Update: This offer is NO longer available. To see the latest credit card deals, click here.

You might’ve heard a version of the infamous British Airways 100,000 points deal is back.

It’s a beast of a deal – there’s no doubt about that. And I mean that in a good way AND a bad way.

There are many cons to accept with this deal: the minimum spending, the materiality of the points themselves, and a gigantic black hole of opportunity cost. But let’s call a spade a spade here: at this point I’m taking what I can get.

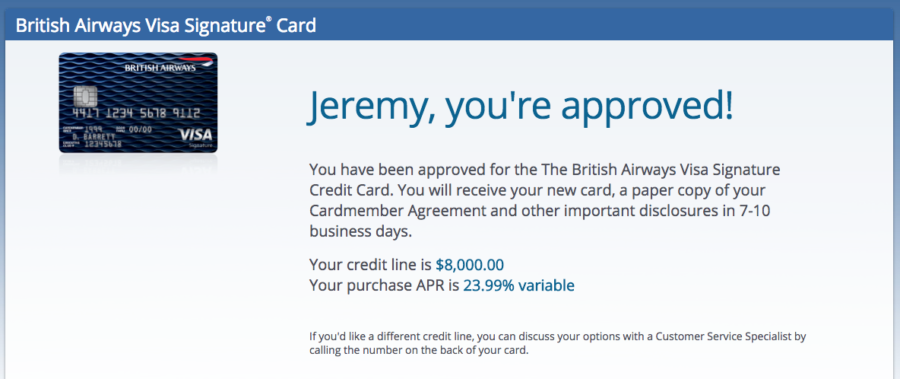

And 100,000 of any kind of points is nothing to sniff at. So I got the Chase British Airways card again – even after I brutally dumped it a little over 2 years ago.

A hard look at this 100K offer, OK

- Link: Chase British Airways card – Compare it here

There’s zero doubt in my mind this offer isn’t for most people. But it’s definitely for me. The more I thought about it, I realized that.

Peeps say British Airways Avios points are difficult to use because award availability on American Airlines (their partner) is scarce – at best. And their best European partner, Air Berlin, recently, uh, went under.

Award flights on British Airways themselves are laden with $1,000+ fuel surcharges.

Not to mention the terms of the deal. You earn:

| Chase British Airways | 100,000 British Airways Avios points |

|---|---|

| • 5X Avios points on British Airways, Aer Lingus, Iberia, and LEVEL flights within your first 12 months (then 3X) • 10% off fares to London from the US • No foreign transaction fees |

| • $95 annual fee | • After spending $5,000 on purchases within the first 3 months |

| • Compare it here |

$20,000 in spend to unlock the full deal! That’s a LOT of spending. But when you break it down, that’s $1,666 per month if you stretch it out over a year – which is a LOT more palatable.

The rent on one of my Airbnbs is $1,535 + parking and utilities so even if I just stuck that on the card, I’d unlock the full bonus.

What reeled me in: 6X everywhere!

It’s not hard math to see you’ll earn 5X points on everything you purchase. Spend $20,000, get 100,000 points. I know there are 5X bonus categories out there – and I’ll still make the most of those – but to earn 5X on rent payments through Plastiq (even with the 2.5% fee considered) is still a lot of points per $1 spent. More than I’m used to these daze.

But it’s really 6X everywhere.

Because you’ll earn 1 point per $1 spent, too. If you spend exactly $20,000, you’ll get the 100,000 point sign up bonus + 20,000 points for the minimum spending. That’s 6X (120,000 points / $20,000)! Not a bad deal at all.

I’ll still likely use my Chase Sapphire Reserve for dining, my Citi Prestige for airfare, and my Chase Freedom for its own 5X quarterly categories. But yeah, I can stick a rent payment on the Chase British Airways card without missing out of any of that.

Previously, I determined it’s worth it to use the Amex Blue Business Plus for Plastiq rent payments even at 2X points per $1. But to get 6X on those payments is obviously even better.

The thought of 6X everywhere on up to $20,000 in spend… I couldn’t hold back any longer.

NOT a 5/24 card

I have 30 credit cards to my name right now. So I’m not falling below 5/24 any time soon. Fortunately, this is one of the few Chase cards NOT impacted by their 5/24 rule – so it’s still open to every commoner in the land, including knaves like me (I’m a knave!).

Honestly – there are not many cards I can get any more. I can’t get most Amex cards because I’ve had them all before. I can’t get Citi cards because of their “family of brands” rule. There aren’t many Barclaycards I care about – and the ones I do, I have. I have my Discover It. And 2 US Bank cards (including the US Bank Altitude Reserve).

What’s left if you’re an “old-timer” to this hobby?

I don’t have the luxury of picking through offers. I have to take what comes my way. Even if this offer isn’t exactly tops on my list, it’s a good deal and a great number of points. And despite not fully knowing how I’ll use them, I know myself – and I know I’ll put them to good use.

