It’s been a good month. The weather is warmer and we’re all starting to feel the shift that’s coming.

I’ve been working diligently behind the scenes to arrange trips, find new opportunities, and move the family forward. I’ve been embroiled in court drama since December 2021, and there are just a couple more obstacles to knock out of the way. Once it’s done, we’re seriously contemplating moving to a new place. And a remote working visa in Europe is looking really appealing right about now. #expatlife

Cute spring scene

But we’ll see what happens.

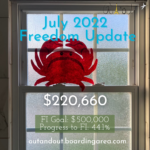

Financially, I’m flat month-over-month, but that’s to be expected. The U.S. stock market is reeling in the wake of bank foreclosures, ongoing interest rate hikes, and the fight against inflation.

I personally managed to get everything paid for the month, plus laid out cash to get some documentation for the boys, and didn’t get to invest much. Oh, and our fridge decided to give up, so we had to order an emergency replacement – which was a whole saga unto itself.

Anyhoozers, the first half of the year was a great push forward. I’m hoping the second half will be full of progress, travel, and fresh ideas.