Also see:

- Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

- Yes! Instantly Approved for Citi Prestige!

I got my Citi Prestige card this week and wanted to share the experience. Because it was an experience getting this card.

And I can’t wait to dig in to to all the perks this card has to offer!

Here are my first impressions and things I noticed right away.

The 2-package process

Early in the day, I got an envelope delivered from UPS.

Oh good, I thought, it’s here.

There was literally 1 page in the package. No card.

An “account approval notice.” Thanks, Citi. I already knew that from when I was approved online, and from the subsequent email you sent right after. But it’s nice that you spent money on a UPS express delivery service to send me another letter about it.

Soon after, a FedEx box came, too.

And it was quite a process to dig out the thin little plastic card inside of it.

Inside the box was another box.

Granted, it was a sturdy matte-textured box, with a flap to open it.

Once you flip it open, you get to another box.

Within that box was a plethora of paper: benefits guide, T&Cs, more T&Cs, rate information, oh, and in an envelope, the card.

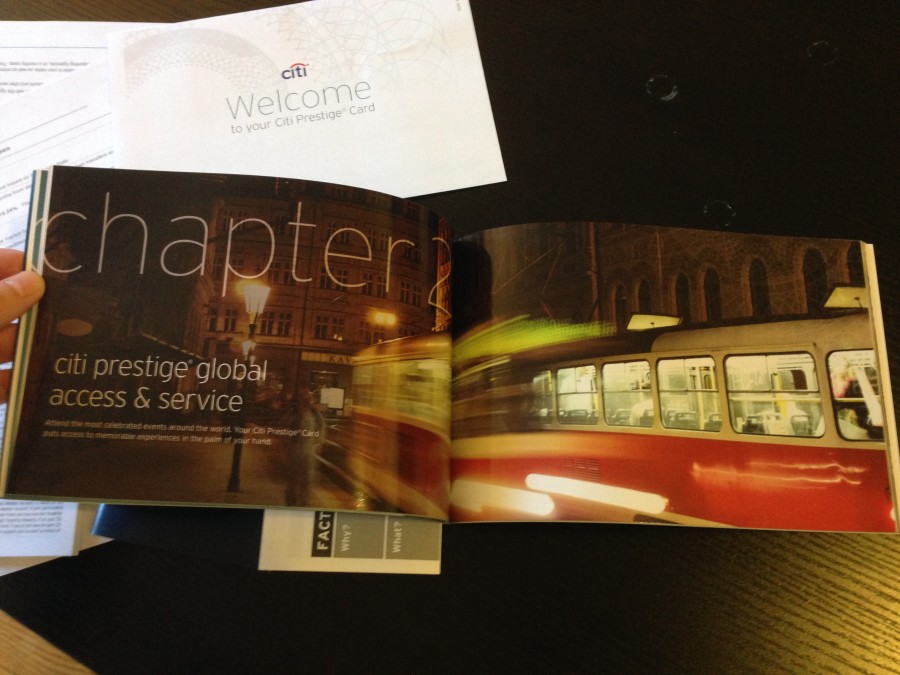

As I flipped through the guide, I kept thinking, wow, how neat.

Did you know, for example, the $500 trip and baggage delay benefit starts after only 3 hours? And that flights purchased with Citi ThankYou points are specifically included?

(I want to do a whole post series on this soon.)

All-in-all, lots of paper and packaging for one little ol’ card.

You’d think that for all the effort they put into the packaging, they could’ve sprung for a heavier card made of stronger materials, like the Chase Sapphire Preferred (which “just” comes in an envelope).

I kinda don’t want to keep all this hullabaloo and clutter, but another part of me doesn’t have the heart to immediately discard of it. I’ll at least keep the benefits guide and the T&Cs, just to have in my file cabinet.

