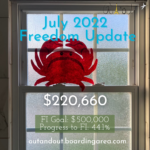

Because the stock market has been thriving and the economy is beginning to even out, my net worth saw a new high this month – just shy of $300,000 and nearly 60% of my ultimate $500,000 goal.

Yay! I’m thrilled/relieved for this update. On one hand, I cognitively know that investing during a downturn means huge gains down the road. On the other, that road felt (feels?) really long.

In fact, I hit $200K invested in November 2021 – the same month I moved to Oklahoma. Right now, I’m sitting at $241,320 invested despite maxing out my 401k and Roth IRA in 2022, and opening an UTMA for Warren, my three year old. I’d been flat and hovering around the same level for over a year and tbh these updates were starting to get same old.

Friend to all trees

But I know that powering through that slog will benefit me well in the future. It’s to the point where if the stock market has a good month, I can see gains of $20K+. This is the momentum I’ve been looking forward to. My hope is always cautious, especially these days, but I’m having a milestone month and I’m gonna celebrate those accomplishments.

As I work my way back toward financial stability and pay off lingering debt, I’m seeing the light again and am beyond ready to plow forward.

Let’s review.