Or, Lightning Strikes Twice!

I shared how my brother’s credit score jumped 100+ points in a month after I added him to one of my credit cards. He had literally nothing on his credit report.

Last month, I added an authorized user to a 5-year old (no annual fee!) credit card with a $13,000 credit limit. The statement closed on July 3rd. And on July 11th (a week later), we pulled his credit report.

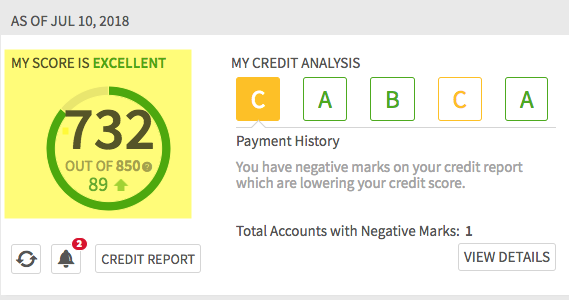

His new score (according to Credit Sesame) is now 732 – 89 points more than it was this time last month! (FWIW, it was the same on Credit Karma, too.)

After adding my brother, and now with this new experience, I’m convinced how beneficial it can be to add authorized users to old cards with a high limit. And why it’s so important to have a couple of cards with NO annual fees in your wallet.

This AU had one negative mark, but all my info transferred

Whereas my brother had NO credit at all, this authorized user had one negative mark – a collection account for ~$400 from December 2016.

Because of it, his score was 643, which isn’t horrible – but not great.

I added him to my Fidelity Visa, which I’ve had for ~5 years by now. I once called it the best cashback card in the universe.

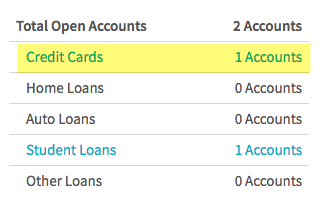

Before, he had zero credit accounts and one student loan. I was impressed that all my credit card details transferred to his account – as if they were his.

Further, our credit ages blended to form an average. This is why having a no annual fee card is so important – because you can keep it forever to age all your other accounts!

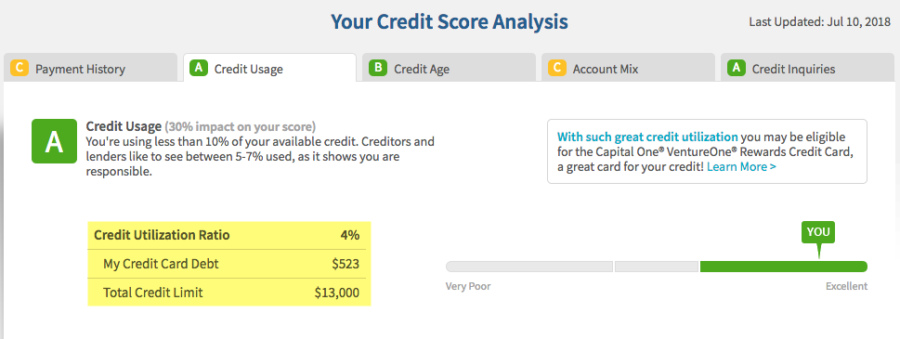

All of my credit line and utilization details transferred, too. So if you want to really help, add an authorized user to a card you use sparingly. Under 10% is a good mark.

At the time, there was a promotion to spend $500 on the Fidelity Visa (which has a $100 sign-up bonus right now!) and get a bonus $25 in points (on top of the normal 2% cashback, for an effective 7% cashback, which is awesome). I always go a little over, so I spent $523 on that card last month. Sure enough, I earned the bonus points – and the spending shows on his account, too.

All of this transferred after one credit cycle. A week after the billing period closed, the information showed up on my authorized user’s credit profile. Really cool.

Add AUs to old accounts with high limits (and preferably no annual fee!)

Why would you want to do this?

When I added my brother, it was to help him buy a car and get his own apartment. For the new AU, it was was to offset the one blemish on his account.

In both cases, I wanted to help people I knew and trusted to get ahead with better credit.

Having good credit – and a high score – is so important for:

- Preferred rates on mortgages

- Renting an apartment

- Getting a new car with a note or lease

- Applying for rewards cards

- Building credit history early

- Refinancing private student loans

The best way to help is to add users to cards that:

- Are 5+ years old – the older the better!

- Have high limits – over $10,000 preferably

- Don’t have annual fees – that way you’re NOT on the hook to pay a fee while their credit profile gets an update

Keep in mind, Chase and Citi do NOT ask for SSNs – the information is based on address. So if your AU doesn’t live with you, it’s best to add them to an Amex, Bank of America, Barclays, or US Bank card. That’s important to remember – those banks all DO ask for an SSN.

Bottom line

I love all the benefits I’ve gotten from having excellent credit. I got my mortgage when rates were low. And bought a new car with a great interest rate. I’m nearly always approved for new card accounts instantly. And any time credit is a factor, it’s never a worry – which is awesome (my score is currently 768).

I’m to the point where I can help others by adding them as authorized users (AUs) to my oldest card accounts with high limits and no annual fees. When I added my brother, his score got a healthy 100-point jump.

And this week, I added another AU, whose score jumped 89 points despite one collection account from ~2 years ago.

I’m now a believer this really works – each time, I saw results after only 1 month.

If you have friends or family you (trust – although you do NOT have to give them the card) and want to help, the benefits can help them get a new car, a home, or rewards cards of their own. I recommend Amex, Bank of America, Barclays, or US Bank cards that are 5+ years old with $10,000+ credit limits for maximum, fastest results.

Have you had a similar experience? Would you add someone to your card account to help their credit score?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

So would this work? I’d like to have my sister be an AU on my 5x Ink card b/c she’s near some stores that are very lax with limits on promos…So, if I added her to my Chase Ink she could use the card but it wouldn’t effect her 5/24? She has a common name and lives 3k miles away.

Don’t care about upping her credit score, it’s already excellent.

Chase Inkbcards are business cards, so you can add your employees. Since Ink cards are business cards, it normally wouldn’t appear on their personal credit report.

Bill is correct. Employee cards generally don’t show up on a personal credit report. With Chase, you don’t have to give an SSN to get the card, either. You should be fine to add her.