It occurred to me I only drive for a handful of reasons:

- To go to the gym

- To drop the dog off before I travel

- Costco runs every ~6 weeks

- To visit nearby places, like Fort Worth

Most of the time I walk or use Uber/Lyft. Because if I intend to drink, I don’t want to deal with parking (and possibly having to pay for it) or of course driving back unsafely. And I live so close to many of the places I frequent that I can walk.

I realized, surprisingly, there are lots of peeps in Dallas who don’t have cars. And I I was shocked by how extremely walkable certain parts of the city really are.

I’ve also been using the $325 travel credit from my US Bank Altitude Reserve card for Lyft rides lately (I prefer Lyft for many reasons). Then it hit me that I could subsidize $825 in Uber and Lyft rides thanks to travel credits of 3 of my premium cards. It got me thinking – are those credits enough to consider getting rid of my car?

$825 in Uber and Lyft rides from 3 cards

Three of my premium cards come with a travel credit:

- $200 in Uber rides with Amex Platinum Card ($550 annual fee)

- $300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

- $325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

Granted, these cards all come with steep annual fees. But if you use the other perks, you can consider the travel credits as basically free. For example, I:

- Visit the Centurion Lounge at DFW a lot and get $200 to spend on an airline of my choice each year with Amex Platinum Card (I choose you, Alaska!)

- Use the Chase Sapphire Reserve for 3X on travel and dining and primary rental car coverage (upcoming story about the rental car thing!)

- Get 12 Gogo Passes from the US Bank Altitude Reserve which I value for at least $240 on their own

I love making the most of all my card perks.

