If you can’t tell, I’ve been thinking about ultra-premium cards a lot lately. Which ones to keep and pick up… and my overall card strategy.

All roads lead back to the Amex Platinum Card (learn more here) – the original, and a current stronghold.

Several years ago, it was my first card that had a big annual fee. Lots has changed in the industry since, but it’s held up remarkably well. It’s still the card to have if you’re seeking lounge access (though admittedly denigrated a bit in the past few years).

Among ultra-premium cards, it holds its own – especially if you can get maximum value from the long list of benefits.

There are three main ways to approach recouping the cost of the $550 annual fee: through lounge access, with statement credits, or from ancillary bennies.

In each case, the card earns its keep – making the rest of the perks gravy. 🤤 Let’s dig in a bit more.

And don’t forget the 60,000-point welcome bonus, worth ~$1,200 by itself!

Use the Amex Priority Pass to take a nap in airport Minute Suite locations – and many other lounges around the world

Here’s my expert analysis. 🧐

Amex Platinum Card review – how to make the $550 fee worth it

- CardRatings link: Platinum Card® from American Express – benefits and information

Here’s the current offer for the Amex Platinum Card:

| The Platinum Card® from American Express | 100,000 Amex Membership Rewards points |

|---|---|

| • $200 annual airline incidental credit • $200 in Uber credits annually • Enroll in $240 in digital entertainment credits annually for Peacock, Audible, SiriusXM, and The NYT • 5X points on flights up to $500,000 per calendar year and travel booked through Amex • Access to the fantastic Centurion Lounges, Delta SkyClubs, and Priority Pass network • Enroll to get up to $179 back as a statement credit each year for CLEAR membership • Terms apply |

| • $695 annual fee (See Rates & Fees) | • Spend $6,000 on purchases in the first 6 months from account opening |

| • Learn more here |

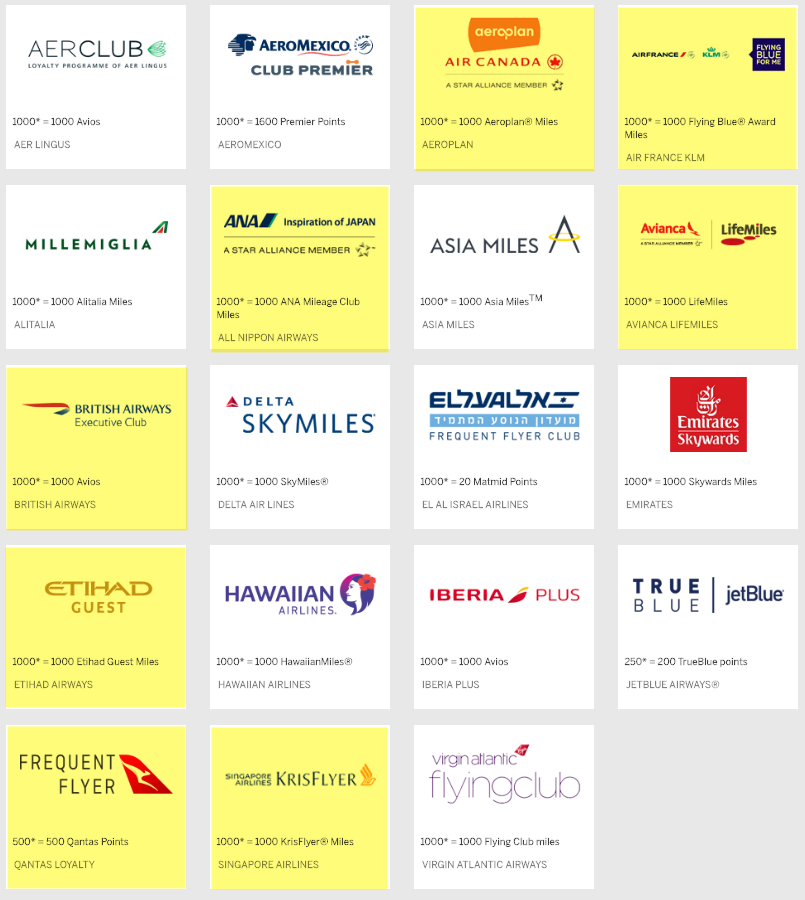

I value Amex Membership Rewards points at 2 cents each – so this offer is worth ~$1,200 to me, and potentially much more, depending how you redeem your points. You could get:

- Business Class flight to Europe or South America via Air Canada, Avianca, Singapore Airlines, or Virgin Atlantic miles

- Lots of short-haul flights – 10, to be exact @ 6,000 British Airways Avios points for flights under 651 miles outside the US

- Nearly 2 round-trip coach flights to Hawaii on United via Singapore Airlines (at 35,000 Singapore miles each) after completing the minimum spending

- Tons of other cool awards with 19 airline transfer partners

Amex has some valuable airline transfer partners (I’ve highlighted my faves)

The welcome bonus alone covers the annual fee for 2 years based on my valuation. But let’s look at the other benefits.

1. Lounge access

With the Amex Platinum Card, you get access to:

- Priority Pass Select network (excluding restaurant locations – 2 guests allowed)

- Centurion lounge network (9 and counting – 2 guests allowed)

- International Amex lounges (random ones in MX, SYD, MEL, EZE, GRU, DEL, BOM, and ARN)

- Delta Sky Clubs (but you gotta be flying Delta same-day, guest are $27 each)

- Escape lounges (15 lounges in 11 airports)

- AirSpace lounges (2 locations – CLE and SAN)

You can get into literally 1,000s of lounges worldwide with the Amex Platinum Card’s extensive reach

At this point, you have to consider what a lounge visit is worth to you, how often you’ll use the benefit, and if you bring guests.

And I’d rank a Centurion Lounge visit higher than a Sky Club or Priority Pass visit, for example.

You might value a lounge visit for $50, considering you’ll:

- Bring a guest

- Have a couple/few drinks each

- Eat full plates of food or hit the snacks hard

- Use wifi

- Shower, nap in the lounger chairs, or spend a long layover

I’d say that’s worth $50. With the $550 annual fee, you’d need to make 11 lounge visits in a year, or roughly once per month. Easy peezy.

You bet I can pig out in a Centurion Lounge… and get a manicure while I’m at it. That’s worth $50 a pop

If you travel frequently, like a couple of times a month, it becomes an excellent deal and a no-brainer.

But if you value your lounge visits for say, $30 each, because they’re short or you don’t use everything offered, you’d need to make ~18 visits in a year ($550 / 30).

That’s still doable, especially if you connect or have a multi-city itinerary. I once used three Priority Pass lounges in a row on a complex trip.

Suffice it to say this perk is most valuable if you use it often. The same can be said for any perk on any card – they’re only valuable if you actually use them.

2. The CREDITS

The Amex Platinum Card has several credits:

- $200 in Uber rides ($15 each month, except for $20 in December)

- $200 airline fee credit per calendar year on an airline of your choice

- $100 in Saks credit ($50 Jan-June, another $50 July-December)

- $100 Global Entry reimbursement every 4 years

- Terms apply

That’s $600 in credits, which again, completely covers the annual fee if you:

- Will use them/like them

- Give them face value

I can definitely use the Uber credits, buy gift cards to fly Delta or Southwest, could order some cologne from Saks twice a year, and will 100% use the Global Entry credit.

Even if you don’t use all the credits, you can give them away – like if you get Global Entry from other cards, or use the Saks credit to purchase gifts for loved ones.

