Also see:

- Is the Citi AT&T Access More Card + RadPad a Viable MS Option?

- I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

Hello from sunny and HOT Martinique! I’m at Hotel La Pagerie (which I booked with the 4th night free through Citi Prestige).

Quick update because I just received my first statement on my brand new Citi AT&T Access More card.

I didn’t go for the Citi ThankYou Premier to get the full 3X on all travel including gas. Instead, I hedged my bets and got the Citi AT&T Access More card.

The main draw for me was paying rent through RadPad and earning 3X Citi ThankYou points.

And because I also have Citi Prestige, each point is worth 1.6 cents toward American Airlines flights (including codeshares). So even with RadPad’s 1.99% fee, I’d still get close to 3% back of value (4.8% – 1.99% = 2.81%).

Which is awesome – and better than a 2% cash back card obvi.

I outlined the numbers in detail here. And commenters on both Doctor of Credit and Reddit said RadPad earns 3X Citi ThankYou points per $1.

But I just had to confirm it for myself. It really does!

My 3X Citi ThankYou points experience

I made a variety of purchases before I left for Martinique to see what would (and wouldn’t) count for the 3X “online retail website” category. Thankfully, it’s very broad!

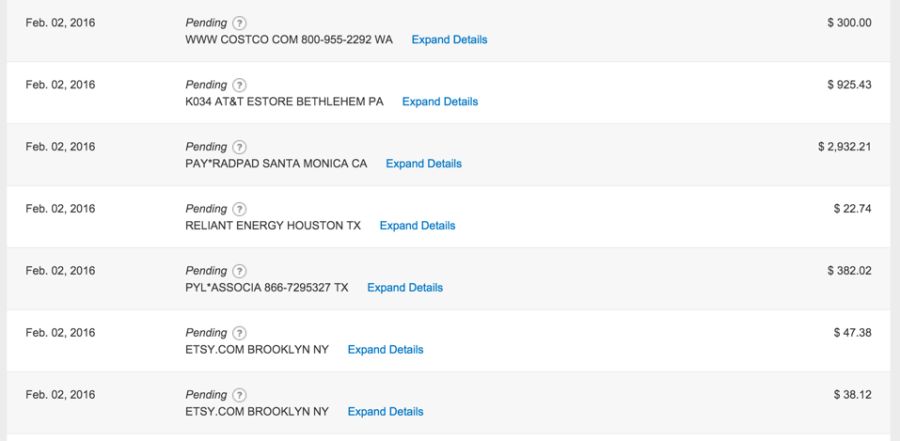

I had charges from various merchants in February:

Everything I bought on the card the 1st billing cycle. Random assortment of merchants, including RadPad, Amazon, and Costco

The list is pretty good though. I earned 3X points at:

I did not earn 3X points on Reliant, which is an energy provider. But Citi specifically says utility companies are excluded, so fair enough. However, it’s free to pay it online with a credit card, so I’ll switch to my Fidelity AMEX next month to get 2% cash back instead.

Earning 3X points at RadPad is awesome! Much better than 1% cashback with the PayPal Business Debit MasterCard.

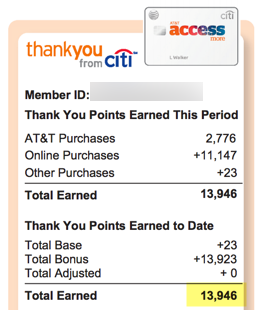

In total, I earned 13,946 Citi ThankYou points this month. That’s worth ~$223 toward flights on American Airlines.

And score – the HOA dues on my new place in Dallas count for 3X, too!

It’s all in the pairing

Even if you only had the Citi AT&T Access More card, you could cash out your Citi ThankYou points for 1 cent each and still come out ahead of the 1.99% fee from RadPad.

And remember, you’ll earn 10,000 bonus ThankYou points when you hit $10,000 in spending per year. With RadPad, that’s going to be super easy to hit – which more than offsets the $95 annual fee.

But the good stuff happens when you pair it with another Citi card, like the Citi ThankYou Premier or Citi Prestige card.

If your rent is $1,000, you’ll pay $20 to RadPad as a fee. But earn 3,060 Citi ThankYou points worth – at a base – $30.60.

Or ~$49 on American Airlines flights when you have Citi Prestige. Or ~$38 toward travel when you have the Citi ThankYou Premier.

