I’ve had my Aspiration checking account since I first wrote about it waaaay back in 2015. When it launched, there was no app and funky web access. But they were committed to sustainable business practices, which I really liked. Since then, they’ve created an app and a beautiful website. And widely expanded their care for our wonderful planet.

Then and now, this is among the best checking accounts if you travel – and care about – the Earth. ✈️🌎

You can open an account with only $10. And there are no fees at all to have or use it – including for up to 5 ATM withdrawals per month anywhere in the world. If you pay any fees to withdraw your money, you’ll be reimbursed at the end of each cycle.

They also offer cell phone insurance up to $600 when you pay your phone bill with the debit card, up to 1% APY when you direct deposit $1,000+ per month into Aspiration savings, and you’re FDIC-insured on balances up to $2M. Plus, none of their profits are spent on oil drilling, pipelines, or fossil fuel projects. Instead, they donate 10% of all earnings to charities.

“Do well. Do good.” is Aspiration’s tagline. If you want a fee-free checking account (including 5 ATM fees reimbursed per month) with a conscience, this is for you

If you’ve been looking for an account to use when you travel abroad, this one is perfect. Plus, you get $25 free in your account when you sign-up for an account.

Aspiration checking account basics

I write about the Aspiration checking account from time to time. Inevitably, someone will point out Schwab and Fidelity have cash management accounts that offer free unlimited ATM withdrawals worldwide. I have also written an article comparing them.

I will also go ahead and say, yes, there’s a 1% foreign transaction fee when you use the Aspiration debit card abroad (Fidelity has this too, Schwab doesn’t but has a hard pull to open the account). The fee is from Mastercard, and has nothing to do with the ATM fee. So while you’ll get the ATM fee reimbursed, you’ll pay $1 per $100 you withdraw.

When I go overseas, I usually pull out the equivalent of $200 USD, and am fine paying $2 because I use no forex fee credit cards for everything else. Note you will get ATM fees reimbursed – up to 5 per month from anywhere in the world (including the cash only bar on the corner in your hometown!).

What sets Aspiration apart is everything else.

Aspiration has a huge focus on planet-friendly business practices

They’re committed to giving back to communities, rewarding eco-friendly businesses, and never giving money to fossil fuel projects or lobbying. And that’s really cool. Like, really cool.

Over the years, I’ve earned $425 through referrals that I’ve donated back to human and women’s rights campaigns. I also put some cash into the Redwood Fund, which invests in companies with sustainable environmental practices. And I’ve loved supporting them in the process.

Who is Aspiration checking account for?

Aspiration is an online-only bank. So the only ways to get cash into the account are:

- Deposit checks with your phone

- Direct deposit

- External transfer from another account

And while there are savings accounts with better APYs and many similar checking accounts, this is a good choice for peeps who want to:

- Make free ATM withdrawals at home or abroad

- Have linked checking/savings that earns interest and zero fees / minimums and transfer funds instantly between them

- Support sustainable businesses

- Keep a backup / extra account for savings goals or just to have around for free (there are no inactivity fees)

- Easily bank online or through an app

Other neat features

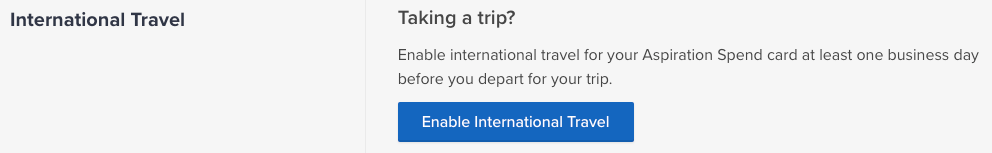

The best feature is the ability to turn international spending on by switching a button.

Loves it

Ready to travel? Flip it on. Back home? Turn it off. That way you’ll avoid locked cards, frustrating international calls outside an ATM, and no hassle if you forgot to notify your bank before a trip.

Cool, but meh

They also offer:

- Cell phone insurance when you pay your bill with the card – up to $600 (I already have this with credit cards, but super helpful if you don’t have it already!)

