Last month was absolute murder for the stock market. Earnings season revealed, if anything, that we’re still dealing with fallout from Covid and navigating headwinds from:

- The war in Ukraine

- Interest rate hikes (with another one being announced tomorrow)

- Runaway inflation

- A “post”-Covid market that no longer cares about Netflix, online shopping, and delivery services – or can’t afford to

I made it back to Dallas last month!

It was the worst start to a market year since 1939, the worst year for Nasdaq stocks since 2008, and the worst month overall since March 2020. So course my portfolio is down.

Mentally, I see this as an opportunity to buy more stocks at a lower cost basis. But seeing the drops in real-time is hard, especially with murmurs of “recession” and “bull market” everywhere you look.

This month, I also got interested in a new DeFi app with 15% APY that pays daily interest. More on that and the rest of my updates below!

May 2022 Freedom update

Despite the drain in the stock market, last month was good to me. I got to visit Dallas and Austin to see two concerts from the Tori Amos tour. She was magical, and it was good to get away for a few days.

I have a work trip to Knoxville coming up soon, and heading to Memphis to visit family in June – that should be, um, fun with 7+ hours in a car with a toddler.

My little guy is getting so big

Speaking of which, I opened an UTMA account for him with Fidelity. There’s nothing in there yet, but it’ll be a valuable resource for us as he begins to learn about money and finances. If I put $1,000 and never add another cent, with a 10% return, he’ll have $348,912 in 60 years. Compound interest is amazing when it works in your favor.

But of course, I will add more to it and show him how to grow his funds with the simple investing techniques I’ve learned. I’m excited to get that going for him.

Sweet, sweet baby

Last month was also just a lean month in general. I kept thinking I’d have extra funds but things popped up. I was still able to put over $1,000 into savings, and my house continues to appreciate well – plus I’m accruing a little more equity each month.

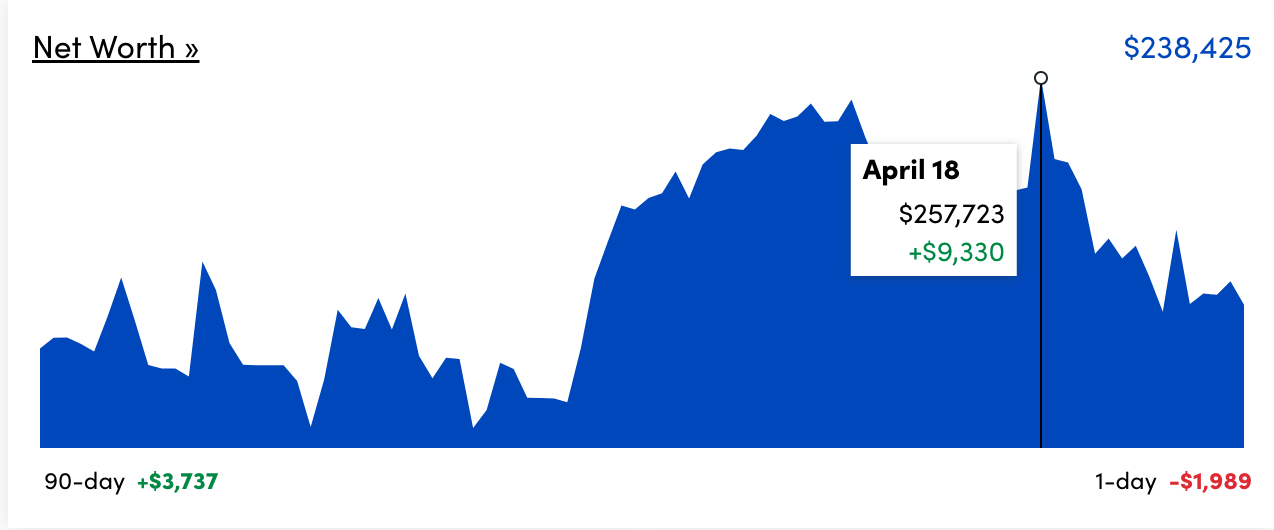

It felt insignificant with the backdrop of the free falling stock market, though. Every day it sank and sank. I was on a high from reaching half of my net worth goal (I briefly touched almost $258K on April 18), but then the last half of April was just a straight dive back to where I was last month.

