Also see:

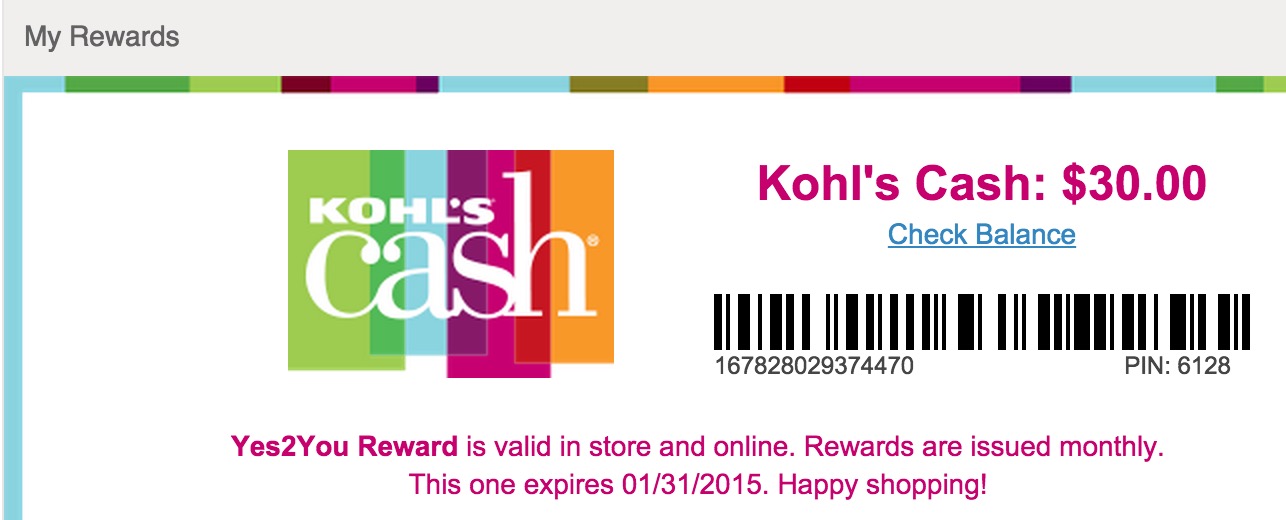

As I sit here on a cold, windy winter evening, a thought occurred to me that I should get some long johns AKA thermal underwear. I had some Yes2You Rewards that gave me $30 in free Kohl’s Cash to use by the end of January.