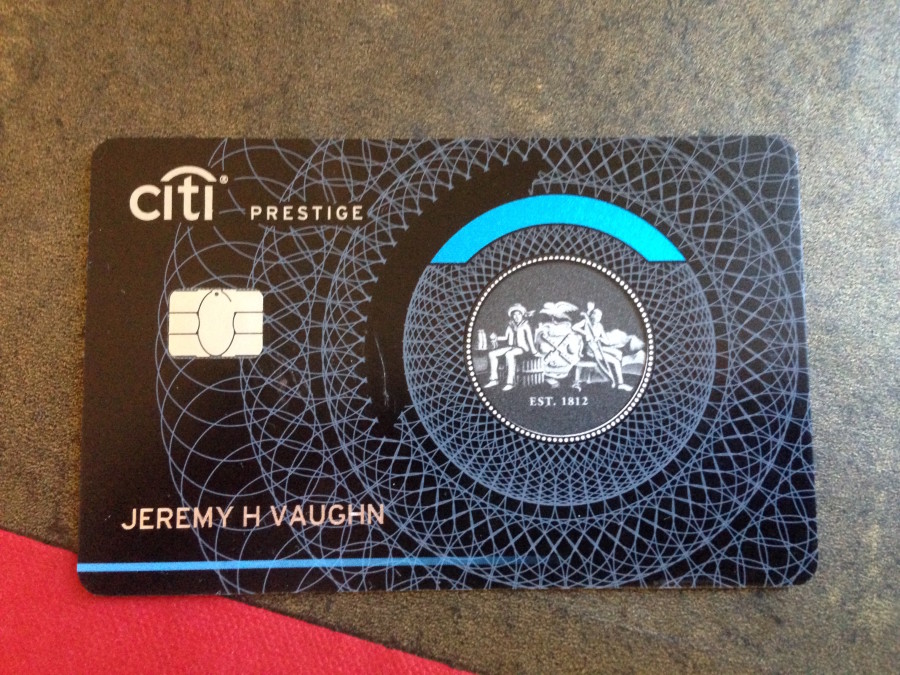

Now I can finally be one of the cool kids and post a pic of my new Citi Prestige card.

It’s the new design with the stripe on the back of the card, and it comes with a chip-and-siggy embedded into the front.

On the back, you’ll find your name and card number, as well as what the folks at the Admirals Club will be looking for when you go for a visit.

Your lounge access is denoted here. Note this benefit is only for the primary cardholder. If you add an authorized user, they’ll have to be with you to get into the lounge.

Your Priority Pass membership card will show up a few days after – there’s nothing you have to do to make it happen. It will arrive automatically.

The website

I activated the card, then made sure to set it up on my Citi account online.

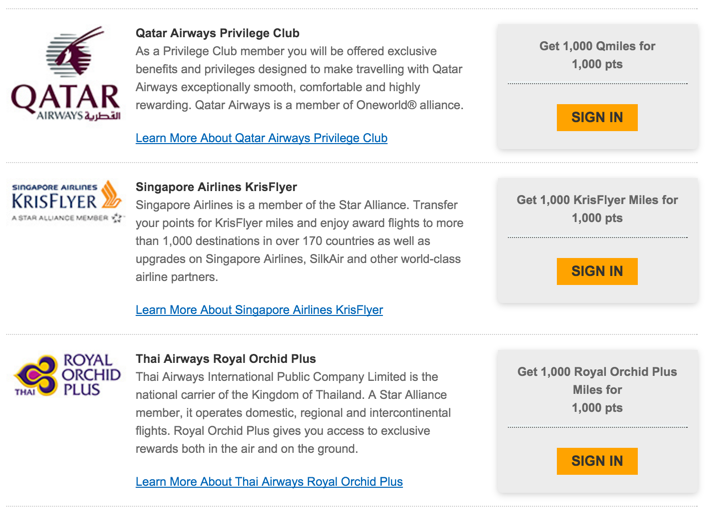

I headed over to ThankYou.com to explore the new points system.

I could see all the transfer partners, but when I pressed “Sign In,” I got an error message:

Which was fine, I didn’t expect it to really sync up moments after adding it to my online account.

But the next day, it did show up. So if you notice that, it’s nothing to worry about.

I had a great time going through the seemingly never-ending perks and benefits on the card.

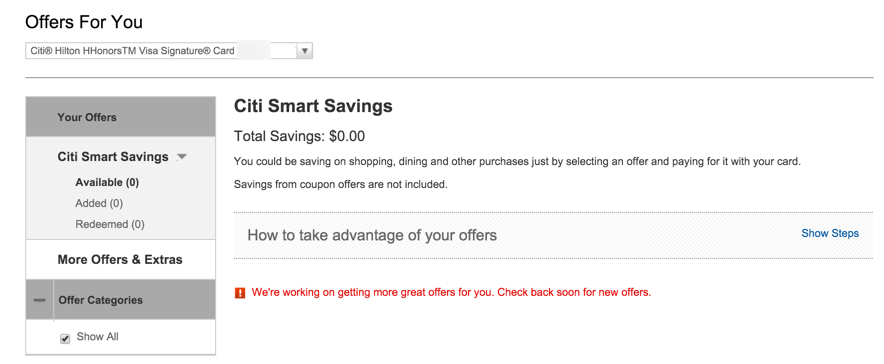

Including Citi Smart Savings, which seems embryonic right now, but intended to directly compete with AMEX Offers.

