Also see:

- Get Instant Access to Aspiration Summit, the Best Checking Account in America

- Tips to Get Started With Aspiration Summit Bank Accounts

- Fidelity Cash Management Account: Why It’s Great

Update 10/1/15: I just got my own invitation link. Yay! You can sign up for an Aspiration Summit account here.

Update 8/26/15: I have the account set up now as well as email invites. If you’re interested, leave a comment below or shoot me an email and I’ll hook you up – it’s supposed to let you “skip the line!”

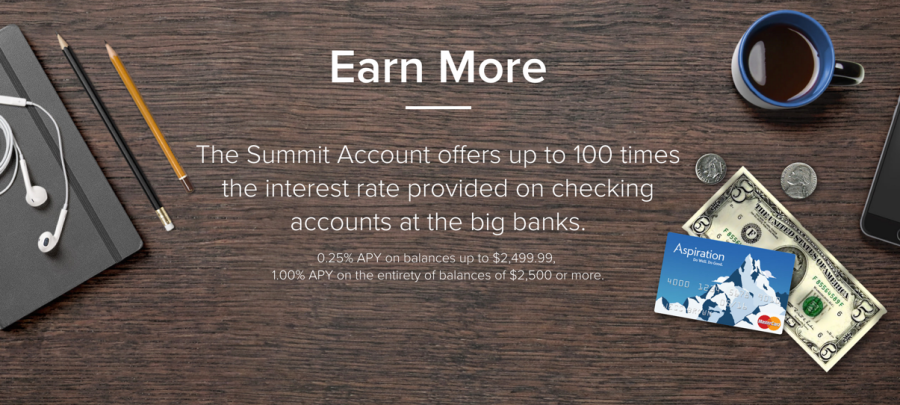

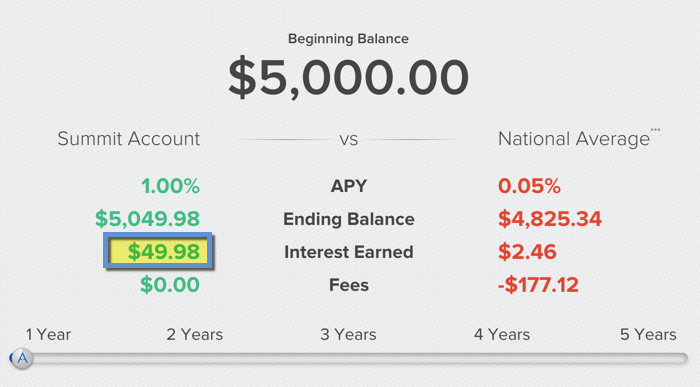

I’m always on the hunt for a great new banking product, so when I saw Aspiration’s new Summit checking account with a 1% APY (NOT APR!), I had to check it out.

I’ll show you the benefits and highlight one big caveat.

What’s Aspiration?

We’re a new kind of investment firm – built on trust, focused on the middle class instead of millionaires, and founded on the idea that we can do well and do good at the same time.

Very cool.

I’m leary of signing up for yet another new checking account after I found out Radius Bank’s 1% cashback would be useless for me.

Well guess who’s behind this new checking account? Yup, Radius Bank again.

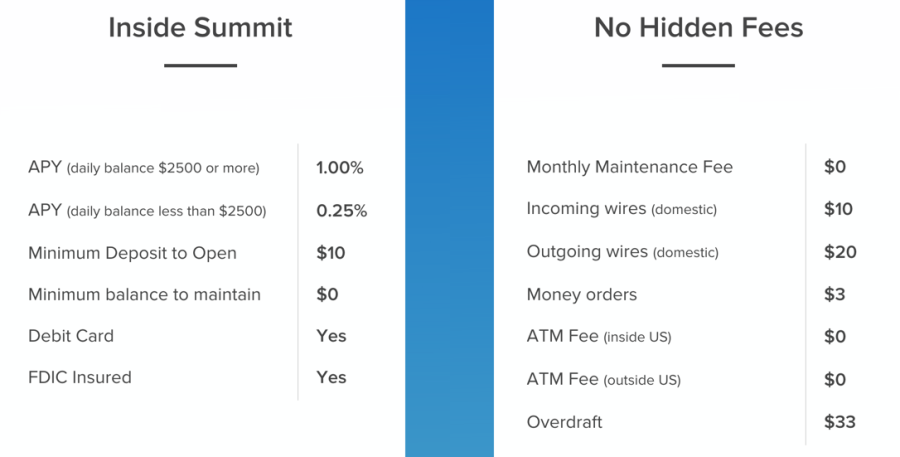

The idea is that once you hit $2,500 in the account, you’ll earn 1% interest on the balance, which compounds monthly.

You’ll also get a free debit card and free access to ANY ATM in the WORLD. Fees are reimbursed monthly.

If you don’t meet the $2,500 daily balance requirement, you’ll only earn .25% interest… a staggering fall from 1 full percentage point.