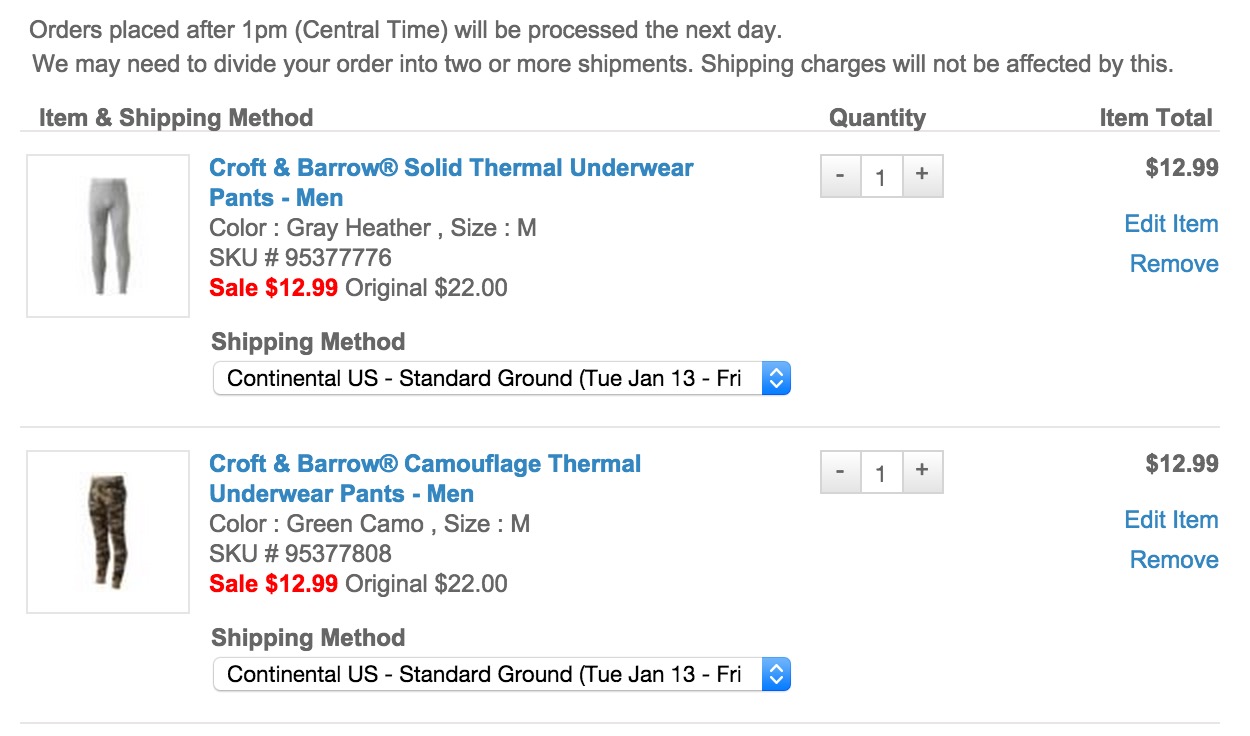

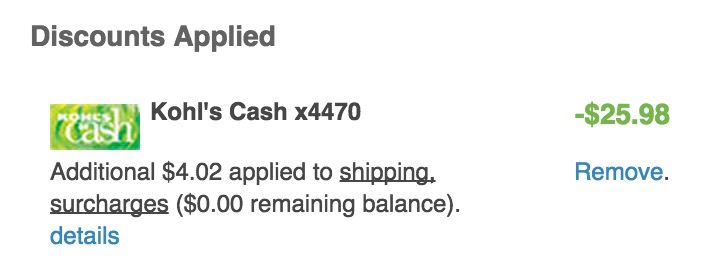

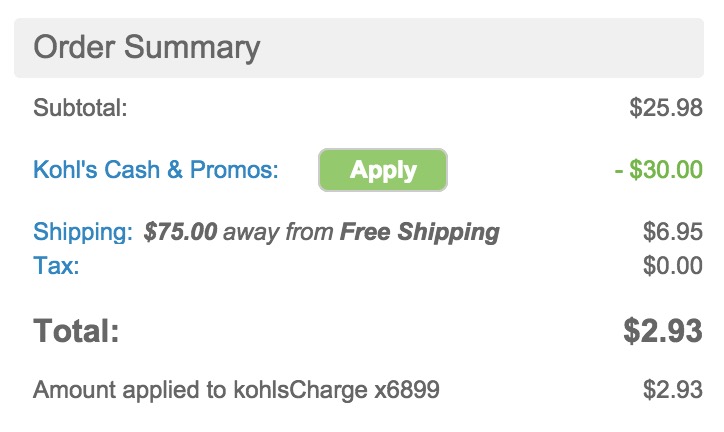

So, I headed over to kohls.com, added two pairs of long johns to the cart, and pressed the buy button. Total cost? $3, inclusive of tax and shipping.

All the dips

Let me say right out the gate that you’re gonna miss out on one of these dips if you don’t have a Kohl’s Charge card. And ditto if you don’t buy the gift cards at an office supply store. So, you’ll get three or four dips, depending. But even getting three out of five is still pretty nice.

Dip 1. Gift card from office supply store

I like to take my Chase Ink Plus MasterCard down to Staples and load up on gift cards about once a month. I usually grab some Starbucks gift cards, maybe a Visa gift card or two, and Kohl’s gift cards. I prefer to get them in $50 increments. Why? To earn Kohl’s Cash, $50 is the cutoff for earning the bonus $10 in Kohl’s Cash. So I like to get it *just* over $50, zero out a gift card, and put the rest on my Kohl’s Charge.

Dip 2. Shopping portal

This is very much “in a vacuum.” If you start adding promo codes, that might knock out the shopping portal bonus. Kohl’s is very generous with its multitude of promo codes, so you kinda have to decide whether you want a percentage off and/or free shipping or the points. It’s pretty case-by-case here.

I miss the olden days when Ultimate Rewards would offer 10 points per dollar at kohls.com. But, alas, you usually find a portal or two that will offer 2x or 3x. Sometimes it’s better to use a promo code and get say, 30% off than 2x or 3x back in points. Nevertheless, I always click through a portal. Half of the time the bonus posts, and the other half of the time – it doesn’t. I know there’s no going back to claim it since I used a gift card, and I am OK with that.

I figure I’m already building in 5x for myself with the gift card step, so it’s not the end of the world when the bonus doesn’t post.

