Also see:

- I rented an Apartment to Airbnb in NYC

- Airbnb First Month By the Numbers

- Airbnb by the Numbers: Q1 Update

- Airbnb by the Numbers: Q2 Update

- Airbnb: Us and Them

I’ve written a lot about my side hustle with Airbnb a lot in the past. So I thought I’d follow up, because side hustles are a big part of my FIRE, and a great way to dig yourself out of debt – or earn more income.

In my Q2 update, I estimated I’d make an extra ~$31K off the endeavor in 2015.

I took some knocks here and there, but doubled my original projection. All told, I earned an extra ~$60K from Airbnb in 2015. And most of it went toward debts. In 2016, I’ll earn less but hopefully knock out my student loans once and for all.

Here’s how I did it.

The numbers

The numbers are complex. I have 4 places in total, but split 2 of them 50/50 with my business partner, Chris.

So, 2 of them are 100% mine and 2 are 50% mine. For these numbers, I’m only looking at my side of things.

I added 2 new places in 2015, so those 2 have partial-year numbers available.

And tomorrow, I’m getting rid of 1 (long story… basically it’s no longer worth it).

But the raw numbers tell me I earned ~$60K in profit.

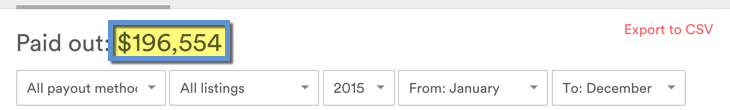

All of the money from Airbnb, absolutely all of it, was nearly $200K paid out in 2015.

Of that:

- $47,730 went to my business partner

- $78,050 went to paying rent in NYC (!!!)

- $10,754 went to taxes

Which left me with:

$60,020.

Here are the 4 places and their associated rents:

- #1: 2300 a month X 10 months + 2875 (rent increase) X 2 = $28,750

- #2: 1600 a month X 9 = $14,400

- #3: 1300 a month X 7 = $9,100

- #4: 2150 a month X 12 = $25,800

As you can see, I had 1 place for 9 months of 2015, and another for only 7.

I paid a lot of rent in 2015.

Where did it all go?

This money is not in my checking account any more, but that doesn’t mean it’s gone. Well, most of it is.

Here’s how I spent it:

- $14,000 for down payment on a house in Dallas

- $5,500 for Roth IRA

- $35,000 to paying off credit cards

The lion’s share of it, was… credit card debt.

In the background of life, I managed to accumulate a ball of debt that would slow down most people. Thirty-five thousand dollars. Geez.

That’s why I got into this whole Airbnb business in the first place – to alleviate that debt, save up for a house, and then knock out my student loans.

This side hustle not only surpassed, but doubled, my expectations. And I’m happy to report I am credit card debt-free now.

And I did buy that house.

I even invested.

2015 was the first year I maxed out a Roth IRA. I contributed the maximum amount allowed. So this money lives on as retirement income, which will hopefully appreciate to much more in the next, oh, 30 years.

And I plan on moving permanently to Dallas in Spring 2015. The $14,000 includes down payment, property taxes, interest, fees, blah blah blah. So some of it was a sunk cost, but some of it lives on as equity in my brand new investment property.

And I’ve already got my eye on investment property #2. In fact, I plan on starting my search for a multi-family duplex in the Dallas ‘burbs.

But I’m not debt-free all the way yet. 2016 will suck up most of the profit toward previous debts, too (which is totally fine in my book! I’m just happy to be rid of them!).

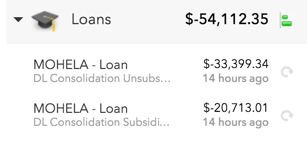

I still owe a staggering $54K to the US government for student loans.

There are 2 more things I want to talk about real quick.

How did I surpass my goal so much in 2015?

If you read my Airbnb Q2 update, you’ll find find I threw out all of Q1 as a sunk cost. I broke even for 3 months.

I was kinda wondering what I got myself into. And now here I am again, back in another Q1.

I’m expecting the same results this year. 3 months of work for $0 return. But as you can see, it is worth getting through (it starts to turn around in mid to late March).

Q2 gave me hope.

But Q3 and Q4 blew it out of the water.

August and October were my #2 and #1 months this year, respectively. So I had a strong Q3 and Q4.

