This August 2021 Freedom update finds your protagonist in beautiful Oak Hill, NY – upstate in the Catskill Mountains. It’s certainly welcome after July 2021, which was a doozy of a month. I went from West Virginia to Pittsburgh to Philadelphia to upstate New York.

Not gonna lie, in Philly I started to get travel fatigue. I found the city overwhelming. Plus, it was really hot while I was there. Here are reviews of recent stays at the Kimpton Palomar and Hyatt Bellevue in Philadelphia. And here’s my West Virginia trip report.

But now I’m staying at a friend’s house for a month or so, which will help me save cash. In fact, I’ll meet my $30,000 savings goal this month, then switch to investing all my extra income (and soooo excited about that).

After all the short stays last month, I’m firmly a believer in staying put for at least three weeks. After a month, I start to feel froggy, but two weeks is too short, so I think that’s the sweet spot for me.

Fenwick is having the time of his dog-life

OK I have a lot of ideas to share so let’s hop to it.

August 2021 Freedom update

Y’all know me: I can’t leave well enough alone! In a flash of inspiration, I thought about purchasing several single-family homes for $150Kish each and renting them on Airbnb. And then I can move between them whenever I want. A few in Memphis, one in Oklahoma City, and another in Vermont (which has always been a dream of mine).

It would take some time to get them all, and I’d have to use the money I just got done saving as a down payment. But now that real estate prices are lower and mortgage rates are still low, I’m giving it serious thought as a new long-term strategy. That way, I’d always have housing, and provided the rentals can make more than the mortgages (which I’m sure they would), other people could pay them off for me with minimal oversight (although it’s definitely NOT passive income, but I have plenty of experience managing Airbnbs).

Plus, it could provide long-term security as I could sell them off – or keep them – depending on how well they perform and appreciate. I’m not ready to make any moves yet, but maybe this fall I can scoop up my first property and get it set up.

I’ve been pondering my future on gorgeous and excellent hiking trails in New York

Even if I don’t, it feels good to have inspiration and the prospect of a new goal to work toward – a new WHY.

Plus, 5% down on $150,000 is $7,500 and I could definitely swing that, especially for a primary-then-investment property. I also want to see what happens this fall once the mortgage protections expire. Getting ideas, getting ideas. :p

Investments are coming

Speaking of investments, I’ll soon be able to purchase all the FSKAX, VTI, crypto, REITs, and whatever else my little heart desires as of this month. That’s because I’m under $1,000 away from my $30,000 savings goal and will knock that out with my next paycheck. I suppose $7,500 (more like $10,000+ with closing costs) toward a new residence/Airbnb would fall into this category. Suffice it to say, I’m ready to get going.

In fact, I can’t wait to transfer a nice sum to my Fidelity taxable brokerage account for a helping of FSKAX this month (because Merrill Edge doesn’t support fractional shares? WTF?!). I expect my net worth will grow more quickly now, even though I’m up ~$7K this month.

And because I met my savings goal and am gearing up to invest, I fully expect to reach $250K by the end of 2021 – half of my overall goal (!!!).

Here’s the meadow I walk around every day

I’m not sure how I’d factor investment properties into the mix, but I’d figure it out. Maybe just use the equity plus projected appreciation? But mark that for another time – soon.

Other money moves

In July, I paid cash for most of my hotel stays, knowing I’d be able to offset it in August by saving on lodging. So that ate through most of my extra cash, which is fine – I’m still well under budget per month, according to my housing spreadsheet.