Dip 3. Kohl’s Charge

I had to get the Kohl’s Charge, just for the discounts. In addition, if you run $600 per year through the card, they upgrade you to MVC (“Most Valuable Customer”) and guarantee you 18 promo codes/sale days per year, which is pretty nice. You don’t have to have the Kohl’s Charge to get in on this dip. I value it for the additional sales and the ability to always use the free shipping promo codes that pop up.

Also, whenever there is a 30% code floating around, they always honor it. 30% off can add up to a pretty hefty discount, and the free shipping adds up too. A

dd in that’s it’s a no annual fee card and I figure it’s at least aging my accounts overall and helping my credit, even if only in a diminutive way.

Dip 4. Yes2You Rewards

5% back. Period. On everything. No matter how you pay. Spend $100, get $5 back.

Rewards are issued monthly, and you can combine this with other Kohl’s Cash, promo codes, and sales. It’s free to sign up, which makes it a total no-brainer. Free money!

Dip 5. Kohl’s Cash

This promotion comes around about once a month. I never buy anything unless I’m getting Kohl’s Cash. You get $10 back for every $50 you spend. Again, free money.

This promotion comes around about once a month. I never buy anything unless I’m getting Kohl’s Cash. You get $10 back for every $50 you spend. Again, free money.

Stacking it all

Say you go to kohl’s.com and spend $100.

Here’s how it all adds up:

Dip 1. 100 * 5 = 500 Ultimate Rewards points. Value: $10

Dip 2. Assuming 3 points per dollar = 300 points. Value: $6

Dip 3. This would’ve already given you 30% off, so your pre-discount total is $142.85. $142.85 * .3 = $42.85. $142.85-$42.85=$100. Value: $43

Dip 4. 5% back. Value: $5

Dip 5. Kohl’s Cash, $10 for every $50 spent. Value: $20

So let’s add once more:

$10 + $6 + $43 + $5 + $20 = $84 back in value

Using this equation, I’ve assumed the promo code from the Kohl’s Charge is giving you 30% off. This is best case. Sometimes it’s only 15% or 20%. So I get if you’d want to just exclude Dip 3 from the calculations and get the raw math without that.

If you spend $100, straight up, the value you’d get back for spending that would be $41, or over 40% back.

If you do include the promo code in your arithmetic, that number increases to a staggering 59% back.

The next play

I recently signed up for a Shop Your Way Max membership (uh oh), which gives free shipping from Sears, Kmart, Land’s End, and a couple of other stores. They offer free shipping all the time with no promo code needed, so I’m thinking of trying out Sears, just to compare it head-to-head with Kohl’s.

Don’t worry, I won’t get a Sears Card for the experiment. I am curious if anyone has any thoughts one way or the other, though.

Bottom line

I do think this is interesting and can get you a whole lot of value if you play your cards (plan your dips) right. It’s really as easy as picking up some gift cards and clicking a link.

The value comes back partially in the form of points and miles, and partially in the from of cashback that can only be spent at Kohl’s. That last bit really puts you on the Kohl’s treadmill though, at least for another month.

So plan on that. Don’t buy everything all at once. Save something to buy for free with your earned Kohl’s Cash and Yes2You Rewards, and get as close to the amount of the two combined as possible. That’s a pretty easy way to hop off the treadmill.

However, if you find yourself buying a lot of clothes, home furnishings, bed and bath stuff, or small appliances, stacking up these dips is a great way to get some some value back.

I also want to say, and maybe I should’ve said this earlier, only do this if you’re buying stuff that you already know you need. Don’t get random stuff just for the sake of earning some points. There are better ways to go about it.

Takeaways here:

- Promo codes are at your own risk

- You do need a card that earns something at office supply stores to get all the dips

- You don’t need the Kohl’s Charge, but it often provides bigger discounts

- Only buy when Kohl’s Cash is being offered

- Sign up for a Yes2You Rewards account for free before you buy anything

Anyone else got any good tips for hacking and getting even more value out of Kohl’s? Any opinions, one way or the other, about Kohl’s vs. Sears?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Yeah, Just make sure whatever you buy to earn Kohls Cash or Y2Y is something you are going to keep, matter what. Returning things that earned points or cash is a massive headache. I shop at Kohls a lot and never ever use the KC for that reason. I really wish there was an “opt out” option because I worry about losing the KC and someone else using it. Then, if I have to return something that earned the KC, I don’t get the full refund because somebody else used my KC.