Fits and starts, or a bear rally?

May 2022 should be better for me financially. I’m hoping to add more to savings, start building Warren’s UTMA account, and get some outstanding expenses paid down.

Now to the good stuff!

Stablegains

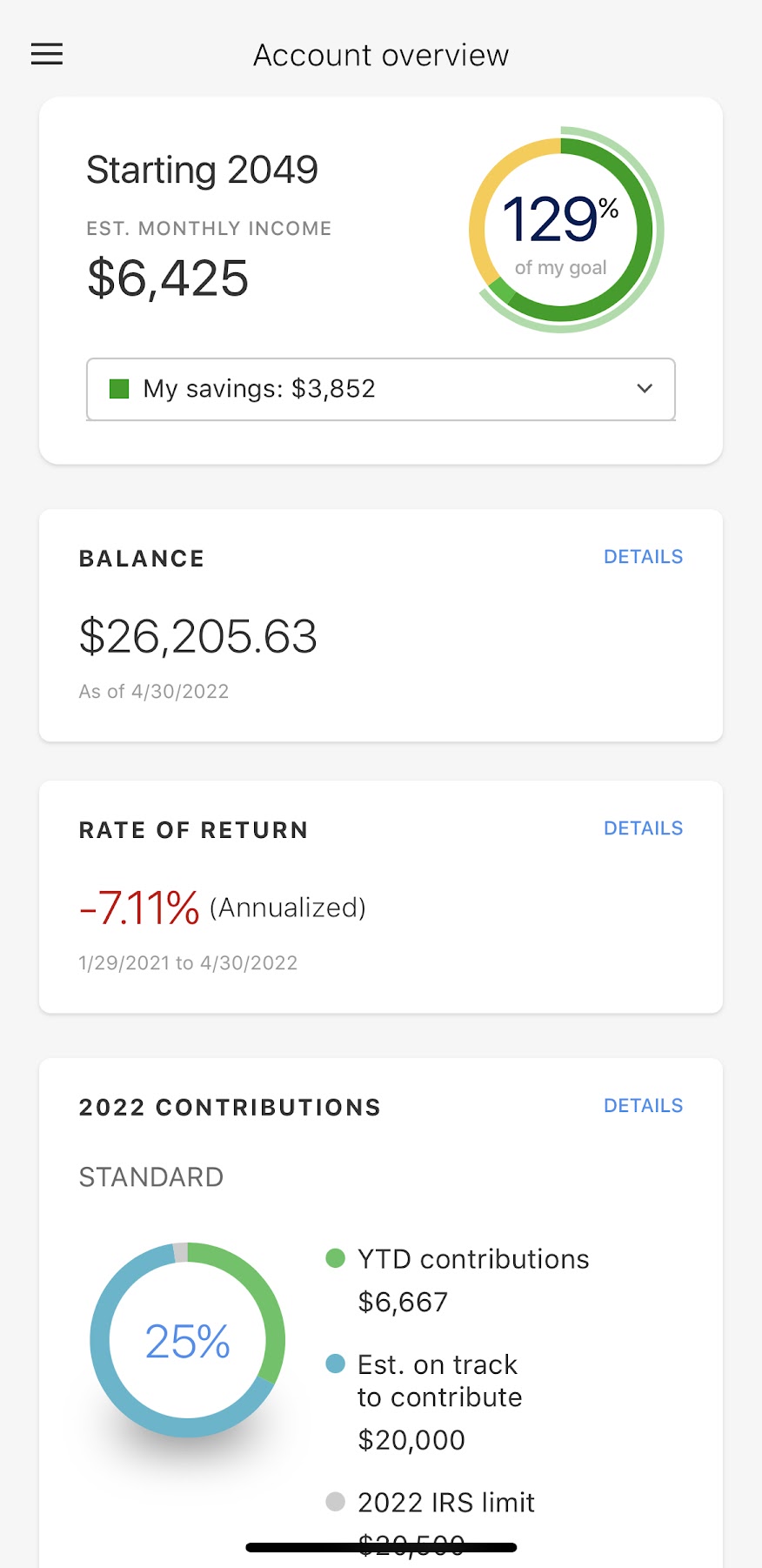

So looking at my 401k and seeing this was a bummer:

That red text is not the kind of return I wanna see

Since January 2021, my total return is -7.11%. Negative. Despite maxing it out last year and adding another nearly $7K so far this year. I know it’ll bounce back over time, but it’s also demoralizing. Both things are true.

