Also see:

I wish I got a better screenshot of this.

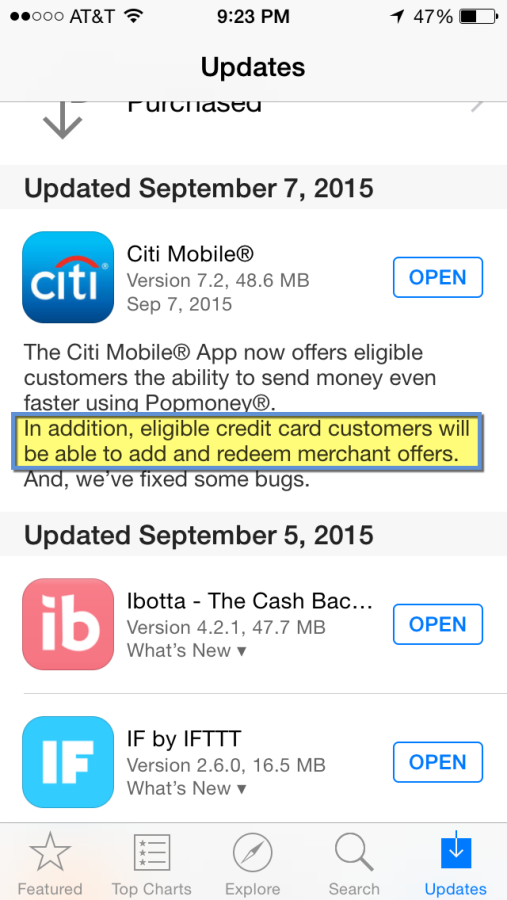

But it comes up right after you pull up the Citi mobile app after the September 7th update:

The other screen was much more effusive, and promised new “Citi Offers” on eligible cards at certain merchants – just like AMEX Offers. The only timeline Citi offered was “soon,” but I wouldn’t be surprised if the new feature hit in the midst of the holiday shopping season.

Benefits for consumers

I’ve been hoping another credit card company would compete for with AMEX for the lucrative “offers” market.

I kinda thought it might be Chase, who’s been a bit lagging with transfer partners and earning options recently.

Citi and AMEX have both really stepped up their game. Especially Citi and their ThankYou points program (which I need to look into stat!).

If this becomes a reality before Small Business Saturday, AMEX will have some serious competition in the offers market.

You know what I always say: when banks compete, you win.

In fact, I’ve been hoping for this sort of turnaround given the health of the economy.

Points redemption options are plummeting, hotels are packed, and planes are flying full. But at least we can save some money in other ways.

All-in-all, this new development should be a net win for shoppers.

I’m looking forward to seeing who Citi partners with, what the offers look like, and if there’s any duplication of partners between Citi and AMEX (which would be awesome to see them duke it out).

Bottom line

Be on the lookout for Citi Offers – a direct competitor to AMEX Offers.

I’m super excited about this. Not only because I just got the no annual fee Citi Hilton Visa, but because between this new feature and Citi Price Rewind, people might have the chance to save a LOT of money with their holiday shopping.

I hope this becomes a reality before November. As of now, all Citi will say is “soon.” But because it’s part of the most recent mobile app update, my inclination is that it’ll be sooner rather than later.

I’ll post more deets as they become available!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

After a couple of days of seeing nothing, and a friend seeing offers immediately, I used the Live Chat to figure out if something was wrong with what I was doing. The rep informed me that there was a technical issue with the interface, that they were aware of it, and it should be fixed shortly. I work in technology to a degree where I was fairly confident that was a BS answer. I’ve checked for a couple more days, and nothing.

I go into a new chat, and the person had no idea what I was talking about. After googling it to see the Citi name for it, I told him what the benefit was called, Smart Savings, and he said I needed to call into a number to speak to an account specialist to have my card upgraded. While still in chat, I called that number. I asked him what exactly to what the card had to be upgraded. I got some weird answer in broken English that didn’t make any sense. When I called him on it, and on the multiple explanations that made no sense, and expressed my disappointment, I mysteriously got disconnected due to a server reset (yet somehow my chat session was not interrupted. Again, I think this is BS), and I was given a new rep. Again, this rep went through my benefits, and had no idea what I was talking about.

During this time, a woman had picked up on the phone call, and she had no idea what I was talking about. I had her and her supervisor google “citi prestige smart savings,” after they tried to tell me that it was likely someone trying to impersonate Citi Prestige. Eventually, they said they needed to do some research, and would call me back in 15 minutes. In fairness, she called back in 5 or so.

Apparently, the upshot is that you only get these benefits if you bank with Citi in some way. This is not a benefit available to people who only own the Citi card. At least, that’s the answer I have for now.