Also see:

I’ve been looking forward to writing this post for a few months by now. Now here it is!

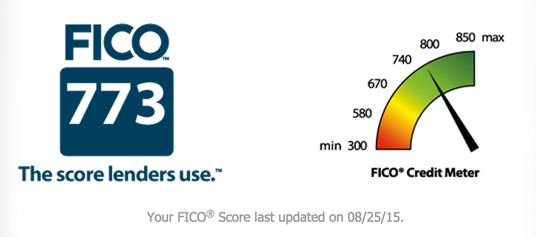

Yesterday, I made the final payment on my credit cards. Now, I don’t owe a cent of credit card debt!

As you guys know, I charged those puppies up to:

- Get my Airbnbs started

- Meet minimum spending requirements

- Earn more points and miles

- Stay afloat (#independentcontractor)

There was a point, a real and scary one, where I felt I’d certainly overleveraged myself.

I wrote about the feeling in Smart Debt: Is carrying a balance ever a good idea?

And I definitely felt I’d nearly crossed the line into plain ol’ dumb debt.

Digging out of credit card debt is by far one of the most psychologically strenuous exercises I’ve faced. And that moment where I saw the interest get charged felt so wrong, my stomach turned. But I knew I could shoulder a couple of months of interest to make it all back, plus more.

Still, it sucked.

And today is the official turning point where I go full-force into FIRE.

What is FIRE?

FIRE stands for “Financial Independence, Retire Early.”

It’s a long-term goal with actionable short-term steps.

My credit card debt was an out-of-control flaming emergency.

I still have student loans, to the tune of $53K, and it’s time to take a hybrid approach to paying those down, saving, and investing all at the same time.

I went down to Dallas earlier this month to take a look at some investment properties down there. The numbers seem to work. And I’m thinking about snapping something up in the next few months.

With FIRE, the ultimate goal is to have the option to work or not work, without being dependent on it.

The actionable steps now that the credit cards are done are:

- Set up an emergency fund (maybe with my new Aspiration Summit account?)

- Save a down payment for a property

- Max out Roth IRA (with the help of the Fidelity AMEX, of course)

- Possibly make a move soon

- Save, save, save, and keep reinvesting

OK, so what’s ABC?

I no longer work in real estate.

But every day in the office, I heard “ABC.”

- Always

- Be

- Closing

Which reminded me of this:

So I changed it to:

- Always

- Be

- CELEBRATING

Which is much more positive. Hey, it’s all about mindset, right?

But it’s a good one. I make sure I always have something to celebrate.

And taking the first steps into the FIRE mindset definitely qualifies for ABC!

Birthday plus solar return

I’m a huge fan of Susan Miller’s Astrology Zone. (If you’ve never read it, carve out an hour. She writes a tome each month!)

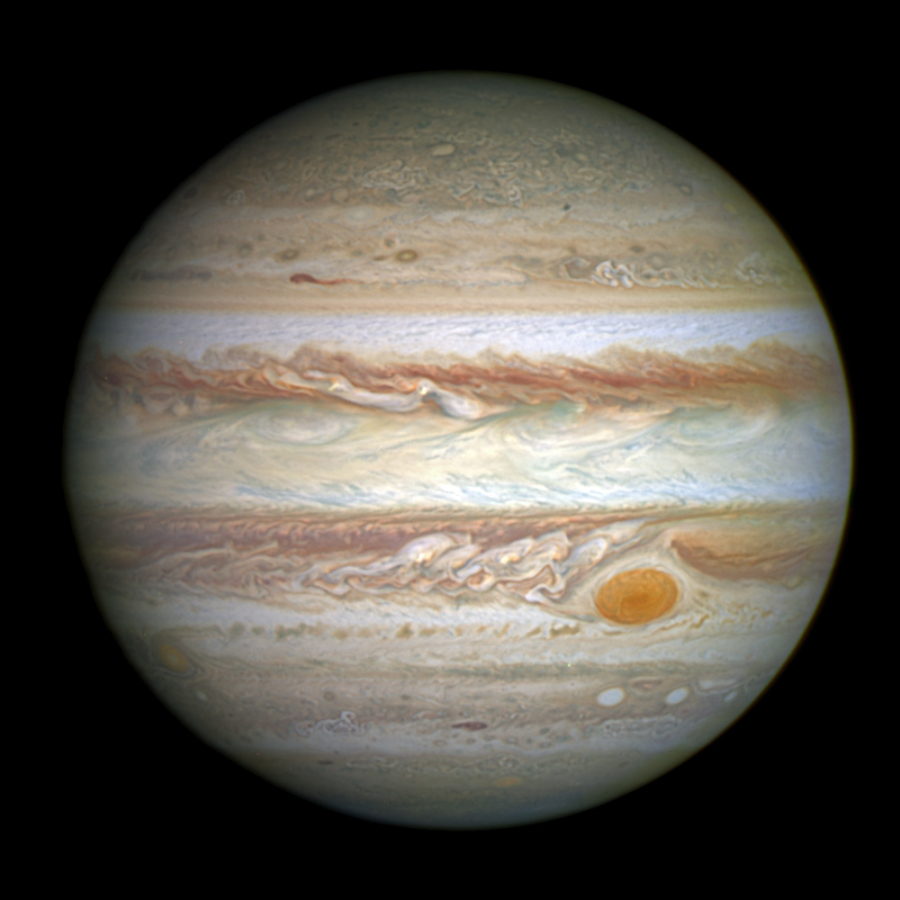

This is a great time to be a Virgo, because Jupiter just came back to the sign – to stay for nearly 13 months!

For those not into astrology (I’m not super into it, but it’s fun to think about), that means it’s a great time to pick yourself up and really go for it, especially if you’re a Virgo.

My birthday was this past week (on August 26th), so now I’m a year older and feeling energized. In fact, I’ve already made progress toward my goals and it feels great!

I missed the Reach for the Miles meetup this month because of b’day stuff. (Missed seeing Stefan, Mike, and other points junkies!) But I’ll be at future meetups. And if you’re in NYC, be sure to join the group to be notified of the next meeting!

Bottom line

I’ve been working super hard to pay off all my credit cards, and it’s finally done!

I don’t really have any nuggets of wisdom other than make your mind up to do it – make the decision – and then freakin’ do it.

It sucks but it’s necessary. Because you sweep away all the energy that’s holding you back and create new things to look forward to.

Now I’m a year older and this is the year of ABC + FIRE. Already can’t wait to see what this upcoming year brings.

Stay scrappy out there and have a great weekend!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Announcing Points Hub—points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

What does this have to do with Boarding Area?