Also see:

- Maximizing Free Night Awards With the Club Carlson Visa Signature

- Club Carlson: Is Second Night Free Using Points and Cash?

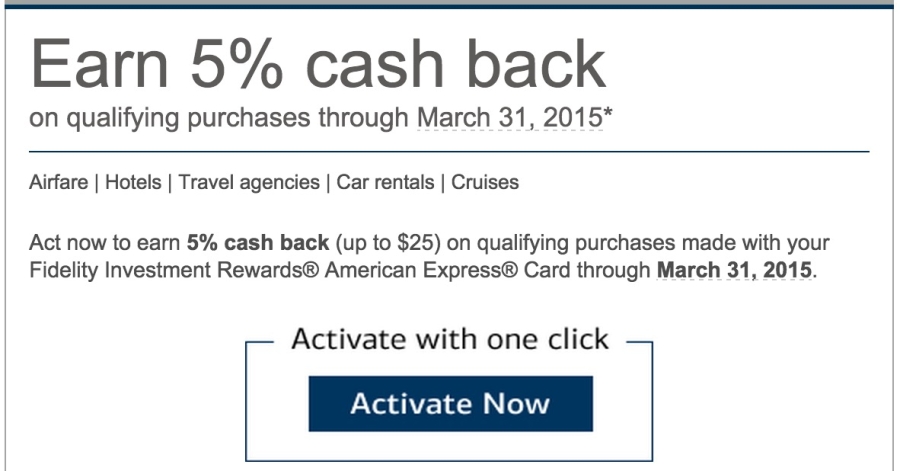

I’ve said over and over that I think the US Bank Club Carlson Visa Signature card is one of the best for everyday, non-bonused spend. In addition to 5 Gold Points per dollar on every purchase, you also get buy-one-get-one-free award bookings, and an annual bonus of 40,000 Gold Points by renewing the card – which is $75 per year.

My bonus posted a couple of days ago and got me thinking: what is the annual bonus actually worth? Or rather, what could it be worth? After Club Carlson-ing my way through Europe a few months ago, I can firmly say, “a lot.” But I like putting numbers and values to things, and hence this post was born.

Club Carlson has an awesome online interactive tool where you can filter hotels by category… which is pretty sweet. They currently have Categories 1-7, but for this post, I’m only going to focus on 1-5.

Category 1

This category can get you 8 free nights at Club Carlson properties.

How?

With the buy-one-get-one (BOGO), you pay just 9,000 Gold Points for every 2 nights. Even if you book 8 nights at Category 1 hotels, you’d still have 4,000 points left over – and realistically if you stay 8 nights in a hotel, you’ll get 5,000 more from room charges (make sure to charge everything to your room at Club Carlson properties, because with the card you get 30 POINTS PER DOLLAR – 20 points per dollar for being Gold + 10 more points per dollar for using the credit card – which is insanely awesome!). And then you could book 10 free nights. 🙂

A few Category 1 properties that jump out at me are:

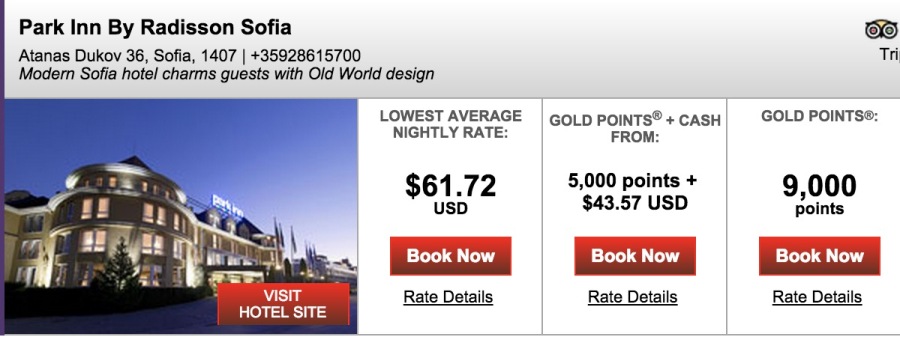

- Park Inn By Radisson Sofia – Sofia, Bulgaria

- Park Inn by Radisson Budapest – Budapest, Hungary

- Radisson Blu Hotel, Alexandria – Alexandria, Egypt

- Park Inn Jaipur Jai Singh Highway – Jaipur, India

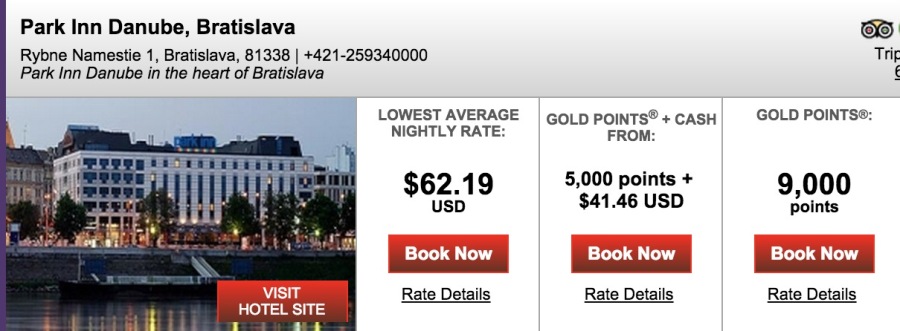

- Park Inn Danube, Bratislava – Bratislava, Slovakia

This is a pretty sparse category, but if you are in the right place at the right time, it could really be a boon.