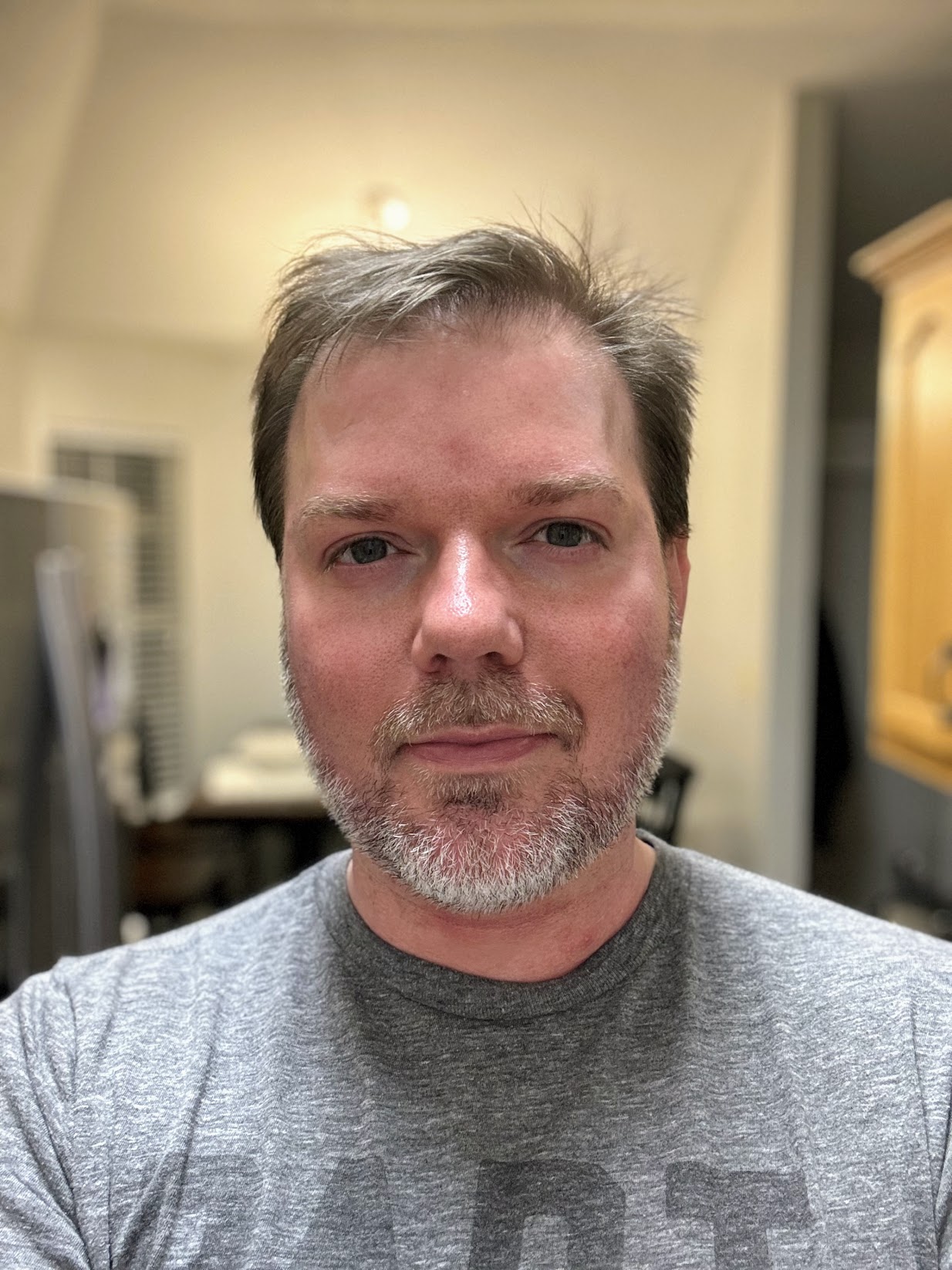

What a month already! A week ago, I was laid off from my job. It was my second layoff in as many years, just when I was starting to feel like I was doing well in the position. Oh well—it lasted a year. So that was how June ended.

It was a particularly nasty layoff: the kind you hear so much about on LinkedIn these days. I was shocked/sad/mad for about a day, then decided to move on. Easy come, easy go.

Here’s to more peaceful and prosperous times ahead

While I look for the next thing, I decided to go full force into creating a points, miles, and travel rewards community packed with info, courses, events, and more. I announced Points Hub on Friday. As of today (Monday), many members joined with a Pro Lifetime membership, which showed me how crucial this resource will be for so many people.

I’m still applying to full-time jobs on the side. I’m also making outlines for courses, adding info, and building the community at Points Hub. It’s just getting started, but already a blast. Come on in!

Also, spoiler alert, this is kind of an anti-update because, uh… no income at the moment. But this journey has its own life, so let’s see what’s up.