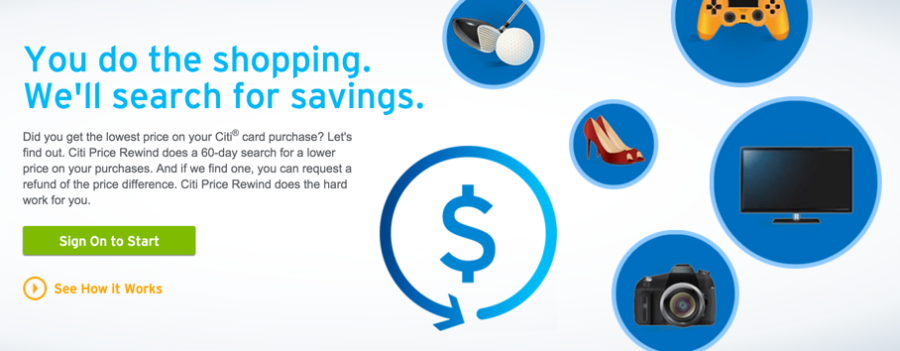

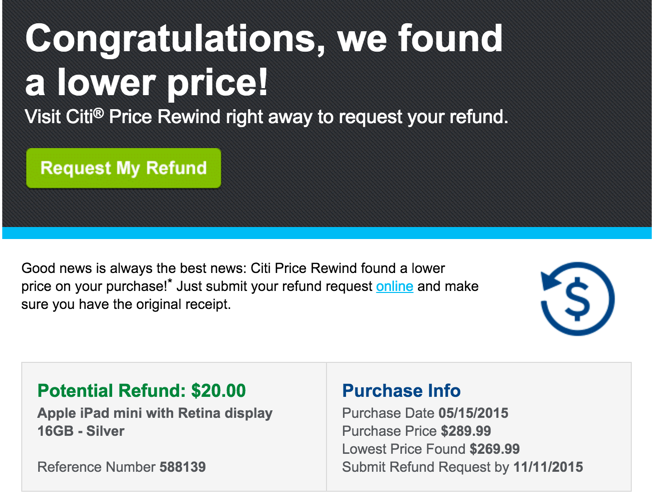

And don’t underestimate Citi Price Rewind, especially with the holidays coming up.

They’ll track the items you pay for with your Citi card for 60 days. If the price drops, you’ll get a credit up to $300 per item and $1,200 per year.

This is super handy for appliances, electronics, and anything else you think will go on sale in the next couple of months. Which, during this time of year, is absolutely everything.

Note this benefit is per card, so you could theoretically get a ton of value out of this.

I got $20 back from an iPad purchase earlier this year. Citi did it all for me, and credited my account within a month.

What now?

I need to use the $250 annual airline credit like, now. I’m thinking of booking a trip to the French Caribbean for next year.

Tickets to Martinique are ~$300 round-trip right on Norwegian. But only $50 for me after getting $250 back! (Or, I just buy American Airlines gift cards.)

And, because of the timing on this, I can turn around and get another $250 next month. That’s why I said to apply ASAP or wait until next year.

And you bet your tookus I’ll be using my 4th night free benefit! (Be sure to look on the Carlson Wagonlit website to see which hotels you can book with the 4th night free.)

With this card in particular, I’m swapping out the AMEX Platinum for it (what a weird sentence that is).

I’m hyper-focused on value. Getting the most out of it.

So much so I’ve created a new page, Citi Prestige by the Numbers, to document exactly how much value I get from this card.

I’ll update it every time I use the card, and I’ve added it to the home screen under the “Credit Cards” tab. So keep an eye there to see how much I save (and how much you can potentially save).

If anything, I’ll save $500 this month and next with the $250 annual airline credits alone. After that, I’ll have recouped the annual fee and will be into pure savings mode. Can’t wait!