So I was poking around online and ran into Stablegains, a DeFi app based on the Anchor protocol with a 15% APY that accrues daily.

15% interest beats the pants off -7% loss for the year in my 401k

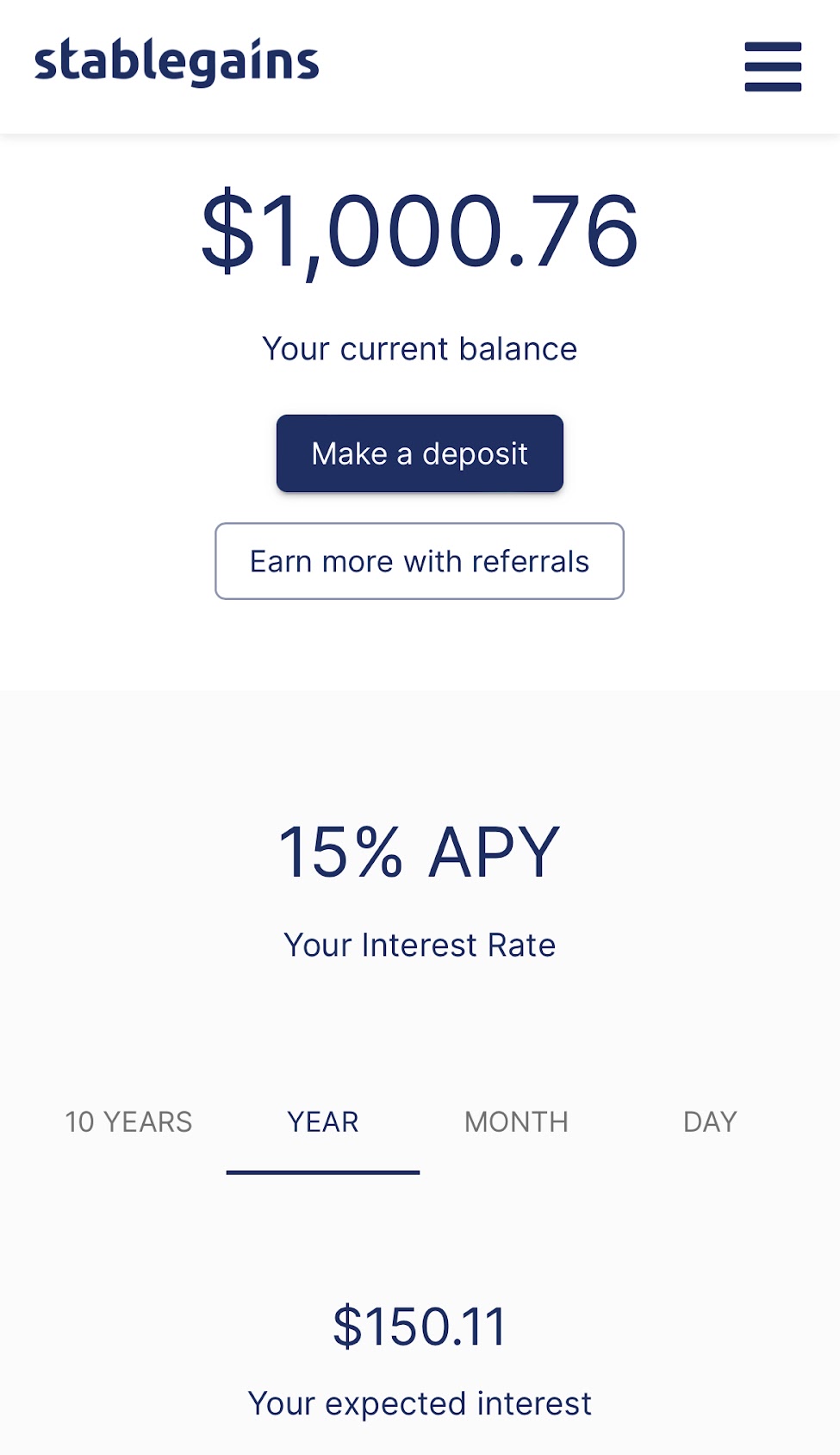

I downloaded the app and did the onboarding after thinking it over for a few days. They had me scan my ID and wanted me to prove I live in Oklahoma (which is one of the 20 states available for this product). After that, I linked my account and sent $1,000 over with ACH. And I’m already earning interest!