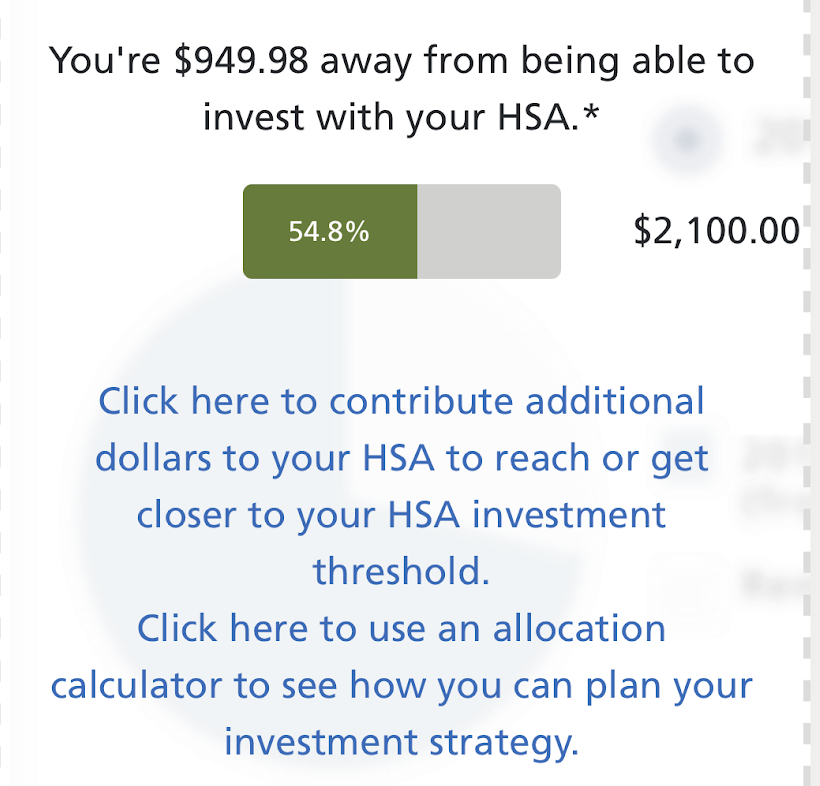

I’m on track to max out my 401k through my employer by the end of the year. I also have an HSA account with $1,250 in there, but can’t invest the cash into index funds until I reach $2,100.

Should I go ahead and fill this bad boy up?

I’m kinda wondering whether I should go ahead and meet the minimum to start investing? They have excellent Vanguard broad market index funds as options. Or should I stick to my taxable brokerage and let it grow on its own (I stick $200 a month in there, so I’m close to meeting the threshold)? I’ll run the numbers and see what makes the most sense – also open to ideas if anyone has an opinion here.

1,121 more daze

Later this year, I’ll begin a 1,000-day countdown to $500K. I’m hoping the momentum picks up pace and I can reach the goal even more quickly. But I get ahead of myself.

I’m gonna be fine

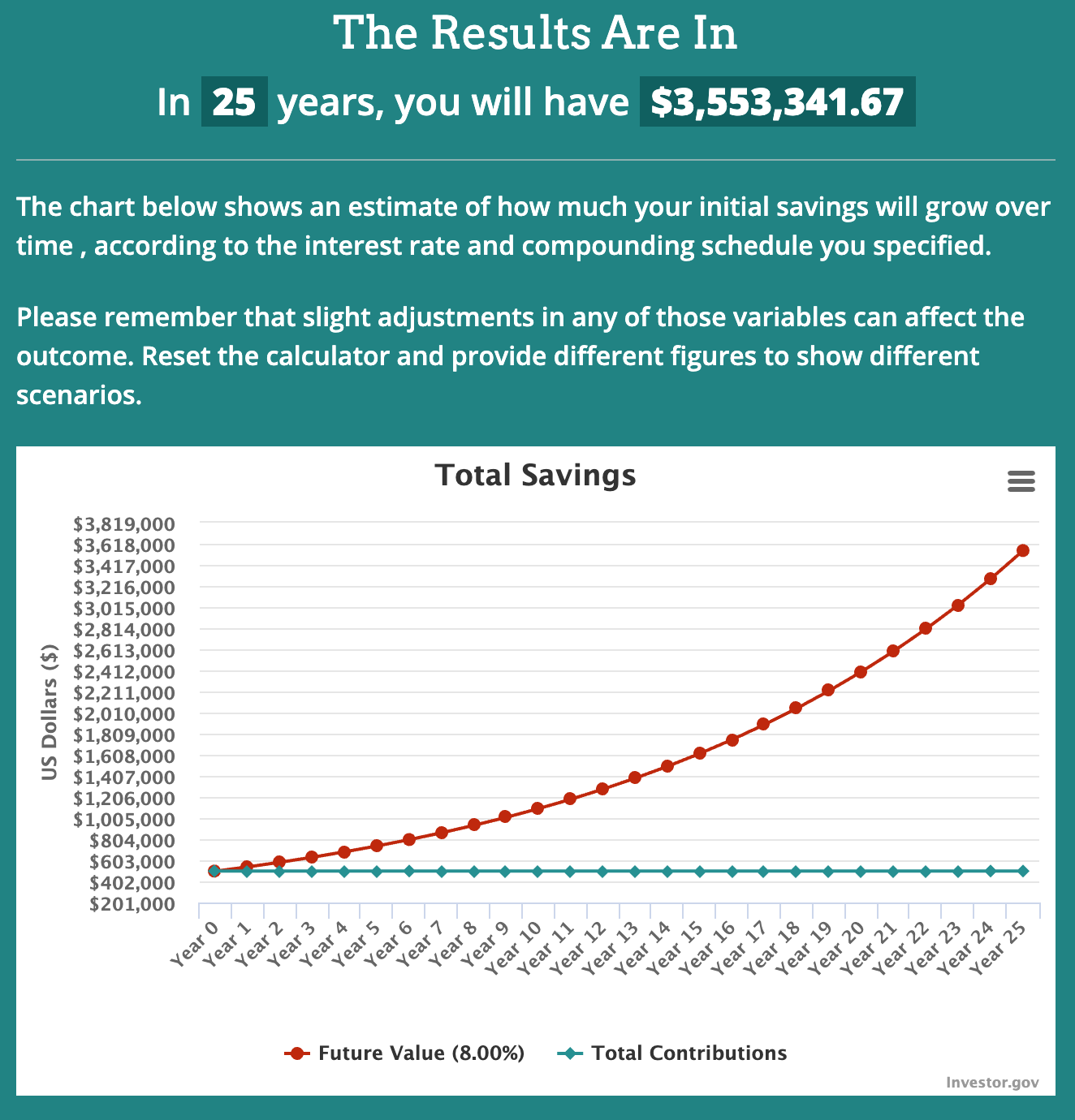

When I save $500,000, I can leave it alone for 25 years (age 40 to 65) – even without contributing another cent – and have $3.5 million, assuming an 8% return. Bump that up to 10%, and the number shoots up to nearly $6 million. 😳

