Chase Sapphire Preferred 100K? Holy wow am I kicking myself. Chase keeps upping the ante on the Chase Sapphire Preferred. First 60K, then 80K, and now – 100,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months from account opening. WOW.

I don’t think it’s going to get better than this. 100,000 Chase Ultimate Rewards points are worth:

- $1,000 in cash

- $1,250 toward travel booked through Chase (flights, hotels, cruises, car rentals, and excursions)

- Potentially much much more when you transfer points to travel partners like Hyatt (my favorite), United, British Airways, Air Canada (coming later this year), and others

Get back to travel in a big way with the new Chase Sapphire Preferred 100K offer

If you’re eligible for this offer, this is your sign! There’s no end date yet – get it while it’s still around!

Chase Sapphire Preferred 100K offer – what to know

| Chase Sapphire Preferred® Card | bonus_miles_full |

|---|---|

| • 5X Chase Ultimate Rewards points per $1 spent on travel booked through Chase • 3X Chase Ultimate Rewards points per $1 spent on dining |

| • $95 annual fee • $50 annual hotel credit • 10% anniversary points bonus • Free DoorDash DashPass subscription | • $4,000 on purchases in the first 3 months from account opening |

| • The best card for beginners | • Compare it here |

The Chase Sapphire Preferred earns 2X Chase Ultimate Rewards points on travel and dining. Both categories are broadly defined.

Travel includes flights, hotel stays, cruises, and the usual things you’d think of as “travel,” but also parking lots, commuter trains, subway passes, tolls, and other travel-related expenses.

Dining includes eat-in restaurants, but also cafes, diners, carry-out, delivery, services like Uber Eats, fast food, and coffee shops.

So there’s a lot of 2X earning potential here.

There’s a lot to like about this 100K offer

Each Chase point is worth 1 cent when you redeem for cash, and 1.25 cents when you book travel through the Chase travel portal.

Points value is more variable when you travel to transfer partners, but I always shoot to get 2 cents in value from each point. That means 100,000 Chase Ultimate Rewards points are worth at least $2,000, which is just incredible.

There is a $95 annual fee on this card, but it’s more than worth it for the value you get from the sign-up bonus.

Pair Chase cards to earn even more points

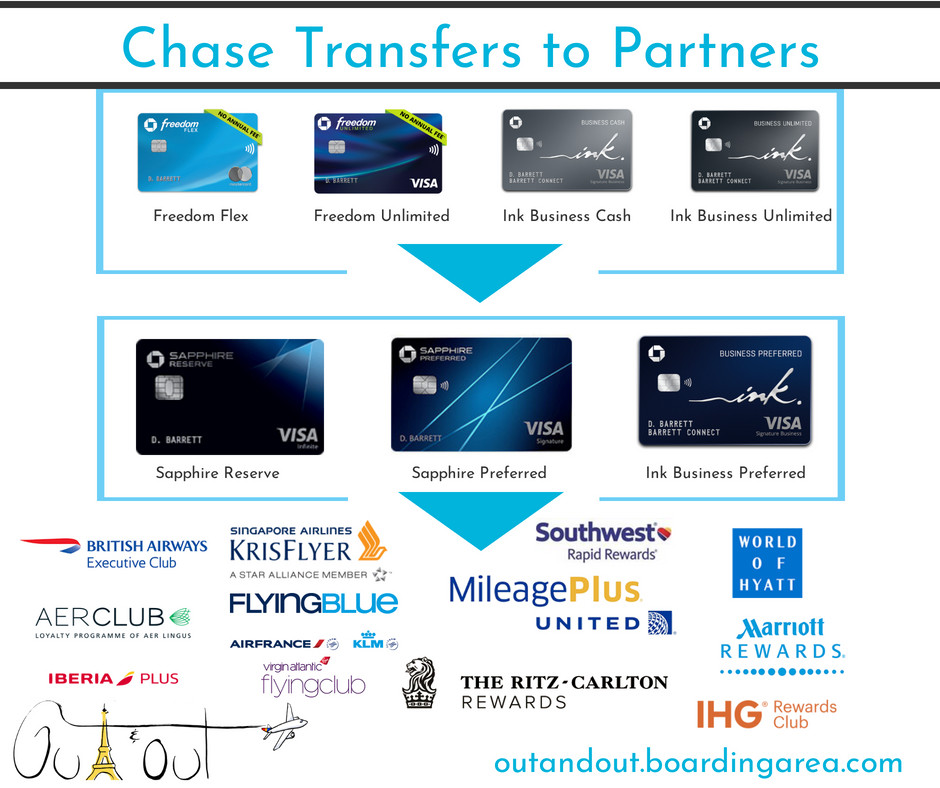

You can combine the points you earn from all Chase Ultimate Rewards card in one place, and transfer them to travel partners when you have the Chase Sapphire Preferred.