Woot woot!

According to the app, I’ll make:

- $0.38 per day

- $11.56 per month

- $150.11 per year

- $3,047.89 per 10 years

And that’s if I don’t add any more cash. Stablegains is NOT insured by the FDIC, so if they go under, I’m holding the bag. But I feel comfortable with the Anchor protocol and the way the app works. There are thousands of positive app reviews, and even the folks on Reddit seem to like it.

Most importantly, earning 15% interest just feels like a huge win psychologically, especially on days when my stock portfolio is tanking.

So far, Stablegains is available in:

- California

- Colorado

- Delaware

- Idaho

- Illinois

- Kansas

- Maryland

- Massachusetts

- Montana

- New Hampshire

- North Dakota

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Utah

- Virginia

- West Virginia

- Wisconsin

- Wyoming

If you’re interested and want to sign-up with my link, you’ll get $25 when you deposit $1,000 for 30 days – on top of the 15% interest you’ll earn.

I’m going to add a bit more and see how it goes but so far, it’s been amazing!

By the numbers

Here’s the part where I’d usually say something about how painful it is to turn pluses into minuses, but I remember how the earnings calls for Q2 are for Q1 earnings, when the Omnicron variant was raging, along with supply chain issues. What’s happening today won’t be fully reflected until next quarter.

But the market looks forward and reacts quickly. I believe it’s already priced in the interest rate hike. The ongoing war in Ukraine could have more impact as it keeps going on (and god, I feel terrible for Ukraine!).

On the Colorado River in Austin

But mostly, if this is a recession or a bear market, that’s fine – because I have a long investing horizon. I’m investing for 20+ years out. Even though my portfolio is suffering now, I understand that it’s important to raise interest rates and get inflation under control.

So while it’s challenging, it’s an opportunity to build my portfolio at a much lower cost basis. I dollar-cost average a portion of my paycheck into my 401k every time I’m paid, and I’ll continue to build out my savings, too.

| Current | Last month | Change | 2022 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $195,980 | $211,622 | -$15,642 | As much as possible | |

| 401k (contributions only) | $6,667 | $5,000 | +$1,667 | $20,500 | |

| 401k (overall balance) | $26,482 | $27,095 | -$613 | As much as possible | |

| Traditional IRA | $106,261 | $116,374 | -$10,113 | xx (can't contribute) | |

| Roth IRA | $48,300 | $52,719 | -$4,419 | $6,000 (in contributions) | COMPLETE! |

| Taxable brokerage | $8,955 | $9,769 | -$814 | $25,000 (total invested) | |

| Savings | $8,170 | $7,119 | +$1,051 | $30,000 | |

| Primary home equity + appreciation | $29,665 | $27,170 | +$2,495 | $20,000 | COMPLETE! |

| Net worth in Personal Capital | $239,425 | $254,041 | -$14,616 | $500,000 (overall goal) | Track your net worth with Personal Capital |

And one more thing. If you’re investing in low-cost index funds that track either the S&P 500 or total market, you’ll be fine because of the broad diversification.