If you’re interested in this card, thank you for applying through my links!

Bottom line

Receiving this card felt like a special experience, so I wanted to share it with you guys.

It’s a beautiful card, very well put-together, and Citi’s attention to detail really shines.

The list of perks is dizzying, but I’m excited about unraveling them one-by-one and documenting the savings as I go along.

The only thing I’d change is: I wish the 3X category was for all travel and not just airfare and hotels.

It’ll be a nice complement to my Chase cards, though, and I’m now firmly in a Chase/Citi combo with my credit cards for regular spending. I’ll keep my AMEX cards – for now- for AMEX Offers and to maximize the perks until the annual fees are due, but after that, sayonara sucker. Unless they really step their game up in a big way, and soon.

Let me know your thoughts about Citi Prestige, and if you have any questions, ask away – I’ll do my best to dig up answers!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Congrats on getting your Prestige card. I was super excited too when I received my card in the spring. My card has the old hidden strip thing which I actually like for some odd reason. Your post did a good job touching on the benefits of the card, one of my fav’s also is the extra points on entertainment purchases. To expand on using GC purchases for the air travel credit, I did a little experiment and received credit for Southwest and American gift card, but not Alaska. Alaska seems to code from a marketing department. I might call Citi and see if they will credit me anyways but don’t want to ruin a good thing. Enjoy your card and looking forward to future posts on how you’ve explored the benefits.

Thanks for the tip about Alaska Airlines gift cards! Good to know. And thank you for reading!

I’ll definitely keep up-to-date on this card. I’m fascinated by it for some reason. Want to see how it actually works in application instead of in theory. Especially the travel transfer partners.

I seriously just bought an Alaska gift card for the remainder of my $250 credit. It wasn’t a lot of money but still…ugh

I’m sure if you call Citi and explain, they’ll make an exception. Try it!

No exception made. Oh well =/

Aw! 🙁

I figured for all the runaround, I might as well pay the extra $100 to get the $250 airline credit twice. The timing was right, so I went ahead and did it.

Will you go ahead and get it anyway, or wait?

— It’s 3x on air, hotels AND travel agencies. I understand that on-line agencies like Orbitz count.

— Airline gift cards will count for the $250 credit so you don’t have to rush to buy a ticket.

— The Carlson site is somewhat indicative of what’s available but I understand that it isn’t anywhere even close to complete; in other words, there are a lot of hotels that are included in the fourth-night-free program that aren’t listed on the website.

Great point about the travel agencies.

I don’t mind rushing to buy a ticket. 🙂 Gives me a swift kick in the pants to take a trip somewhere! But if it gets down to it, I’ll go with AA gift cards because I know I can always get use out of those.

I was thinking of calling the Citi Travel Concierge to see what they can pull up for Martinique and get ask how the booking process works. That’s very helpful to know about the expanded selection!

Uhm not difficult to read your card number even with the blurring.

I blurred it 4 times, but just in case I’ve deleted the old image and replaced the blurry box with a solid black one. Thanks for the heads up!

I am not a huge amex guy either but am a fan of the SPG card. The are valuable to me and super versatile for topping up airline accounts for redemptions. I cant get rid of that one. If given a gift of 1 million points in only one currency between SPG, UR, MR or TY points which would u choose? I am curious.

I think I’d take the Chase Ultimate Rewards points. They’re useful for so many award redemptions.

Starwood points are too hard to earn – but I’d pick those 2nd only for the airline transfers and a few Starwood stays.

After that, probably the Citi ThankYou points.

AMEX Membership Rewards points last. Only good partner is Delta for very select redemptions, like on Virgin Australia or Korean.

LOL that was a fun exercise. Which would you pick?

The preference for the transferable points and for frequent flyer programs is highly personal. Which partners do you plan to transfer to? Are they covered exclusively by one program? Can you book flights on your desired airline by going through an airline partner (e.g. transfer to Singapore for booking Lufthansa flights)? In my case I have a slight preference for Amex MR and Citi TY since I can easily and safely use those points for the flights I’m interested in (Lufthansa via transfer to Singapore Air and AirFrance/KLM with direct transfer). I’m not sure how well it would work if I tried to use URs to transfer to Korean for booking AirFrance flights. I have zero interest for transfers to Southwest, JetBlue, Amtrak and to the hotel chains but your situation might be very different.

