Update: Some readers let me know not all mortgage payments are working, but many are!

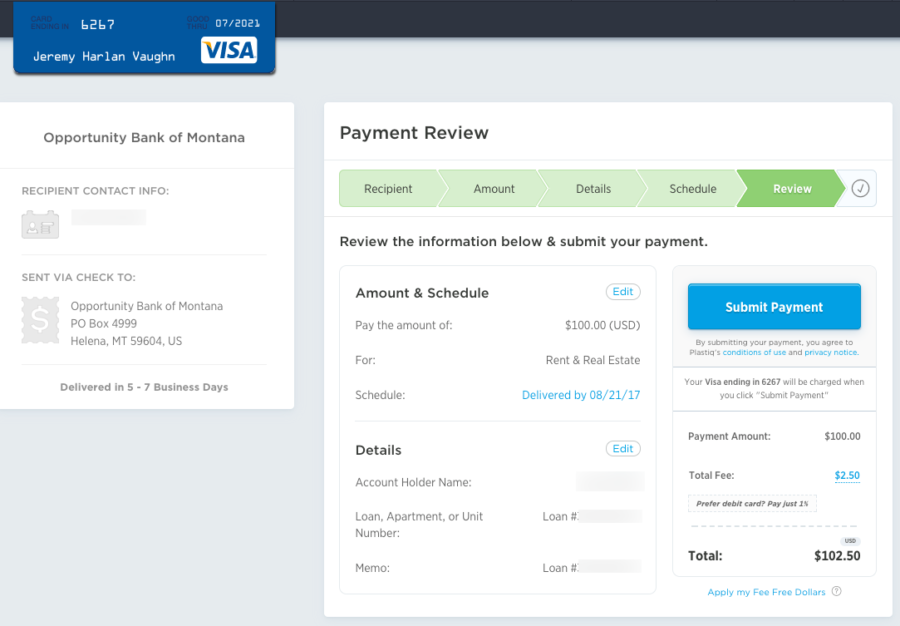

Here’s an example from my account:

As long as the “Submit Payment” button isn’t grayed out, you should be good to go! Let me know if it works for you!

More data points slash adventures with Plastiq.

So I just got a new Bank of America Alaska Airlines card – I get a new one every 45 days for a quick injection of 30,000 Alaska miles. Those are, of course, Visa cards, which Plastiq said would no longer work.

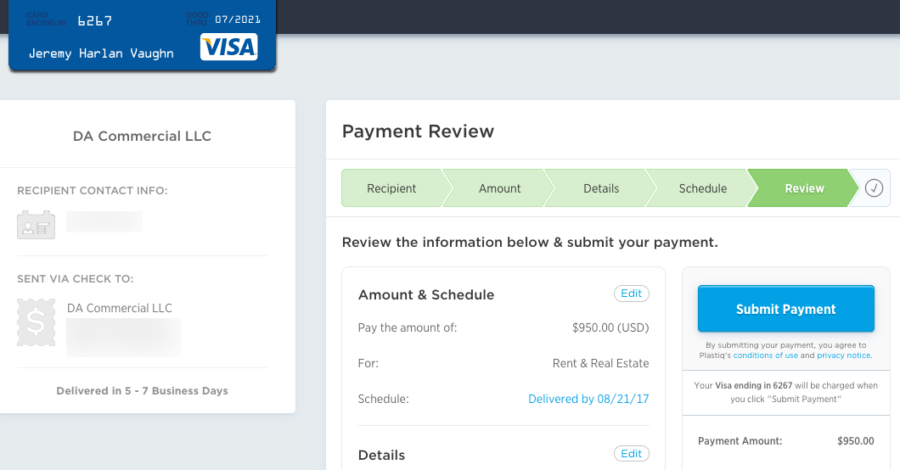

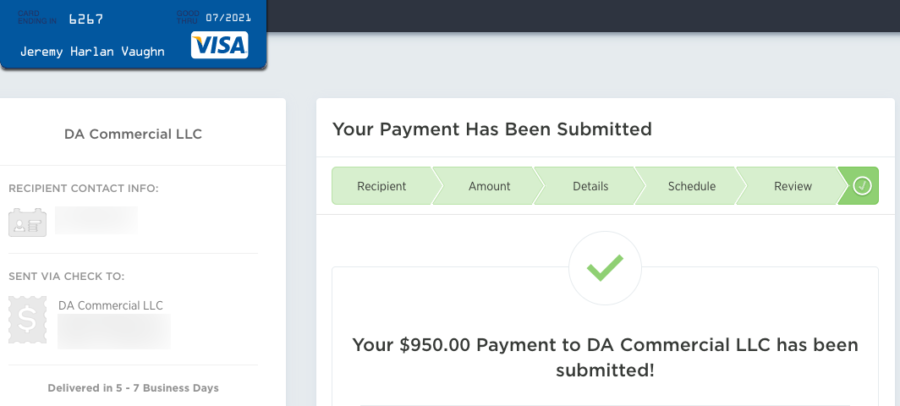

Well today, I paid the rent for one of my Airbnbs with this card on Plastiq.

And it went through without a hitch:

Considering the minimum spending on this card is only $1,000, I was able to knock most of it out with a single rent payment. Then I sent $50 to my utility company to trigger the sign-up bonus. Minimum spending done in under a minute. AWESOME!

This isn’t a fluke. My friend Angie used her Chase Fairmont card to pay her mortgage via Plastiq recently, too – that’s also a Visa card. And I’ve heard others have had success, too.

Plastiq Visa payments

While I think 3X with the Chase Sapphire Reserve is long gone, using Plastiq to meet minimum spending on Visa cards is extremely easy. Even with the 2.5% fee considered, having it done in seconds sure beats having to monitor it for a few months. Especially if you need to spend a few thousand.

I also just confirmed 3X still works with the Citi AT&T Access More card. And wrote about why you’d even consider using the new Blue Business Plus Amex for Plastiq payments, too.

But given that I can still get 3X, the gravy train is still on – at least for now.

And moreover, it seems you can use your Visa cards again. So if you have a Visa and want to make some Plastiq payments for rent, mortgage, or HOA, they should go through just fine. 🙂

Have you had recent success using a Visa card for a rent payment through Plastiq?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I don’t think plastiq ever said visa wouldn’t work for rent. I’ve never had a problem. The notice I got was it would stop processing mortgage payments.

I think they’ve always coded the same and said Visa cards would no longer work. Regardless, they’re working again. My friend made a mortgage payment and it went through without issue.

Sweet! Mortgage too?

I was able to get a mortgage payment to load in my account. And yes, my friend Angie confirmed she made a mortgage payment with her Chase Fairmont Visa. Seems YMMV but def give it a try and let me know if it works for you!

Perhaps I’ve missed the answer, but why Plastiq rather than RadPad? Seems that with the Altitude Reserve (via Apple Pay), RadPad is most favorable. Is it just that you don’t value the USB currency very much? Or am I missing something obvious? Thanks!

As an aside, I’m super envious of your new BoA AS card. I recently applied *yet again* and was denied for too many inquiries. They won’t give me a strict number but it seems they’d like < 5 combined hard pulls per year. Grrrr.

RadPad’s fee is 3%, so it’s more than Plastiq’s 2.5%. Plus the actual points themselves: I’d rather have 3X Citi TY than 3X USB points because they’re worth more when transferred to travel partners. It really is personal preference, though.

And I deffff have more than 5 hard pulls this year alone. BofA just keeps giving ’em to me! Some banks are like that – my friends Jasmin can’t get a Barclaycard despite having stellar credit. Do you have other BofA cards? Veddy strange!