On May 1st, I got the US Bank Altitude Reserve card – the first day it was available.

I wrote how payments with Plastiq coded as travel with the Chase Sapphire Reserve card (lots of peeps on Reddit confirm this, too). So I was hoping that would be the case with the US Bank Altitude Reserve. Especially because the minimum spending requirement is $4,500 – that would’ve been a nice points haul at 3X.

And the charges did code as travel. But my statement just closed and I only got 1X point per $1.

This US Bank card and the Chase Sapphire Reserve are both Visa cards. So while it doesn’t work for the former, I’m hoping it will still earn 3X with the latter for a while longer.

Here’s what I found.

A charge that codes as travel but didn’t earn 3X

- Link: Visa merchant codes (PDF file)

- Link: Sign up for Plastiq and get $500 fee-free dollars

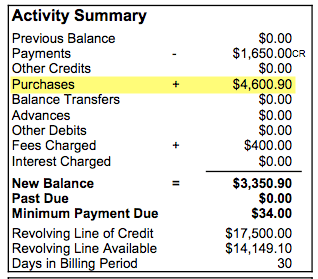

I made all my rent and mortgage payments last month via Plastiq. And mixed in a couple of regular purchases to meet the minimum spending requirement.

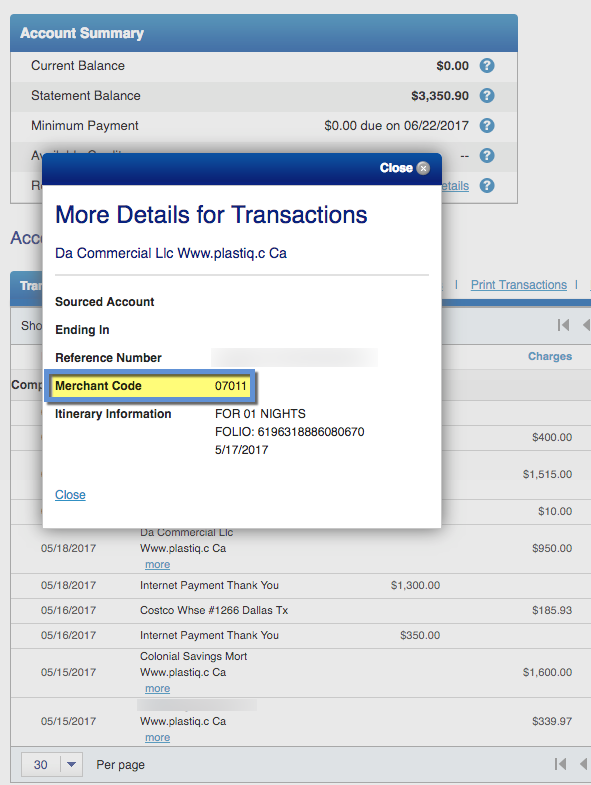

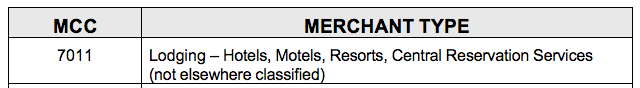

After the Plastiq payments cleared, I noticed the merchant code was listed as 7011 (see pic above).

Then I got excited after I looked up the code and saw it was for “Lodging” and that my “itinerary” was for 1 night. All the makings of a 3X travel charge. I was even hoping to trigger the $325 annual travel credit.

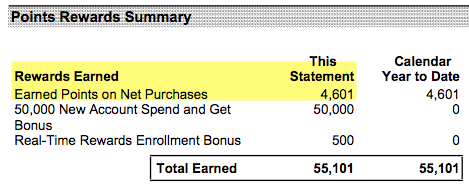

I spent a little more than needed to earn the full 50,000 point sign-up bonus. And was hoping to score 13,000+ more points for the Plastiq rent payments.

However, I earned exactly 4,061 points AKA 1 point per $1. Womp womp.

Why did this happen?

I was kind of expecting to get 3X on these purchases. It worked with my Chase Sapphire Reserve, so I thought surely…

But the fact that it didn’t code as 3X but did code as travel makes me think US Bank knows more than they’re letting on. I have no idea why they’d code these charges as “lodging” and not reward 3X points. It makes me a little nervous for the future of 3X with my other cards with travel as a bonus category, like:

- 3X with Chase Sapphire Reserve

- 2X with Chase Sapphire Preferred

- 3X with Citi Prestige and Citi ThankYou Premier

Pretty bizarre.

I still think the US Bank Altitude Reserve is worth it

I have yet to do a full review of this card. But so far, I am loving it, if only for the sign-up bonus, $325 travel credit, and 12 Gogo in-flight passes.

I wrote about how to save on in-flight wifi. I regularly see in-flight internet selling for $20+ for the duration of the flight. So the 12 Gogo passes, at $20 each, are worth $240 on their own. That and the $325 travel credit easily cover the card’s $400 annual fee. And the 3X with mobile pay is certainly nice. Just don’t buy gift cards! And you can’t get the card without at least 35 days as a US bank customer (another credit card, mortgage, checking account, etc.).

Bottom line

So now I know Plastiq rent and mortgage payments do NOT earn 3X with the US Bank Altitude Reserve card even though they code as travel.

Now I wonder what would happen with Citi Prestige and Citi ThankYou Premier… but as long as it still works with the Chase Sapphire Reserve, that’s really all I care about for now. I just hope that whatever US Bank is doing with their purchase data doesn’t make its way to Chase.

