Citi’s been hit-or-miss with peeps calling in about various website errors recently.

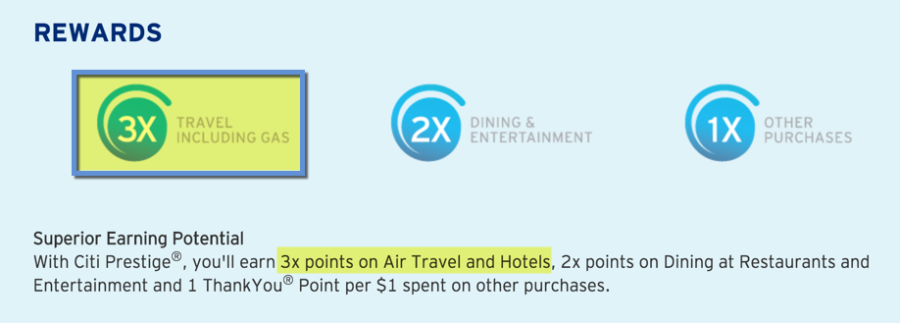

Doctor of Credit shared an experience about getting a 5,000 bonus Citi ThankYou points because the Citi Prestige application site showed an error on earning 3X ThankYou points on all travel purchases including gas.

It actually earns 3X points on airfare and hotel purchases, not travel broadly defined – probably my only complaint on this otherwise incredible card. (Here’s how much I’ve saved I picked up the card in November 2015. And it’s available via my links if you decide to apply.)

How I got 10K points

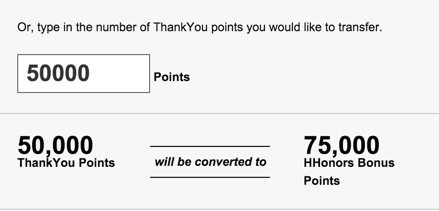

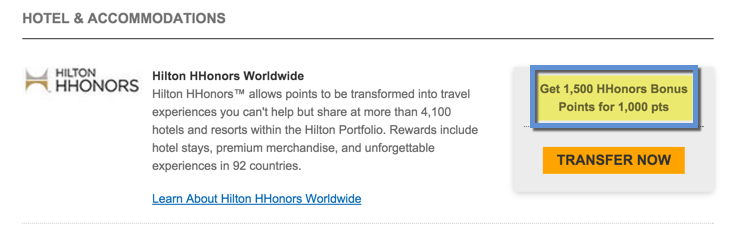

I noticed an error at ThankYou.com. I can’t find the screenshot, but the site advertised 2,000 Hilton points for every 1,000 Citi ThankYou points. It was an artifact from a transfer bonus promotion Citi had going on, which ended January 6th, 2016.

When I clicked “Transfer”, I saw the normal 1.5:1 ratio instead.

So I called Citi and told them what I saw on my account. The rep logged in and saw the same 2:1 price, and then the lower amount after clicking through.

I told her I was hoping to get 100K Hilton points for transferring 50K Citi ThankYou points. But now I’d only get 75K.

I was transferred twice. But everything went fast. The whole call took less than 15 minutes. I spoke with a supervisor, who’d already been informed of the situation before we were connected (I love that!).

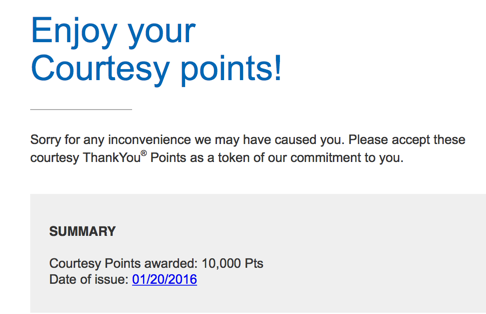

She instantly offered to split the difference and post 10K ThankYou points to my account so I’d have enough to make 100K Hilton points.

I accepted, and before I hung up, got this email:

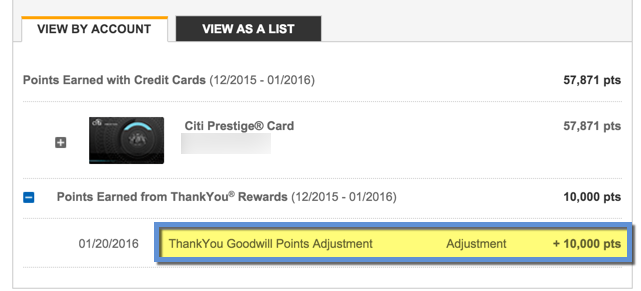

Then I logged into my account and saw the transaction and new points balance:

I was blown away by the service and speed.