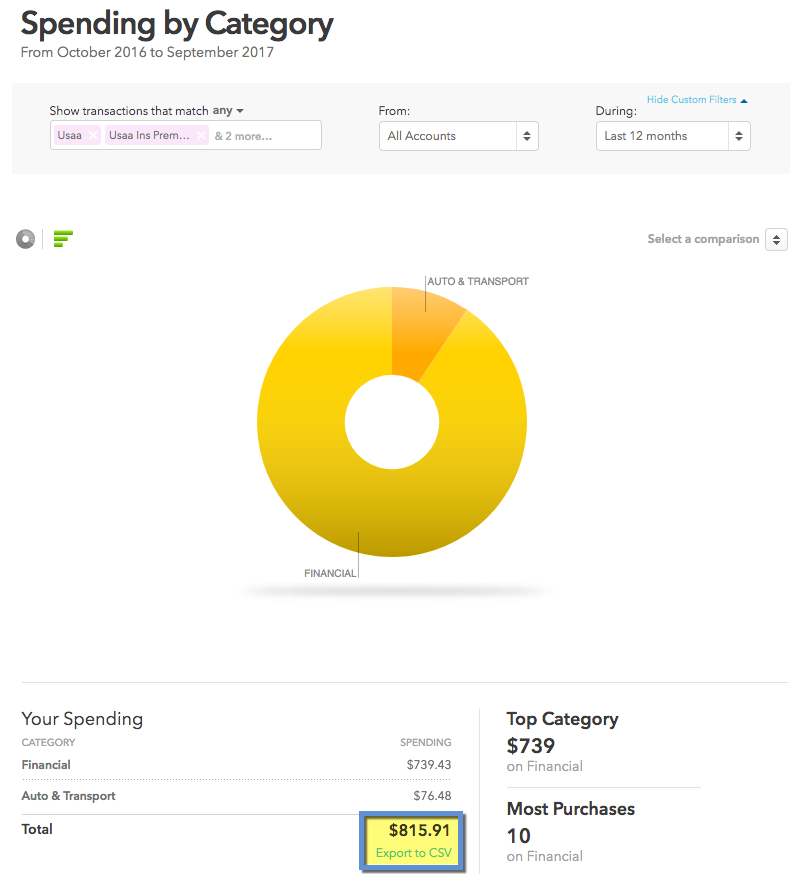

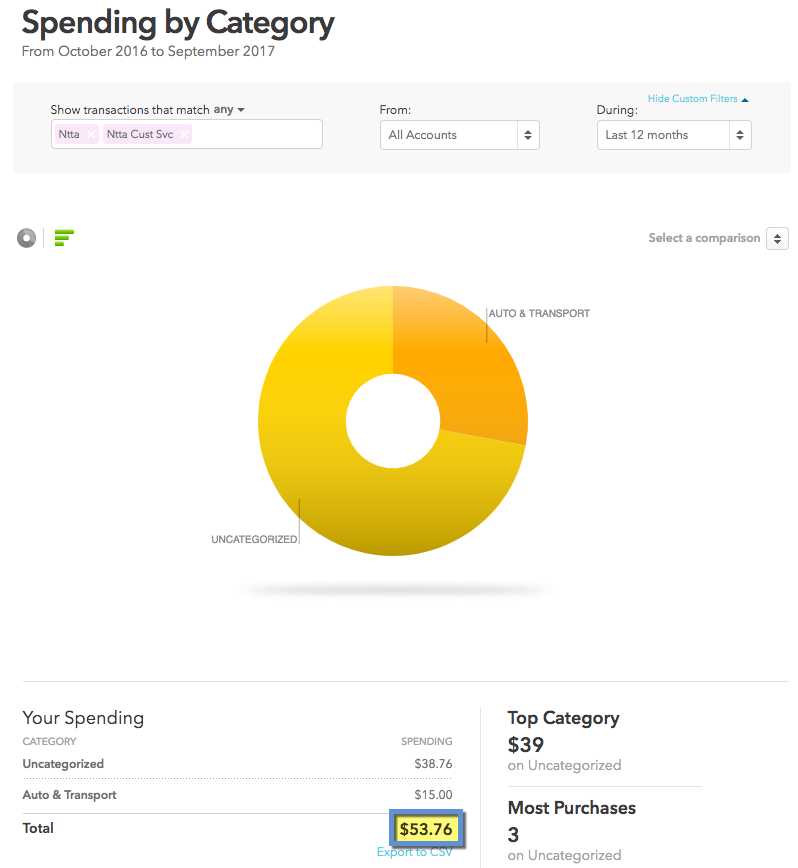

How much I REALLY use rideshare services

Could $825 toward Uber and Lyft rides really be a reason to stop having a vehicle? After all, if I can do it in Dallas, surely it must be worth a ponder for peeps in other cities.

