What a month! The stock market had its worse first half since:

- 1970 for the S&P 500

- 1962 for the Dow

- Ever for the Nasdaq

It’s still firmly in bear market territory – and I believe it has farther to fall. There are real-world issues that need solving that no amount of interest rate hikes from the Fed can touch. Namely supply chain backups, geopolitical tension from the Russia-Ukraine invasion, and lower company earnings and forecasts from too many of the wrong products and a tight labor market.

Interest rate increases are affecting home sales, and certain sectors are seeing hiring slowdowns (particularly tech). So how’s it affect me, the average investor?

It me: “average investor”

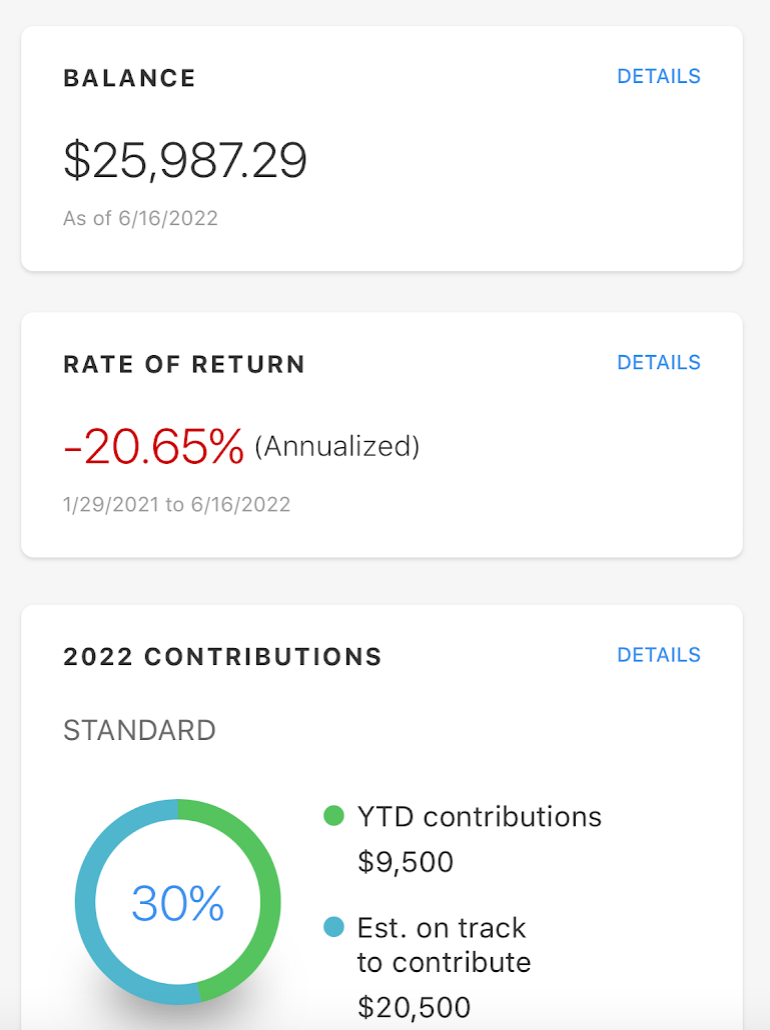

Well, I contributed $2,000 to my 401k last month, but my overall 401k balance is only up $146. That means my money is losing value in real-time. It also means I’m getting more stocks at a lower cost basis. Instead of lowering my contributions during this volatility, I opted to increase them.

And the accounts I don’t touch (my Roth IRA that’s maxed for the year and my traditional IRA) are negative since last month.

The average bear market lasts for under a year, but the average bull market lasts nearly three years and has much higher highs than the bear market’s lowest lows, percentage-wise.

So I’m staying the course, sticking to my plan – and I have huge news I’m finally ready to share! Ahhhhh!!!!

July 2022 Freedom update

So the big news is:

We’re having another baby!!!!!!

This September, we’ll welcome a new little one to our family.

Dad x2

We are beyond excited to have another baby. Warren will be a big brother, and we’ll have a new baby boy in about a month and a half.

