If you haven’t had the Chase Sapphire Preferred yet – or if you’re eligible to get it again – the new sign-up bonus of 100,000 Chase Ultimate Rewards points is worth – at a minimum – $1,250.

And how are we getting to that figure? Chase Ultimate Rewards points are worth 1.25 cents each when you redeem them toward travel through Chase, so 100,000 x 1.25 = $1,250. You can book flights, hotel stays, even cruises through the Chase Ultimate Rewards site. Set your payment to points and 100,000 of them are worth $1,250. 💥

Who’s ready to travel again with 100,000 Chase points?

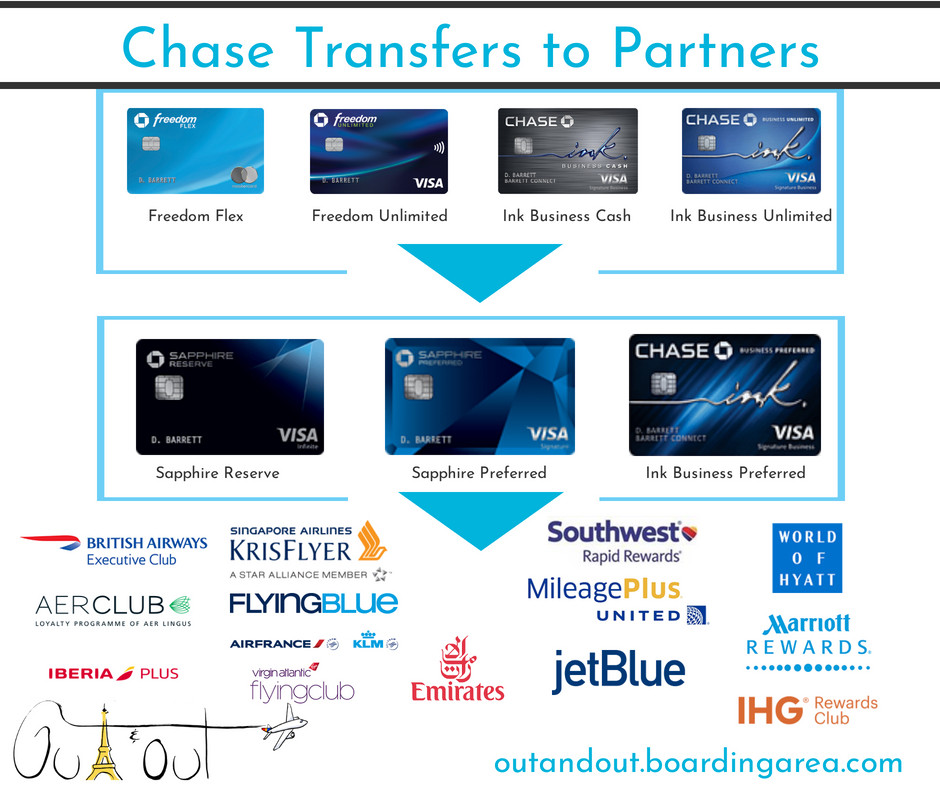

That’s an amazing sign-up bonus on its own. And can be worth soooo much more when you transfer your points to Chase’s travel partners, which include Southwest, United, and Air France/KLM.

But the best transfer partner? Wait, lemme start a new section for all that. 😛

Chase Sapphire Preferred 100K bonus

- Link: Chase Sapphire Preferred

| Chase Sapphire Preferred® Card | bonus_miles_full |

|---|---|

| • 5X Chase Ultimate Rewards points per $1 spent on travel booked through Chase • 3X Chase Ultimate Rewards points per $1 spent on dining |

| • $95 annual fee • $50 annual hotel credit • 10% anniversary points bonus • Free DoorDash DashPass subscription | • $4,000 on purchases in the first 3 months from account opening |

| • The best card for beginners | • Compare it here |

I got this card when my Chase status was 2/24 (two new cards opened in the last 24 months), I was wayyyy under the 5/24 threshold. Chase won’t give you their cards if you’ve opened more than 5 cards in the last 24 months (the 5/24 rule). That’s not an issue for most people, but for those heavily into points, it usually means Chase cards are a non-starter.

But not this time!

I’m using my Chase points along my nomad journeys

I was 2/24 and hadn’t earned a sign-up bonus on a Sapphire card since 2016 (?), so I was well within the bounds. I’ve never hopped on a card application so hard in my life.

And now, this new offer is the best there’s EVER been for this card. If you’ve been waiting for the right offer, this is the one.

Chase travel transfer partners

So while you can get $1,250 in travel with this bonus, you can get much more travel by transferring to Chase travel transfer partners.

In the past, I’ve gotten excellent value with United, Flying Blue, Singapore Airlines, and British Airways.