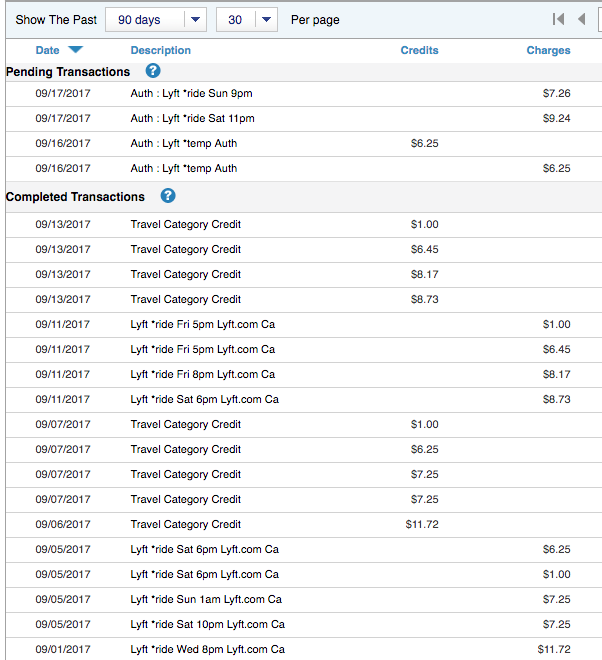

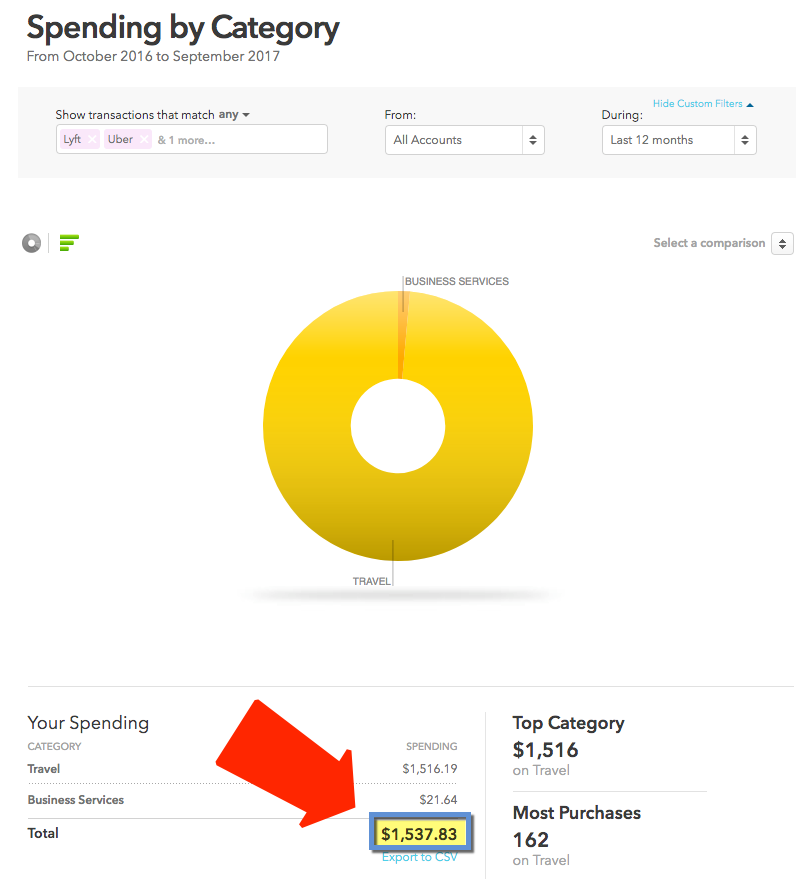

I checked my Mint.com account to get all my rideshare transactions from the last 12 months. That includes:

- Drunken rides

- Times I didn’t want to deal with parking

- Airport rides

- Jaunts in other cities (including Honolulu and Prague)

- Every other time I used the service

At first I was shocked: I spent ~$1,538 on Lyft and Uber rides in the last 12 months. But then I figured that’s ~$128 per month. If I used all of my $825 in travel credits, that would bring my spend down to ~$713 for the year, or ~$59 per month – less than my monthly car insurance is now!

How much does my car REALLY cost me?

Here are the real, raw numbers.

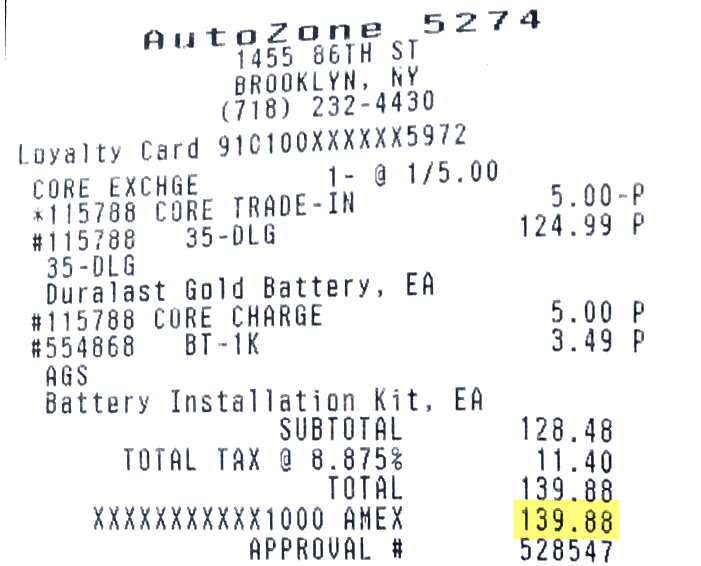

A lot goes into keeping a vehicle. Expenses for the past 12 months include:

