Like most points fanatics, I held Chase Ultimate Rewards points in the highest regard. It was my primary points program for years. At a recent Meetup, I asked everyone to include their favorite points program on their name tag. Literally everyone put Chase Ultimate Rewards points.

I was the odd one out. I proudly put Citi ThankYou points – which spurred interesting conversation. Because I haven’t really used my Chase cards since January 2019, when Citi Prestige unveiled 5X points earning for flights and dining with the Citi Prestige card.

Chase’s nearest competitor to Citi Prestige, the famed Chase Sapphire Reserve®, slid to ye olde sock drawer. Then, when the $550 annual fee came due, I downgraded it to the Chase Freedom Unlimited®, which I’ve used exactly never.

Why? Well, for my spending patterns, ThankYou points are much easier to earn. Combine that with the fact that Ultimate Rewards points aren’t as shiny as they once were and you have a recipe for saying “Chase Ultimate… who?”

Sorry, Chase. It’s not me, it’s you.

One’s in, one’s out – which is which?

I say this as someone who is soon to be 2/24 (did I hear you gasp just then?). I mean sure, I’ll prolly get a couple more Chase cards for the sign-up bonuses. But I doubt it’ll change my long-term spending strategy.

Here’s my reasoning.

Chase No-Longer-Ultimate Rewards points

How did we get here? To borrow from the new Taylor Swift album (I promise I’m not a #Swiftie, but rather a #ToriBoy forever), it was death by a thousand cuts. It happened in near slo-mo:

Chase:

- Lost Korean Air as a transfer partner

- Had to deal with Marriott’s “Bonvoy” program turning into a verb rather than anything useful #StarwoodRIP #Bonvoyed

- Has United moving to dynamic pricing in November and I’m SURE that’ll be a bleep-show

- Has had minor devaluations with other programs recently, including IHG, British Airways, Singapore Airlines, and Flying Blue

- Only has Hyatt to lean on as the best transfer partner

- Hasn’t refreshed the Sapphire cards since launching them (! – Compete, Chase!)

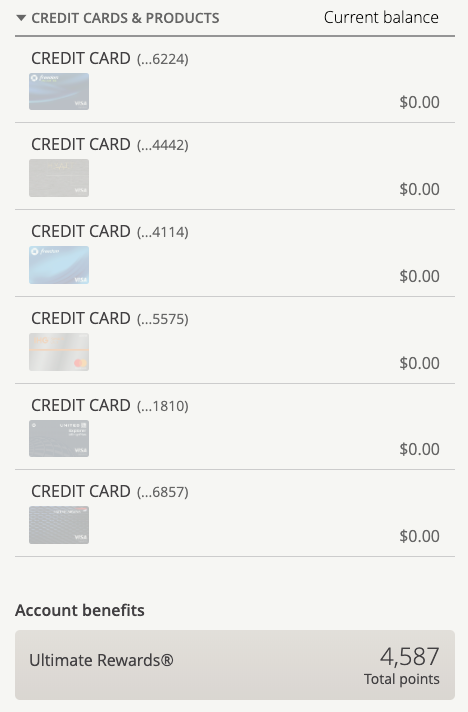

Ain’t spent a dime on any of my Chase cards, and drained my UR balance

I currently have seven Chase cards (the six above and an old Ink Plus), and have transitioned all my spending away from them.

For one, the Chase Freedom Flex℠’s 5X categories have been mostly uninspiring lately. I’ll use it here and there, but unless it’s groceries, Amazon, Uber/Lyft, or dining – meh.

Then there’s the curious case of the Chase Freedom Unlimited®, which earns 1.5X Chase Ultimate Rewards per $1 spent, with no cap. The argument goes that when you combine it with the Chase Sapphire Reserve®, where points are worth 1.5 cents each toward travel booked through Chase, that’s a 2.25% return for the Chase Freedom Unlimited®, which has no annual fee (1.5 X 1.5).

If/when Hyatt ever devalues, Chase points are trash. This is me in Houston

Sure, it’s a step up from most 2% cashback cards – but the catch is you have to tie it to the Chase Sapphire Reserve®, which has a $550 annual fee.

And that was fine for a long time, because when it launched, the Chase Sapphire Reserve® was the best all-around travel card out there. But it’s simply not any more.

Prestige redemptions are devaluing too, but it doesn’t matter

The Citi ThankYou points you earn with Citi Prestige are worth 1 cent each toward travel. Assuming you only spend in the bonus categories and earn 5X points per $1 spent, that’s a 5% return.