He’s the reason I was so keen to get a new HVAC system installed. We’re building the nursery now and getting ready for the baby shower – and I really wanted to get the heating and cooling figured out before the baby gets here. Because when that happens, we’ll be focused primarily on him for… a while.

It’s also why I’ve been spending more money recently. My net worth is taking a turn backward, mostly because of the market. But I’ve been spending more to get ready for the new addition, too – a confluence of factors.

Whew, I’ve been wanting to talk about this for so long! But now he’s nearly here and it’s starting to feel real. Our lives will be totally different – again – later this summer.

The journey into fatherhood has been incredibly intense. I’m catching up to all the changes. So much is different, but I absolutely love being a father and parenting. September will be a busy month!

HVAC fallout

As mentioned, the HVAC installation took a bite out of my finances – but I simply had to get it done. It’s been a few weeks and it’s blazing hot here in OKC. The house has been cooled well and it’s working like a dream.

Despite all the dips and gains, my current net worth drop is nearly identical to the balance on the card I used to pay for the upgrade ($18K). It’s 0% interest until December 2023, so I’ll be paying it off a little at a time until then.

Warren playing with his new tool set

It was the best thing for the house and to get ready for the new baby. I couldn’t let my family deal with window units this summer and one small furnace this winter. Plus, the house is appreciating well, so this was also an investment toward that end.

Next year, I’ll get around to improving the deck and landscaping, but… one thing at a time. We have much more coming up before that’ll be a possibility.

Recession, bear market, losing gains

As far as my money mindset, making this financial journey during a(nother) recession – (and as a millennial) – suuucks.

It’s hard to see the constant negatives knowing it’s probably going to keep dropping. Inflation is high and recovery likely won’t happen until 2024. Not being negative here – just realistic.

Also not complaining, but DAMN, it does feel like my generation keeps living with recessions and setbacks one after another. I do believe we’re living in a recession now.

Father’s Day was extra special this year – shoutout to my Allbirds shoes

Of course, having this new baby will distract me for a while. I’m OK with backsliding. Remind me of this when the bull market returns and I’m shooting toward my goal at warp speed.

But for now, I keep hovering around this halfway mark despite my efforts. I’m figuring out how FIRE fits with parenthood. And I’ll continue investing no matter what happens.

Slow and steady wins the race. I have 786 days to reach my $500,000 goal. Will it happen? We’ll see. I still think it will. 😛

By the numbers

In a way, it’s good that I’m making home improvements now. With stocks dipping so much since the bear market began on January 3, I might as well take all my losses at once – in the hopes that the gains come back in a big way.

I think Q2 earnings reports will be a bloodbath, and Q3 forecasts will get lower. I think the Fed has another 75 basis point increase on the docket for this month, and that investor confidence is low. But dips are part of the cycle, and a healthy part. Valuations were getting waaay too high. It’s good to have a reset sometimes.

Between the new baby, paying down the HVAC, and rebuilding my savings, I’m stretched to the max. I’m doing my best – and that’ll have to do.

Ughhhh

But the constant losses are hard. I’m reeling. I’m also sticking to my plan and dollar-cost averaging my investments. No one knows where the bottom is, so I’ll keep buying every two weeks despite what the market is doing.