Good news for us travel junkies… but there’s still a forex fee. Stick to cash from ATMS and you’ll be fine

But, if you’re looking for an account with no fees and free ATM access, this one may be looking into.

The fee that jumps out to me is the $33 overdraft fee… ouch! But if you’re planning to keep $2,500 in the account to earn the 1% interest, it should never be an issue.

Their Twitter account has been around since July 2013, so they’ve obviously been working on this offering for a while. I’m glad the funding for their products has finally come through. It’s always good to see people succeed in their passions.

Thinking of a checking account as a savings account

Because you have to maintain such a high balance, it worth viewing this as a savings account with a debit card instead of a normal checking account.

You’ll want to keep your balance at the $2,500 mark for sure.

The APY is on target with most high-yield online savings accounts, like the ones offered by AMEX and Barclays.

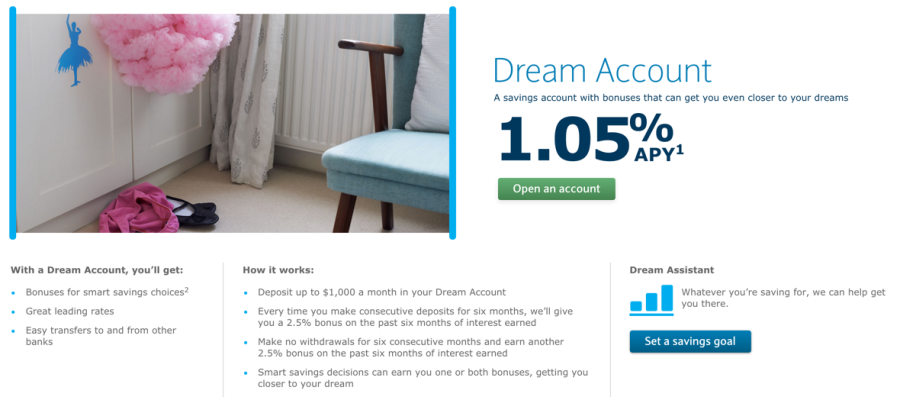

Personal finance is, well, personal, so choose what feels best for you. The Barclays Dream Account has a similar interest rate, but it’s a savings account

If you like the flexibility offered by a checking account and trust yourself to keep enough in there to earn the 1% APY, the Aspiration Summit account could be a great option.

But if you want your savings separate, tucked away, and hard to access, this might not be the right account for you (because of the “temptation to spend” factor).

You won’t earn enough to retire early or anything, but if you want to start a savings fund and want access to it in the event of an emergency, want the option to pay bills, need an account with no fees/no ATM fees, or simply like the product, you might consider checking out Aspiration.

Bottom line

The new Summit account from Aspiration might be interesting to some peeps.

There’s a waiting list to sign up right now. I’ve been on it for a week and will open my account in the next day or two. If I can pass along early access, I’ll be sure to share a link. Update: here’s the link.

1% interest from a checking account is nearly unheard of these days. It’s on par with the best online high-yield savings accounts, like the ones from AMEX and Barclays.

Some will enjoy the flexibility of a savings account, and others will want to keep checking and savings completely separate.

If you can maintain $2,500 in the account to trigger the 1% interest rate, this could be a great, flexible option. And the free global ATM access is a huge plus – especially for those who travel often.

Will you be signing up for this new checking account?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Radius Bank already offers that all on its own. No ATM fees worldwide, no foreign transaction fees (caveat because they pass on the Mastercard fees as is common with many banks including Barclay, but in my experience, that’s a difference of 0.18% compared to Visa), and they reimburse you for any ATM fees globally.

For you at least, there’s literally no point in opening another account.

The account I have DOES have those features but NOT the 1% APY. Instead it has 1% cashback, which isn’t useful for me.

So it seems like this account would have a major feature the other one is missing.

Sorry for being terse, but I can only use my mobile now.

I meant that you wouldn’t need to open a new account because you could convert your existing Radius Checking to a hybrid checking. It has all the features described above, including the interest but without the rewards debit, and you wouldn’t go through a while new application process.

Yes, I’ve read your article on Radius and Smarter Bucks and how you don’t find it useful. But you can use the remains from that and avoid reinventing the wheel.

Oh, and added benefit is no waiting list.

No worries!

That account has a different earning structure too, though: https://www.radiusbank.com/personal/hybrid

1 Annual Percentage Yield (APY) is accurate as of Minimum amount to open account is $10.00. Rate tiers are as follows: 0.00% APY applies to all balances from $0.00 to $2,499.99 and for balances of $2,500.00 and over, the APY would range from 0.00%-1.00% APY. Accounts will earn the stated APY only for the portion of the balance within the specified tier. The higher the dollar amount in the account (over $2,499.99), the higher the APY (up to 1.00%) will be earned on the account. Rates may change after account is opened. Fees may reduce earnings.

It’s NOTHING under $2,500 (whereas Summit is .25%) and the amount “varies” over $2,500 (whereas Summit is a flat 1%).

