Also see:

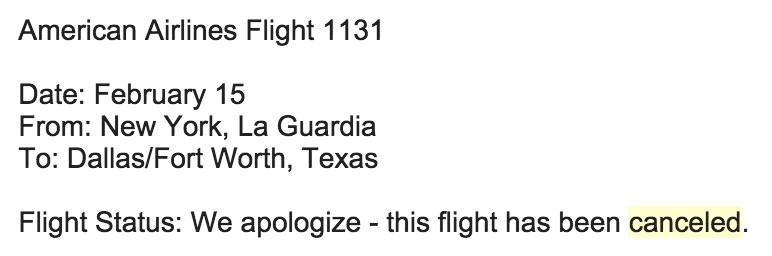

Iceland is a bit of an enigma for us frequent flyers. It’s not that it’s hard to get to – it’s just a 4.5 hour flight from New York – but the only airlines that fly there are Icelandair, Wow Air, and seasonally… Delta. Flights are cheap enough. Wow had KEF on sale recently for about $200 R/T, and Icelandair/Delta are around $600 R/T, depending.

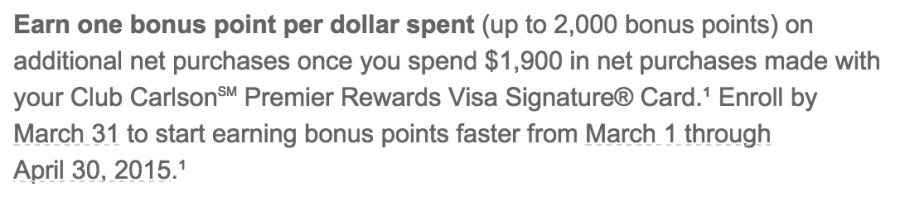

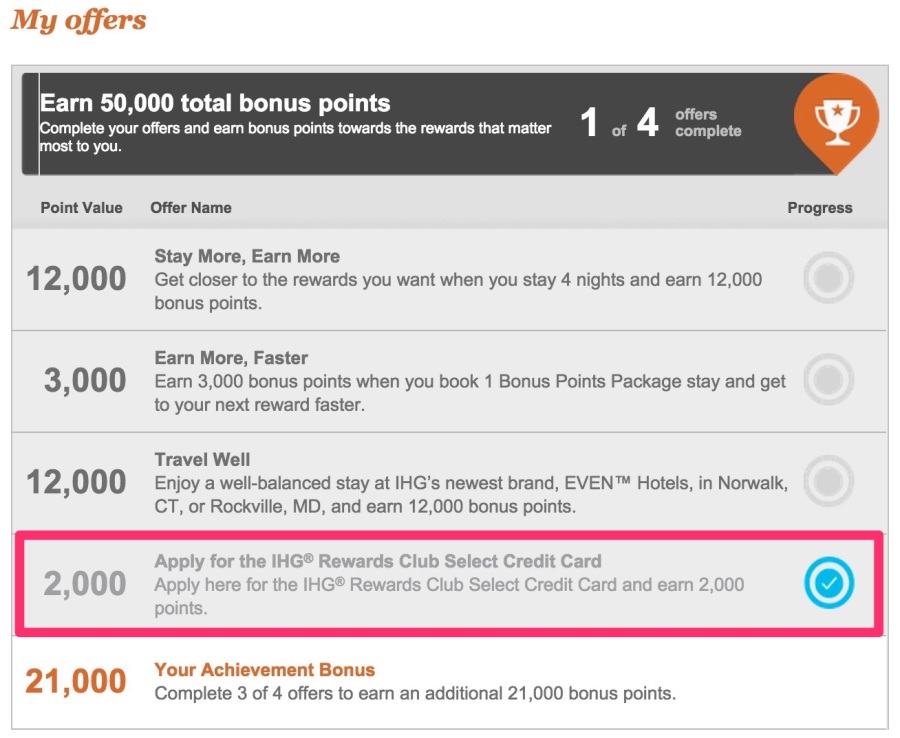

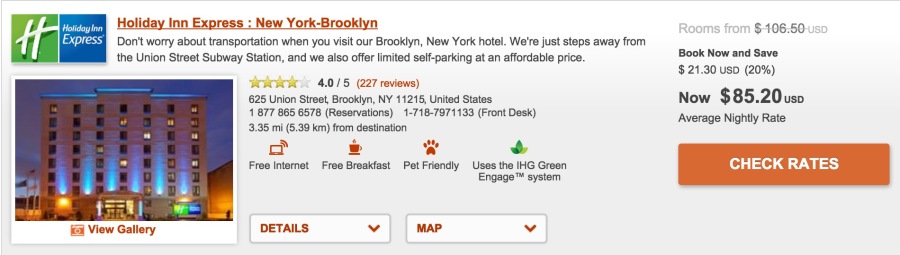

There are only a couple of chain hotels, and they’re all in the northernmost capital city in the world, which is Reykjavik. Club Carlson operates two properties – the Radisson Blu 1919 and the Radisson Blu Saga, 44,000 Gold Points per night and 38,000 Gold Points per night, respectively, and Hilton also has their Hilton Reykjavik Nordica property there.

Anyway, I’m hoping to kick off a little series about what to do in Iceland, and I’ll start with the South Coast. Originally, I was going to do a post called “What to Do in Iceland (Hint: Not Reykjavik)”, but then decided to expand and break down the individual sections, because they are all vastly different. So I hope you enjoy!

South Coast

When you get to Iceland, you’ll find there is one road that is constantly referred to: The Ring Road, or Highway 1. It loops around the entire perimeter of the island. There is no way to go through Iceland, only around. The interior is uninhabited, and uninhabitable. The land in there has never been tamed, and is severe. Aside from glaciers, there are deep fissures and crevasses that are extremely dangerous.

Iceland has always had and still has deep roots to fishing. It is a huge source of export for them, and as such, most of the population has settled along the coast over the centuries (remind you of anywhere else?).

The South Coast of Iceland only has one major “town”, if you can even call it that: Vik. The town is tiny, really just a collection of hotels and a gas station, and a few restaurants.

Arrive

After driving in from (most likely) Reykjavik, Vik, will be your next big stop more than likely. Side note: “vik” means “bay” in Icelandic. Reykjavik translates to “smoky bay” and the town of Vik is simply “bay.”

On the way from Reykjavik, you will have most likely stopped at the “Golden Circle” and maybe explored Reykjavik and the Reykjanes peninsula a little bit. You are most likely going to Jokulsarlon (“glacier lake”), Vatnajokull (“vatn” is “water” and “jokull” is “glacier” – this one is Europe’s largest and is about 11% of Iceland’s total surface area), and to see the astounding black sand beaches and huge columns of natural basalt, and maybe the simple, understated and completely elegant lighthouses.

You are not going for the weather. Vik is very rainy. They receive about 3 times the precipitation that Reykjavik does, and about 5 times what the North Coast receives. But it doesn’t matter. Iceland has its weather and it’s worth going anyway. You are bound to hit a good patch of weather at some point.