I feel like my life is on hold. Like I’m on hold, but life just keeps on life-ing.

We’re days away from getting the judge’s ruling for a set of cases that have been going on for the past year, hopefully early next week. We think it’ll be in our favor, but until we get that document, we’re kind of just… on hold. Stuck. Like we can’t move forward.

Oof

Oh, and I was laid off from my job this week, so go ahead and add that to the mix. I’m taking some time to regroup. I’m not worried about the future so much as I can’t even imagine the future right now.

With that, I’m making February 2023 the month of self-care and taking my insurance for all it’s worth before it expires in a few weeks. I’m:

- Getting new glasses and contacts and a fresh eye exam

- Having a tiny cavity filled next week

- Seeing a doctor for an all-around checkup and allll the preventative care my insurance will allow

- Getting a couple more chiropractic adjustments (Baby Beck is now over 15 pounds!)

- Going to therapy every week this month

I also snagged an appointment for an in-demand dermatologist. Plus, I already have new insurance so I’m taking advantage of being double insured and criss-crossing town to keep myself healthy and active. I’m feeling good about everything.

With all that in mind, let’s talk about money.

February 2023 Freedom update

Lots of good things happening here. This month, again, finds me at the peak of my net worth. This time it’s $273,473—a stone’s throw from $300K.

Stocks performed in a big way, my ex-employer finally matched by 401k contributions, and I also got a little bonus. If stocks keep going up, I could be to $330K as soon as next month.

I’m getting severance money in a couple of weeks along with my last paycheck, so I’ll use that to:

- Finish funding my 2023 Roth IRA

- Make a big credit card payment

- Give my lawyer a big payment

- Maybe get a new MacBook Pro (the one I’m using is literally from 2013 💀)

- Add to my savings

- Maybe plan a trip? I really really really miss traveling

Life’s good

I’m not worried about employment or money. I have a few income streams and already working on a couple of projects. I even thought about taking a month to just write. We’ll all be fine, we all have health insurance, and the bills will get paid.

Tbh, I was out of love with my job for a long time (if you couldn’t tell by previous Freedom updates). So this is a good thing. I just want to figure out where to go from here.

Money movements

You’ll notice my savings went down. I transferred some of it to my Roth IRA and Warren’s UTMA, and paid down my credit card/HVAC with the rest. This was before the layoff. I might’ve used it differently if I’d known, but… no going back. Just forward.

I only did it because I finally got tired of dealing with Citi’s funky interface for my Accelerate savings account. So I transferred out everything except $500 to keep it fee-free. While it was sitting in my checking account, I thought what the heck and put it to work.

Sure do

Looking to $300K

I still have some savings, and definitely want to save more this year. I gotta get my attorney paid and find my balance. I’ve tried various strategies, but now realize how fluid it all is, especially now. So I’m gonna ride the wave and do my best. Now that I’m close to $300K, I definitely want to keep up the momentum.

Getting close

I’ll be 40 in 568 days, and want to get as close as possible to my $500K goal by then. 2023 will be a pivotal, make-or-break year. I plan to make the absolute most of it.

Other investment goals

Now that I’m without a 401k (at least for a while), I’ll turn to my taxable brokerage and Warren’s UTMA for a while. As far as retirement goes, I’ll be fine coasting by and can use this lull to really set up Warren (and Beck).

My sweet baby and future millionaire

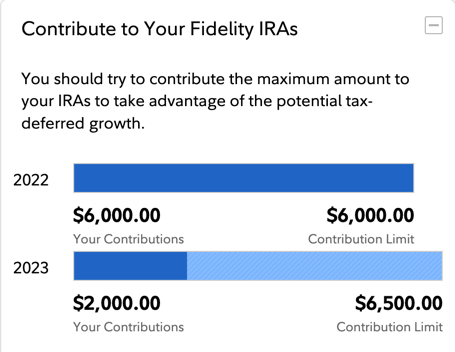

In a few weeks, I’ll have my Roth IRA maxed out and will turn to that.

$4,500 more to go

January was a rough month, but I typically have amazing Februarys. And you know what? I can’t wait to see where 2023 takes us. Already I feel things stirring.

By the numbers

In the last couple of months, I:

- Hit another new net worth peak

- Contributed $2,000 to my Roth IRA

- Paid nearly $2,000 toward my credit card

- Built up a little more home equity

- Sent more funds to Warren’s UTMA

| Current | December | Change | 2023 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $220,780 | $212,973 | +$7,807 | As much as possible | |

| 401k (overall balance) | $43,863 | $40,617 | +$3,246 | As much as possible | |

| Traditional IRA | $106,760 | $104,552 | +$2,208 | xx (can't contribute bc I'm doing Roth) | |

| Roth IRA | $50,665 | $47,461 | +$3,204 | $6,500 (in contributions) | |

| Taxable brokerage + UTMA | $12,011 | $11,248 | +$763 | $25,000 (total invested) | |

| Savings | $6,691 | $10,312 | -$3,621 | $30,000 | |

| Primary home equity + appreciation | $49,868 | $48,360 | +$1,508 | $30,000 | |

| LIABILITY | |||||

| Credit card/HVAC upgrade | $12,708 | $14,351 | -$1,643 | $12,708 | |

| Net worth in Personal Capital | $273,473 | $266,210 | +$7,263 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Love seeing that percentage get closer to 100%

Lots of shifts! This month will have even more thanks to my severance and ongoing projects. As always, I’ve got an eye toward progress and hoping for the best.

My priority is on self-care and getting things going after getting the court ruling. Everything else is incidental, but of course – life will keep on life-ing, eh? Always does.

February 2023 Freedom update bottom line

After all of this, I feel myself slowly coming back to life. Getting laid off this week was a huge shock, but really, no love lost. The layoff is already setting other events into motion, so I’m going to let them take me with their current.

If ever there was a time to do a trust fall to the universe—it’s now. Trust the process and all that.

My mom came to visit her grandbabies last month

This month will also have lots of money movements. For one, I’m going to rollover my 401k to an IRA to get rid of all the crappy junk fees. It’ll be nice to regroup and just get things together again. And make sure I’m happy and healthy for whatever is already on its way.

I want to write more here, too. Once travel comes back into my life and we get past this court drama, I’ll be ready. I appreciate y’all sticking with me. This is the hardest thing I’ve ever done in my life.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Always enjoy reading these freedom updates!

Glad you are doing well. Come back to dallas for a meetup again some time!

We got your back. Keep living, keep saving and keep dreaming. (your support team at BoardingArea).

Always appreciate your transparency! Good luck on the next chapter of your life and it sounds like you’re still on your way to financial freedom! With FIRE, you already have an emergency fund but hopefully severance pay and/or unemployment benefits will be enough for the time being so the emergency fund will remain untouched until next job comes along.

Gotta admit, I’m kinda jealous. You’ve got a lot of great stuff going on these days. For me things are, well let’s just say they are. I’m happy for ya man. Keep it up and you’ll get to FIRE before you know it.

I guess this means congrats. But insincere at best. Coming out is great except when it’s not. Are you true?

https://news.yahoo.com/lesbian-mom-loses-parental-rights-022202020.html?ncid=twitter_yahoonewst_sjwumo1bpf4