The numbers don’t lie

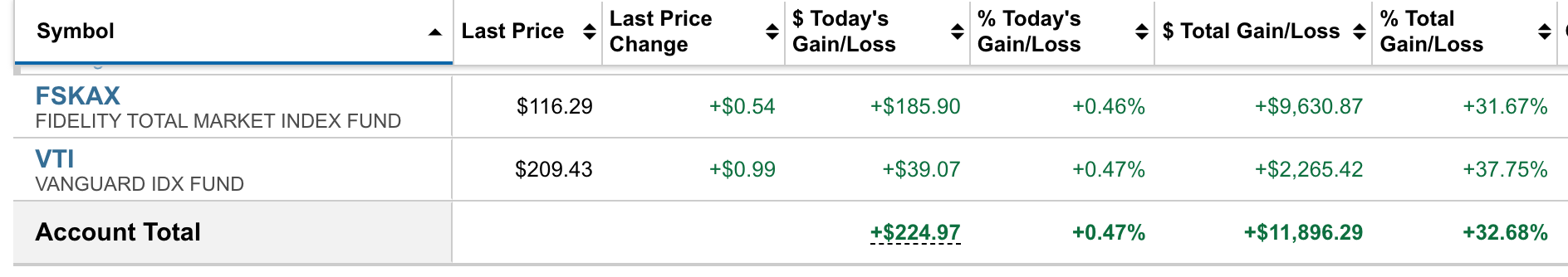

Even with the recent dips, I’m still up 32+% overall in my Roth IRA with FSKAX and VTI (two of my faves). With a long timeline, index funds are the way to go – the exposure to numerous sectors helps to even things out across all your investments and provides stability during downturns like what we’re seeing now.

May 2022 Freedom update bottom line

In the last 30ish days, I:

- Started an UTMA account for Warren and can’t wait to teach him about money

- Started saving with Stablegains to get 15% interest and mitigate the recent stock market dips

- Kept investing every single pay period

- Didn’t save as much as I wanted, but I think May will turn that around

- Got a bit more equity + appreciation on my house

Lots of headwinds in the stock market. Historically, we know moments like what we saw last month are a great time to buy – and a great time for new investors to come into the market at a low cost basis. I’m gonna keep investing and stay the course.

I will say though – I had high hopes for last month. April tends to end on an upswing, but this April was only the second with losses in the last 17 years.

My investments (and net worth) slid back again, but onward and upward. This is a blip in the big picture. Curious to see how the next couple of months perform!

Thank you to everyone who reads these updates. It means the world to me. 🌌

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Great article! What percentage of your overall IRA portfolio do you put into Index funds?

100%! It’s better to have aggressive funds in a Roth because the earnings grow tax free. That screenshot is my whole portfolio in that account.

How do taxes work for these DeFi things like Stablegains? Do they send out a 1099-int or?

It’s such a gray area tbh. There hasn’t been official government guidance on the topic since 2014. Even Stablegains gives a vague answer. As of now, there are no technical “exchanges” from what I understand, so there’s nothing to tax. I plan to look into this more before next tax time. Worst case, it’s taxed as income which is still a positive return compared to the losses I have in my portfolio now.

Thanks for the reply. Does seem pretty confusing to me.

Is this a travel blog or investment blog?

This is the third time you’ve left this comment on these monthly updates. You see the headlines and still choose to click through and leave the same comment that I’ve answered for you before. If you don’t like it, don’t read it. Do something better with your time than use the same trite attack over and over. Fuck off, troll.

How’s this Stablegains generating a 15% APY? Not familiar with the app, but any product that promises gains clearly above benchmark raises a red flag. The reddit forum you linked has mixed feedback at best, and the positive ones are clearly from folks invested in it. Don’t want to sound negative, but I would suspect gains are coming either from highly risky investments like crypto, or aren’t real gains at all (ponzi style). If the former, you can probably do better direcly investing in those sectors. If the latter, well, hope you are out before it collapses.

could it be a ponzi scheme?

I always enjoy reading your updates. 🙂

Curious about the UTMA account. Have you written about it more somewhere else on your blog? Assuming it is a brokerage account? What kind of risk are going with for your child with that account? What kind of asset classes? Have a few young kids myself and am curious how you’re starting this account out. Thanks.

Hey Lochquel! This is an amazing question! I actually wrote about it in detail on NextAdvisor: https://time.com/nextadvisor/investing/why-i-have-a-utma-for-my-son/

Check it out and let me know what you think! Happy to answer any questions you have – investing early for our kids is so important!

Great article. I’m on the fence with the 529 vs UTMA path myself. Wish there was a better vehicle for investing for kids, but I suppose there are tradeoffs with each available path. 2nd your focus on Roth IRA when the kid would start working.