Also see:

Well, it’s been nearly a year since a $6 charge from Dollar Shave Club on an Amex card plunged my credit score over 100 points.

At the time, my credit score was 803 – the first time I’d ever gone over 800. I know it doesn’t intrinsically “matter,” because a score over 750 is as good as it gets. But I did have some pride at earning an above-800 score.

So I was pretty horrified when one stupid error brought me down to ~700. All the work I’d done to build my credit was instantly erased. And, Amex was totally clueless, unhelpful, and actually prolonged the repair process by saying they’d corrected it on their end when in actuality they hadn’t done anything.

I dragged my feet on filing a dispute with the 3 major credit bureaus because I knew it would be a slog – and it was. No sugar-coating that ish.

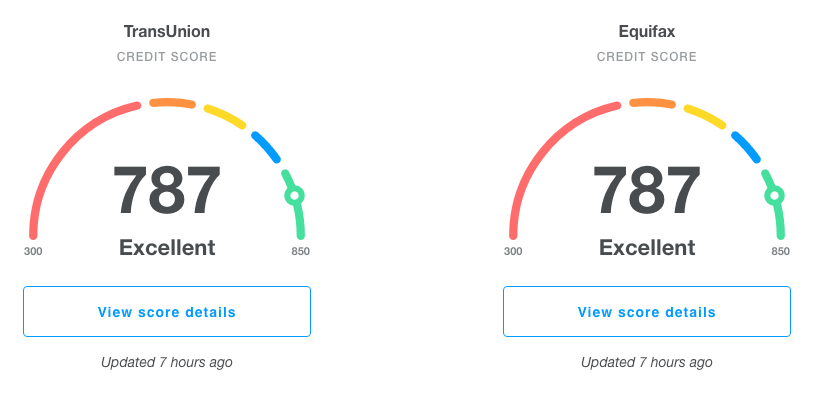

But, as of last month, my score is now above 780 across the board!

It’s not over 800 yet – I doubt that will happen any time soon – but I am happy my score is recovering. Here’s how it went down.

The long, long dispute process

- Link: Equifax dispute process

- Link: Experian dispute process

- Link: TransUnion dispute process

After I filed my initial disputes, I knew it would take some time for the whole thing to resolve. Because each bureau says something to the effect of, “This is gonna take 30 to 45 days for us to even look at it.”

After that, if resolved in your favor, it could take a couple of more months for that information to appear on your credit report. So, 3, maybe 4 months, from filing the dispute to seeing any update. And the whole time, you’re uncertain and in limbo. Of course.

And also of course, the websites are from the mid-90s, clunky, and hard to navigate. If you ever have to do this, plan to spend at least an hour – most of that clicking through error messages.

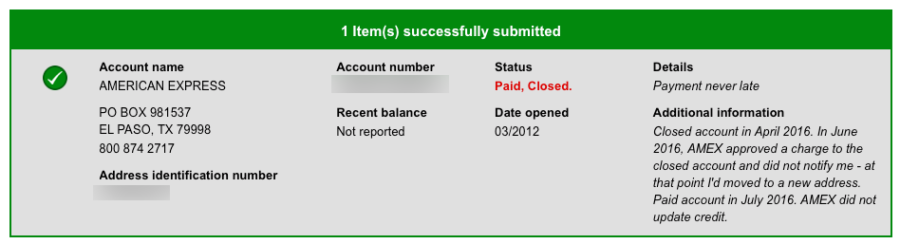

On each dispute, I wrote:

Closed account in April 2016. In June 2016, AMEX approved a charge to the closed account and did not notify me – at that point I’d moved to a new address. Paid account in July 2016. AMEX did not update credit.

And I marked that my payment was never late – because the account was closed and therefore had no due date.

I won!