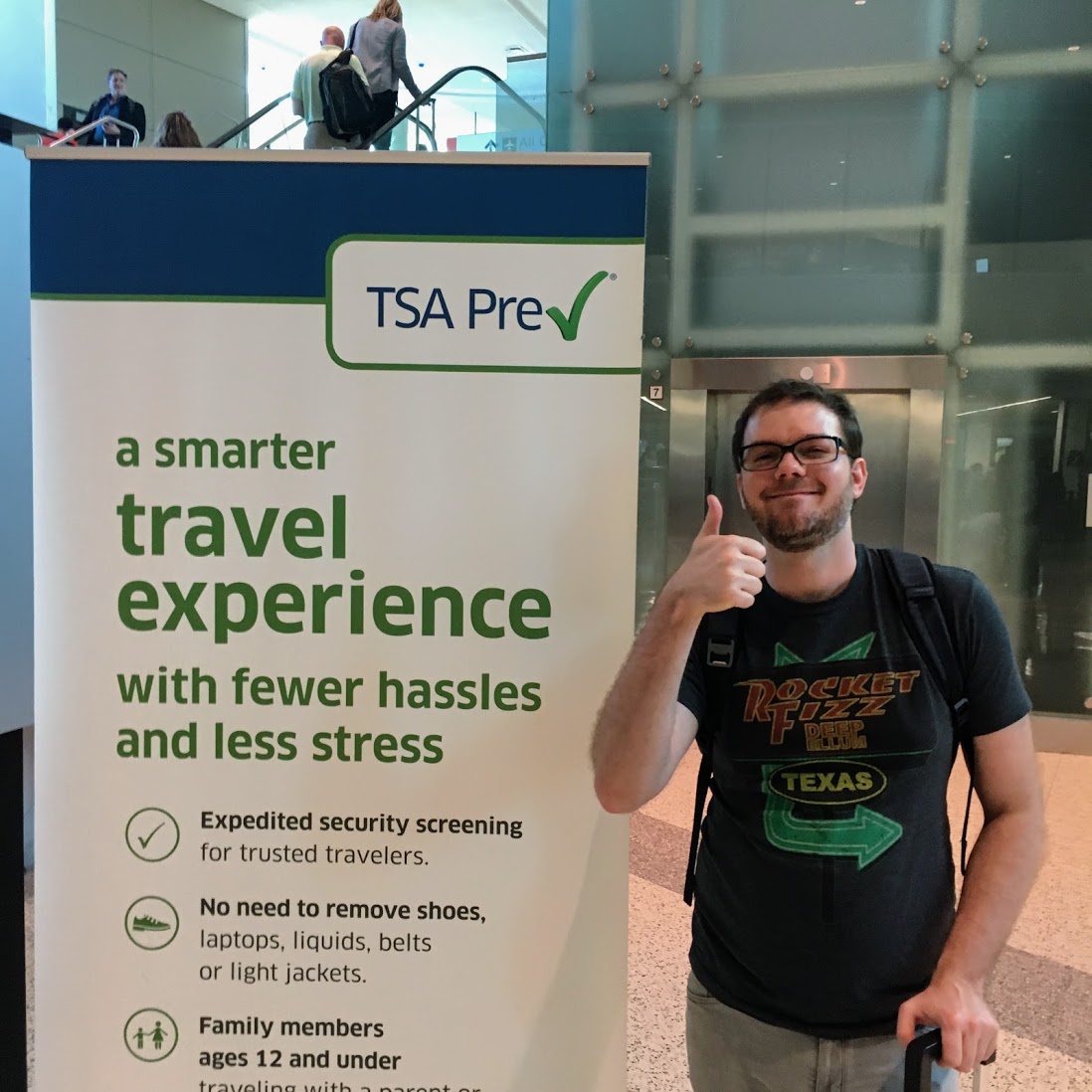

I will always always have Global Entry and TSA PreCheck because it’s saved me dozens of hours of standing in line at airports!

And even if you don’t value the credits 1:1 to cash, if you use them, they kick a nice dent in the annual fee.

With them, using another benefit becomes super cheap. Subsidizing, if you will. And these credits are something most peeps can use – or again, give away. Personally, I maxed mine out every year.

Don’t forget, they all reset. The first year of having the card, you can get the airline credit twice – once in 2019, and another in 2010, before your annual fee is due again.

That’s $400 worth of Delta or Southwest flights!

3. All the others

It’s easy to cobble together tons of value from the remaining bennies, like:

- Hilton Gold elite status (free breakfast at every Hilton hotel, upgrades and late checkout when available)

- Marriott Gold elite status (free breakfast at certain hotels, upgrades)

- Access to Fine Hotels & Resorts (usually a HUGE value-add to any paid booking)

- 5X Amex Membership Rewards points on flights booked with airlines, and travel booked through Amex (industry best)

