Big news first: I closed on my condo on June 29! It hit the market April 22, and I got the offer on May 30. As y’all know, I’ve been on veritable pins and needles waiting for this. Now that it’s over, I’m almost embarrassed at the sheer amount of mental and psychic energy I put into it.

It drained me and consumed my thoughts. For the first time since I was little, I got down on my knees at night and prayed (for a smooth, quick sale).

This whole thing started in January when I got a small ceiling leak and morphed into this whole debilitating thing. But it’s done. And I finally feel like I’M BACK.

Now I live in an apartment in Dallas with the goodest boy

I’m always amazed (in a bad way) at how consumed I get with situations to the point where it zaps me so fully. That said, the last couple of weeks before closing were absolutely freaking crazy. In no way would I describe myself as being “calm.”

I didn’t post a June 2020 Freedom update because I knew the sale was pending and that it would shake up my financial situation. It did. And now I’m heading into the best financial shape of my life.

July 2020 Freedom Update

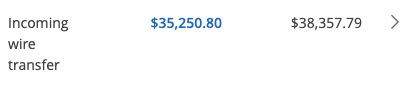

On June 29, I got up early and went to the title office. Within an hour, it was done. Later that day, I got the money from the sale.

Wowza

All told, I walked away with $35,250.80. Not as much as I wanted or could’ve gotten, but plenty considering I was ready to get rid of the condo for pennies if necessary.

Manna

In the interim, I sat and had a long margarita. Selling that condo was such a relief. Such a weight off. I let the liquor take off even more. It was my first drink in several weeks.

Then I went home and set about distributing the money. I’d thought about it for a while – exactly what I wanted to do with it. After I canceled my homeowner’s insurance and turned off the electricity, I split the proceeds into little pieces – and met a slew of my 2020 financial goals in the process.

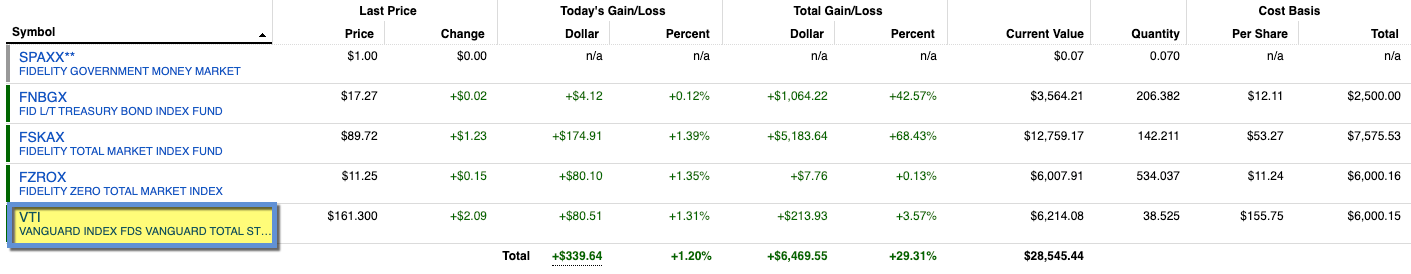

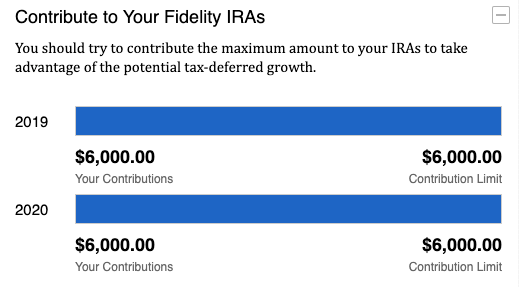

Maxed out my 2020 Roth IRA

First things first, I sent $6,000 to my Roth IRA and maxed it out for 2020 in one fell swoop. When the cash cleared, I bought $6,000 worth of VTI and called it a day. Boring, simple, easy index funds: exactly what I want in my retirement accounts.

VTI is my newest flavor of vanilla. Here’s what’s in my Roth IRA

I have a few different index funds in my Roth IRA. The stocks are total market, with near-equal portions of FSKAX, FZROX, and VTI. I went back and forth about FSKAX vs VTI, but wanted to see how an ETF stacked up to a mutual fund over time. I’m also keeping an eye on FZROX (Fidelity’s completely free to own fund) and will change that up in January 2021 if needed.

This felt so dang good

But they’re all index funds and all roughly the same. I guess I like comparing similar flavors. 🍨

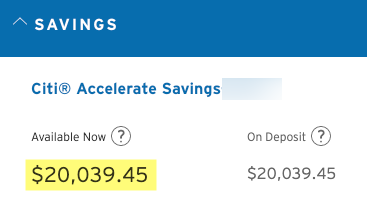

Sent $20,000+ right to savings

Covid is freaking me out. While I want to invest heavily, I also want cash on hand in case things get worse before they get better. To that end, I met my goal of having $20,000 in a savings account. And for good measure, put $4,500 more into my PNC high-yield savings account and have a new stretch goal for $30,000 in that account, too.