Also note that Citi’s ThankYou points can be transferred between Citi ThankYou accounts (e.g. your spouse’s), thus giving you a bit more flexibility. With Amex MR you can only transfer to your own frequent flyer accounts or to those of an authorized user on the cc account. That can be limiting if you can’t add authorized users for free (the annual fee for an Amex Platinum authorized user is $175, for example).

Totally, that’s why I love this points and miles stuff – how very customizable it is for your travel goals.

I specifically get a TON of use out of British Airways Avios points, United Airlines miles, and Hyatt points for award stays. Singapore, too, is great for certain trips (and is also a UR transfer partner). And I recently took a free Amtrak trip.

I’ve never explored FlyingBlue, but would like to in the future. That’s another reason why I signed up for Citi Prestige – to learn a new program.

My real desired airline is American Airlines, though, and there are no transfer partners there aside from SPG. But between all the various programs, I’ve put together a system that works for me, and always remain open to new and better ideas!

Thanks so much for sharing your insights. They are always welcome here!

I’d pick spg points first they transfer to American and Alaska which are super valuable plus the bonus 5k points in 20k increments. I personally like the St. Regis brand and Luxury collection portfolios and enjoy redeeming using the 5th night free. Spg is harder to earn but if you had a few redbirds to load over the last year it was easy for me to earn 15,000 points for free many months. My spouse and i also churned the biz version of the spg amex netting us another 60k points.

UR would be my second choice

MR and TY points are about even to me. No winner there.

Definitely see your point about AA/AS and the 5K transfer bonus. I’ve never actually had 20,000 Starwood points all at once to transfer that many.

But if I were offered a million of ’em, I sure wouldn’t say no! That’s a LOT of free flights!

I also have this card and I enjoyed using it this year. I disagree regarding your comment about dumping all the Amex cards you have. I manage three Amex accounts for my family – two PRGs and one Platinum – and I will definitely keep the PRGs since the annual fee for them has been more than covered by the relatively few Amex offers I took advantage of. I will only dump the Platinum since I have no real use for it and the annual fee will be hard for me to cover using the Amex offers.

Re. the Citi price rewind – I got $100 off an iPhone but only after sending the proof that the price dropped. The automatic price detection didn’t work so I wouldn’t rely on it.

Glad to hear you like your Citi Prestige card!

I’ll keep the AMEX EveryDay Preferred (will downgrade to the no annual fee version), and 2 other AMEX cards NOT issued by AMEX – and I should’ve been clearer – but it’s really the AMEX Platinum that’s on the chopping block. I’m still very much in a “we’ll see” phase after many not-so-great experiences with AMEX customer service. But I do agree, keep a couple for the amazing AMEX offers that spring up from time to time.

Good to know about the Citi Price Rewind. They caught my price drop for me, but it never hurts to be vigilant ESPECIALLY around the holidays with so many sales coming and going quickly.

Thanks very much for reading and commenting!

First Citi Prestige statement arrived. The good surprise: Citi tracks and displays my air travel credit spent and remaining. I think this is a great feature. The surprising surprise: message that my credit will reset to $250 on December 7. I thought the credit was annual, as in “calendar year.” Creates a little more urgency about buying those airline tickets.

Yes, it runs from December statement to December statement – so if you got the card on November 7, and it closes December 7 (for example), it would reset at that point. So you’d have $250 spend in November and another $250 to use until the following December. Essentially $500 between the 2 consecutive months.

I’m the same boat as you and love it! That specific scenario is exactly why I wanted to apply in November – to make up the annual fee as quickly as possible.

Remember you can always buy airline gift cards. Be sure to check which ones count (American Airlines and Southwest are OK, but Alaska Airlines doesn’t seem to trigger the credit).

But I vote for booking a trip! 🙂

Will Citi claw back the $250 if you use it on an airline ticket that you later cancel?

No, at that point it will be between you and the airline.

Hu? I meant if I buy a refundable ticket. Will citi reverse the $250 credit they gave me if I later cancel the ticket (and the original airline charge gets credited back to my credit card).

I didn’t find ANY info in the T&Cs about reversing the credit. To me, it looks like once you receive the credit, there’s no going back:

https://www.citi.com/credit-cards/additional-info/citi.action?ID=AdditionalInfo-CitiPrestige