Compare that to spending in the Chase Sapphire Reserve®‘s bonus categories to earn 3X points with points worth 1.5 cents toward travel. That’s still only 4.5% back toward travel (3 X 1.5).

Of course, this only matters if you book travel through the respective bank portals. I’m mostly interested in the transfer partners. And considering Chase’s recent losses, I can do everything I want to do with Citi’s selection of transfer partners:

- Avianca

- Asia Miles (Cathay Pacific)

- EVA Air

- Etihad Guest

- Flying Blue (Air France / KLM)

- Jet Airways

- JetBlue

- Malaysia Airlines

- Qantas

- Qatar Airways

- Singapore Airlines

- Thai Airways

- Turkish Airlines

- Virgin Atlantic

Especially the most valuable five of the lot.

I’m not too concerned with the minor difference in the premium cards’ annual fees – $550 a year for the Chase Sapphire Reserve® vs. $495 a year for Prestige. That $45 isn’t going to sway me either way all that much.

The power is still in the pairing – and it’s better for Citi ThankYou points

Lots of peeps have a “Chase trifecta,” usually the:

- Chase Sapphire Reserve® or Chase Freedom Flex℠

- Chase Freedom Unlimited®

- Chase Freedom Flex℠

- AND/OR

- Ink Business Preferred or Cash

I personally have an Ink Plus, Chase Freedom Flex℠, and Chase Freedom Unlimited® (right now).

This is because you can combine all the points you earn into the highest-value card account – and supercharge all the points you earn across every card.

For example, you can earn 5X points with Chase Freedom Flex℠‘s rotating quarterly categories, then bounce those points to the Chase Sapphire Reserve®. From there, they’re like all other Chase Sapphire Reserve® points. You can:

- Transfer them to travel partners or

- Book travel at a rate of 1.5 cents per point

At a minimum, you want at least one Chase card with an annual fee, because then your points become transferrable to travel partners. Useful for so many situations.

If you have a few Chase cards, the theory is you can maximize every purchase – and then reap the benefits of the best Chase card in your bunch.

Now, Citi ThankYou points

But, it’s even better with Citi. Mmmmhmmmm!

That’s because your points inherit all the best qualities of each card when you combine them into the same account.

The cards look the same, but have wildly different characteristics

Por ejemplo, say you have Citi Prestige, ThankYou Premier, and Rewards+. ALL your points:

- Are worth 1.25 cents each toward travel from having ThankYou Premier

- Are transferrable to partners from having Prestige/ThankYou Premier

- Earn 10% back to your account from having Rewards+

Plus, you can stack the fantastic bonus categories:

- 5X points on air travel and dining from Prestige

- 3X points on all travel with ThankYou Premier

- 3X points on gas with ThankYou premier

- 2X points on entertainment with ThankYou Premier

- 2X points at supermarkets with Rewards+

IMO, these are better reward categories than what’s offered with any of the Chase Ultimate Rewards cards. Now THAT’S a “Citi trifecta.”

Make sure not to discount that 10% rebate with the Rewards+ card. You can get up to 10,000 points per year back to your account. That amps up the earning on all your Citi cards!

“But Citi is cutting benefits”

Have to address this.

I’m *super* disappointed Citi is cutting all their travel insurance and many other benefits:

Effective September 22, 2019, Worldwide Car Rental Insurance, Trip Cancellation & Interruption Protection, Worldwide Travel Accident Insurance, Trip Delay Protection, Baggage Delay Protection, Lost Baggage Protection, Medical Evacuation, Citi® Price Rewind, 90 Day Return Protection, and Missed Event Ticket Protection will be discontinued and will no longer be provided for purchases made on or after that date. Coverage for purchases made before that date will continue to be available, and you may continue to file for benefits in accordance with the current benefit terms. Roadside Assistance Dispatch Service and Travel & Emergency Assistance will be discontinued and will not be available on or after September 22, 2019.

Honestly, eff you, Citi. Those are huge ancillary benefits. I used Citi Price Rewind constantly, but nearly every card issuer has cut price and return protection recently. I’d love for them to keep trip delay and interruption, and lost baggage and delay insurance – at a bare minimum.

But then again, Amex doesn’t offer much in the way of travel insurance either. And this mostly affects flights. So while I hate they’re doing this, I’m not sure it’s worth keeping a Chase card just for these benefits. I did take a lot of comfort in knowing they were there – so yeah, this one definitely stings. What do you think about this issue?

You still need a card with primary rental car insurance, though

That is, if you ever rent cars. The Chase Sapphire Reserve® and Chase Freedom Flex℠ both offer primary rental car insurance both domestically and abroad. In practical terms, this is the one benefit that makes or breaks a proper premium rewards card. Make sure you have one. Chase is still the best for this.