If you already have the Chase Freedom Flex or Chase Freedom Unlimited, you unlock that transfer ability by pairing it with the Sapphire Preferred. That’s a big reason they complement each other so well – and yes, the pairing principle works with Chase small business cards, too.

A few high-value examples

Keep in mind, Chase transfers to partners are 1:1 and instant – meaning they appear in your account right away as soon as you transfer!

1. Hyatt award stays

Hyatt Category 1 hotels cost 5,000 points night, while Category 2 hotels cost 8,000 points per night. Most of these are Hyatt Place or Hyatt House hotels, but if you can make it work, you could get:

- 21 award nights at a Hyatt Category 1 hotel

- 13 award nights at a Hyatt Category 1 hotel

- 4 or 5 award nights at a Hyatt all-inclusive hotel (depending on location)

I’m including the minimum spending here. If those 21 award nights would usually cost $100 each, that’s $2,100 in value – and doesn’t account for taxes. Plus, you’d earn 21 tier-qualifying nights toward valuable Hyatt elite status.

There’s absolutely no reason you can’t get $2,000 or much more in value from this transfer partner alone.

2. British Airways for short flights on American

Get short hops on American by transferring points to British Airways.

Bahamas, anyone?

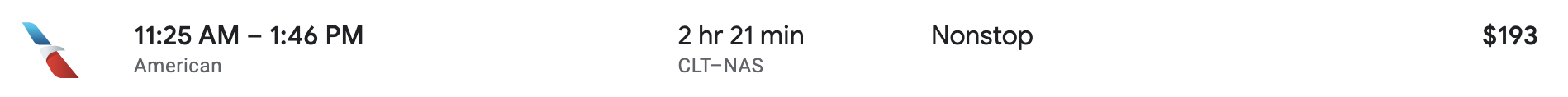

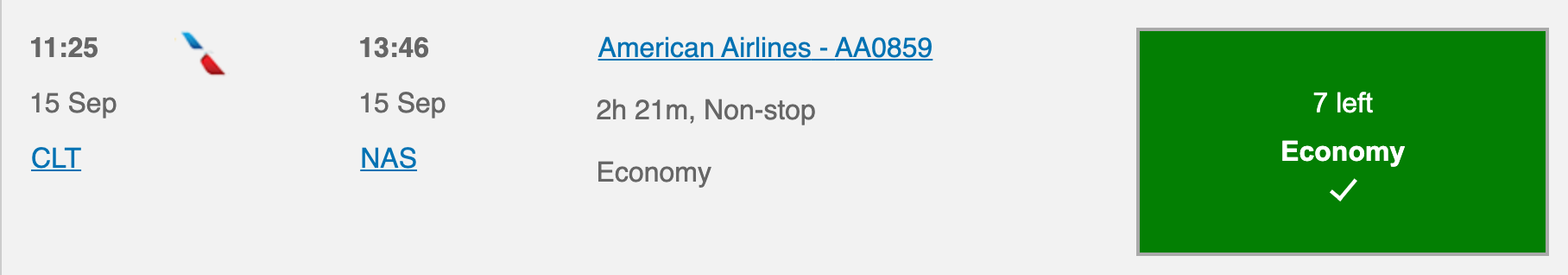

With a quick search, I found flights from Charlotte to Nassau, Bahamas, for $193 each way.

On this same route, I found 7 seats available for 9,000 British Airways points and $6 in taxes.

Short hops on American can be notoriously expensive

For this 2 hour flight, you could just redeem points instead of paying cash.

With 100,000 Chase Ultimate Rewards points, you could book 11 one-way flights @ 9,000 points each or 13 one-way flights @ 7,500 points each. That’s because the price of the flight is based on distance with the British Airways program.

In this example, 11 one-way flights to the Bahamas would cost $2,123 in cash or 99,000 Chase Ultimate Rewards points. You could easily hit $2,000+ in value for short flights on various routes.

3. Fly on Southwest

On average, Southwest points are worth 1.4 cents each. With 100,000 Chase Ultimate Rewards points, you could get $1,400 in flights on Southwest (plus taxes and fees).

