Also see:

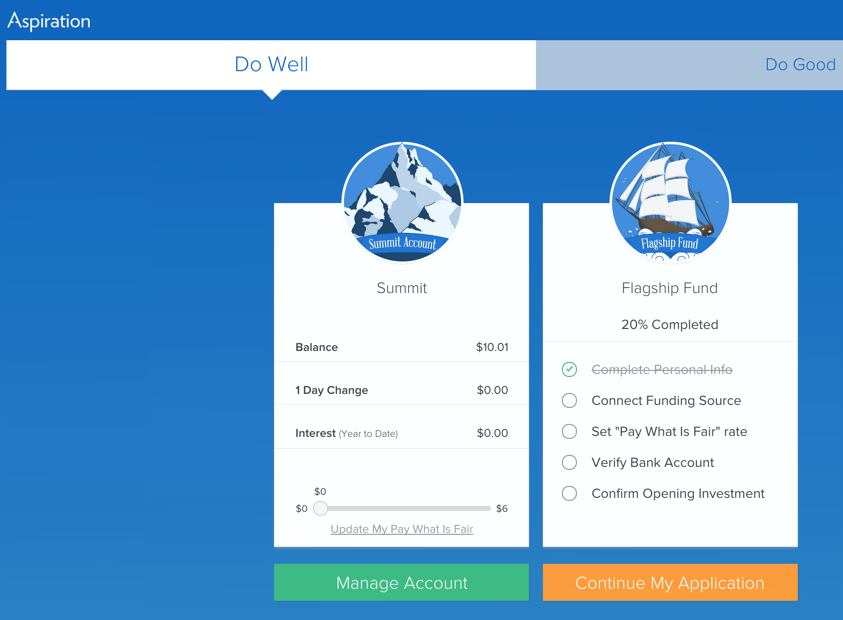

My new favorite banking product has, over the last month, become the Aspiration Summit account.

But, getting started wasn’t exactly a cakewalk. So here are a few tips that’ll help you, should you decide to open this account for yourself.

What’s an Aspiration Summit Account?

It’s kinda like a checking account, but kinda like a savings account. In that regard, it’s a hybrid.

The account is only worth a diddy damn if you plan on keeping over $2,500 in it.

That’s the threshold to earn 1% APY.

Anything below that, even a cent, gets you just .25% APY (which is still, sadly, more than most corporate banks’ savings accounts).

My APY on my Chase Plus Savings account is .01%. Yup. So Aspiration Summit is 100x more.

There are also no setup fees, no maintenance fees, no service fees. And no ATM fees.

This is great for frequent travelers!

Use any ATM worldwide.

Fees are reimbursed monthly.

The sign-up process is a little cumbersome, but I don’t think it’s possible for them to streamline it any more than they already have.

So after you sign up and get the debit card, then what?

Keep this stuff in mind

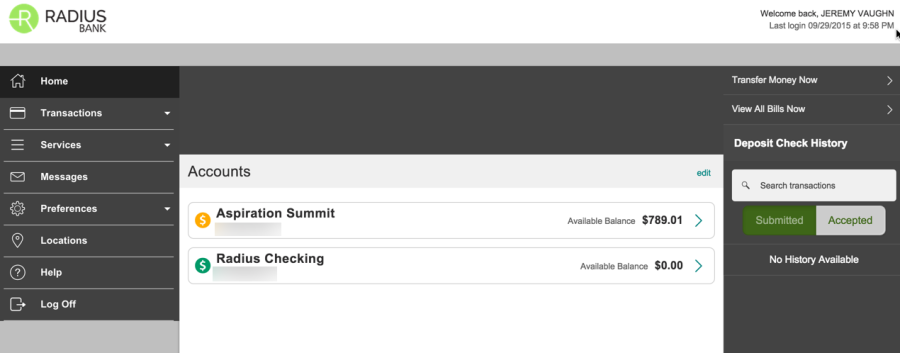

1. Radius Bank

At a certain point in the sign-up process, you realize that Aspiration has partnered with another organization, and it’s a little out-of-the-blue.

Aspiration Summit is totally, completely powered by Radius Bank.

For all purposes, you are signing up for an account with Radius Bank.

They have a really similar account called the Radius Hybrid account.

But for balances in that account under $2,500, you get 0% APY and over that amount, you get “up to” 1%.

Aspiration Summit is much more clear about its earning structure which I really appreciate.

You’ll be asked to create a login for Radius Bank. Remember it, because it’s what you’ll want to use moving forward.

2. Don’t sign in on the Aspiration website

Sign up for the account on the Aspiration webpage, and then forget it exists.

Because functionally, it’s a mess.

Yes, it looks all slick and pretty, but it doesn’t really do all that much.

Login on the Radius Bank webpage instead.

This is your key to access:

- Bill pay (which is very robust, with most payees already in their system)

- Account services

- Support

- Alerts

- Account preferences

- Updated transaction history

- The ability to export your transactions

You know, the things you actually want to have with a bank?

The Aspiration Summit page is spare and minimal, but it’s the Radius Bank page that shows you this is a real, actual bank account with normal banking features.