I got higher margins than I thought were possible, and even hit $10K in profit in October (my best month).

I attribute it to:

- Getting the best rates in the high season thanks to good reviews

- Low vacancy

- Low rents (relatively speaking)

- Quick turnover

- High rate of communication

- Good management (quick and thorough responses and double/triple-checking everything)

Why I DO NOT expect this to continue

The gravy train is slowing down.

One of my rents increased from $2,300 a month to $2,875 a month.

That’s… insane. That’s $7K a year in extra rent! Which severely cuts into my margins.

And, as mentioned before, I’m getting rid of 1 of them.

I expect to get rid of a 2nd in late April because I won’t renew the lease (the building is too difficult for Airbnb).

Finally, I don’t know how much rents will increase in 2016.

New York is a fierce, competitive, and growing market. Both with rents and with Airbnb. So I’m balancing rising cost of doing business with lower prices to remain competitive, which means I earn less.

Even still, With 3 places left, then 2, and maybe just 1 by the end of the year, I expect to keep the Airbnb stream going in 2016. But I do NOT expect to make nearly as much as I did in 2015, realistically.

With the profits, now that my credit card debt is gone, I’ll:

- Pay down my $54K in student loans

- Max out my Roth IRA again

- Save up for investment property #2

- Contribute to a Solo 401(k)

But my #1 focus is to eliminate my student loans in 2016. It’s just time. I’m tired of them hanging over me. Even if it’s the only one on the list I knock out this year.

Even if I repeat the success of 2015, I’ll barely get beyond my student loans and spend 90% of the year paying them off. I may have a little left over for my Roth IRA and the other financial goals.

And I’m already planning to create new income streams to help bolster those. And who knows, maybe I can move my Airbnb income down to Dallas with me.

2017 will be the year of real profit, or at least of rapidly building up equity and paying down mortgages.

Bottom line

Was it worth it? To have, on average, an extra $5K per month in income in 2015? Hell yes.

It paid off my credit card debt, bought me a house, and got me on track toward retirement income – all for my FIRE.

While I don’t expect 2016 to touch the levels of 2015 as far as pure profit, I do hope to at least pay off my $54K in student loans this year once and for all (the curse of the millennial generation).

I said it once and I’ll say it again:

If all this Airbnb side hustle does is pay off my student loans, I am 100% OK with that.

Here’s to side hustles, creative problem-solving, taking control, and living dreams in 2016. (Oh, and travel, independence, and freedom of schedule. It’s all tied together, in a roundabout way.)

I’ll report back with an update on how the year is going and progress toward getting rid of student loans once and for all.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Curious – do your landlords know you are doing this?

Yes, all of them. No issues there.

Is it a standard sublet agreement, or something more involved?

What’s “it?” My agreement with the landlord? Or do you mean for the travelers who book the Airbnb?

I’ve wanted to get into the Airbnb business in Manhattan but actually purchase a property and partially (fully?) cover the mortgage with the income. How do you go about sidestepping the NYC anti-Airbnb rules/fines?? Any primer worth reading?

Oh wow, that would be awesome. I thought about doing that too, but the idea of getting a 20% down payment together for a $1M+ mortgage only to be outbid by an all-cash buyer put me off big time. Not to mention the huge upfront cash outlay.

But, if you can swing it, I say go for it! NYC is always a great investment. Where in Manhattan are you thinking?

I don’t sidestep anything, really – I just keep it clean. Be selective about your guests, no partiers, request quiet at all times. I’ve never dealt with a fine or anything like that. I imagine they’re easy to get if you’re sloppy, though.

I wish there was a primer. For me it was all trial by fire. I just kinda… did it.

Here are a couple of guides I found that might help:

http://www.thesimpledollar.com/how-to-make-money-as-an-airbnb-host/

https://www.guesty.com/blog/how-to-be-an-airbnb-host-guidelines-advice/

Def keep me posted on your journey! Would love to hear if you take the leap!

I was under the impression it is illegal and NYC is trying to crack down on people posting on vrbo/Airbnb? That is my major barrier – I worry about possible fines

Was looking into the midtown area simply because that’s (in my opinion) the most desired by tourists

It’s unfortunate you’re leaving to TX or we could possibly work something out

There are a lot of forces at play: the City Council, Airbnb, and many many others. Ultimately the fines are against the building – not to you as an individual. The only way you’ll pay them is if the landlord pays them first, then comes after you for the full amount – a process that can take a long time. And even then, it would be between you and your landlord, if it comes to that. I wouldn’t worry too much about fines.

