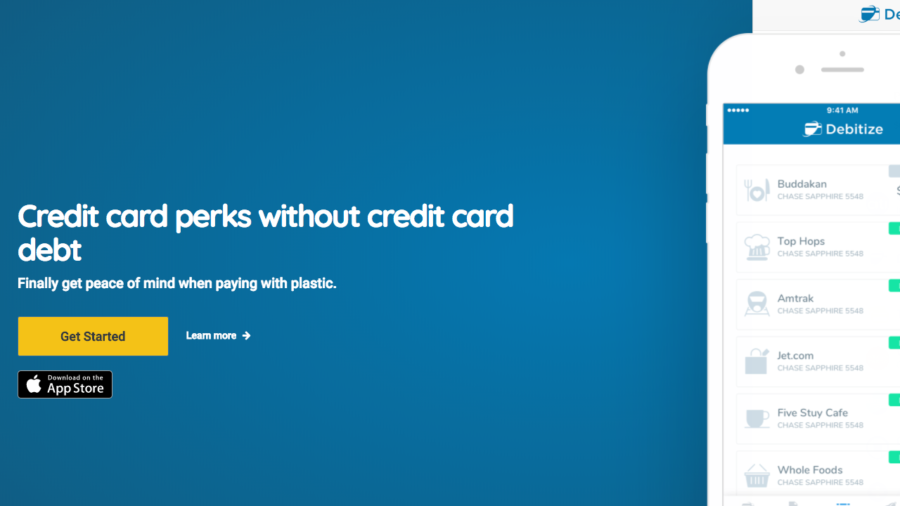

Debitize has been on my radar for a long time. It’s a website (and iOS app) where you plug in your credit card and bank account information. As you make purchases on your credit card, money is moved automatically every time you swipe – as if you were using your debit card.

For peeps who have trouble with the idea of managing credit, or afraid to overspend, you can still see money leaving your account every time you use your card. And Debitize will pay your card off in full each month.

In essence, you can treat your credit card like a debit card. But the big plus is, you can still rack up valuable credit card rewards!

Here’s more about the service.

What’s Debitize?

The #1 thing I hear from friends about why they insist on using debit cards (🙄) and don’t want a rewards-earning credit card is they don’t want to overspend.

I’ve also heard they like to see the money leaving their accounts so they know how much is left. And they’re terrified of missing a payment and getting late fees and interest added to their balances.

Enter Debitize, which aims to solve all those pain points:

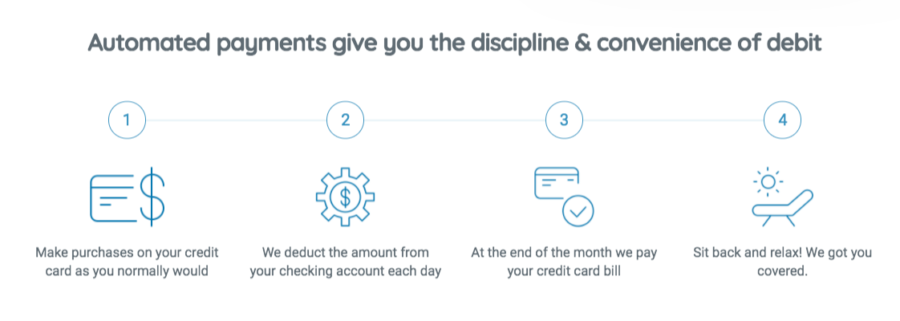

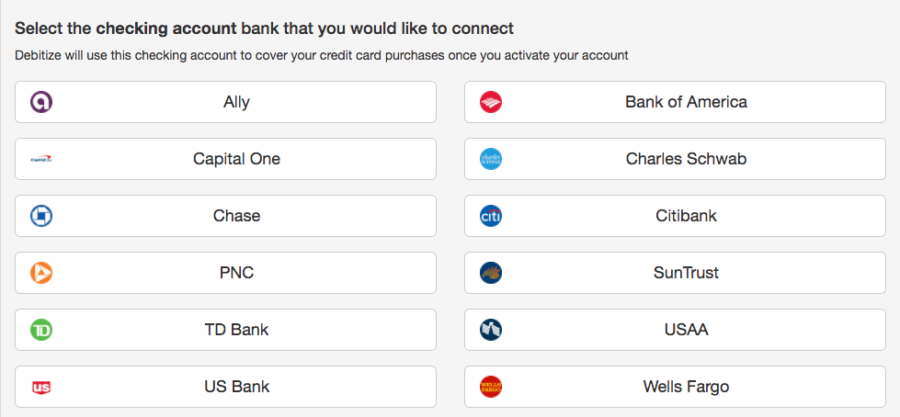

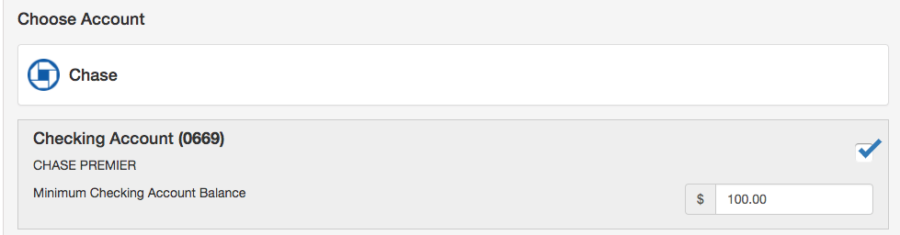

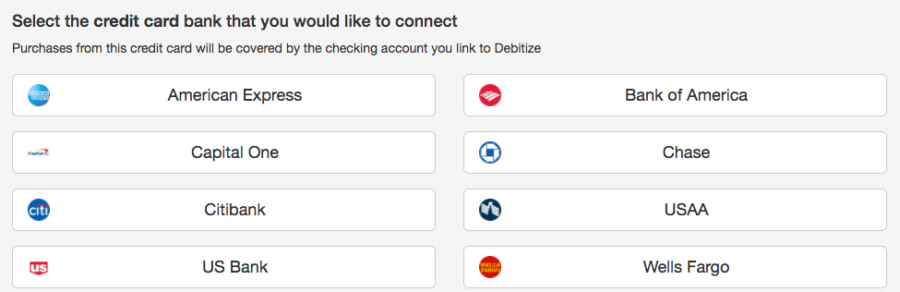

You link up your credit cards and your checking account. All major banks are supported. (Check out these totally free checking accounts while you’re at it!)

Then, add as many credit cards as you want to your Debitize account.

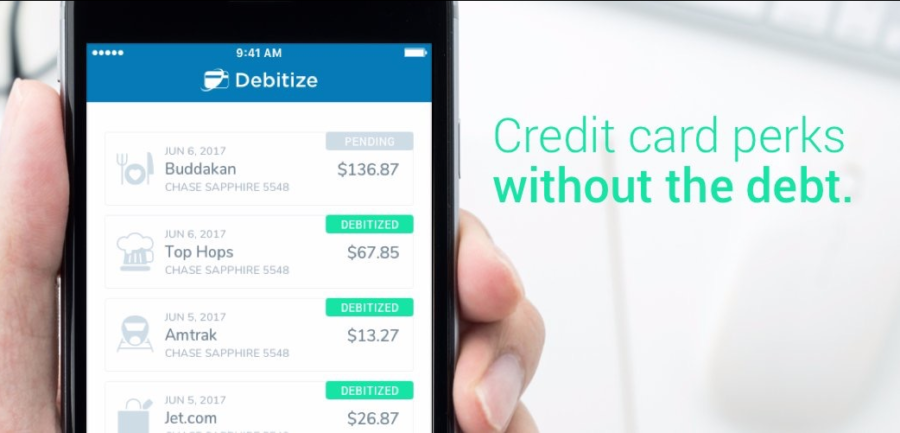

Every time you swipe your credit card, Debitize will deduct that amount from your checking account. And hold it in your Debitize account (which is FDIC insured).

And the end of each billing cycle, Debitize pays off your credit card for you. This happens seamlessly behind the scenes so you never have to think about due dates, how much is in your checking account, or getting a late fee.

Plus, the service is completely free to use.

Even better, Debitize exists as a website AND an app. So you can access your account whichever way you prefer. The only drawback is the app is only available for iOS.

What are the benefits?

The biggest and most obvious win is if you’ve been avoiding travel rewards cards because you’re afraid of mismanaging them or missing a payment, Debitize takes care of that for you. So you can finally earn rewards on all your purchases! Instead of using a debit card, which earns… nothing.

At the most basic level, you can get a 2% cashback card with NO annual fees and get literally free money on everything you purchase. To not have at least that is leaving money on the table every time you make a purchase.

If the biggest barrier is the management of a credit card, Debitize takes care of that for you. In a sense, if you’re bad at managing your money, Debitize saves you from yourself by handling the credit portion of your credit card.

Are there drawbacks?

Overdrafts

My biggest concern would be overdrafting on a checking account.

Not only will Debitize never overdraft your account, but you can set a minimum balance you want to keep in your checking account. That’s helpful if you need to withdraw some cash with your debit card, or have subscriptions plugged in (or anything else automatically deducted).

Funds delay

It takes a day to transfer funds from your checking account to your Debitize account. So if you’re used to seeing your checking account balance instantly decrease after every purchase, it’ll be on a slight delay.

A day isn’t a huge deal if you’re using your card a couple of times a day. But if you have a big purchase, that extra day will create a lag in getting instant gratification if you decide to go on a shopping spree, for example.

Security

Debitize is committed to security. And you have to enter your banking logins to connect the accounts. Debitize uses the same money transfer system (Plaid) as Venmo, Acorns, Betterment, and many other financial firms. So in that way, it’s nothing out of the ordinary.

Also, you can only transfer your money back to your main checking account. So if someone got your login, they couldn’t transfer money out of your Debitize account. Debitize does not store your information on their servers.

One checking account, many credit cards

I only saw the ability add a single checking account. If you have than one, you could always swap them out. But of course, that’s more effort.

However, if you rely on a single checking account, you can use it to pay multiple credit cards.

It would be nice if you could link a business checking account to a business credit card, and keep your personal checking account linked to your personal cards.

This won’t be a huge deal for most peeps, but it would be nice to have.

Stay connected as you want

Debitize has lots of settings for notifications, including:

- Bills scheduled

- Reminders

- Low balance warning

- Large transactions over an amount you specify

- Weekly summaries

You can opt-in to get emails or app push notifications for all of these. Or turn them off and check in once a month to make sure all is running smoothly. Or just set it and forget it.

I like all the customizations with alerts and settings, for those that like to stay involved.

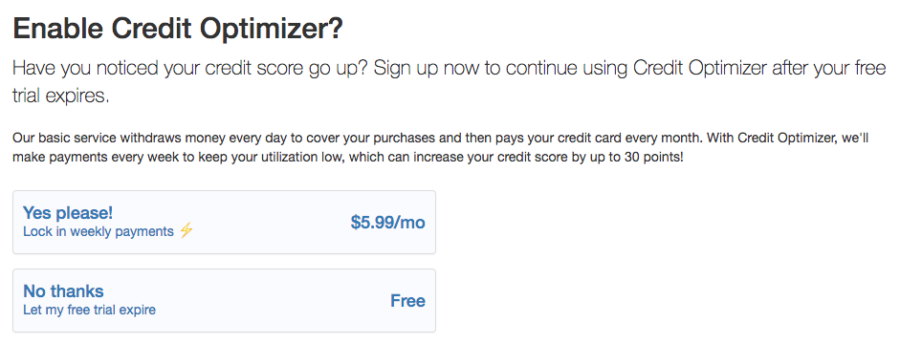

Enable credit optimizer?

There’s another feature called “credit optimizer” that, for ~$6 a month, will pay your credit cards weekly instead of monthly.

The idea is to keep your credit utilization low. Because some banks report it to credit bureaus mid-cycle. And with weekly payments, it will almost always appear very low.

This is a nice idea, for sure. But is it worth $6 a month? Maybe for some people, especially if you have a low limit on a card. But for most, I’d say skip it and enjoy the free features – they should be more than enough for the average user.

Bottom line

Debitize is an amazing idea! It solves the pain points I’ve always heard about credit cards: fear of overspending, missing due dates, and accruing interest. It also simulates that feeling of watching your money leave your account like a debit card – albeit on a 1-day delay.

The service is a website and an iOS app. It’s free to use, and secure. And has plenty of settings and alerts to put you at ease. Most of the reviews of the iOS app are 5 stars. And people seem to enjoy the feeling of using a debit card while earning credit card rewards.

If you don’t like managing your money, or just don’t want to think about it, it’s worth setting up Debitize once and putting it on autopilot. The fact is, debit cards earn nothing, while even the most basic 2% cashback credit card with NO annual fees will at least earn you something for your spending. Why leave free money on the table?

When you sign up with my link, you’ll get $10 added to your account after 5 automated withdrawals (5 purchases). If you want help managing your credit card to get rewards and like the feeling of using debit cards, give it a try.

I’m definitely going to recommend this service to friends in the future. If you’ve used it, what do you think? Would Debitize make you feel at ease using a rewards credit card?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

so their business model is taking your checking account cash for a ~30 day interest-free loan then reinvesting those funds in short-term vehicles for a higher return ?

That’s what I’m thinking. Even overnight loans can be lucrative if you have enough volume. Of course, you won’t earn any interest for letting it sit there.

It seems if you’re not using an APY checking account anyway, even with the interest-free loan to Debitize, you can come out ahead with a 2% cashback credit card. There’s no difference in your return, other than the credit card rewards. You also gotta think of the target audience for this service: people who don’t want to manage their money. I personally don’t mind making payments and all that, but a lot of people do.

I think it’s smart on their end. Seems like it could be a win-win for the people they’re trying to serve, really.

Hmmm. Certainly something to think about and I haven’t heard of it before; thanks.

For sure! You could always try it and see how you like it. If you don’t, unlink your accounts and it’s done. Either way it’s free, so nothing to lose, really.

Thank you for reading and commenting!

This is great. I think for those of us (most of us here?) for whom credit cards and rewards are second nature and have no problem whatsoever with it all tend to forget that lots of people aren’t wired that way. (shocker!) I have family and friends who think I’m crazy and will only end up getting into trouble messing around with all this credit card stuff. This could be a great way for some of these types to safely “dip their toe in the water” without having to worry about drowning. I’m definitely going to be checking this out more and passing it around. Thanks for the heads up!

Gosh, I so feel you on that. My friends also think I’m crazy to manage so many credit cards and seem terrified of the idea. As if they’ll go binge shopping just because they got a credit limit. I’ve already hooked a couple of friends up with this and waiting to hear what they think at the 1-month mark.

It’s a shame so many people use debit cards and give up even the most basic of rewards. If this service gets them acclimated to earning free money, then I’m all for it.

Thanks for sharing your thoughts, I really appreciate it!

I can’t believe how careless people are with connecting their bank data to third party apps…it’s not about the interest free money but about all the transactional data they get both from the bank account (your funding source) and the transactions you make with their app to sell to marketers.

Very interesting. Sounds like a great service for people who either have over-spending problems or don’t have the time or organization to pay multiple credit cards every month. One thing I wonder about is if there is a fraudulent charge on the credit card. I would assume the money for the fraudulent charge would be debited from your account until the credit card company issues a temporary credit. I wonder how Debitize would handle something like that. Would they put the money back into your checking account? This is one thing I’m curious about. Also, sometimes when subscriptions are cancelled, the company continues to make charges, and it needs to be disputed. How would Debitize handle that? These are a few different scenerios that I would be interested to know about how things would work with Debitize.

Most of those answers are here: https://debitize.com/faq.php

You can always stop Debitize from withdrawing for certain charges. Or, you can send the money back to your checking account. In the case of a fraudulent charge, the credit card bank would give you a credit and you can put the money back into your checking account. Hopefully that’ll never happen, but you do have some options.