- Cashback for spending at a list of sustainable businesses (I use credit cards for everything, so…)

- 1% APY if you direct deposit $1,000+ per month, otherwise 0% (I can’t commit to doing that, would rather have an account without requirements)

- Impact score for businesses – a proprietary metric for how planet-friendly they are

Plus, the account comes with a savings account pre-linked to it. So while this can be a fully-fledged checking and savings account for lots of folks, I’m content to just get free ATM withdrawals, the occasional chance to give to charity, and knowing I’m supporting a company with admiral goals and visions. ✔️

Bottom line

There’s really not a downside to opening an Aspiration checking account. It’s totally free to have and keep, there’s no hard pull, and you can open it with $10. Plus, you’ll get $25 free when you open an account. Always nice to have an extra option to withdraw cash for free.

I’ve personally had my account since 2015 and have no reason to ever close it and enough good reasons to keep it around. While I wish ATM fee reimbursements were unlimited, 5 per month should be enough for most. And if the savings 1% APY came free and clear, I’d probably use it more. But maybe they’ll get there one day.

For now, I’m content with Aspiration, love their company mission, and highly recommend them to everyone who loves the Earth and traveling far and wide to see more of it.

Do you have an Aspiration checking account? How’s the service been for you – and what’s your favorite feature?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I have enjoyed my Aspiration Summit account for a few years but am confused about the Radius Bank switch a while back. Now I seem to have two accounts and don’t know what Radius was all about. Did you have this experience?

Yes! I can still login to Radius, but there’s nothing there any more – it’s just blank. It’s because Aspiration used to use Radius to service their accounts, and now they service themselves. The only way to see your Aspiration info is to log into the Aspiration site. But yes, same experience!

Reading the requirements it appears that it is 2% APY for when you toss $1000 in there a month. Otherwise if you ahve a balance of $10,000+, you automatically get 1.50% APY. Am I missing something? Historically has it been 1%?

Hey Andrew! I received this email last night and updated the post to reflect it:

“As you may have seen in the news, today the Federal Reserve announced a cut in interest rates for the second time this year.

This results in a cut to how much we earn and how much we’re able to pass back to you. As always, we seek to provide the absolute best we can to our customers and give the greatest benefits to those who are most committed to being part of the conscience-driven community of “Aspiration Nation.”

Therefore, effective today, our interest rate is 1.00% APY.1

Even with this change, our Aspiration Spend & Save and Aspiration Save cash management accounts continue to dwarf traditional savings account rates, offering an interest rate that is up to 100 times higher than the savings account APY of banks like Wells Fargo.2

The requirement to access our highest rate has not changed: for any given month, you can earn 1.00% APY on the entire balance in your Save account by either depositing a total of $1,000 into any of your Aspiration accounts within that month or maintaining a Save balance of over $10,000.1”

Perhaps it’s different for new accounts, but I wanted to include the most recent information. I still see 2% on the site too, so maybe they haven’t updated it yet? That’s the only thing I can think of. Wait and see, I suppose.

Harlan,

I’m surprised you’re promoting Aspiration given your fondness for Fidelity. I used to use Aspiration, but have actually moved over to my Fidelity CMA as I receive the same ATM reimbursements worldwide, but it does not require a direct deposit, it’s unlimited, and it’s usually within 24-48 hours. On top of that, I can invest in a Fidelity MMA account that is currently yield 1.78-2% depending on how much you have invested. Fidelity is SIPC/FDIC insured depending on your account set-up. The only downside is having to put in purchase orders when money hits the account.

Yeah, I don’t have the patience to constantly monitor purchase orders. But I mostly use Fidelity CMA anyway, especially overseas. I only consider Aspiration a backup and like some of their features. I certainly wouldn’t use them for savings as there are much better rates out there. But for an “every now and then” backup account, they’re great. Just wanted to share another option. Sometimes it’s nice to have an account all off on its own, not attached to anything else.

Are you still getting 1% interest on your Summit account?

Noooo they cut that out a long time ago. I really do need to go through these old posts and update them.

Is your account the same as this one? They’re still advertising 1%.

https://www.aspiration.com/summit/

Yes, they’ve split it up into “Spend” and “Save” accounts. The checking account is the “Spend” account. I don’t use the “Save” account which has the 1% now. You also need to upgrade to Aspiration Plus (which costs money) and spend $1K on your debit card in a given month to get the 1% rate. Not worth the hassle.

Pffft, they conveniently left those details out. Thanks.

Great Job! such an informative blog.

–