These next few months, I will save like a maniac. Maybe I’ll end up using it on a down payment for a single-family home. But whatever happens, I’ll sleep a lot better knowing I can support myself for a year if I have to. I don’t feel secure in my job and have general uncertainty about pretty much everything right now, like everyone.

Boom

This is also the first time in my adult life I’ve had 6+ months of expenses in a savings account. Now that it’s there, I’m going to do everything in my power to leave it alone.

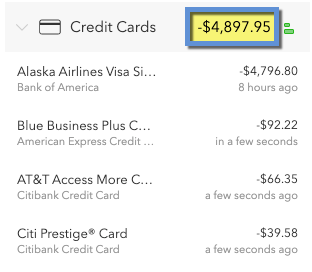

Paid down my credit cards

I had $10,000 sitting on a 0% APR card. The rate is good through September 2021. So I’m not in a huge hurry to pay it off. Nevertheless, I chopped it in half with a $5,000 payment. 🗡

This is next on my hit list

I don’t like owing money, even at 0%. From a psychological point of view, I don’t want to make myself comfortable carrying credit balances. So I’ll focus on finishing this as well as building up my savings account even more.

Made a big car payment

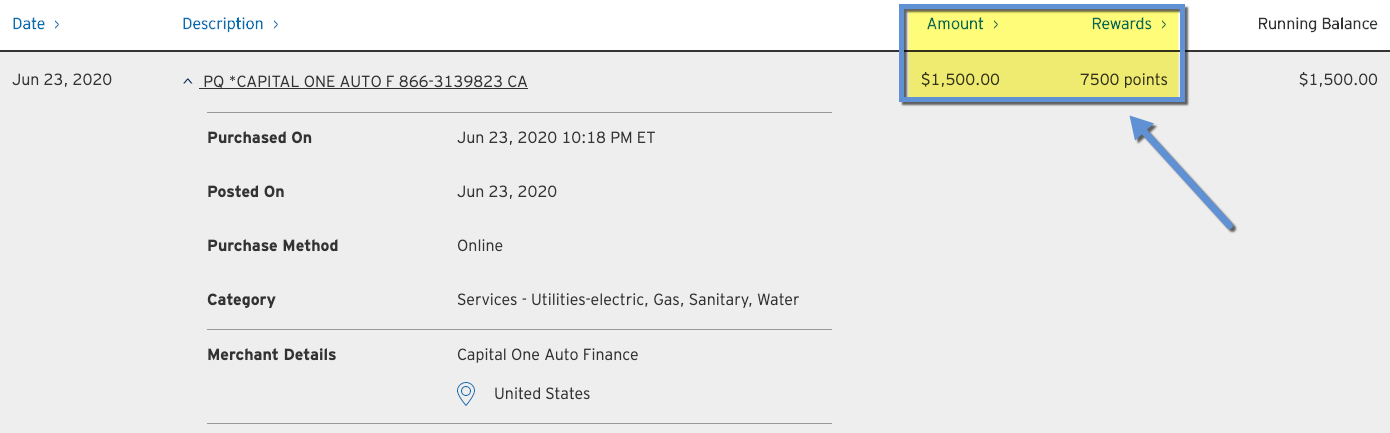

I took advantage of the current Citi Prestige 5X offer for online purchases (which works with Plastiq payments). I wrote that post on June 26 and got some hateration in the comments saying it was a bad offer.

At that point, three days before closing, I was probably halfway delirious but was eager to write anything. I also thought it was a genuinely good deal. Maybe it isn’t? It’s certainly not the first time I’ve written a post and looked like a doofus. I learn as I write, so I leave everything up. It’s not too long before I learn from my errors. But I don’t forget them.

$1,500 down and 7,500 ThankYou points up

Anyway, I made a $1,500 payment toward my car loan and now owe a little under $4,000 on my car.

It’s got a low interest rate and the payments are only $161 per month, so it’s not a concern. I just want it gone. But again, credit card and more savings is where my head’s at right now.

Upped my 401k to 30%

I still want to max out my 401k in 2020 if I can. To do that, I needed to bump up my contributions from 10% to about 35% through the end of the year. I settled on 30% because it’s a round number and leaves me with one check per month to use for rent, car, and insurance, and another for credit card payments and saving.

I’ll add $2K+ to this each month now

I also figure if I’m fired or laid off soon because of Covid, at least I’ll reduce my taxable income in the meantime. I don’t have a huge selection of funds in the company 401k plan, but FXAIX (Fidelity® 500 Index Fund) was available, so I settled on that. Another boring, low-cost index fund. 😛

By the numbers

Get ready for some wild gyrations:

