The stock market had its best quarter since 2020, and I’m now back to where I was two months ago. If that ain’t a metaphor.

These gyrations (plus life) have kept me hovering around the halfway mark of my $500,000 goal (that’s a long way of saying $250K) since I first hit it… exactly a year ago. #GroundhogYear

Inching ever closer

I’ve had my sights set on $300K for a long time. As life continues to come together, saving money should get easier. I’ve been saving what I can while fighting down 0% APR credit card debt and lingering legal bills.

All said, I’m doing good – and hoping that compound interest will do some of the heavy lifting for the remainder of the year.

April 2023 Freedom update

We have a few more court dates to get the case finished. It’s still not done, but it will be soon. It can’t go on forever.

I’ve been doing a lot of freelance work and applying to jobs here and there. Just the ones that look super interesting. We’ve also been thinking about getting out of Oklahoma.

There’s nothing for any of us in this place, and there’s no way we’re putting Warren in public school here. We were thinking somewhere in the Northeast or Northwest. Anyone have good recommendations for a place with excellent public schools? The only requirement is that it’s 1,000+ miles from anywhere in Oklahoma. 🌪️

Or maybe a different country. Portugal sounds nice. Someplace that’s easy to get a visa for the fam. (Can you tell I’m finally dreaming about the future? We’re gonna get out of here, like, soon.)

Financially, I’ve continued to do what I can, including:

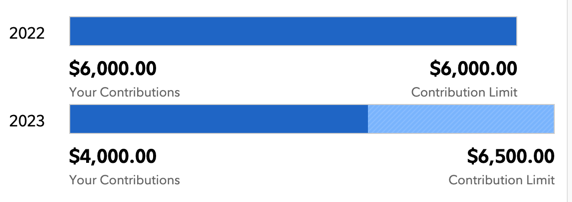

- Finish funding my 2023 Roth IRA – Getting there! I’m at $4K / $6.5K

- Big credit card payments – Paid $1,000. More this month!

- Invested in a brand new top of the line MacBook Pro for my writing and freelance business

- Sent cash to savings. Maybe a new house is on the horizon?

- Added some cash to Warren’s UTMA account

Thankful for friends who work at Apple for 25% discounts on new computers (that’s Fenwick in the background)

The computer was a $3,000 purchase, so that took the lion’s share of my financial efforts last month – but so worth it. My previous computer was dragging and on its last leg. And the new computer has basically already paid for itself with new freelance projects.

Money movements (and a new card)

This month, I want to focus heavily on paying down my credit card debt that’s currently at 0% APR until December 2023, as well as max out my Roth IRA for the year.

$2.5K to go

I also opened a new credit card – The Bank of America Customized Cash Rewards card to get:

- 18 months of 0% APR – I think I might just go ahead and pay my attorney everything I owe

- 3.5% cashback at wholesale clubs including Costco, where we shop weekly. I get this rate from being a Platinum Honors member with $100K+ invested through Bank of America

- 5.25% cashback on a category of my choice. I’m gonna go with online shopping for now. Again, I get this rate from my banking relationship with BofA

- The $200 cash welcome offer

- Lower debt ratio overall

- No annual fee, so it’s free to keep long-term

- A new card in general. I’ve had or can’t get cards from other banks, and yes, I tried to get in on that sweet Chase Ink 90K offer and was denied :/

Oh man, haven’t done one of these pics in a while

I checked my 5/24 status and I’m at 8/24 right now. The oldest inquiries will fall off in the next 6 months. At that point, I will be eligible for another Chase card. Just hoping there’ll be a good offer at that time. Daddy’s ready for more Hyatt points (which let’s be honest is all Chase Ultimate Rewards points are good for any more).

For now, I’m focused on saving, paying down debt, and adding cash to my savings account. Planning for a move soon. I live a life of upheaval. This one I want.

By the numbers

Last month, I was down about $11K. This month I’m up by the same amount.

I’m making good progress on saving and Roth IRA contributions, as well as paying down my credit card balance. Instead of plowing into one thing, I’m spreading everything out: a little here, a little there.

It all affects the bottom line (net worth number) in the same way. And especially since stocks are flat now, this seems like a good moment to save cash for the next thing.

| Current | Last Month | Change | 2023 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $220,220 | $209,162 | +$11,058 | As much as possible | |

| Roth IRA | $52,001 | $49,863 | +$2,138 | $6,500 (in new contributions) | $4,000 so far! |

| Taxable brokerage + UTMA | $12,194 | $11,798 | +$396 | $25,000 (total invested) | |

| Savings | $7,993 | $6,693 | +$1,300 | $30,000 | |

| Primary home equity + appreciation | $49,881 | $46,074 | +$3,807 | $70,000 | |

| LIABILITY | |||||

| Credit card/HVAC upgrade | $10,691 | $11,708 | -$1,017 | $12,708 (starting balance) | |

| Net worth in Personal Capital | $273,654 | $262,014 | +$11,640 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Hoping for some forward progress this year, that the stock market picks up and that I’ll be able to get ahead of everything.

April 2023 Freedom update bottom line

Also hoping to get some forward motion with regard to moving on with life. I’m ready to travel again and get back out in the world. And to plan for the future. And to talk more about what I’ve been through since November 2021. Maybe I’ll write a book one day.

Looking forward to having more good news to report soon. I feel like I’ve been stuck in the same scenario for months and months by now. Hanging in there.

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply