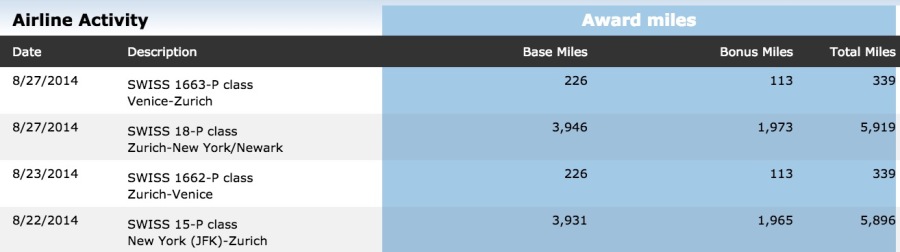

After arriving in Venice on Swiss from ZRH, I picked up the rental car and set about orienting myself in the direction of Padova (Padua), Italy.

I went to Italy for my “round” birthday. After reading up on Venice, I made the executive decision to stay off site at the Radisson Blu in Terme di Galzignano. I wanted the freedom to spend a day or two in Venice, and then drive down to Florence if I wanted. I also wanted to see some of the Italian countryside, and it seemed like the resort was well-situated for day trips in multiple directions. And so it was.

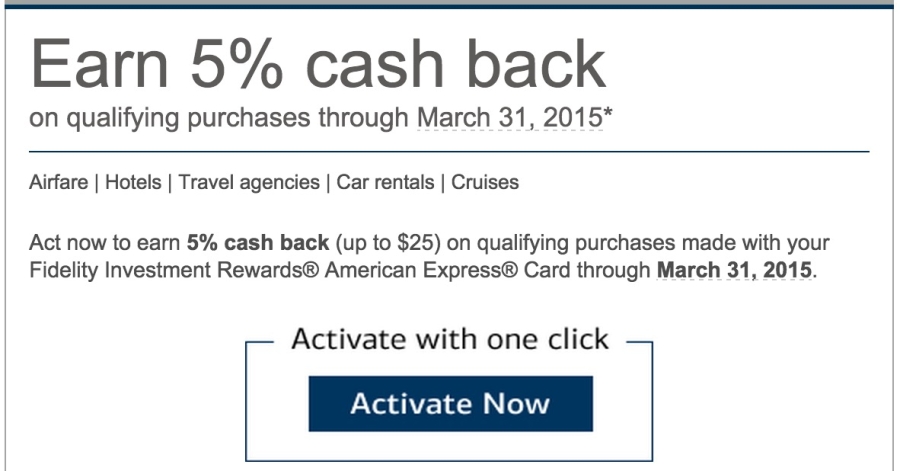

My boyfriend and I booked 4 nights. We both have the US Bank Club Carlson Visa Signature, and both used our BOGO award night for 2 nights each.

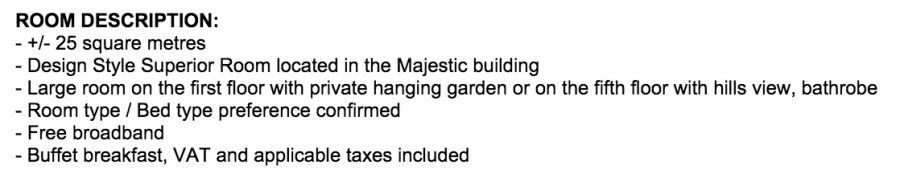

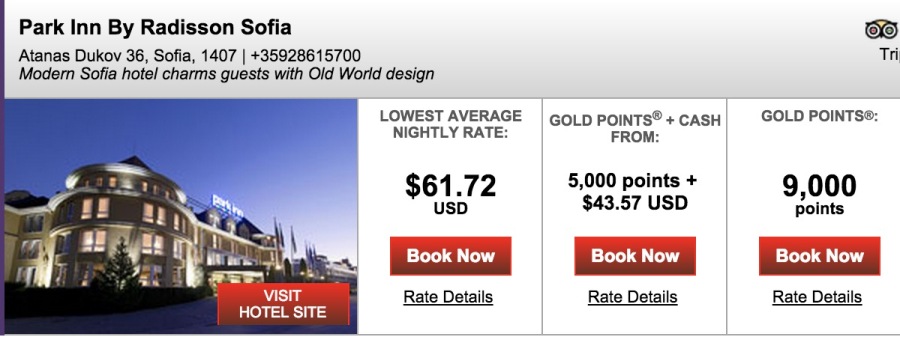

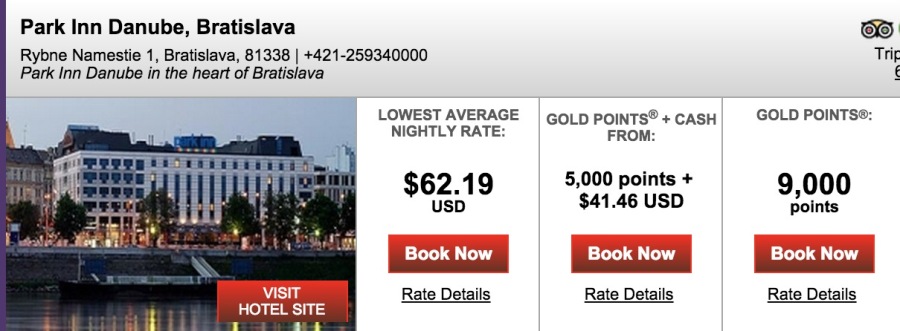

We booked a “Superior Room” for 57,000 Club Carlson Gold Points for each 2-night block.

But why the Superior Room?

We are both Gold in the Club Carlson program, wifi is free at all of their hotels, and for what’s it worth, breakfast is included in every room rate here. I might’ve even scored an upgrade to this room, owing to my status.

I just didn’t want to chance it. It was my birthday trip, and I wanted to be assured of my room choice before I got there.

The normal booking rate is 38,000 Gold Points, so we paid the extra 19,000 points to have our room preference locked in. Plus, I wanted to make sure I had the view of the hills. It was admittedly a purely emotional decision, and probably not the smartest, but I feel like for special occasions it’s worth it to have the peace of mind.

And also, Club Carlson points are just so easy to earn. So I never really overthink my redemptions with this program.

Getting there and first impressions

Dear lord, driving in Italy just about gave me a brain aneurysm – the highways are so poorly signed. Even though Padova was a “straight shot” on the map, in actuality, it required about half a dozen exits, each one leaving me second guessing for miles (or kilos) if I’d done the right thing.

When we finally got onto the one correct highway, I saw a series of (tiny) signs pointing toward the next turn, until finally, after about a hour, we were at the Radisson Blu.

It is very isolated. There is nothing going on in the hamlet of Terme di Galzignano.

There was another tiny town nearby, Battaglia Terme, that had a couple of restaurants and not much more.

Parking was easy outside of the Radisson Blu, and we went inside to check-in. It was a beautiful, sunny day and right away, the resort felt welcoming and friendly.

The agent checking us in spoke little English and we don’t speak Italian, so it involved a huge variety of hand movements, but after a few minutes, we had our room keys. He wrote down the phone number to the hotel office and indicated that they spoke English if we needed anything. Despite the language barrier, we understood that they recognized our Gold status, combined our reservations, and were fine to let us keep the same room all 4 nights.

Then we headed up to Room 306.