Bottom line

Chase Ultimate Rewards hasn’t kept up in terms of bonus categories, points earning, or transfer partners – all things that are amply available with Citi ThankYou cards.

Because of this, I’ve switched my loyalty and spending to Citi ThankYou points cards. And for the odd non-bonus purchase, I use my Amex Blue Business Plus because it earns a flat 2X Amex Membership Rewards points per $1 spent, on up to $50,000 in spending per calendar year. Basically, I want every dollar I spend to have a meaningful return, and I no longer find that happening with Chase cards. I haven’t spent anything on my Chase cards recently.

One more thought: Chase’s best transfer partner is now Hyatt. But since I got my Amex Hilton Aspire card, I’m going full Hilton fanboy – a place I’ve always occupied anyway. So while I still like Hyatt hotels, I personally don’t see myself using them all that much in the near-term.

And just to give a bird’s eye view: I simply don’t think Chase as many useful bonus categories as Citi cards do.

Over to you – what do you think regarding UR vs TY points at this moment in time? Are you still #TeamChase like so many of my compadres? Why are you sticking around? Why not utilize Citi?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Yes yes and yes! I agree 100% with you. I use my Citi Prestige and Premier for everything. I use my Chase Ritz for car rentals and then switching to Amex Aspire for hotels. I seldomly use Chase for Hyatt at low 12-15k properties.

If Citi had 1.5 cents to redeem for travel it would be the best card in the market.

Oh gosh, that would be an absolute dream. Here’s hoping! Even if they don’t add that, I’d take them not taking anything else away! Sounds like we have similar spending/travel patterns. Good card combos for what you’re going for!

I totally agree with your points :). I collect points strictly for international premium travel. The two cards I use the most are the CITI Prestige and AMEX Gold. I use the TY Premier for gas and local travel, Chase Ink Business Plus for 5X at stationary stores, and Chase Reserve for travel insurance coverage. I was about to cancel the Reserve until CITI eliminated all of their travel insurance coverage.

Yes, losing travel coverage on Citi Prestige felt like a low blow for sure. You’ve got a nice collection of cards! For Amex Gold, do you keep it just for 4X at grocery stores? Because your Prestige earns 5X at restaurants. Maybe you keep it for the ability to transfer to partners?

Using points for international premium travel is by FAR the best strategy. Love it! Thank you for reading and commenting, Jason!

I’ve had the citi premier for 3 years now and love it because of all of the bonus categories: 3X gas and travel. 2x entertainment and restaurants is one of the best. I like to transfer to Cathay Pacific and Singapore but Avianca is a nice transfer partner too.

CSP is soooooo outdated. 2x on restaurants and travel? That’s it? How boring and outdated.

Citi Prestige is one of my 2 main credit cards.

Totally. CSP has nothing on TY Premier. That 3X on gas is a big perk all on its own!

There are other choices for gas purchases, between Costco, Sams, PenFed, or even BJs. While they’re not travel points, earning 4-5% as cash is great. I’d like to have the 1.5x rewards right away, rather than speculate on potential trip redemptions, giving that point values can change at any time, and nearly always it’s a devaluation.

Totally feel ya. I’m optimistic about my points redemptions and definitely get 2 cents per point (usually more) every time I redeem. But hunting for award flights can be tedious and cash in hand – you can’t argue with that!

I have Prestige & Premier for mortgage, but still going with 5X VGC with Ink for most daily purchase.

The real trigger for me is when Double Cash TY points become transferable to airlines, even at 2pts to 1.5 miles.

Nice strategy you have there! Love it!

And yes, that would be a HUGE move in the right direction for ol’ Citi. I do hope they get their card portfolio aligned one of these days.

Thank you for reading and commenting!

Agree in concept on points, especially with earning and the redemption values w Turkish. I can see how Citi is able to devalue the other benefits especially 4th night free as they can still compete. However that is the most unique valuable benefit so very sad to see that turn to crap. 2x entertainment on Prestige is minor but will be a niche to be missed

I used the 4th night free a few times, and it was totally an amazing benefit. Sad to see that one go. ThankYou Premier still has 2X on entertainment – no idea why they chose that particular category to eliminate with Prestige. I’d like to see them add something more to the card – or at least not change it for a while. That card’s been through a few iterations already. Leave well enough alone, Citi!