Nowadays, there’s a lot of overlap between Chase Ultimate Rewards and other bank programs, including Amex Membership Rewards, Citi ThankYou, and Capital One.

Pair Chase cards to earn even more points

I recently wrote about a few high-value ways to redeem Chase points with this offer.

But there’s one partner I zero in on with the focus of a laser and that partner is…

My favorite way to redeem Chase points

Hyatt. All day and night.

Why?

Chase and Hyatt have an exclusive relationship, so there’s no other way to transfer points to Hyatt except through Chase. Historically and now, Hyatt has a generous award chart and it’s relatively easy for even casual travelers to get a big return for their points.

Plus, transfers are instant. You can literally send Chase points to Hyatt, refresh the booking screen, and they’re in your account. (I’ve done that many times before.)

My last Hyatt stay was last month in Nashville, where I earned Globalist elite status partially through award stays

Hyatt Category 1 hotels (think Hyatt Place and Hyatt house), start at 5,000 points per night.

With 104,000 points (the sign-up bonus plus the minimum spending), you could get:

- 20 award nights at a Hyatt Category 1 hotel

- 13 award nights at a Hyatt Category 2 hotel

- 8 award nights at a Hyatt Category 3 hotel

- And so on, up to Category 8

You could even get a free night at some of the most exclusive and luxurious Hyatt hotels in the world, like the Ventana Big Sur (on my list), Park Hyatt Tokyo, or a few nights at an all-inclusive resort, like the Hyatt Ziva Los Cabos or Hyatt Ziva Puerto Vallarta (been to both – click for my reviews).

Because I’m now living on the road, I lean into those Hyatt Category 1 hotels, which can cost over $100 per night. Even assuming a base of $100 per night, 104,000 Chase Ultimate Rewards points are worth $2,000 (20 nights @ $100 each) and often much more.

That’s an astounding bonus from one card.

Another reason I’d recommend Hyatt right now is because flights are generally cheap. Travel is coming back slowly and flight prices reflect that.

Also – for flights, the best award redemptions are usually long-haul international flights in a premium cabin and well… that’s not a possibility right now. Until it is. And then your points will be ready!

Or you can do what many others are doing and build up your point reserves for when travel does return. Nothing like a luxurious free trip to declare revenge travel. 😉

Chase Sapphire Preferred 100K bottom line

- Link: Chase Sapphire Preferred

If you’re able to open this card now, I’d highly recommend doing so. You can:

- Stay at Hyatt hotels for free

- Wait until international flights open back up

- Book expensive flights as awards now

- Or just save your points toward a fabulous post-pandemic vaycay

Any way you slice it, you can’t go wrong because there’s never been a better bonus on the Chase Sapphire Preferred. I opened the card myself recently before this offer and I’m kicking myself because this is the best offer there’s been for this card.

At a bare minimum, this bonus is worth $1,250 toward travel which is a phenomenal value from one card. There’s a $95 annual fee, but that pales in comparison to the value you can potentially get.

Plus, if you have other Chase cards, like the Chase Freedom Flex or Chase Freedom Unlimited, you can pair and pool your points – and then send them to travel partners or book travel with them where they’re worth 1.25 cents each.

To be honest, I can’t think of a single reason why you wouldn’t get this card if you qualify. If you’ve been antsy to travel like I’ve been, those points are going to come in handy when you’re ready to travel again.

Have you already gotten this card? Will you? How will you use your 100,000-point bonus?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’m just wondering how you could get a sapphire bonus again as you did with this application – assuming you applied for the CSR in 2016 and got the signup bonus then, did you product switch or cancel your original CSR in order to be eligible to apply for it again? Thanks !

Hi Harley! Yes, I downgraded it to a Freedom Unlimited card a couple of years ago. And will likely downgrade the new CSP in the future, too.

Whoop whoop, Hyatt is where we stayed all over the US while traveling. Tough to beat the value from cat 1-2 Hyatt place/house properties. There’s a cat1 Place in SW Utah by all the national parks that was so great, and the newish one in Vegas is only a cat2. Great to fill weekend nights while you do super cheap weekdays at Caesars resorts with Diamond status.

I would looove to do this but pretty sure dogs aren’t allowed basically anywhere on the Vegas strip. I could always hire a sitter. Sooo much to think about here. Thank you for the ideas!

I’ve seen several dogs at Caesars hotels which is mainly Bally’s, Harrah’s and Flamingo for us.

https://www.caesars.com/las-vegas/hotels/pet-friendly

But the Hyatt Place Silverton is only a cat2 and it’s nearly brand new. Super nice staff, breakfast was great before covid, and the pool and gym were also great. Close to the strip, just a 5-10min uber or drive and parking is free with Caesars Diamond which is easy to match to. Also pet friendly.