I’m coming in sheepishly! My Travis Scott ticket reselling fiasco made a splash—for others in my situation and in the ticket reselling community. I’ve already talked about that here and don’t have more to say about it… for now.

I mention it because I sold stock for the first time in my life to correct my mistake and allll the life lessons that came along with that. Anywhomst’ve, I’m completely at peace with it. I learned my lesson, and I’m moving forward. It sucked, but it’s over.

Alt text: Blurry Tulsa hotel boy boss pic

You’ll see that debacle, a market that struggled through most of September (with one of the lowest days since March and the Dow that went negative for 2023 YTD), and a big decline in my home value reflected in this Freedom update.

As of now, I will most likely NOT hit $500K by August 2024. As my toilet stopped draining last week and lead to further large repair reckonings this month, I had my freakouts and regrouped. Here’s a link to the amazing BOY BOSS t-shirt from the photo above if you want one. (Sorry for the jarring transition.)

Life has changed a lot since I made that goal way back when. I will have multiple millions by the time I retire—even without adding another cent to my savings. And it’s true that, in general, I’m focused on the day-to-day more now.

I accept all that. And, not to get too philosophical, realized it’s not that serious. Spending money now, while I don’t love it, is what I have to do right now. (And maybe I do love it? Because we’re always getting what we want.)

All that to say, anything could happen and I’m still sticking to my plan of investing heavily, paying debt, and reducing expenses. There are speed bumps now. They won’t always be there.

Anyway, let’s talk about it.

October 2023 Freedom update

My net worth would’ve been down this month without my interferences, but adding the ticket spending on top of it made it extra low. *whimper sounds *

I was feeling all triumphant last month and decided to serve myself a nice slice of humble pie, I guess. And it’s not a total loss. I’ve sold many tickets already and the tour goes through December so… I’m not totally ready to write it off as a total loss just yet.

“My Rose-Colored World” by Warren Vaughn. Watercolor on bristol board. 2023.

Those expenses are mostly paid off. And then the plumbing decided to go haywire. *increasing anguish*

I’m afraid of going into credit card debt again. But as of now, everything is on 0% APR cards, so I’m not paying interest. And I can always get a new 0% APR card, I just don’t want to get into that pattern again.

LOL/24 t-shirt interlude

- Link: Buy the LOL/24 t-shirt

Presenting the best, nerdiest points and miles shirt of all time (click to view, send it to all your friends, wear it to all your conferences and get-togethers)

OK, back to the Freedom update

Still, life has required me to use all the ingenuity and “creative solutions” I can muster. It’s exhausting. At a certain point, I gave in and decided to be at peace with it.

When slash if (leaning toward when) we move next year, I’ll likely recoup everything through the home sale and give myself a clean slate.

I’m letting it sit for now—the money stuff, I mean. I’m tired of tormenting myself with every perceivable scenario when in reality, things need to play out so I can respond in kind. My overthinking to “get ahead of it” isn’t productive, just obsessive. And anyway, I can only control what I can control. I can control my reactions. I can control what I think about.

My mom said it’s fortunate that I can pay for things when I need to. It’s simple, SO simple, but hearing that helped me zoom out and look at the bigger picture.

What’s true is simple—what’s simple is true. Do you love when I get all faux poetic?

This month’s progress

This month, I:

- Lost my mind and bought a lot of crappy concert tickets thinking I’d instantly resell them :/

- Kept investing in my 401k and HSA accounts despite it all 🙂

- Bought my third parcel of land through auction, worth $5,400 (will add to my net worth once I get the deed)

- Got a few side hustle ideas and now want to figure how to use my dwindling energy reserves for extra cash long-term

It was a down month overall, with some nasty stock market days and foreboding housing market forecasts. Mortgage rates also touched the 8% mark for the first time in decades. Very “doom and gloom” and “asunder” and panicky.

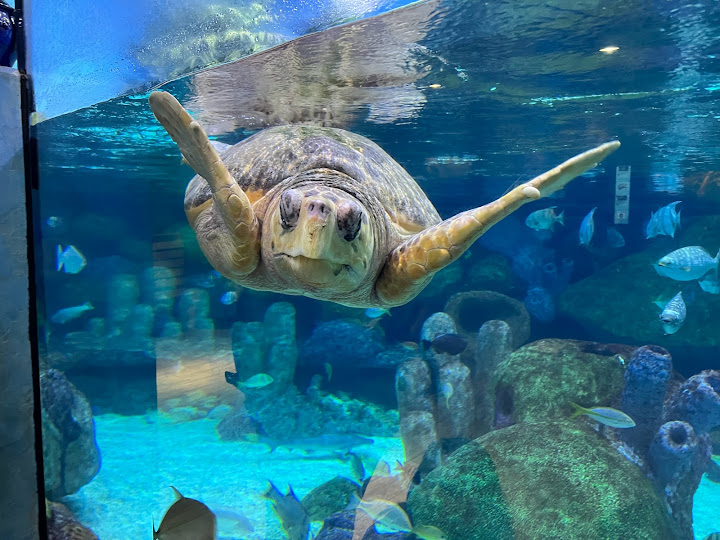

We saw this beautiful sea turtle at the Oklahoma Aquarium in Jenks

That’s another thing: I feel like I’m fighting a twisted economy on top of everything else, which it makes everything all that much harder. The big losses are hard to take.