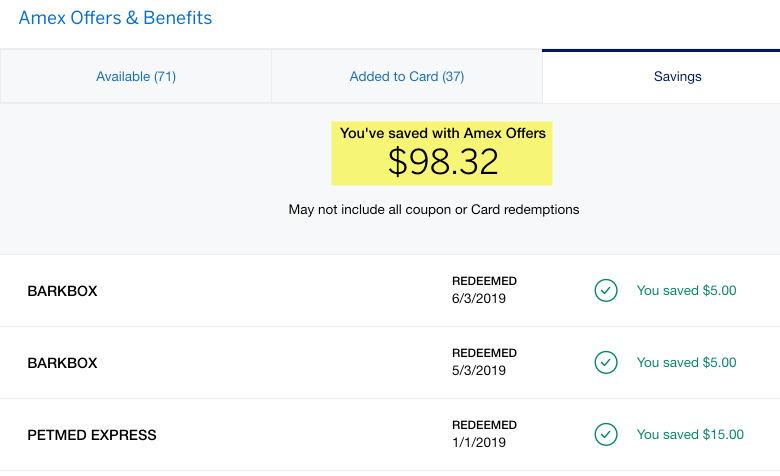

- Amex Offers (not as good as they used to be, but still worthwhile)

- Purchase and return protection (excellent for big purchases)

- Extended warranty coverage (ditto)

- Terms apply

I use Amex Offers to buy stuff for my dog 🐶

These are all astoundingly helpful if you don’t get them from other sources. For example, if you don’t stay with Hilton or Marriott to get elite status, but have a random stay – you’ll get a few extra perks, and bonus points for a paid room.

Or if you like peace of mind with truly excellent purchase protection.

I really like 5X points on flights, but be aware there’s no travel insurance if your trip goes awry. It’s great if you book flights for others, though.

How much are all of these things worth? It’s tough to say.

Because they fall into an unquantifiable “name your own value” zone. Using Fine Hotels & Resorts even twice can make a good trip into an awesome one – how much is that worth to you?

And having instant hotel status with two global chains with zero stays required? That’s sweet because you’ll get all those perks from the first moment, no counting stays needed.

All combined, I’d definitely peg them north of $550 – no question.

Amex Platinum Card best case scenario? A mix of everything

While these three avenues make a case for the Amex Platinum Card, in an ideal world, you’d use a little of each.

Such as, a lounge visit here and there, using some of the statement credits, and really enjoying your Amex Offers and hotel elite status, for example.

I certainly appreciate the enhanced value the Amex Platinum card has brought to my travels

Or maybe you book lots of flights for others and like raking in 5X points, ride with Uber often, and use the purchase protection for a big-ticket item.

There are lots of ways add it up. Again, some perks are tangible, others not.

If you travel with moderate frequency, like a few of the offerings, and have a plan to make the most of the card, the Amex Platinum Card is definitely 100% worth it.

The issue mostly becomes about opportunity cost with other ultra-premium cards, namely the Chase Sapphire Reserve and Citi Prestige. Although if you’re truly a frequent traveler and like to diversify your points, you can make a case for multiple cards… I have a few big annual fee cards myself.

Bottom line

- Key link: Platinum Card® from American Express – benefits and information

Hopefully this gives food for thought about the Amex Platinum Card, its annual fee, and the multitude of benefits you’ll get.

I can see myself getting it again, especially if I dump other cards I’m not using much any more. Keep in mind, the small business version of the card is similar but has wholly different benefits – here’s my review of the Amex Platinum business card.

If I have a period of heavy travel, I’d apply in a heartbeat, if only for the lounge access and airline fee credits.

So what do you think? Has the Amex Platinum Card aged well? Is it still competitive in the current card landscape (cardscape)?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Don’t overlook Amex referrals.

Absolutely! Definitely a great perk of any Amex card.

Can’t use the $200 airline credit for Delta $50 gift cards any more. I have trouble using that perk now, as I don’t buy up to expensive seats, or check a bag (get that on the Delta card anyway), or change tickets or whatever else fees it covers. (Any suggestions?)

Delta gift card purchases were working as recently as this month, according to folks on FlyerTalk:

https://www.flyertalk.com/forum/american-express-membership-rewards/1739932-airline-fee-250-200-100-reimbursement-reports-dl-only-105.html

I bought 4 x $50 Delta GC’s on their desktop site on 5/21 using my Amex Plat. Reimbursed for all the following day.

And right now there’s a targeted 40% or 50% bonus for MR > Avios transfers too.

The generous emergency evacuation insurance plays a major factor into keeping the card for me.