happens automatically

This cannot be overstated. Your rewards, once you reach 5,000 points, are auto-swept into your Roth IRA (or checking or brokerage) account. You set it up once and it just… happens. No effort on your part. You can, of course, change it at any time. But if you set it up once and forget it, it happens for you without any extra steps required. Automation is powerful.

It has a signup bonus right now

Yep, a $100 signup bonus.

It’s not huge or anything, only $100, but that’s $100 more than you usually get for opening this card.

Also, the minimum spending requirement is only $1,000 and you have 90 days to do it. You could knock that out with 3 days of Serve reloads and then pocket that cashback, too.

It will age your credit reports

Since it’s a no annual fee card, you can feel good about holding on to this one forever. The longer you have it, the more it will help to age your accounts and improve your credit score.

I’d recommend using this with Serve while the getting is good, but even when that goes away, you can still hold this card and it’ll help you even if you never use it again.

It has promos… sometimes

FIA, the issuer of this card, is so cute. They try to have promos and spend bonuses sometimes. They’re usually nothing to write home about, so it’s cute in the little-engine-that-could kind of way.

But who knows, one day they might run a really awesome promo… and give you more free money to invest tax-free.

The cons

Gasp! There are cons?! Well, yeah. But they’re not terrible, actually. Here’s what I’ll say. FIA makes it hard to MS. They flag everything as fraud. In the Vanilla Reload days, I got it to the point where I could go to CVS without fear of them flagging it, but it took many calls and a little time.

Also, it has a foreign transaction fee. It’s only 1% and earns 2% cashback on everything, so you get 1% back when you use it internationally. But it’s not a good prospect. There are better cards to travel with. But still, 1% is better than using a debit card.

The cashback thing might not last forever. At present, it’s been extended until early 2016 and then? Who knows. It’ll most likely be renewed, but there are no guarantees.

Still, I feel like FIA will want to maintain this product. And I’d also like to be grandfathered in if they ever change the core offering of the card in any way.

Bottom line

Ah, the FIA Fidelity Visa. I love this card.

When I’m not using points and miles credit cards, or the Barclaycard Arrival, meeting a minimum spend, or taking part in a promo, sure… I’ll throw a little spend on this card to earn some free money that will grow tax-free and eventually be withdrawn tax-free after taking advantage of sweet, sweet compound interest for 30 (or so) years.

And that reason alone is why this is the best cashback card in the universe.

So what do you guys think? Is this card awesome or am I drinking the Kool Aid? Does anyone else like this card as much as I do?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

So, you’re saying that Serve Amex loads are going to be around for 20 years? I’m going to hold you to that.

Lol, to be sure Serve will not be around in 20 years. And neither will the Fidelity Amex. I do think the Fidelity Amex has a good 5 years of life though, and there will be other ways to make “purchases.”

Right now though, while the getting is good, this is great! Enjoy it while it’s still there. And you do get to keep the Roth IRA money for 20+ years!

The only thing that I find interesting are the Serve loads – I already have a Vanguard account that automatically pulls from my checking account, and have both Roth and Standard IRAs on another service. I so wish Vanguard had a co-branded credit card!

Where does the 7% growth come from?

You don’t pay tax on cashback anyway because it is not income, so what’s the difference between, say, Citi Double Cash and Fidelity Amex?

Citi Double Cash allows you to withdraw money to any checking account, that’s superior to me. You can always invest in IRA if you wish.

All good points!

7% is the average growth rate of an IRA, so I went with that.

You’re correct about the tax on cashback. But it seems to me the most important key difference is automation. The most successful financial strategies are often automated.

I didn’t know that about the Citi card. So you have to withdraw to a checking account, and then transfer to an IRA? That’s 2 steps. The FIA card sweeps directly into your IRA – zero steps. That, combined with the automation, makes the FIA card superior IMO.

Thank you for weighing in and for reading!

You have made the most compelling case about this card that I have ever seen. Great arguments but for serve loading, I will give it another year max

Thank you!

You’re probably right about Serve. Something else will pop up, though. Gotta keep it rollin’.

Does this work if you already max out a Roth, or if you are ineligible to contribute to one?

You could always contribute to a traditional brokerage account. The *BEST* deal here is with the Roth IRA, but I’d say the free money earning compound interest is gonna be good, if not AS good, on pretty much anything. Especially if it’s automated.

Automation is fine. Remember that your automation will lock your money up for atleast 5 years or you lose 10% since it’t to a Roth.

While earnings may not be withdrawn, your own contributions can be withdrawn without penalty.

Truth.

It needs to meet the 5 year rule first unless you already have a established Roth that is 5 years old from the first contribution year.