September is my personal new year. I had a birthday last week and turned 39. And next week, Beck will be 1. [times flies, etc.]

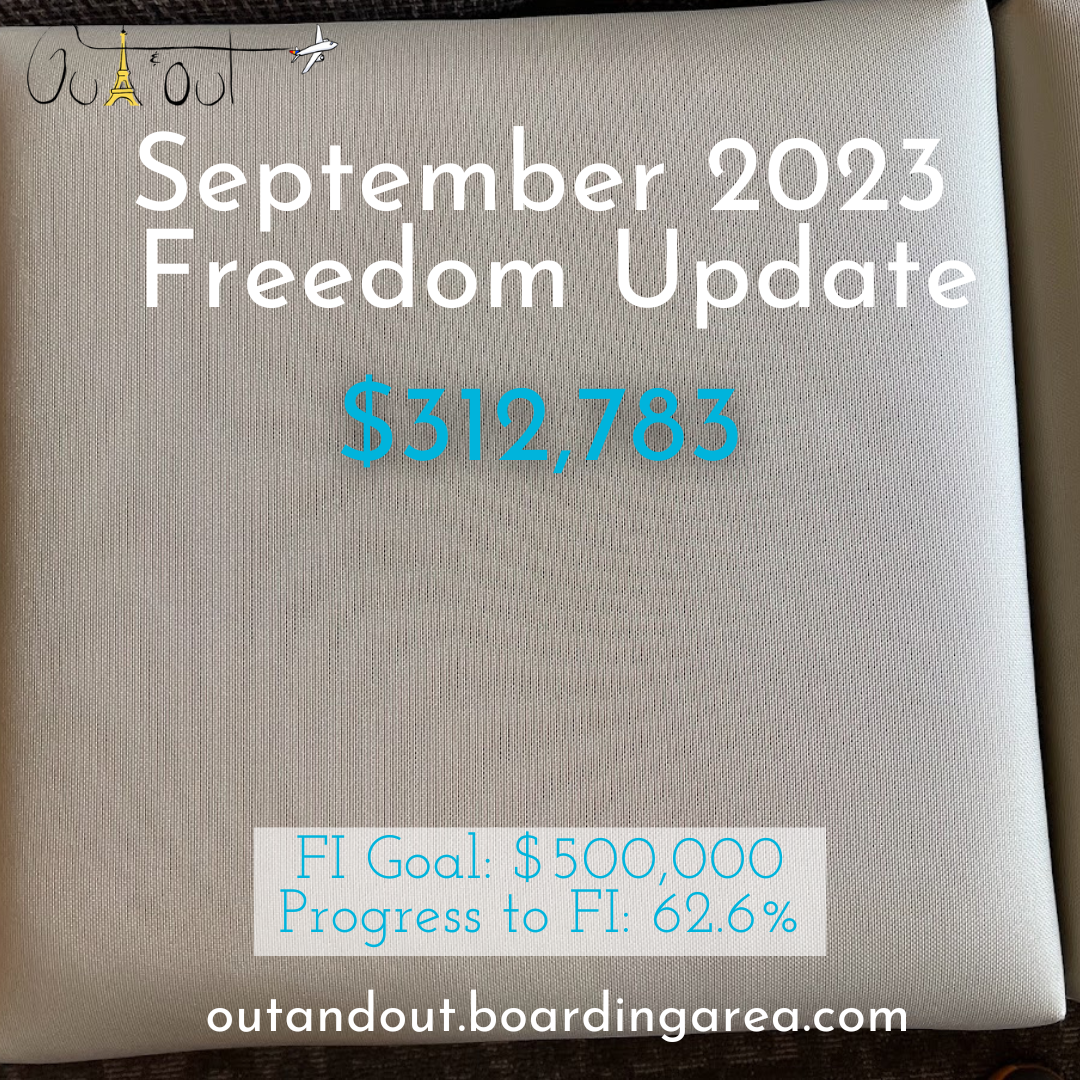

It’s also a countdown to my $500,000 goal – one year left.

It’s looking unlikely that I’ll hit it—unless something massively shifts (which is always a possibility) with an unprecedented bull run, influx of cash, huge real estate increase, or something of that caliber.

Daddy mode

Not to say that won’t happen, just that it’s easier for me to grasp if I’m realistic. But there’s still that dreamer in me.

Right now, I’m at ~$313K. That’s $187K short. To hit $500,000, I’d need to collect $15,583 per month for the next 12 months.

I’ve had months like that before. And every time the stock market rises even 1%, that’s a huge gain for me. But it’s more than I can produce on my own.

So this month finds me, as always, pondering where I can place the best 20% of my efforts to get closer to 80% of the overall results I seek. 🌠

September 2023 Freedom update

We’re also thinking about moving a lot these days. Warren will be 5 next year and we want him to be in a great school district. We’re currently in the core of Oklahoma City. There are good schools here, but not our current district. We’d have to either home school or move to be in a better one.

My sweet, curious kiddo

Oklahoma, as a state, is going through transitions with school funding, teacher certification, and more. It’s not reassuring. We are leaning toward moving to another state. I’d rather pay more in property tax to have a good school than pay for a private school here.

This is an ongoing topic, so we’ll know more when we know more. TBC.

A Hot Springs vacation

For my birthday, we all piled into the new van and took a 5.5-hour road trip to Hot Springs, Arkansas. It was our first time traveling with Beck. It was… a lot.

The hotel situation was less than ideal

For one, the drive was more like 7 hours for us. And it was miserably hot (my birthdays often are – I have so many memories of steamy-lush birthdays).

We tried to get out and “see the sights” but Beck kept overheating, so we couldn’t be out for more than a short walk to a restaurant the entire time. That was challenging. Luckily, there were several homestyle places within a few short blocks, but after a week of having down-home Southern-fried cooking, I was soooo bloated. And now all I want to eat is salads for the next month. 🥗 It was good, but… we definitely can’t do that every day.

The other thing was the hotel situation. The rooms are so small and don’t allow for any amount of privacy. Because of the heat, we spent more time than we wanted in the little rooms. I went to the “business center” to work as we waited for the heat of the day to pass.

At least I had a urinal from 1913 to pee in

Family travel is hard. But, I only spent $100ish bucks + gas and food, so we got a nice vacation for next to nothing. Even though it was tough, it felt so good to get out of town for a little while.

This month’s progress

My Roth 401k and HSA accounts are in full swing capturing the bulk of my savings now. Automating is powerful. I’m putting away at least $1,000 per month into them while paying down my 0% APR credit card on the side.

There were a few dazzling stock market days within the last month, and a few down days. I’ve heard rumblings of a mild recession coming later this early or early next, but then, when hasn’t that been the case?

REALLY pleased with my raw land

The biggest change for most is student loan payments are restarting. I switched to the SAVE plan and my payments are currently $0, which is great because I don’t know how I could add another monthly expense to the mix. We are operating on a thin margin as it is.

In other news, I reached the HSA investment threshold and am investing all those contributions now. I’m just gonna keep pouring as many funds into savings and toward my credit card as I can, while living off the rest. For now, that’s the plan.

This BABY 😻

This month, I:

- Applied for the SAVE plan for my student loans—it was approved within a week

- Started investing with my HSA account, as mentioned

- Hit a new net worth high (again)

- Used savings to speed up my credit card repayment

- Went in person to see my two parcels of land, which was a really positive experience

- Found a groove with investing and life expenses after doing a thorough budget last month

There’s still plenty to work on. Automating some of it will help. And then, I’ll keep working—and doing my best work—to keep the manna flowing.

By the numbers

I always love this part, because numbers never lie.

Some months, this part is hard to type up and post. Other months, it feels like a huge win—and everything in between.

| Current | Last Month | Change | 2023 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $241,279 | $241,320 | -$41 | As much as possible | |

| Roth IRA | $56,998 | $56,491 | +$507 | $6,500 (in new contributions) | $4,000 so far! |

| Taxable brokerage + UTMA | $13,376 | $13,253 | +$123 | $25,000 (total invested) | |

| Savings | $5,292 | $5,900 | -$608 | $30,000 | |

| Primary home equity + appreciation | $59,518 | $62,407 | -$2,889 | $70,000 | |

| LIABILITY | |||||

| Credit card/HVAC upgrade | -$10,270 | $10,372 | -$102 | $12,708 (starting balance) | |

| Net worth in Personal Capital | $304,726 | $299,127 | +$5,149 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Getting closer!

I’m trending up and am now at ~63% of my goal. Wow. If I have get to 75% and the stock market continues to rise, I might just have a shot of hitting $500K.

It’s a big “if” but also not impossible. This next year is gonna be interesting.

Computin’ at the li-berry

September 2023 Freedom update bottom line

- Link: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card

- Link: Join Yotta and get a Loot Box with free tickets!

It’s such a tragi-comedy that I’m over here having all these big ~*~feelings~*~ about my journey while the money is off doing its own thing.

Despite my pontificating and observing, it’s taken on a life of its own. After the $200K mark, I began to feel like I was just along for the ride. Now, after hitting $300K, that feeling is more pronounced. Here’s hoping for that $400K mark soon. I’m hoping that’s a fun wave. 😅

My ultimate lesson has been to stick to the plan and let it ride. When I look back, I see the upward trend. It’s been a trip, but I’ve definitely calmed down about the big swings in favor of the overall increase.

So I guess I should be excited to review all of this in a year? As a Virgo, my neuroticism will likely get the better of me. But I’ll try.

Thanks for sticking with me through all this. Hope everyone is doing well.

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Keep chugging along my friend!

Can totally understand wanting to get out of Oklahoma. Check back with me after November, but for now I can wholeheartedly recommend my little corner of VA – happy to chat about what life’s like here if you’re interested.

Definitely open to that! We want a cheap place with great schools – does that exist? Natural beauty and access to the outdoors is a huge plus. Four seasons would be nice, too. #dreaming