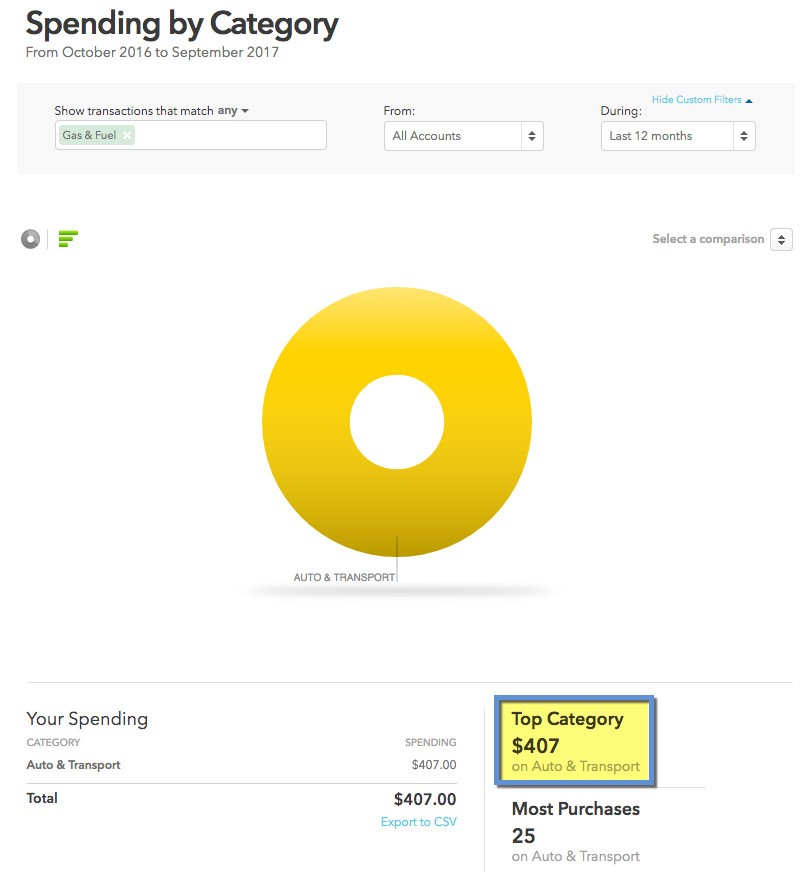

- Gas – $407

- Tolls- ~$54

- Insurance payments (mine are ~$76 per month) – ~$816

- Oil changes – ~$172

- Yearly inspection fees – ~$26

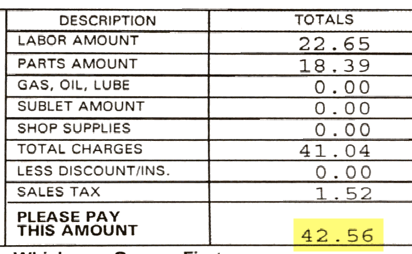

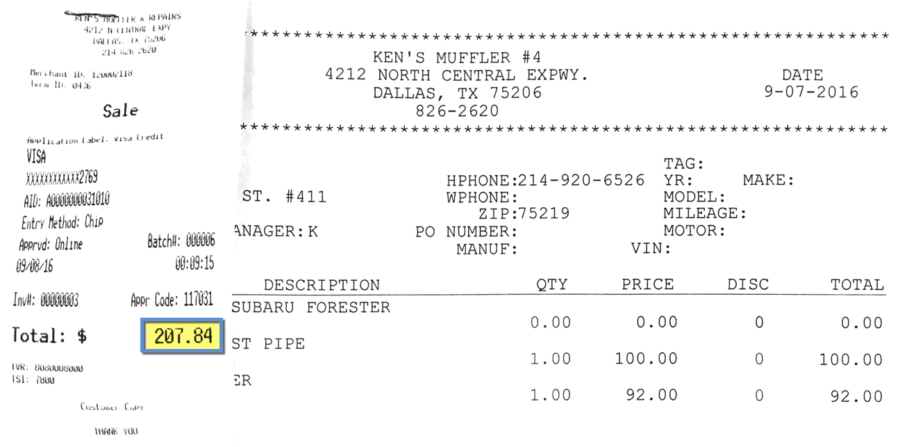

- Repairs – $400 (my estimate based on this year – see below)

My car is paid off, so I do NOT have a car note. That would obviously be another huge consideration if you have one.

My car costs me ~$1,875 each year. Again, this number would be a lot higher if I had a monthly car payment.

Over the past 12 months, I spent ~$156 each month to have a car. That’s more overall that I currently spend on rideshare services. But I feel like I use my car a lot less overall.

Lifestyle and location are huge factors

If I didn’t have a car, I’d pay more to visit the gym in a Lyft to and from. And I’d likely pay for Zipcars every 6 weeks for a Costco run (~$25 bucks a pop).

I’d also pay a lot more to visit nearby cities (or spend more time getting around). Whereas now I can just hop in my car. So I’d increase or replace rideshare expenses. But would save on gas, tolls, insurance, and repairs.

However, I don’t have a daily commute because I work from home. And I can walk many places.

Average daily commutes are getting longer all over the country. So taking an Uber to and from work every day simply isn’t an option for lots of peeps. And, others need to drive for various other reasons. My friend Jasmin used to drive from Buffalo to Toronto every other weekend for work. It wouldn’t be feasible or affordable to rent a car every time. She needed a personal vehicle to make those trips.

Or maybe you need to travel to see your significant other or kids.

There are many reasons why people need cars. It’s almost a requirement if you have frequent long trips in town (commuting) or drive out-of-town often (commuting, personal reasons).

Peeps in cities could make the switch

However, if you live in a dense urban center or only have short trips around town, it would be extremely easy to use Uber and Lyft instead of owning a car – even if you had to commute to work. Because these places also tend to come with lots of extra costs like parking, tolls, higher insurance bills, more expensive gas, and more repairs because of touch-and-go traffic.