I am also using my citi cards more and more (especially for restaurants and airline tickets), but you have a couple gems in your chase arsenal that I think you are missing:

-Your old chase Ink plus (not available anymore) that has a 5X in office stores. Get creative and those 5X become a 7.5 % cash back minimum and an amazing value to transfer to Hyatt. Time to take it out of you drawer.

-The World of Hyatt card, where you can get globalist status just by spending. If you travel enough and appreciate amazing perks, this could be priceless Also a couple (or more) free nights, etc. I love this card. It also has some bonus categories. I am not a fan of Hilton like you are.

-The United card opens the door to the Mileage plus X app, where you can get instant gift cards and more with amazing bonus miles. The card gives you 25% more miles when you buy gift cards. Yes they are united miles. But I think they will still be valuable at least to use on their partners.

Awesome tips, Ricardo!

I do occasionally use all my Chase cards. My Hyatt card is the old one, not the new World of Hyatt card. I wish I could be loyal to Hyatt, I really do. I believe you’d have to spend $140,000K per year on the card to earn Globalist – that’s just way too much opportunity cost. But could be worthwhile for super big spenders.

And I def use/love the Mileage Plus X app. I actually find myself on United a couple times a year and the Explorer card is definitely worth it. Plus – primary rental car insurance. So I’m definitely keeping that one.

I could live without the British Airways card. I also have the old IHG card, with benefits that would stack with the new IHG card. But again, just not that into IHG. I got it for the free night, but that’s been watered down. Will see if I can get some use from it this year. It’s only $49, so not much. I’d let it go if it meant opening a new Chase card, though.

Great Post! My Sapphire Reserve has been in my sock drawer for some time now. I have lifetime status with Marriott and I carry the Hilton Aspire so I have effortless hotel status and don’t need Hyatt. The Chase airline partners are nothing special.

Not many bloggers have your courage to post this 🙂

Totally agree. Thank you for reading and commenting, I appreciate it!

I’m glad to see a more pragmatic comparison between cards (compared to what i feel like are “agenda driven” posts that TPG and others have become).

However, i think in terms of bonus category, chase still has some really useful nuggets that make it compelling enough like the 5% on cell phone, cable and office supply with Ink Plus/Cash and the 3% categories on CIP.

Plus the 2% on groceries with Rewards+ is just meh compared to Amex Gold with 4% (given that if you are able to use all benefits, the annual fee on that is just $30)

My biggest gripe with Citi Prestige is the reduction in all the benefits, i’m no longer sure why i should put 5% airfare spend on prestige instead of the Amex Platinum and to me MR points are as valuable as TY points.

Also for annual fee between Prestige and CSR is not just about 495 vs 450, there’s also the 250 vs 300 travel credit so the difference is $95, not just $45.

Having said that, currently i do have Prestige + Rewards+ to leverage the 10% back on points (btw, there’s a TYPO in the post – You can get upto 10000 points back NOT 100000 points back with the 10% on Rewards+)

Thanks for reading and commenting! Wow, lots of good observations here.

Def hear you re: Chase bonus categories. I do use my Ink Plus for cable and cell phone. But really, how much does one spend monthly for those? $150ish? And I don’t spend much at office supply stores any more. Used to MS back in the day but it got to be too much. Still a total winner there for sure, though.

I dumped my Amex Platinum Card a while ago. It only has one bonus category, and the fee is now $550 on the personal card. I never put a dime of spend on it, so it was a lot to pay for Centurion access and the statement credits. But yes, either card (Amex Plat or Citi Prestige) would be great for 5X earning – I like both rewards currencies about equal.

Because of 5X earning on dining with Citi Prestige (a huge category for me), it’s worth the upcharge over the CSR even with the difference in travel credits/annual fees. It’s definitely top of wallet.

Also, fixed the typo – thank you for catching! Really enjoyed hearing your counterpoints. Thanks again!

For two years, the CSR was my go to card for most spend. Then this Jan, Bank of America introduced it’s cashback bonuses for Platinum Honors loyalty tier and I’ve stopped using my CSR almost entirely.

With 3 Cash Back cards (zero annual fee) and 1 Premium Rewards card ($90 annual fee), one can get:

– All travel: 5.25% cashback

– All dining: 5.25% cashback

– All online purchases (except utilities, insurance and home cleaning): 5.25% cashback

– All other spend: 2.62% cashback

– $100 back annually on airline incidentals

With this combo, the only reason to keep any other fee card at all is for primary rental insurance and for purchase protections like trip delay insurance. So one can stick with the cheapest card that meets one’s needs of this kind.

Of course the caveat with BoA Cash Rewards, is a $2500 quarterly spend limit on the individual categories mentioned. But hey, zero fee cards will beat fee cards on ROI any day.