Any way you pick, you come out ahead. You “profit” ~$29 with Citi Prestige and ~$18 with Citi ThankYou Premier after the RadPad fee.

That’s per $1,000 of rent. So you can scale it up or down to figure out how much you can earn.

Bottom line

I’m officially going to be jammin’ on my new Citi AT&T Access More card for as long as I can.

I’ll do a separate post on my experience getting the phone and $650 statement credit from Citi (hint: it all worked fine and was super easy).

This card is ideal if you are a heavy online shopper and/or pay rent through RadPad.

The $95 annual fee isn’t waived, but once you hit $10,000 in spending, you get 10,000 bonus Citi ThankYou points – which offsets the fee. It should be pretty easy to hit that mark if you go the rent route.

The real magic is when you have Citi Prestige or Citi ThankYou Premier. Because then your points earn outsized value that more than cover RadPad’s 1.99% fee for MasterCards (which this card is). If you want to pick up either, thank you for using my links!

I’m going to switch all my rent payments to this because it’s wayyyy more lucrative than just earning 1% cashback. Or even PayPal My Cash cards (except when meeting minimum spending requirements).

I plan on crediting all my American Airlines flights to Alaska Airlines this year. That means a lot of paid flights. But with my new Citi AT&T Access More card, all my flights will be pretty much covered. My only regret is not getting this card sooner.

Of course, you can also transfer the Citi ThankYou points to travel transfer partners like Singapore Airlines or Flying Blue to get even more value than what’s listed here.

Let me know if you have questions, or an experience with the Citi AT&T Access More card!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I just entered my Citi AT&T card and the RadPad app is quoting me a 3.49% fee. how are you getting 1.99%

Is yours a MasterCard? The 1.99% fee is only for MasterCards.

So this seems like an amazing deal as a Citi Prestige cardholder. One question though… I have no desire to join AT&T and I’m perfectly happy with my current phone. Can I sign up for this card without signing up for AT&T service and ignore the phone bonus? I just want 3X TYPs on Radpad!

Yup, you can. You’d just lose out on the phone, but if you don’t want it for whatever reason, you certainly don’t have to buy it.

I did only because I currently have AT&T and an iPhone, so I treated myself to a lil’ upgrade. :p

There’s no way this lasts. Citi has already cut out a bunch of sites since the card started. In the beginning boy was it good.

Like all good deals, get it while you can. It’s been going on for at least 6 months by now. Here’s hoping we have at least another 6!

Does anyone know if Plastiq works for the 3%? Would like to make my car payment this route

I’ve heard that it DOES.

Plastiq does not. I’ve paid my electric company through Plastiq since July and it doesn’t earn 3X on Citi AT&T Access More, sadly.

Awww, that’s too bad. Thank you for the data point, though!

When does the 3x post in the citi account? when the balance closes or can you see them in your transactions like Chase does?

At the end of the billing cycle.

Great writeup Harlan, thanks for all the hard work on this one.

I’m just getting into the churning game, and I really like how you have paired these two cards together. However, I am going to wait before I sign up for either the Citi Prestige or Citi Premiere. In your opinion, is it worth going for the ATT card without having either the Prestige or Premiere cards?

Just for reference, I pay 1800 in rent per month, so I’d be coming up on 5400 points per month, minus the 36$ fee I would have to pay by using Radpad. Thoughts?

Sorry for the delay here!

But yes, I do think the Citi AT&T Access More card is worth it all its own! The 3X category is a points machine!

Can anyone confirm the posted category for the charge?

Thanks

Sure! Category: REAL ESTATE AGENTS AND MANAGERS RENTALS

I see the rate for a CC is now 3.49% which still makes this semi-worth it, especially when trying to meet minimum spend. Can someone please verify it is still coding as an online purchase for the 3x?

Hey Benjamin!

I use Plastiq now for rent payments, and wrote about the change here: http://outandout.boardingarea.com/hello-to-plastiq-for-2-bill-payment-fees-with-mastercard-including-mortgages-and-utilities/

I can confirm both services code for 3X (Plastiq as recently as a week ago). Here’s my write-up on it: http://outandout.boardingarea.com/earn-points-for-rent-and-mortgage-payments-with-plastiq-2-fee-with-mastercards/

Hope this helps, don’t hesitate to ask any questions!