So once I reach this goal, I’m gonna focus on investing more short-term, taking more risks (like the Airbnb investment homes), and making enough to get by. I don’t ever really want to “retire” – I like working too much. But it will be nice to be work optional and pursue projects, jobs, clients, and hobbies that really set my soul on fire. And that’s really my WHY for all of this. 🔥🔥🔥

By the numbers

I’ve sort of already covered everything that’s shifted so far this month – here it is in table format. The one thing I want to highlight is that I’m close to having $200,000 invested. I should reach that milestone in a couple of months and head into my third $100K invested. In general, I look forward to having cash on hand a smaller percentage (and investments the bulk) of my net worth number.

| Current | Last month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| 401k (contributions only) | $10,833 | $9,167 | +$1,666 | $19,500 | |

| Overall investments | $179,445 | $175,191 | +$4,254 | As much as possible | |

| Savings | $29,160 | $27,176 | +$1,984 | $30,000 | |

| Net worth in Personal Capital | $216,898 | $210,185 | +$6,713 | $500,000 | Track your net worth with Personal Capital |

I’m starting to question whether I need so much cash on hand. I was cautious during covid, but am starting to feel like I can weather whatever comes along, especially if my taxable brokerage account takes off. And I always have credit cards I can use to handle whatever comes up. Paying interest to get through an emergency would be worth it – and much less than the opportunity cost of not investing that cash.

Depending on what happens this fall, I might be content to use savings toward down payments and cycle through the cash that way. But again, getting ahead of myself.

43.4% of the way there

This month, I’ll start investing in that taxable account, possibly in my HSA account, and think about my next moves. I feel something starting to bubble up. It’s exciting. And it must be said because of our current situation: I really hope we can get covid under control. I’m ready to travel the world again.

August 2021 Freedom update bottom line

So that’s where I’ve landed! August 2021 has me:

- Filling up my taxable brokerage account (finally!)

- Potentially investing inside my HSA?

- Thinking about investing in SFHs for residence/Airbnb purposes

- Close to $200K invested in index funds

- Resting up after a big month of traveling in July

I’ll likely spend most of August in upstate New York, hiking around the Catskills and spending time in the cute towns that dot the mountains. I may also take a day trip to Vermont and visit Albany to do some maintenance and Big City Things like oil change, haircut, and a night on the town.

With this month, I’m hoping to start nudging the wheel to turn a bit faster to accelerate gains. I still find moments of clarity and epiphanies about this journey, which I find so interesting and endlessly engaging. I’m designing my life the way I want it – and feel empowered because of that. The security I’m finding is giving me more room for creative ideas and risks, which is a really cool side effect. I hope my impatience is translating as excitement, because that’s where I’m at right now.

Also, August is my birthday month! So for the next update, I’ll be a year older. Fenwick’s birthday is this month, too – he will be 11. Our journey continues. Thank you to everyone who reads these updates. Your insights and checkins and comments have given me so much inspiration.

Stay safe and scrappy out there! ✨

With gratitude, – Harlan.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

So inspirational. I’m older than you but I’m in the midst of purchasing my first passive income producing property to add to my business’ revenue, Your updates remind of what is possible!

Hey JimBob! Woohoo – that’s amazing! I sometimes feel like I’m “behind” too, but I realized the best time to start anything is right NOW! Congrats on your first property and cheers!

Thank you for reading and commenting!

Nice update. So cool to see what your $500k will grow to by age 65.

Thank you, Nancy! It really is so cool! Time in the market is a hugely underrated part of debt accumulation. That’s why the earlier you can begin, the better. And the next best time is right this instant! Running those numbers really set me at ease – no matter what happens, I know I’ll have a nest egg waiting for me. Plus, I’ll continue to contribute to it for as long as I’m working.

Thank you for reading and commenting!

Crazy how fast things move along when you really buckle down. Only a few short years.

It’s starting to take off like a runaway train! Today I moved $200 into my taxable brokerage account. It felt so good. Getting to $100K felt like it took forever, but things are taking a life of their own now. Compound interest is truly a wonder, especially when it’s working for you (instead of against).

Hope you and Kim are doing well! We’re still being dumbasses here in the US of A re: covid/delta variant. Be glad you got out. Can’t wait to get back to Japan one day.

Happy Birthday month to you and your furbaby! Last month of summer too so a good way to end it!

Thank youuuu! All my memories of my birthday are being super hot lol. Hope you’re doing well, Boonie!