Random thought of the evening.

I’m going through my cards and want to dump:

And replace them with:

- Citi Hilton Visa

- Citi Prestige

- Discover It

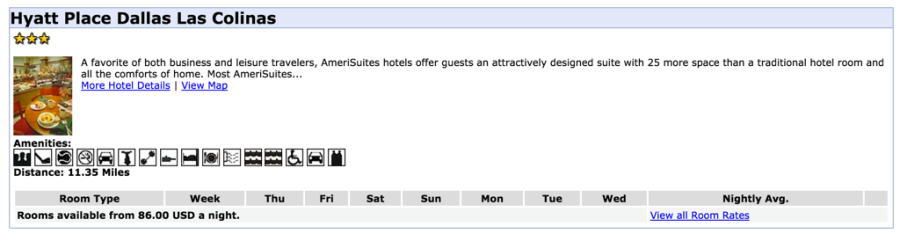

The hitch is that you have to wait ~8 days between applications with Citi, so I’m not sure which of their cards to get first. But I’m warming up to the idea of Category 1 and 2 Hilton hotels – there’s a ton of value to be had there.

Anyway.

Citi Prestige + Hyatt Diamond Challenge

Via The Points Guy, tomorrow is the last day to sign up for the Hyatt Diamond Challenge (something that’s always tempted me). You’ll have 60 days to complete it when you sign up (so until September 30th).

And via View From the Wing, the Citi Prestige card’s 4th night free benefit is “too good” to last. (I agree.)

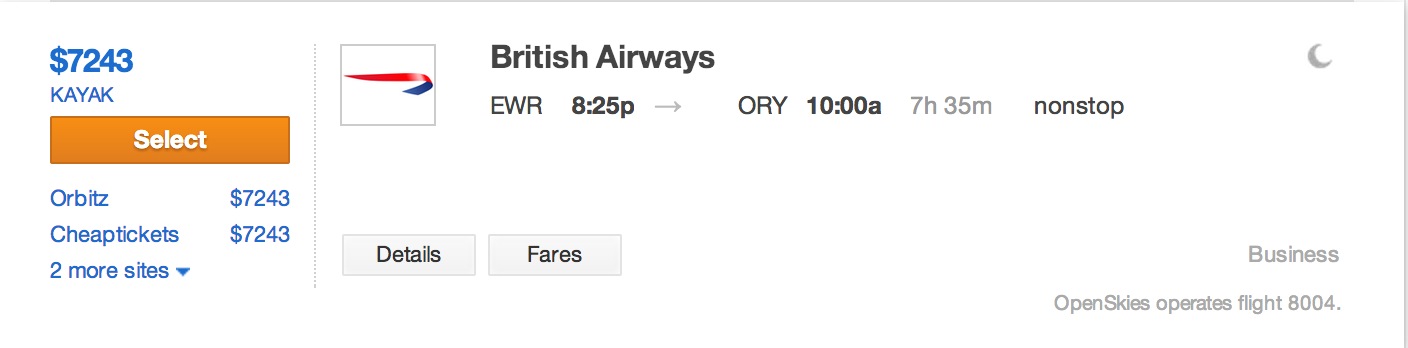

Hyatt hotels are easily bookable with the Citi Prestige travel program. (Here’s the link to Carlson Wagonlit to search.)

If you book a 4-night stay for $100 a night, you’d pay $300 (after the Citi Prestige statement credit).

Do this 3 times in 60 days, pay $900, get Hyatt Diamond status. Any many hotels are available for under $100.

If you have Hyatt stays coming up anyway, this might be something to mix-and-match with cash + points stays.

And hotels booked with the Citi Prestige card do earn elite credit.