The Midtown area is definitely a hot spot. I’ll be in NYC for a while longer and managing my places still. Feel free to shoot me an email with your ideas (zynner@gmail.com). Maybe I can help!

You do realize that what you are doing is illegal in New York City. Probably not the best idea to post so many details about it. I know there isn’t a whole lot of enforcement going on, but writing this seems pretty risky.

It’s not illegal, but it is in a huge gray area.

Here are my thoughts on the topic: http://outandout.boardingarea.com/airbnb-us-and-them/

Renting an apartment for less than 30 days at a time is illegal in NYC. It is not grey, it is black and white. I mostly disagree with that law that was passed by the hotel industry being in the pockets of the city council. Nonetheless, you should still be wary of fines. With all of the detail in this post, they could easily come after you.

http://nypost.com/2015/12/02/most-airbnb-rentals-violate-the-states-short-term-leasing-law/

Could you please tell me what you’re doing in terms of taxes? Don’t you owe taxes on that $200,000?

I have $10,000 in total Airbnb income this year. I have been saving all my receipts. Like you, I am in New York, and the rental is a place I am actually renting myself.

I’ve only done my taxes twice, with straight 9-5 income but this year will be a bit more difficult.

A response personally or here would be soooo much appreciated.

Taxes… I funnel 20% of every transaction into a savings account. Then my accountant completes a Schedule C form with the 1099 Airbnb sends. I estimated my taxes for 2015, and made quarterly tax payments last year according to the IRS schedule.

And I save ALL of my receipts in Evernote, and write off every expense, like cleaning supplies and laundry (a lot of it is actually laundry).

For $10K in income, you should be able to create a Schedule C and itemize your deductions with basic tax software and get a pretty accurate estimate. Or you can hire an accountant for this year. My guy charges ~$200 (which is pretty standard for complex taxes), so it might be worth it to pay someone else to do it, especially if you think they can save you more than that – then it’s totally worth it.

I’d plug in the numbers into some tax software like TurboTax or H&R Block and just see what it says. If you feel confident about the results, go ahead and file. Or take it from there.

It’s pretty easy. If you plan on earning the same or more next year, be sure to make quarterly tax payments. The IRS doesn’t like to wait to get their $$$.

Hope that helps! Keep in mind, I’m not a tax professional but this is what I do and it’s worked well for me the past couple of years.

But if you don’t make quarterly payments it’s under $100 fine. A drop in the bucket for me when I usually owe $7k+/year to the IRS. All my income is in Q4 and I hate giving the IRS an interest free loan, so I just pay the penalty. I know I’m throwing money away, but it’s roughly a wash with interest on the $7k anyways.

Do you have a page with all your side hustles? I need to find something to do the other 9 months of the year when I’m not very busy with my main hustle.

Ah, very cool. I guess I’d do the same if all my income was in Q4 too, because if you file taxes by 2/15, you don’t even take to make the Q4 payment anyway.

No page with side hustles (they’re all in my head lol). I have the BNBs, I’d love to grow this here lil blog, and I have a main W-2 job that I work M-F 9-5. I’m about to get into tarot readings (a great all-cash business), and real estate investing. It’s a lot to keep track of, but it works.

There are a lot of great side hustles out there, especially if you have the time. Do you have any ideas you’re tossing around?

Nothing right now, but I haven’t had any reason for it until now. Shoot me an email if you’d like to chat, I have some questions about the AirBNB anyways.

What are you plans for the AirBNB flats once you move to Dallas?

Cool, I’ll email now.

I have a great team of cleaning people, and friends in the area. And key exchange is super easy.

So I’ll manage from afar as long as it’s feasible. Plus, flights between DFW and LGA are usually under $100 r/t so I plan on coming back every 6 weeks or so to check up on them.

In your post “Us vs Them” you say you paid your business taxes but not hotel occupancy taxes (yet) due to legislation. Above you show $10K in taxes. Do you mean income taxes or something other business tax? I’m assuming $60K is net after your income taxes to NYS and the IRS? Just learning about all this and appreciate your sharing!?