Thank gods.

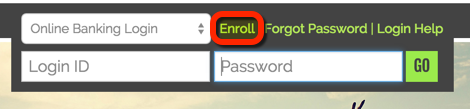

After your account is open with Aspiration, you have to “enroll” with Radius Bank. The enrollment page is here.

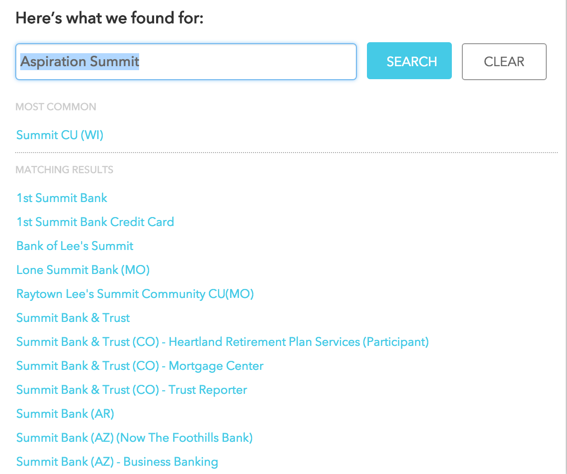

3. Mint.com, App, and Mobile Check Deposit

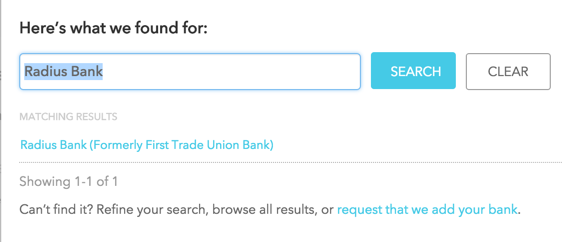

Then, I started to compare Aspiration Summit to my other accounts. I wanted to plug it into Mint.com to track my transactions.

It wasn’t there.

But then:

Same thing for app access.

If you search “Aspiration,” you won’t find anything. Search for Radius Bank, and you’ll find their app.

That’s the ticket to accessing your Aspiration Summit account on your mobile.

And, it’s how to deposit checks through your phone.

It’s pretty much a bare-bones version of the website with the option to deposit checks, which is more than enough for my purposes.

And those were honestly my biggest concerns.

Moving forward, I think I’ll use the account as an emergency fund. The debit card assures constant access to funds, and the interest rate is really high.

Bottom line

It took me a second to figure these things out, so hopefully this will save you some time!

Or, if you don’t already have an Aspiration Summit account, maybe you’d like to sign up for one.

It’s an online-only checking/savings account hybrid with free, unlimited ATM use worldwide. So it might encourage you to dump the brick-and-mortar bank once and for all, and it’s great for travelers.

There’s a wait list to get an account on the official page, but if you use my link, you can skip the line.

Things to note:

- The account is really only worth having if you plan to save at least $2,500 in it at all times to get the 1% APY

- It’s an account with Radius Bank. Forget Aspiration Summit. It’s Radius Bank

- Login with Radius Bank

- To access your account on your phone, and to deposit checks on the go, download Radius Bank’s app

- For Mint.com compatibility, use your Radius Bank login info

- ATM fees are reimbursed at the end of each billing cycle, not “as you go” like with Fidelity

Anyway, those were my biggest concerns. If you think of anything I missed, or if you’ve had an experience with any of this, feel free to comment below!

Here’s your invite to Aspiration Summit!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hmmm, trying to decide if it’s worth $25 a year to just send over some money and let it sit there. Potentially useful as an alternative to Chares Schwab–for the free ATM use worldwide.

Thanks for pointing this out! I think I’ll sign up if you wouldn’t mind emailing me a referral!

With gratitude,

Jake

If you want to have an emergency fund/savings account, it has a great interest rate. Plus with the debit card, you can have easy access to your money.

And the free ATMs are a great perk for when you travel (or simply withdraw some cash any time).

Referral sent – I hope you like the account! Thank you, Jake!

Actually looking to do this for some Airbnb income that I want to stash away for a home purchase downpayment. 1% is much better than the measly 0.03% from BofA’s “Rewards Money Market Savings”. If you have another referral, would love to help you help me.

Thanks!

Very cool! I’m using it for that exact purpose as well! I have a few Airbnbs here in NYC, and am looking to buy a home soon, too.

I just ran out of invites, but as soon as they give me more, I’ll send one to you first.

Thank you for reading!

Sign up is here: http://outandout.boardingarea.com/go/aspirationsummit/

Got it! Thanks a bunch. Just waiting on the test deposits.

All good here?

This is a really cool product Harlan. Thanks for sharing 🙂 .. I have been avoiding the Charles Schwab account since they do a hard pull (Mostly interested in the account for free ATM worldwide use, but wouldn’t mind the 1% bonus!!). Would love to try this product if you get an additional invite. Thanks !

You got it! They usually refill invites the next day, so hopefully I can send more tomorrow morning.

Thanks a ton ! Would you know if they cover the ~1% foreign transaction fee added by Mastercard. I can’t seem to figure that piece out just yet.