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| Credit cards | $4,898 | $12,042 | -$7,144 | $0 | |

| Mortgage | $0 | $141,782 | -$141,782 | $0 | COMPLETE! |

| Car | $3,888 | $5,526 | -$1,638 | $0 | |

| Roth IRA 2019 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| Roth IRA 2020 | $6,000 | $0 | +$6,000 | $6,000 | COMPLETE! |

| 401k | $12,874 | $9,515 | +$3,359 | As much as possible | |

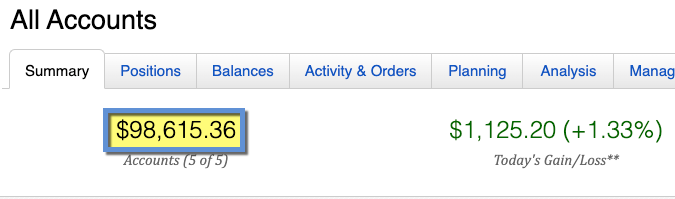

| Overall investments | $98,615 | $83,912 | +$14,703 | As much as possible | |

| Savings | $24,095 | $1,535 | +$22,560 | $20,000 | COMPLETE! |

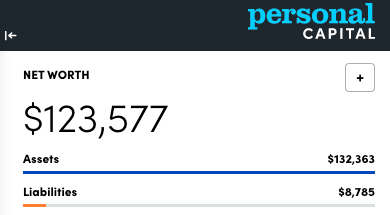

| Net worth in Personal Capital | $123,577 | $88,475 | +$35,102 | $500,000 | Track your net worth with Personal Capital |

Of course, I don’t have a mortgage any more (THANK GODS). Stocks are recovering.

I’ll break $100K invested this month

My savings are up. And my increase in net worth is nearly identical to my home sale – I threw all my gains and equity right into my financial goals. Many of them are complete now!

A return to progress

I’m also expecting a ~$5,000 check in the next few weeks from what was in my escrow account at the time of closing, which I’ll put into savings. In fact, July 2020 should be my month with the highest net worth I’ve ever had – more than my peak of $127,320 in January 2020 (before the pandemic).

Coincidentally, that’s when the trouble with my condo began. And now, six months later I’m back in the same place and finally poised for growth. Everything is coming full circle, except now I don’t have a mortgage. But everything is also totally different than it was in January. Who could’ve predicted a pandemic would rock the global economy? So while my end goal is the same ($500,000), the way there has certainly adjusted. This is shaky ground and I’m trying to plant each step in the right place.

July 2020 Freedom update bottom line

I’m thinking about travel and new goals for myself. I have lofty ones for 2021 that I can’t wait to share. And now that I’m mortgage-free, I’m thinking a good old fashioned credit card app-o-rama is in order to use for those goals.

Because of Covid, I really don’t need my Citi Prestige card any more. The Citi Premier is looking better than ever with its upcoming changes and 60,000-point welcome offer. I was also thinking of opening the US Bank Altitude Reserve card again as my mobile payments/Costco card now that I’m at home a lot more (plus to earn another sign-up bonus). I’m also eligible for another bonus on the Chase Sapphire Preferred. Maybe I’ll go crazy and get all three in a flurry of apps. 🤪

Thank you for keeping with me these past few months. I now know the dangers of HOAs, what it’s like to sell property and get a windfall of cash – and what I want for my next chapter. Thank you for the support, comments, for bugging me to write and for checking in. I needed it. With the home sale finally closed, I’m impatient for what’s next.

But yes. I am back. Like, back-back. Life really is just a continuation of lessons, isn’t it? Want to end this here and say again: thank you thank you thank you. ✨

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Great news! Especially about the condo. I sense a huge difference in your tone and outlook. Have another drink to smoother roads ahead. Troubles are bound to hit again, but you’ll be better able to handle those.when they do come (financially, mentally, and emotionally).

Wahoo – thank you so much, Carl! Congrats again on your wedding! Now that a little more time has passed, I can finally look forward to having new goals again. Woof, I didn’t realize how down I got these past few months. Onward and upward!

No wedding here. Maybe another Carl.

OMG I am so sorry. However that is so funny. Lolllll! You were prolly like WTF. Def got my wires crossed. Hope you have a good day!

Congrats on the sale! If you are investing in a Roth at Fidelity, I’d probably put my money in FZROX over VTI. Not that VTI is bad, but it’s slightly cheaper, and it’s easier to invest fractional shares in mutual funds. Again, Fidelity now allows for fractional shares, so this may not be a big deal at all. Pros of VTI are that Vanguard is owned by the fund owners and it’s easier to transfer to another firm.

The only thing about FZROX is they only pay out dividends once per year in December whereas VTI I believe pays out quarterly or semi-quarterly. It’s a small enough thing, but I do like to see dividends pay out a little more frequently than once per year. But regardless, a healthy mix is good – as long as they’re all low-cost index funds. :p I mostly just wanted to see how FZROX would perform and will reassess later this year for my 2021 plan.

Congrats on the sale of the condo!

With all of that cash on hand, it would seem like a good time to scope out some bank bonuses.

Absolutely! I was actually sort of thinking I could try for a BofA card since I could get a bonus with a high enough rewards tier. I’m still weighing that. But yeah, it’s nice to have some enough cash to float and throw around!

Whoo, nice! Glad things are going your way again.

I needed to have a smooth patch. There will be other things that come up, but hopefully I can chill and regroup for a month or two. Whether the world will be ready to explore after that remains to be seen lol. But yes – I’m gonna enjoy this. Thank you, Ken!

So glad to hear things are taking a turn for the better!

Thank you, Audrey! Hope all is good up where you are! <3