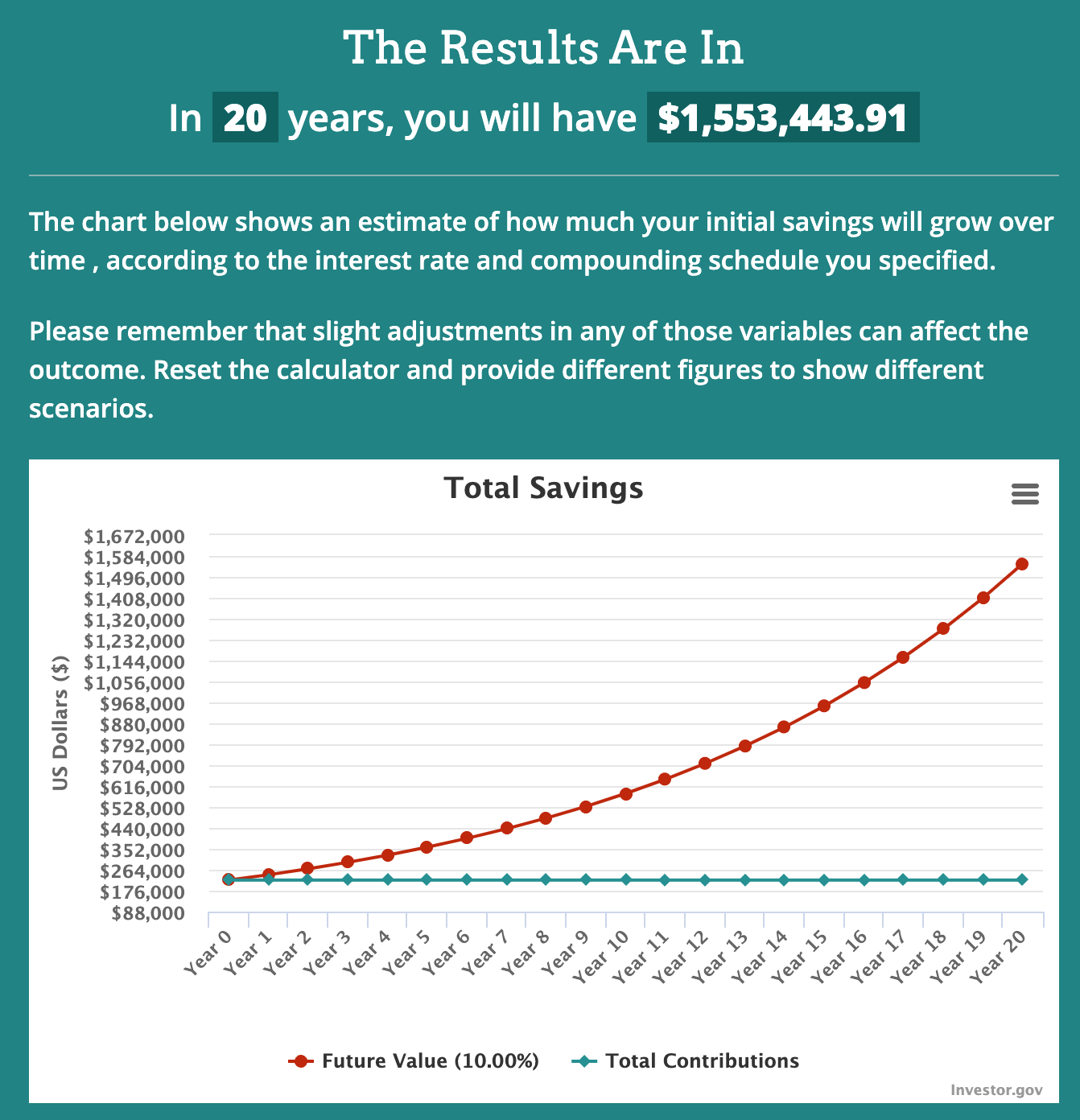

Millionaire status is inevitable

In fact, even if I never add another red cent to my accounts, I’ll end up with $1.5M in 20 years, assuming an overall 10% return. The foundation is set. Now I’m hoping compound interest will work its magic.

| Current | Last Month | Change | 2022 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $184,392 | $195,998 | -$11,606 | As much as possible | |

| 401k (contributions only) | $10,500 | $8,500 | +$2,000 | $20,500 | |

| 401k (overall balance) | $28,125 | $27,979 | +$146 | As much as possible | |

| Traditional IRA | $97,167 | $104,600 | -$7,433 | xx (can't contribute) | |

| Roth IRA | $44,144 | $47,502 | -$3,358 | $6,000 (in contributions) | COMPLETE! |

| Taxable brokerage + UTMA | $9,147 | $9,854 | -$707 | $25,000 (total invested) | |

| Savings | $8,290 | $8,172 | +$118 | $30,000 | |

| Primary home equity + appreciation | $38,559 | $36,162 | +$2,397 | $20,000 | COMPLETE! |

| LIABILITY | |||||

| Credit card/HVAC upgrade | $18,325 | $18,434 | -$109 | $12,000 | |

| Net worth in Personal Capital | $220,660 | $239,242 | -$18,582 | $500,000 (overall goal) | Track your net worth with Personal Capital |

So that’s it for this month.