Check this: https://support.aspiration.com/hc/en-us/articles/208713397-Foreign-Transaction-Fees

Thanks Harlan could you please send me an invit.

They actually just gave me my own link today (yay!) Sign up here: http://outandout.boardingarea.com/go/aspirationsummit/

Hi Harlan, have been reading your blog regularly and this sounds like a great way to avoid foreign transaction fees. Would love to get an invite as well if they are still available once they replenish your account. Thank you

Thank you for reading! You got it!

Sign up is here: http://outandout.boardingarea.com/go/aspirationsummit/

Harlan,

Although we use Schwab when we travel I would love to compare two transactions.

The 1 percent is a nice perk. Please count me in.

Mark

Sign up is here: http://outandout.boardingarea.com/go/aspirationsummit/

Thank you!

When and where do you create the login for Radius Bank?

You can create a login as soon as you open your account with Aspiration. You have to “enroll” with Radius Bank at this link: https://online.radiusbank.com/RadiusBankAutoEnrollmentE2E/Enroll.aspx

I’ll add that info to the post.

I’ll have to try again then. It wasn’t working for me. I kept getting the enrollment unsuccessful page.

I figured it out. It wasn’t accepting my Driver’s License as one of the two security answers. Now it works! Thanks!

Perf! Now you can forget the Aspiration website altogether lol. Glad you got it working!

Hope you enjoy the account. I opened mine in late August and am really enjoying it so far.

HI Harlan,

Thank you for the tip. 1% on savings is great + no atm fees. I have been banking with Ally for no ATM fees, But now the introduced a limit of $10/month for ATM fees reimbursement. Living in NYC i find myself taking cash out very often. This is timely.

Do you know if Aspiration allows initial finding via credit card? I need to sprint to $25000 on my chase explorer card to get my PQD waived. But can’t find opportunities to MS anymore.

Very cool, glad you found it useful!

The most I’ve heard of funding with the account is up to $17,000 (I don’t think anyone has tried for more).

But yes, you CAN fund via credit card. I’d set my cash advance limit to $0 before funding just to be on the safe side.

And yup, MS opportunities are drying up FAST. Hope this helps you!

How are you able to fund via credit card? I’m not seeing this option on the web site. Thanks!

Aw, crap. It looks like it’s changed, per Doctor of Credit: http://www.doctorofcredit.com/does-funding-a-bank-account-with-a-credit-card-count-as-a-purchase-or-cash-advance/#Radius_Bank

Now the limit is only $1,000. I just found out about that.

Now that you’ve been at it a few months with this account are you still loving it? Any new tips? I’ve heard direct deposits aren’t as quick to fund. What’s been your experience? Would love some current feedback on the account. Thank you!

Kylee, I still love it!

I have not experienced that with direct deposits at all. In fact, they post a bit quicker than with my Fidelity Cash Management account. And about the same as my Chase account. I’ve used it dozens of times for direct deposit and never had any issues. And the interest posts each month like clockwork.

As for new tips, I will say this: I noticed some 3rd-party services don’t like the setup of this account. For example, Venmo won’t let me add it as a payment method. And Fidelity required me to send in a paper form to set up transfers whereas other accounts don’t require this.

I’m not sure if it’s because of the banking partnership between Aspiration and Radius Bank or what, but it IS something to be aware of.

For saving, direct deposit, and regular spending it’s a fantastic account. It’s also free to have and there are no minimums so you really have nothing to lose by signing up. I recommend opening an account and seeing if it works for you. Worst case, you never use it again and it doesn’t cost anything anyway.

Feel free to add your experience!

And thanks for reading! 🙂

Hello, just opened my account and received my debit card. Wanted to know if you would suggest having my payroll direct deposited? some comments I read stated that unlike Wells Fargo or Chase, direct deposit did not post on Saturday’s when payday was Monday. do you have any input regarding this?

Thank you

I haven’t any any trouble getting direct deposit on time – similar to every other bank I’ve ever had.

I recommend trying it – it’s free and you can always switch back!

I have an Aspiration account and use Radius for mobile banking into my Aspiration account until the full Aspiration app goes online. Yes, you can do that if you call Radius . They asked me to be a Beta Tester. HOWEVER…Twice in two weeks, two phantom checks have been deposited into my account, held there, then removed. The Radius people cannot explain this. I’ll give them one more chance then moving over to Salem5Direct. The Massachusetts banks are very aggressive with their online side of the business. Salem5 also reimburses ATM fees WORLDWIDE and everything is done in real-time.

Wow, lots of good info in here. Thank you for sharing!

Hi Harlan! Just signing up after seeing this account in a $ article. I’m looking to get rid of my “big bank” and remember the days of the high interest Orange account so this is attractive to me. But it asks me to link to the acct that will “fund” my Summit acct – are you able to tell me more about this? It seems the opposite of going away from my big bank…

Okay, so should I sign up with Radius (requesting thing) after I deposit the $10 to open the account? Is it possible to use both the Aspiration and Radius?

Yes, it is! I had an account with each one as the same time and no issues. Both accounts will appear when you sign-up on the Radius website!