For 15 minutes on the phone, I got 10,000 Citi ThankYou points worth:

- $100 in cash

- $160 on American Airlines flights

- $133 toward other flights

- $200 with transfer partners (read how I came up with this number) Update: After all that, the points won’t transfer to TY transfer partners. HT to pointer for alerting me.

Not a bad haul!

If you wanna try

After you log in to your ThankYou.com account, click “Travel,” then “Points Transfer.”

One of the reps I spoke to said not everyone’s account has been updated yet with the correct totals. So you can see what your account says.

If you see the 2:1 rate, you can call to report it. Who knows, it’s worth a shot.

Or you can take Doctor of Credit’s advice, and see what your Citi Prestige application says about the 3X category.

Bottom line

Citi ThankYou is quickly becoming my favorite points program.

The second they add a meaningful (meaning large domestic airline) transfer partner, I’ll seriously consider focusing on collecting Citi ThankYou points over Chase Ultimate Rewards points.

There are still a few glaring omissions.

For example, there’s no ThankYou shopping portal whereas the Shop Through Chase portal is very good for earning Chase Ultimate Rewards points from online shopping.

And bonus Citi ThankYou points are limited to airfare, hotels, dining, and entertainment with Citi Prestige and Citi ThankYou Premier. Although you can earn 3X Citi ThankYou points with the AT&T Access More card for most online shopping, including Amazon, which is great.

There’s still no way to earn bonus points for office supplies, drugstores, cable, etc. So that means a set number of ways to earn more than 1X ThankYou point per $1 spent. And at most, 3X bonus points.

Finally, the weird expiration and transfer rules between all the different kinds of ThankYou points is confusing. Chase doesn’t do that when you combine your points – they all never expire no matter which card you earned them with, or who you transfer them to.

And one last thing. I was hoping Citi Smart Savings would be a viable contender to compete with AMEX Offers. They rolled it out right before Black Friday, which was promising. But then it just… wasn’t that great.

However, they are making huge strides. And the service I received over this error was incredible. The only thing you can never buy back from a customer is bad will. Take notes, AMEX!

Let me know if you have luck getting extra ThankYou points!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Dude, you going to give me some points. I need some HHonors points for the Hampton Inn in Boise. I’m like 4k away from. It’s a tier 1 hotel, but still don’t have enough points. I have a hooker meeting me there. She is going to give me a discount, I guess she has Herpes or something. I never pay attention. I hear “discount”, I’m in! Any-who, need those points. Need some of dat BIG JUGS SANGRIA. I’m Diamond status, I deserve points, and discounted chicks. Thanks dude bro guy.

LOL, I can guess which one of my crazy friends this is. Nice use of the SharkLasers throwaway email. 😉

I’ll book the room for you. Should I put it under Zeek the Plumber?

Now, with your new found points… Waldorf Astoria ORLANDO. MAKE IT HAPPEN! Put it under, Zeek the plumber, Junior. Zeek the electrician, senior. He is on a sabbatical on Argentina, can’t keep up that him. Probably, staying at the Holiday Inn Express…gross. Just gross Dad.

Done and done. Enjoy Florida! It’ll be a long trip from Boise – hope you don’t take herpes with you!

Thanks Harlan! you da bomb. Herpes man, just the worst. Appreciate it. -Love Zeek (DIAMOND MEMEBER!!!!!) (late check out hiltons are the worst.. 1 PM?! thats it?!)

Nice haul. The only thing you missed is that those TY points you received ARE NOT transferable to partners, so I would cross out that last $200 valuation. All TY points which are considered taxable (via courtesy points issued to your accounts or earned any other way other than a bonus for a credit card or corresponding credit card spend is considered taxable.) You can see that this is accurate by going to a transfer partner and looking at how many TY points you have available to transfer. You will see that the 10,000 TY points you earned will not be in that calculation. Nevertheless, nice job 🙂

You know, you’re right. Which is ironic, considering the original complaint was about not having enough points to transfer to a partner.

I’d love to see them do away with these limitations and expiration dates of certain types of TY points. IMO, if you have Citi Prestige, all points should be equal to points earned from Citi Prestige, no matter the source. But of course that’s wishful thinking.

Thanks for the tip/heads up! Still getting to know the (sometimes confusing) ins and outs of the TY program!

Bonuses to report errors. That could lead to bad places.

Yeah, I wouldn’t cross the line and go crazy with it. But when it’s THIS obvious – I mean, on the public-facing website – and it’s incorrect, they should definitely know about it.