Not where I began, and surely not where I’ll end

Life’s good. Tbh, I’m too over the moon about our new baby to really think about anything else. This money stuff will resolve itself. I know I’m still on my way – and that’s a good place to be.

July 2022 Freedom update bottom line

In the last 30ish days, I:

- Added $2,000 to my 401k

- Saw a dip because of the HVAC + the market

- Kept investing every single pay period

- Got a bit more equity + appreciation on my house

- Ended with a dip this month over last

- Continued getting ready for a new baby!

But the big news this month is that in about 45 days, I’ll be a father to another beautiful son. We’re concerned with getting the house and nursery together, and steeling our resolve and reserves for all the nursing, diaper changes, wake up calls, and all the rest that come with a newborn. I’m preparing to be eternally tired, basically. 😵💫

Life really is wild and magical and unpredictable. I’m enjoying it. Everything happening now is part of the journey – financial, emotional, human. We are so ready to meet baby Beck and get him settled in.

Thank you to everyone who reads these updates. It means the world to me. 🌌

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Congrats on baby #2!! You’re in an awesome spot right now. Remote job, time at home, and saving like a MACHINE! Keep at it. I’m hoping for prices to continue dipping so I can finally start backing up the truck on stocks. No job for me unfortunately, so I’ve got my fingers crossed.

Take care and enjoy.

Thank you, Ken! Life’s good! My company offers four months of paid parental leave, so I just have to get through July and August, then will be off for the remainder of the year. Getting into the family building part of life has been so good. Warren is so bright and sweet, and already growing so much. I can already feel how temporary it all is.

I do think prices will continue going down, especially when Q2 earnings reports come out in a few weeks. IMO, the bottom will be in October (although bottoms are notoriously hard to call). But yeah, we’re gonna dip a little more lol.

Hope all is well with you and Kim! Fingers crossed for all of us here too!

Props on the kids. May they bring you much joy.

On the investment front I find your stuff enjoyable and informative but I’d really disagree with you calling yourself the average investor. The average investor doesn’t put away anywhere near what you do on an annual basis, knows considerably lees about where to invest, and only has vague goals. In short, I’d argue that you’re richer, more educated, and goal oriented than the average investor.

Thank you, Christian! As much as I do with investing, I’ve never made a day trade, don’t know how calls, options, or margins work, and still have a lot to learn about withdrawing and tax optimization (but I figure that’s far down the road). I stick everything in low-cost, broad-market index funds and call it a day.

Thanks again for reading and commenting. Sending good vibes your way!

Congrats on the new baby. If you have never read the Bogleheads Guide to Invest, consider it. Based on principles by Jack Bogle, founder of Vanguard. Millennials are not alone in feeling the pinch. Stay the course.

Thank you for the recommendation, Gina. I do agree – we are all in this together. Staying the course is definitely the best option right now. Keep it up!

Hi Harlan,

Given some of the title of this blog and some of its sections and so forth, perhaps we’ve vastly misunderstood something, but if not, are you adopting, did you use a surrogate, or something else? Would love to know more about your experiences if so.

(And congrats on the path towards FIRE. It’s something I’ve begun in the last couple years too, but there’s quite a long way to go!)

Hey Miles! It certainly is a journey, but a very worthwhile one!

Both Warren and the new baby are my biological children. Warren was conceived via artificial insemination and now he, his mother, and me are living together to raise and parent him. I still identity as part of the LGBTQ community, so you’re not misunderstanding anything. I took a detour to build family but I’m still here. I’m still me.

Hope that helps to explain. Thanks for asking and being interested. It’s great to have these conversations re: the ways LGBTQ people build their families.

So happy for you Harlan! Wishing you all the best with your new little one.

Thank you so much, Audrey! We’re so excited. Hope all is where you are!

Good update. Staying the course is the wise option. Ever used portfoliovisualizer.com to test investment strategies?

I haven’t – will have to check that out. Thank you for the recommendation!