The Plastiq payments were worth it to meet the minimum spending this month. And next month I’ll finish getting 2X with my AMEX Starwood biz card. After that, I’ll ride the 3X train with the Chase Sapphire Reserve for as long as I can. If that comes to an end, there’s always my trusty Citi AT&T Access More card. Just another reminder to hop on the good deals while they’re still around.

Have you had a different experience with Plastiq rent payments? I’d love to hear more datapoints!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I wonder if they have someone with extreme knowledge of the points/miles game on their staff. The reports of shutdowns within weeks of applying and now a know 3x ms option only coding as 1x. It wouldn’t surprise me if these “loopholes” most programs overlook are actively removed from this card.

I could be wrong, but feels like a flyertalker is in charge of this card 🙂

It sounds like a conspiracy theory, but I totally wouldn’t be surprised.

I had a real travel purchase but through a “Tour Company” category that has been rejected for 3X. Their definition of travel spend is very narrow. Caveat Emptor….

Wow, that’s no good. That one I would def call in about, especially since it’s legit.

Appealed 3 times. Not budging.

Wow, that’s really harsh!

What do you mean that SPG Amex earns 2x? Is that for Plastiq payments?

Sorry just was hoping you can clarify that

Thanks!

It’s for everything. Here’s the promo I got: http://www.doctorofcredit.com/spg-business-card-get-10000-bonus-points-spending-10000-targeted/

Spend $10K, get 20,000 SPG points total (comes to 2X on everything).

I agree with you guys bc I also got the altitude and ironically daily getaways were going on the week the card was released. I was actually planning on buying one of the travel getaway deals which I did and luckily was approved for the card too so I was to

Thinking ok perfect it goes both to my spend + get 3x the points on travel since daily getaways classifies as a travel agency. Well Lo and behold nope only 1 point per dollar. I thought about calling customer service and asking why, but honestly given all the negative news about how us bank is shutting gift card buyers (even though I’m not a gift card MSer, but do actually buy gift cards for GIFTS for friends and family – who would have thought that?!) I haven’t even bothered to. So reading up on their T&Cs seems rather 1) clear that you will earn “2 add points for every $1 made directly with merchants who classify their business as a travel category transaction” so travel agency would be that right? But 2) add in the “such as made DIRECTLY with airlines

Hotels, car rentals, et al”.

Basically it seems to me that US bank is engaging in false, but maybe more so “misleading” advertising bc 1) if a merchant considers its business “travel” but it is not 2) a purchase made directly with a “travel merchant, i.e. Directly with an airline vs say Expedia or Travelocity” then you don’t earn the additional 2 points. Similarly I didn’t get credit for the travel credit either. I’m not going to complain about this a ton, but again US bank needs to seriously reconsider how they advertise their card bc as of now it sounds awfully like false or misleading if you cannot earn 3 points per $1 spent on OTAs or real travel agencies – then they truly need to make it crystal clear you only earn3 points per dollar spent only made with travel merchants directly not with “any travel charge or business that classifies itself aa travel” like Chase Travel cards do. My 2 cents.

Cardmembers will earn 1 Point for every $1 in qualifying Net Purchases. Cardmembers will earn 2 additional Points for every $1 in qualifying Net Purchases during each billing cycle for transactions made directly with merchants who classify their business as a travel category transaction (such as purchases made directly with airlines, hotels, car rentals, taxicabs, limousines, passenger trains and cruise line companies), and for transactions using a mobile wallet.

Business accounts don’t qualify you for this card, it has to be a personal account. Same goes for waiving the monthly fees on their checking account with relationship. Learned this the hard way and they stood their ground when I fought it.

Ah, good to know!

I qualified with my super old Club Carlson Visa that I downgraded to the no AF version a while back. Wasn’t sure if it would ever come in handy, but it did.

It earns 3x. At least to me.

Wow, on a Plastiq rent/mortgage payment? I made 4 different payments this month (2 rent, 1 mortgage, 1 HOA dues) and all of them got 1X.

They very explicitly say they only give 3X for specific merchant types, not for all travel. It’s in the terms and is not unclear.

Terms are clear, but the shills who.breathlessly pimp the card rarely mention the big limitations – and rubes gets burned, as usual. Cannot see how any travel hacker/frequent traveler would ever choose the card vs the better alternatives.

US Bank doesn’t have affiliate links for their cards. I think peeps are excited for this one because it’s one of the few many of us can get. I’m tapped out on Chase, Citi, and most Amex cards so the bonus, perks, and possible 3X was a big draw for me.

I’ll give it a year and see how it goes. There might be other opportunities that pop up over the next several months. But I agree, there are better cards out there – I see this one as another one in the mix, especially for mobile payments that would earn 1X with other cards.

I think the terms are pretty vague, actually:

“Cardmembers will earn 1 Point for every $1 in qualifying Net Purchases. Cardmembers will earn 2 additional Points for every $1 in qualifying Net Purchases during each billing cycle for transactions made directly with merchants who classify their business as a travel category transaction (such as purchases made directly with airlines, hotels, car rentals, taxicabs, limousines, passenger trains and cruise line companies), and for transactions using a mobile wallet.”

It just says “travel category transaction” and then “hotels” – which was how these purchases were coded. So I thought there was a chance to get 3X. But of course the final say is always up to bank.

Radpad should still earn 3x since you can pay via mobile wallet

Ah, that’s right! I’d rather have UR points but thanks for the reminder – ya never know!

After reading this, I’m debating whether I should call the “credit department” to attempt to recon my Altitude denial for:

number of inquiries

number of recently opened trade lines

Should I call, or just lick my wounds with an Amex or two? 🙂

If they already denied you, you have nothing to lose by calling. Worse they can say is nope! Let me know how it goes!