While that doesn’t hit the $2K+ mark of the other examples, consider you can use a Companion Pass on award flights and potentially get close to double the value which would be $2,800.

Or, you could book Southwest flights through Chase and earn tier credit toward status and the Companion Pass at the same time. If you go this route, you’d get $1,250 worth of flights, which could be worthwhile if it aligns with your travel goals.

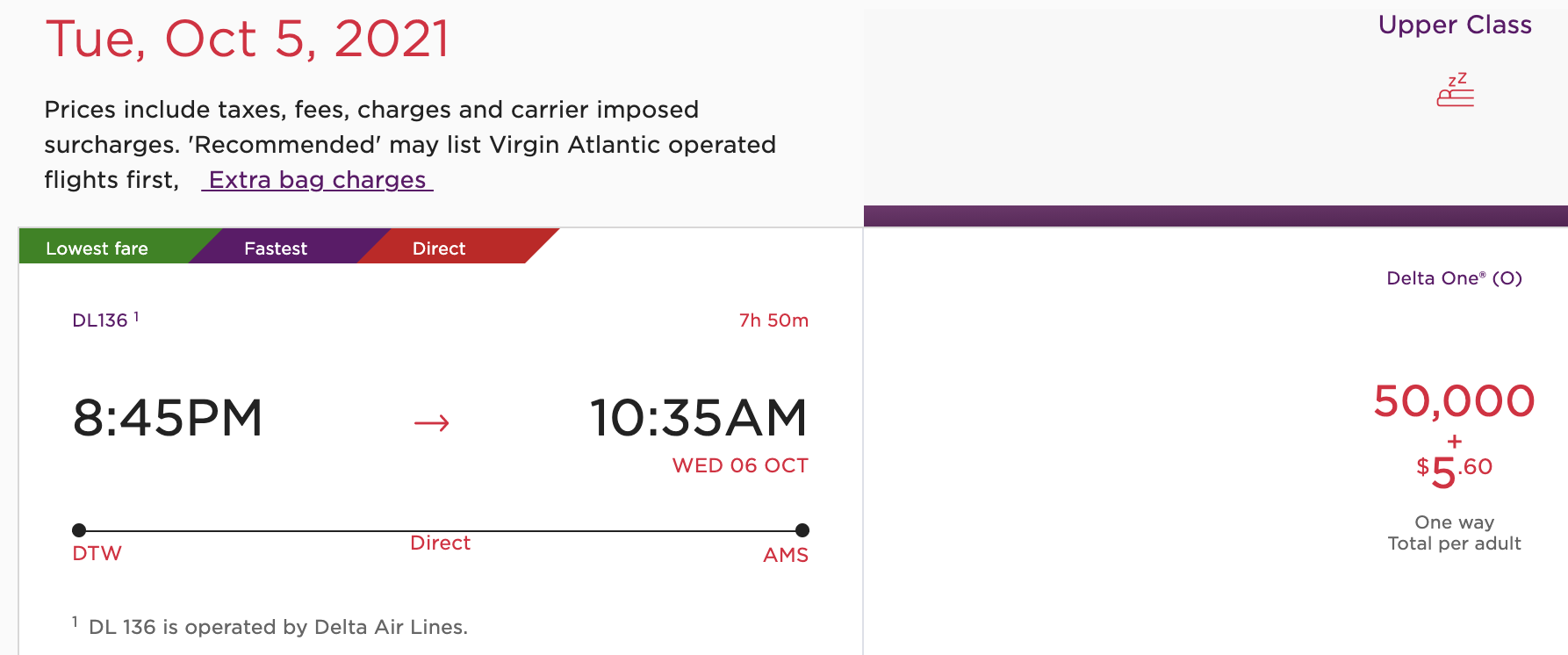

4. Virgin Atlantic for Delta business class

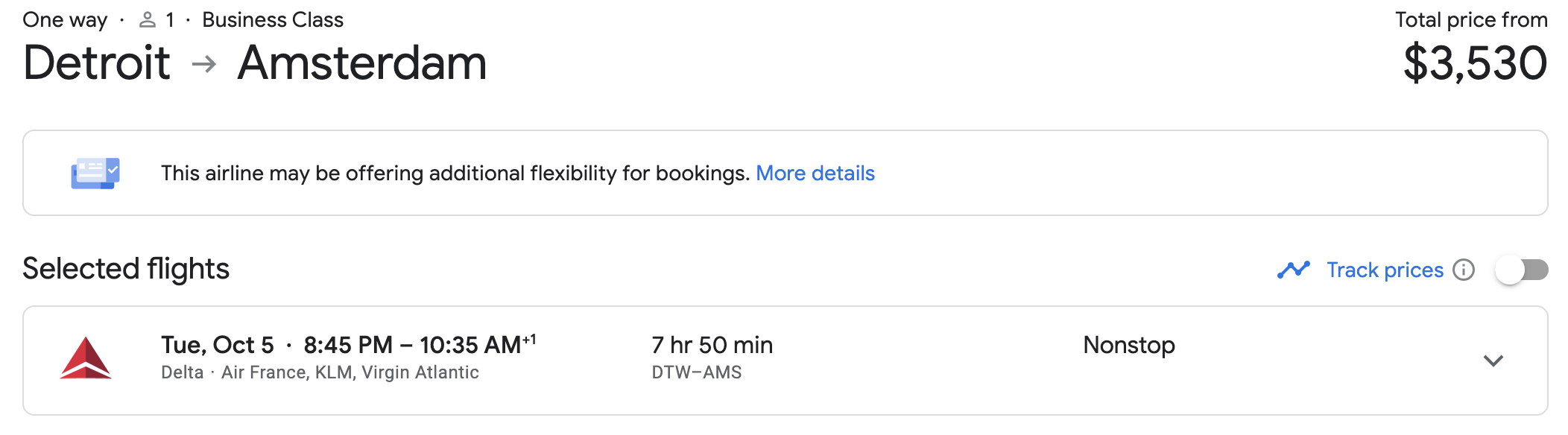

These are patchy to find, but when they’re good, they’re amaaaazing. Flexibility is key! And requires some hunting and pecking. But again – 100% worth it.

Delta One business class to Europe sounds divine

Say you want to fly to Amsterdam, and find this one-way flight for $3,530. That’s… a lot.

But, it’s also available for 50,000 Virgin Atlantic miles plus $6 in taxes.

Doesn’t that sound much better?

If you booked two of these flights one-way (or a round-trip assuming the cost is similar to fly back), that means your 100,000 Chase Ultimate Rewards points are worth a staggering $7,060. How’s that for value?

I actually didn’t spend too much find finding this example. Just know that flights like this are out there for those who want to get the absolute maximum return for their points.

5. Mix and match!

- Fly to Europe in business class for 50,000 points and use the other 50,000 on a hotel stay. Or use them to book a car rental

- Fly your family to the Caribbean round-trip and save the rest for another short but expensive trip later

- Fly in opulent business class to Europe or South America and then in coach for short hops to see multiple cities on the same trip. Top off your hotel award accounts for a free night along the way

- Many many more combinations!