On the plus side, investing in a downswing typically proves extremely valuable later. It might not be on my timeline, but once it bounces back, it’ll all have been worth it. Always now vs the future with this stuff, eh?

By the numbers

And it stings to turn the plus signs into negatives. Note that I lump my taxable account and Warren’s UTMA together (since they’re both taxable) but I in no way touched his account, nor will I ever. The losses there were purely my own.

| Current | Last Month | Change | 2023 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $227,597 | $245,157 | -$17,560 | As much as possible | |

| Roth IRA | $55,453 | $57,460 | -$2,007 | $6,500 (in new contributions) | $4,000 so far! |

| Taxable brokerage + UTMA | $2,838 | $13,494 | -$10,656 | $25,000 (total invested) | |

| Savings | $1,944 | $1,891 | +$53 | $30,000 | |

| Primary home equity + appreciation | $57,343 | $60,370 | -$3,027 | $70,000 | |

| LIABILITY | |||||

| Credit card/HVAC upgrade | -$6,930 | $6,999 | -$69 | $12,708 (starting balance) | |

| Net worth in Empower Personal Dashboard | $285,843 | $312,783 | -$26,940 | $500,000 (overall goal) | Track your net worth with Personal Capital |

The rest of Q4 and 2024 will be about level-setting as much as possible. There are other plans on the go that’ll cost a lot of money. I am probably done with my financial progress for the year.

October 2023 Freedom update

On the other hand, it’s still not too late for a big finish. I’ll try as hard as I can. What’s that saying? Make a plan and God laughs? Very much in that energy.

October 2023 Freedom update bottom line

- Link: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)

- Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!!

- Link: Buy the LOL/24 t-shirt—a must-have for the points geeks among us

- Link: Buy the BOY BOSS t-shirt and go full intersectional feminism!

All said, I’m down $27,000 this month because of falling stocks, falling home prices, pricey expenses, and the now-infamous concert ticket dustup.

September and October are also notoriously volatile anyway, and I seem to remember similar losses in past years even without the added pressure that I gave myself this past month.

So, lessons learned and still letting the flow take me. I will add: I’m proud of myself for continuing to invest throughout all of this.

I’m always hoping to get “caught up” (whatever that means), but more and more I’m just going day to day, and for tracking purposes, month to month. This is a down month (duh). There are more down months coming up. I might not (probably won’t) reach my $500,000 goal in August 2024 at this rate. I still want to keep doing this. And I already accept this.

If I’ve learning nothing else, it’s that life definitely continues. So let’s see what this next month brings.

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’m with your mom at least you have a job and not homeless and able to put the 4 walls up. Maybe life should be more simple. My dad used to say “do you need it or do you want it” He was such a humble man he passed in June and miss his advice. We really do need to put life in perspective and just enjoy the ride even when it get more down than up!

How are you calculating that you’ll have multiple millions by the time you retire even if you don’t add any more money? I don’t know your exact age but let’s say you have 25 years until 65, what I’ll consider to be full retirement age. To get to $2MM (multiple millions) with a starting point of 285k, you’d have to average 8.2% over the next 25 years. If you are older than 40, then you’d have to average 10.3% over 20 years.

Average home appreciation is 3.5-4% and as you’ve noted it’s volatile. A portion of that money is a UTMA account, which shouldn’t be included in your net worth, if it’s true you’ll never touch it. It’s a portion of your son’s net worth. It seems like 8-10% returns are an unreasonable expectation, unless if I am missing something in the calculation.

Hi, Jon! I am so glad you asked about this!

I’m assuming $286,000 @ 8% return for 25 years. (I’m 39, so my timeline is right around 25 years – I also consider 65 to be full retirement age.) The balance comes to just over $2MM: https://drive.google.com/file/d/1lh7OpzzoFWXzRA_cVhRrdwJgPPhxRyCF/view?usp=drivesdk

I’m using the investor.gov compound interest calculator: https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

S&P 500 returns:

– Last 5 years: 7.51%

– Last 10 years: 10.41%

– Last 20 years: 7.64%

– Last 30 years: 7.52%

For FSKAX (Fidelity’s Total Market Index Fund, which is the one I’m most heavily invested in), the 10-year return is at 11.21% and the entire life of the fund is 8.03%: https://fundresearch.fidelity.com/mutual-funds/view-all/315911693 (VTI performed similarly: https://finance.yahoo.com/quote/VTI/performance/)

Based on the last 5 to 30 years of overall market returns plus the performance of the funds I’m invested in, I feel pretty good about an 8% overall return.

Right now, there’s “only” $2,500 in the UTMA, so it’s a small portion. And of course, I will continue adding to all the investment buckets over the years. So I feel OK about planning to have at least 2MM (and hopefully much more) by age 65.

I like the change in mindset. It may seem to you like things aren’t going so great, but I can assure you that you’re doing VERY WELL right now. Don’t focus too much on money or it will completely consume all of you.

YAYY comment email alerts!! Appreciate it much.