Those BofA cards definitely have their fans! I don’t have $100,000 to let them hold to achieve the top-tier Platinum Honors status – because my employer uses Fidelity for our retirement accounts. I think I’d rather earn points than cashback as the variable return can be so much higher when you redeem for travel. The ROI you get depends on how you use any card. For example, the Amex Hilton Aspire has a $450 annual fee, but you can get so so much more than that in returned value.

I’ll get the BofA plan in mind though – there’s a lot to be said for flat cashback returns. Thanks for the reminder and for sharing your thoughts!

So I’m a Citi newbie. I am most familiar with Amex and chase, and have had Citi AA cards but never the ones with thank you points. Your post has me reconsidering my strategy and I wanted to ask about which Citi cards to open and in order to maximize bonus. I thought I read that if I get a bonus with either prestige or premiere I can’t have another sign up bonus. Any ways to work around that? Thanks!

Hey Andres! There aren’t any workarounds to the application rules. I opened my Citi Prestige card in late 2015, and product changed another Citi card to the Rewards+. Somewhere along the way, I had the Premier, but it’s been over two years by now, so I could get it again and earn the bonus. I’d recommend choosing either the Prestige or the Premier, product changing to Rewards+ to get the 10% rebate, and picking up the final card down the road. Remember to pool all your points into one account so you get the benefits of each.

Thank you for reading and commenting!

Opened Citi premiere within a week blocked for “fraudulent activity”. Called in to unblock told they needed to look closer for 5-7 days. Called back and they still can’t unblock because they can’t text me message to verify it’s me. Smh ♂️ definitely making me think twice about opening another one with them. Did you or others have similar experiences?

Hi Harlan, long time no chat! I’m with you on TYP as of late. Lots of spend on my Prestige and ATT More cards.

I do use AMEX gold for grocery and CNB for gas and grocery where AMEX gold doesn’t code properly. I find it odd that I will be under 5/24 in Nov. Thinking about CIP, or possible the SW biz followed by a SW personal to get the companion pass again. What is on your Chase target list?

Hey DW! I *just* got the CIP! I thought about getting the Southwest cards too, but then I thought, nah. I don’t fly Southwest all that often, tbh. And I don’t have a companion right now either, so…

Other than those, get another CSP or CSR if you qualify! If not, the Southwest option might actually be worthwhile. Hope you’re doing well!

Never understood the love for dining as a bonus category. If you spend that much on dining to where that matters, you’re either a millennial or eating out too much (or both). Citi lineup is meh. Transfer partners are trash as well. I’ll stick with UR & MR

Thanks for the perspective! I don’t dine out as much as I used to, but earning 5X when I do is a sweet deal! I’ve found Citi transfer partners to be as flexible as Chase or Amex, if not more, depending on the redemption. I’ll still collect other points currencies and my favorite may change over time, but I’m loving the earning and burning with Citi right now.

With the upcoming ability for 1:1 cash:points from Citi DC to Thankyou points , I’ll have loads of Thankyou points in my arsenal! Will need to look more at the redemption option. Avianca and Etihad seems very good!

Heck yes! I am super excited about this! I’m gonna see if I can covert one of my old cards to the Double Cash. Although now that I have the Amex BBP, I wonder how useful it’ll be. I’ll have to run the numbers and compare them. Will have a post on this soon!

If you use it in conjunction with Rewards+, you are getting a 2.2% return on DC compared to 2% on BBP (assuming TY and MR are considered equal in value)

Yes, and if you use it to book travel when you have a Citi Premier, each point would be worth 1.25 cents each, which bumps you to over 3% (assuming you’d redeem points that way). Otherwise, it comes down to which partners you like better, and if you can access the BBP. If you can only get personal cards, TYP becomes the better option. I’ll have to sit down and run some comparisons.

Thank you for adding that!

Harlan,

Your conclusions are correct, but your math is off a little bit. If you assume 1.25 cpp and DC gives 2x. That is 2.5% back. Combine that with the bonus 10% and it’s 2.5%*1.1 = 2.75%. That is a really great return though for a minimum and a $95/AF. You are unlikely to do better than this unless you have a CNB Crystal Infinite or BoA Platinum Honors.

You’re right! Thanks for helping me fine-tune! Now that the CNB is devalued and given you have to keep $100K with BoA to access their best rates, this is by far the best combo for the average person looking to access great returns with personal cards. Loves it. Hope you are well, always great to hear from you!

Probably the most well written article I’ve see on on boarding area in a long time. Well written and well done!