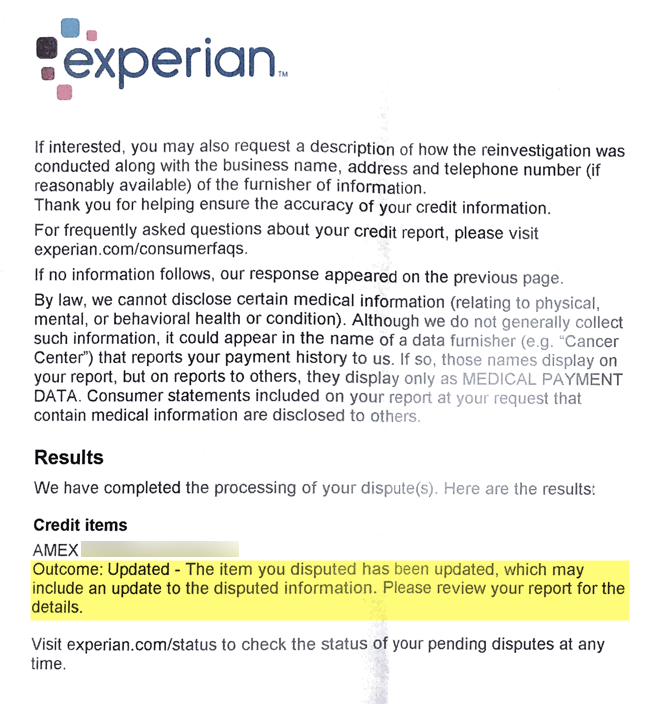

Apparently that was clear enough – because months later, I began getting results of the disputes.

I’d nearly forgotten about the whole thing. And in the meantime, learned to live with my kinda lame credit score.

I was still able to get several new credit cards, and even pre-approved for a new mortgage loan. Although I did have to explain a couple of times what happened via reconsideration.

So when I saw my “outcome” was “updated,” I was pretty excited. But I knew it would still take a while for my score to show recovery.

780+, baby (Credit score recovery phase)

The image at the top showing a 787 score is from Credit Karma, which pulls from Equifax and TransUnion.

I also checked Citi for my FICO (not FAKO) score with Equifax, where it’s currently 781.

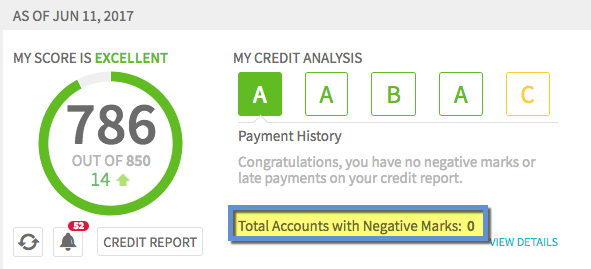

And Credit Sesame shows similar results. The “C” grade is for new credit inquiries – I’ve learned to live with that, too, because there will always be new credit inquires. 😉

And that’s all after opening 3 new credit cards on May 1st (US Bank Altitude Reserve, Amex Hilton Surpass, and Citi Diamond Preferred).

Bottom line

I’m happy this has all worked out slash is working out. Though the process has been extremely protracted, I would highly recommend setting aside an hour to file disputes with all 3 credit bureaus, especially if you have a legit reason for it.

In fact, after my experience, I’d say to file the dispute the second you see something amiss. I waited and trusted Amex to fix their own error – which they didn’t. If I’d filed sooner, my wait would’ve been much shorter. Lesson learned.

From the time I filed my original disputes to seeing any actual change in my score took ~4 months, so brace for that weird limbo phase where you have no idea what the heck is going on. It kinda feels like sending a request into a black hole until the letters randomly start showing up in your mailbox.

All that said, I never stopped applying for new cards. This dispute was mostly a matter of principle. But now that it’s over, I’m glad I did it. And my score is finally starting to get to its previous 800+ level.

Have you ever had to file a dispute for your credit report? How does your experience compare?

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Did you ever contact Amex’s credit department?

I had an escalated an issue with them once. I was an AU on my mom’s card when I was in high school. Removed from the account of when I was 19, it they kept reporting. She had terrible utilization on the card. I wrote them a very stonefly worded letter and my droppers were updated within a few days.

Many times. They said they would “re-age” my account to update my credit report. I waited a couple of months – nothing. Called back again. They said it hadn’t been done properly and that they’d do it again. Waited 2 more months – still nothing.

Finally had to take matters into my own hands. At that point, I filed a dispute. Amex was useless.

good pts but let’s talk about the majority of us 700 to 800 how is this best accomplish? anybody. thanks

You mean how to raise your credit score?

I recently had to file bankruptcy and want to know what my credit score is now.

Sincerely, Carole Diane Yates

Try Credit Karma or Credit Sesame – both will give you a rough idea of your credit score for free!

Hello Harlan!

I was motivated by reading your post. Upon a second round, I recently disputed items on my Experian credit report and received response within about 25 days. Upon reviewing my results, out of 12 items that I disputed, 5 items remained that indicated an ‘outcome: updated and processed’. Does this mean that the other items that did not show up were deleted or ..? Your reply is appreciated.

Huh. I’m not sure what it means, to be honest. Maybe they haven’t had time to update the other 7. 25 days is lightning fast. I’d honestly give it a little more time and see what happens. You can always call and get some clarification. But with this kind of stuff, the best thing to do is wait it out and see how they process.

Glad you took control of the situation and filed some disputes! Yay! 🙂