You could also supplement with biking – which has little upkeep and a one-time upfront cost. It’s something I’ve considered doing.

If you work from home, you could also do well and save money by dumping your car. You also relieve yourself of several recurring costs, like insurance payments, oil changes, tolls, state inspections, and filling up at the pump – which are also huge stressors (for me, personally).

Also if you ever have repairs… those can cost anywhere from a couple hundred to astronomical.

Consider public transportation

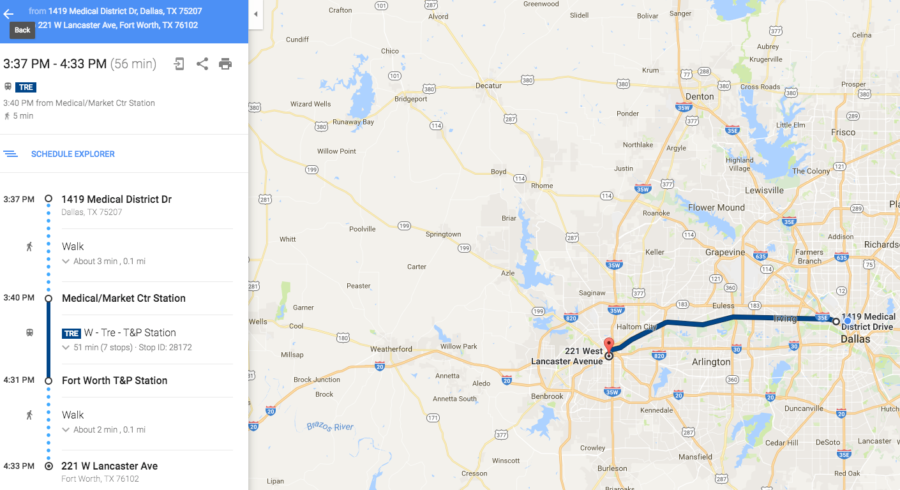

The bus system in Dallas (and many cities) is… uh, lacking. But, there’s a commuter train and DART trains that connect many parts of the metro area. If I did want to spend a day in Fort Worth, I could be there in 56 minutes via train.

It takes anywhere from 35 minutes to forever by driving, depending on traffic. And then I could Uber around to wherever I wanted to go.

I might take me longer to get there and back. But when I think of all the time I’d save dealing with my car (oil changes are easily an hour-long project, etc.), it seems the minor inconveniences are net-net but the costs are way lower overall.

Bottom line

Just some food for thought. If my car were to break down, I think I’d try to get around with Uber and Lyft for as long as I could before immediately buying another one. Since I have $825 in travel credits to use each year, I’d save quite a bit of cash on rideshare services – which I use anyway, even with a car.

If anything, it’s illuminating to look at the raw numbers and see how much rideshare services vs. having a car really costs. When you factor in all the “little things” over the course of a year, it’s pretty staggering.

The thought of never having to deal with parking, pumping gas, repairs, and oil changes is also extremely tempting. Although I’d increase or replace certain expenses with gym visits, Costco trips, and dropping off the critter when I travel. I’ll mark this as “cross that bridge when I get there.” But knowing I have this option makes me feel a lot better – to the point where it might actually be the best choice anyway.

Of course it’s not feasible for everyone. But could you dump your car and use rideshare services subsidized with travel credits from premium cards?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Great points. Stop drinking and see how much more youd save 🙂

Id also look to find a closer gym that you can walk or bike to.

Dallas is a fairly walkable city in the core but most of Texas is a bad pedestrian area. As a runner it can be very hard to find sidewalks in some areas.

I’m thinking about selling my car too. Since I spend about half of the year outside of the US, it seems silly that I pay $1600/year for insurance plus all of the other expenses. I definitely would need to get a ZipCar membership and rent a car from time to time but I think I’ll end up with a net positive and a little less responsibility.

I lived “car free” in DC for three years. I used my bike, capital bike share, metro rail, walking, etc. Work was within walking distance and I used a company car for regional work trips.

Needless to say, I bought a car and it’s truly amazing. It’s a luxury for me, but one that makes my life much better and simpler. Weekend beach trips, seeing my family, wine tasting in NOVA, etc. The hassle of getting an overpriced zip car or rental car every other weekend isn’t worth it, unless you have no other economic choices. Trust me when I say this, if your car is a marginal cost it’s worth it.