Thought this might be useful for peeps who need to meet minimum spending requirements AKA all of us.

This requires you to have:

- An account at Mint.com with your bank or small business services info plugged into it

- Excel (or some other software that supports .csv files)

Then, you can use simple tools on the website to show you clearly how much you’ve spent on a certain card, to the cent, including pending transactions.

What’s Mint.com?

Link: Mint.com

Mint.com is, quite simply, is a budgeting tool. It tracks multiple accounts from nearly every bank, and shows you your balance, updated daily (or more often, if you want).

I use it for so many things:

- To track my savings

- To keep an eye out for weird-looking transactions

- To make sure my payments clear, and see when they’re applied

- And to have an idea of how much I’ve spent in a given month (a sorta-budget)

But, I found an ingenious little trick whilst wondering how much I had left to spend on my new Citi Hilton Visa to get 75,000 Hilton points.

How to do it

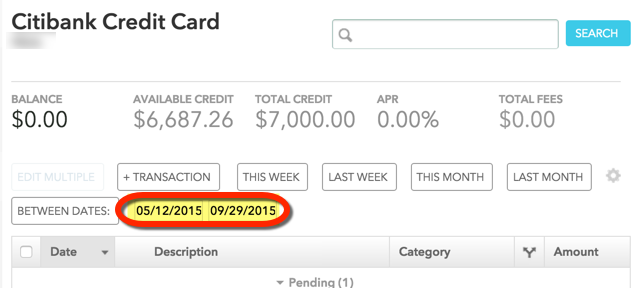

Once you’re logged in and have it all set up, select the account you want to track, over on the left.

If it’s a new card, don’t worry about filtering for dates.

Or, if you have to meet a certain amount of spend within a time period, (like if you were targeted by Barclays to spend $1,250 on restaurants in Q4 like I was!), enter in the dates you want to track.

Scroll allllll the way down to the bottom. You’ll see this:

Click “Export all XX transactions.” Save the .csv file somewhere. Open the file.

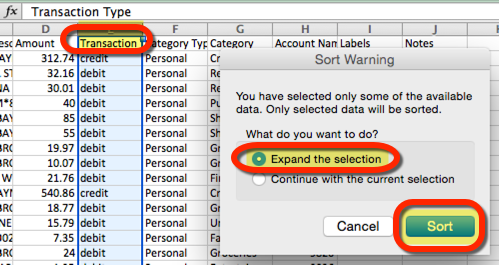

Select the “E” column (“Transactions” – the whole column), then click “Sort.”

Be sure to “Expand the selection,” otherwise, the other columns won’t sort correctly. This’ll divvy up credits and debits.

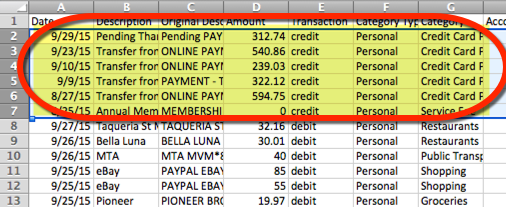

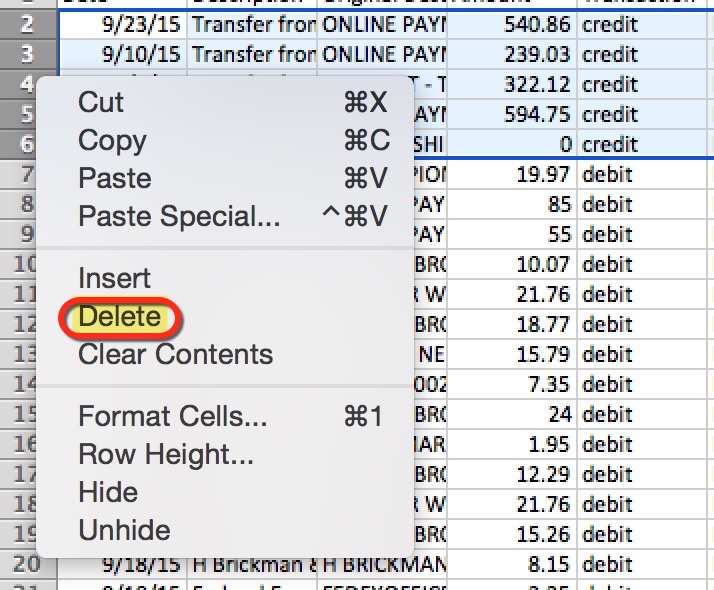

Delete the credits.

(Or, if you have a $0 balance and no pending transactions, you could just add up the credits.)

But if you have pending transactions, and a small balance, like I do, get rid of them.

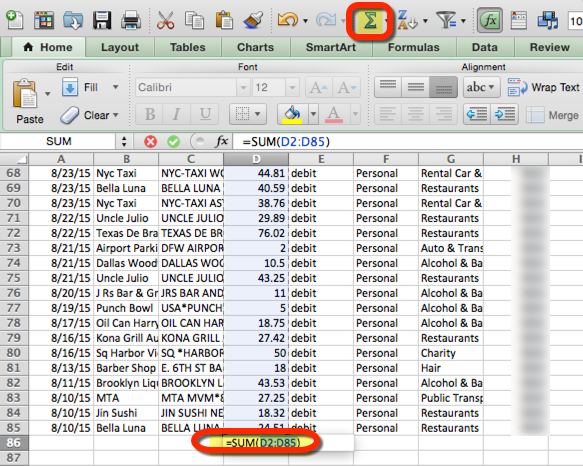

Then select the “D” column (“Amount”).