Perhaps I could switch from the SmarterBucks checking to a Summit account because it’s the same bank?

Something to look into for sure. I’ll see what I can dig up regarding Summit’s daily spend limits (my biggest concern).

Thank you for reading, and for the tips! 🙂

Found it here: https://support.aspiration.com/hc/en-us/articles/204939244-Is-there-a-daily-withdrawal-limit-

For security reasons and to guard you against identity theft, we have the following limits in place:

$100 a day for online withdrawals/transfers, only for the first week your account is open.

$500 total daily limit for any combination of cash withdrawals, PIN purchases, or any charges requiring your signature, for the first 30 days of holding an account.

After this initial 30 day timeframe, then you have:

$5,000 per day external transfer limit

$500 cash limit

$500 PIN limit

$2,000 signature based limit.

I wouldn’t mind the daily limits on this one, as I’d think of it as a savings account with a debit card. So I probably wouldn’t be spending out of it a lot (that one would remain the Fidelity Cash Management account).

But yeah, definitely good to know. Trying to think how this would fit in to my financial goals. I might just open the account and see what happens.

I’m very interested in signing up – would appreciate a referral email. Thanks!

Sent!

Hi I’d like a referral email if possible.

Thanks

Sent!

Hi Harlan- nice website. I just read about the Discover it and Fidelity Amex cards, as well as your Aspiration article. I’ve got the Discover, as well as a 1.5% cashback Quicksilver. I put all transactions on these two cards and pay everything back every month. I hadn’t thought of maxing out the Discover’s 5 (10)%, that’s sweet, though I don’t think I spend enough to do that. I have an invitation for Aspiration in the ol’ inbox now and I’m thinking about signing up for it. A little concerned as it’s so different, but I think I’m going to go for it. Anyway- nice site, awesome info. Good luck with the Aspiration, hopefully it goes well for the both of us.

Thank you, Austin! I’m actually planning a followup article about my experience so far. Dive in, I think you’ll like it!

It’s free to have, and besides, you can always switch back if you don’t like it.

Change is good!

Thank you for reading!

Harlan, would love to know your experience so far. Also if you have any more referral emails please send my way. Thanks!

Love this account! So far, so good! Very easy to use and manage, and I’ve already been paid interest – twice!

Sent you a referral, hope you enjoy!

Is this better than Charles Schwab ?

I believe so. Because there’s no hard pull on your credit to open the account, and you don’t have to open any additional accounts.

Plus, the interest rate is much higher. For me, it’s a no-brainer. And it’s free to have and open, so there’s no risk for having the account – try it and see how you like it!

Sounds Great! – Could I have a refferal by chance?

Hey Rodney! Use this link to register instantly: outandout.boardingarea.com/go/AspirationSummit

Let me know if you have any issue – I think you’ll really like the account!

Harlan,

What have been your most recent experiences with this? How do the ATM rebates work? I do find that both Radius and Aspiration are a bit cheeky as they are not “Free Global ATM” as they have foreign transaction fees?

From aspiration’s website: “Anytime a transaction is initiated in non-US currency, there is a Currency Conversion Assessment of 0.2%. If the transaction is done in another country, there is also a Cross-Border Transaction Fee of 0.9%. Thus, most of your foreign travel charges are going to have a rate of 1.1% – but remember, any ATM fees incurred will be reimbursed to you!” -https://support.aspiration.com/hc/en-us/articles/208713397-Foreign-Transaction-Fees

I don’t have an account with them, but from my understanding, for people who travel abroad all the time, then a card with no FTF and ATM rebates would be better — like Fidelity or Schwab. Am I missing something?

Thanks!

Hi Harlan,

Not sure what happened, but I posted a question here previously and it seems like it didn’t post. After using them for a few months, what are your experiences now? Unfortunately Aspiration checking has a foreign transaction fee on foreign ATM withdrawals. Do you know if Radius bank also has a foreign transaction fee on foreign ATM withdrawals?

Thanks so much!

Hi Alex!

Sorry for the delay here, I’m currently on a road trip. Your research looks excellent – I believe Radius Bank has the same fees as Aspiration really is Radius Bank. I’ll definitely look into this more when I get planted for a sec.

Thank you for adding this info!

Harlan, a while back I used your referral link to apply for an Aspiration Summit account. All was good and account was approved and is open. One thing that is annoying about the account, is their delay in showing transaction on their website (both Aspiration and Radius website are similarly delayed), like a deposit showing with one or two days delay more than any other bank I have had an account with. Did you have a similar experience with Aspiration/Raduis?

Hey Miz!

I use my Aspiration account for Airbnb payments, along with my Fidelity Cash Management Account (and formerly my Chase checking account). I found the payments hit at the same time no matter which bank I was using, so I haven’t experienced the delays you mentioned.

What type of deposits are you thinking of? Checks with mobile banking, or direct deposit, etc?

Now this is apy compound monthly? So 12 months of 1 percent on the balance of the account?

Yes, that’s how it works. The interest shows up in your balance right after your statement closes each month.