Points Hub is rockin’ and rollin’! If you haven’t heard yet, Points Hub is a paid membership community to talk all things points and miles.

The mission of Points Hub is to provide members with their best points and miles year ever no matter where they are in their journey, from beginners to experts.

Join us!

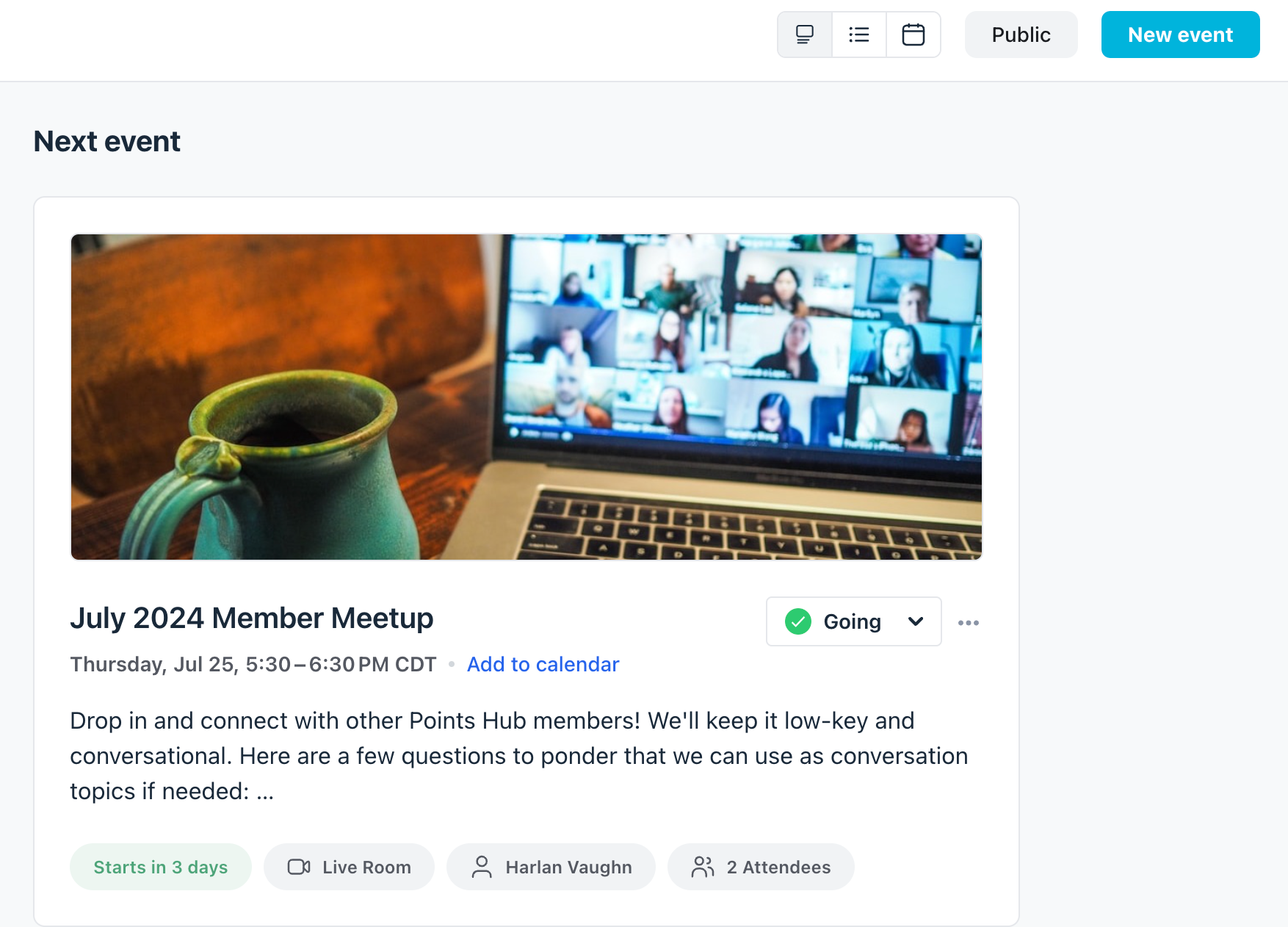

It’s an election year, in case you haven’t heard, so I wanted a space far away from social media. I find Facebook groups fatiguing because notifications and divisive posts are still there—and because most of them don’t allow member referral links.

There’s the value prop for Points Hub: Experts can talk with beginners, and beginners can, in return, learn and use referral links for credit cards and other products to begin their points journey.

It’s got a nice give and take, and there’s plenty of room for everyone—and now there are partnerships for even more added value for members.