Hit “Sum” (the button that looks like a weird-looking “E”) and then Enter.

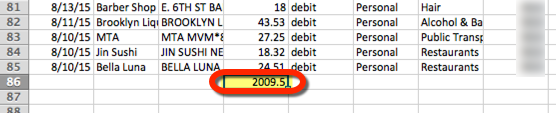

That’s it! It’ll let you know, to the cent, exactly what you’ve spent on the card so far.

And me?

I just completed the $2,000 minimum spending requirement on my new Citi Hilton Visa!

75,000 Hilton points, here I come!

A few notes

When it comes to meeting minimum spending requirements, I always like to go slightly over. And by slightly, I mean like $50, to account for any returns, or services like Paribus that credit money back to my card.

You do NOT want to be in the last month of minimum spending requirements and not get a sign-up bonus over $3 or $4. How much would that suck?

If you have another billing cycle, sure, cut it a little closer (if you’re not in a hurry). But I always like to be safe than sorry.

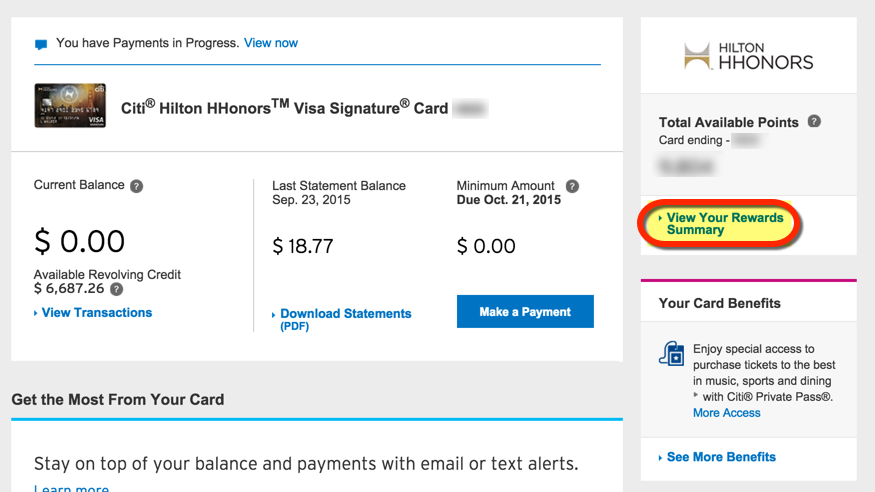

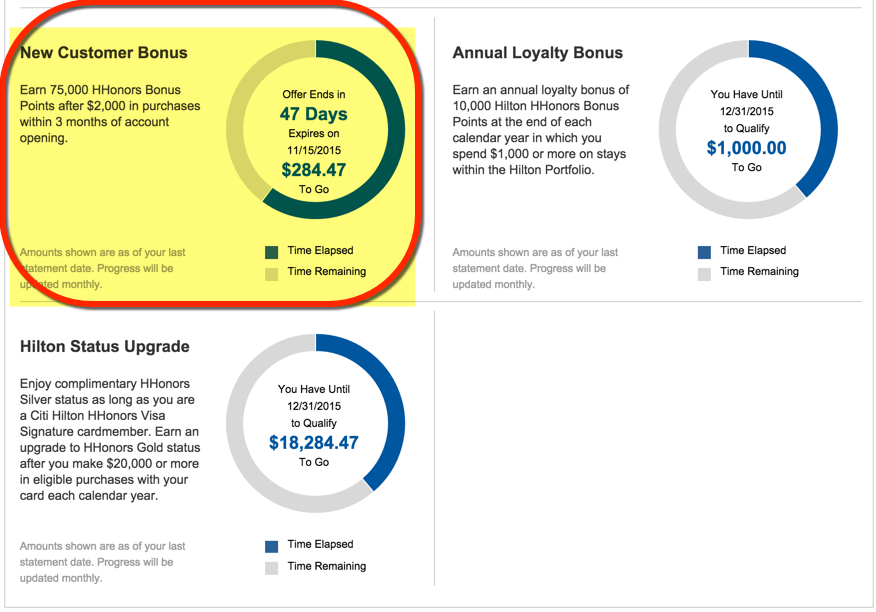

And, Citi already has a built-in tracker for minimum spending. Why they all don’t, I have no idea.

But it only updates at the close of each billing cycle, not after each posted transaction. Still, it’s handy to let you know how much more you have left.

To find it, click “View Your Rewards Summary.”

Scroll down and you’ll see it:

It’s under “New Customer Bonus.”

See that $284 I had left to go? That’s what I wanted to track. And that’s where Mint.com came in handy.

So now I know I’ve met the minimum spending requirement, and when the statement closes again, I’ll look out for my 75,000 Hilton points.

And if there’s any delay, I still have another month to figure out the issue.

Bottom line

I like to use Mint.com for budgeting, tracking my finances, and… making sure I’ve met minimum spending requirements.

This is a handy little trick for when you want to make sure you’ve spent the required amount so you can keep an eye out for your sign-up bonus.

Just be sure if you’re going to cut it close, to leave yourself another billing cycle in case there’s any issue. I always recommend going a little over, $50 or so, to account for any returns/delays/funny business.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You can also use Mint.com’s Trend feature. Select Spending over time, filter by just one credit card, during “all time” or Custom. It will auto-sum for you. No need to export to excel to calculate sum.

Amazing tip! You’re right – taught me something!

I just got the same result with the Trends feature. Another great way to track minimum spending requirements!

Thank you!