Transferrable points are flexible by design and you can use them however you wish! Even better, you can keep them in your Chase account until you’re ready to transfer them, as a hedge against loyalty program devaluations.

Who qualifies for this offer?

Chase has some finicky rules to navigate. If this is your first Chase card and you’re new to points and miles, you’re mostly likely good to go.

You can NOT get this offer if you:

- Opened more than 5 new cards in the last 24 months (excluding certain business cards)

- Earned a bonus on a Sapphire card in the last 48 months

- Currently have a Sapphire card (that includes the Sapphire Reserve, the Preferred’s big sis)

If you’ve had a Sapphire card for over 48 months, you can downgrade to a Chase Freedom Flex or Chase Freedom Unlimited (and you can have multiple of these).

Again, most newbies won’t have to think about these rules. Only us old-timers who want to apply for this incredible offer.

Chase Sapphire Preferred 100K bottom line

There’s no two ways about it: if you qualify for this offer, this is as good as it gets. And it really is the best card for beginners.

100,000 Chase Ultimate Rewards points is a best-ever offer for the Chase Sapphire Preferred card and I don’t expect we’ll see anything better. I value Chase points at 2 cents each, which clocks this offer with a $2,000+ worth. Simply phenomenal. If I didn’t already have this card, I’d be signing up for it immediately!

Do you plan to apply for this offer? Or have you already? Out and Out partners with CardRatings – consider using my links to get this incredible deal.

Any questions? Comment below! As a credit card expert, I’m happy to provide guidance!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You can get this card again if it’s been 48 months since you received your last Sapphire SUB. Also you can’t have either Sapphire card open at application either. This is an amazing offer.

I wish I could get ittttt :::cries in sapphire:::