Plus, what else am I earning now? The best spending you can do is for sign-up bonuses. And this is one of the more appealing ones out there right now.

Opportunity cost

I should address this. Back in the day, I could unlock 4 or 5 (or more!) credit card sign-up bonuses with $20,000 in spending. Those days are over for me.

If you’re still new, you should definitely NOT get this card. You’ll miss you on too much. But me, I’m not missing out on anything because there’s nothing to miss. This deal is all I have open to me right now – but you should think about what other cards, bonuses, and category spend you’d miss by putting so much spending on one card.

Are the points really that hard to use?

The other extremely valid critique is: OK, so I get 100,000 of these British Airways Avios points. How do I use them?

There’s no sugar-coating this: they are more difficult to redeem than your run-of-the-mill points.

They’re best if you’re persistent, and flexible with your dates. If you aren’t both of those things, you’ll have a devil of a time getting anything good from them. Period.

That said, I’m still finding niche routes where these points can save a heap.

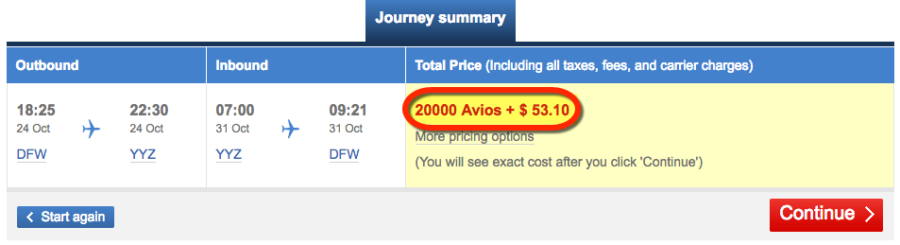

There’s a Dallas to Toronto flight which OF COURSE American Airlines guards like Fort Knox when it comes to award space. These flights are routinely $550 round-trip in coach. Which like: 💥🙃🔫

BUT. I have found space before. And I’ll find it again. It’s 20,000 Avios round-trip in coach. That easily meets my 2 cents per point rule. And I could theoretically get 6 of them and save myself ~$3,300 (120,000 / 20,000).

And and and. You can still redeem Avios flights outside of the US under 651 miles for only 4,500 points each way (no one talks about that any more). That’s an incredible deal.

There’s also a Dallas to Cancun flight that has space sometimes (you know I love my Hyatt Zilara Cancun). And a Dallas to Nassau (Bahamas) flight. The point is: find American Airlines routes (or other partner routes) you’re interested in and watch them. These points do have value still. You just need a bit of patience (and maybe some luck).

Other ways to use them off the top of my head:

- Jo’burg to Cape Town on BA in South Africa

- Sydney to Melbourne on Qantas in Australia

- Around South America on LATAM

- Around Europe on BA or Finnair

- Certain Fifth Freedom routes that are extremely interesting with usually wide open space

And hey, doesn’t American Airlines have a Dallas to Mexico City flight? Back to the point about finding routes you’re interested in… I’ve been wanting to visit Mexico City for so long by now. That might actually be my #1 use of Avios at the moment.

Bottom line

- Link: Chase British Airways card – Compare it here

Are you in my boat? Are you tapped out, open to any slash most offers, and well over 5/24? I urge you to seriously give this deal a ponder. I couldn’t resist the 6X calculation – it’s just too good despite the type of points.

If you’re under 5/24, just starting out, or unwilling to meet the full spending requirements, my god back away from this.

That’s the polarity of this offer. It’s extremely subjective.

All that to say: I bit the bullet. The card is coming next week. I’ll unlock the full offer. I might even try to get the Travel Together certificate for bleeps and giggles.

My plan is to put my Airbnb rents and maybe some utility bills on this card until I meet the full bonus requirements. And then go back to my other cards.

But for now, the race is on. And pretty soon I’ll be 120,000 British Airways Avios points richer when you factor in the minimum spending requirements. 6X everywhere. Ready for it!

What do you make of this offer? Will you take the bait? Or is it total caca?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Avios are incredibly valuable for traveling around SE Asia on CX, especially in J. Bangkok to Singapore is only 30k points in business one way and there’s always tons of availability.. That’s an incredible deal. We’ve done this flight and most are on CX’s great reverse herringbone J cabin and they also fly their new a350 on this route.

Email incoming.

Wow that’s excellent. I’m guessing space on those flights is relatively open, too. Awesome tip!

Yes, TONS of open J space. HKG-ICN/TPE is another open routing in J. HKG-DPS not so much since it’s a popular leisure route, and they have the crappiest planes with the densest J cabin ever.

Ah, all places I’m dying to go. These are very handy to keep in mind. Thanks again for adding this!

Flying Qantas from Sydney to Melbourne can be a lot of fun. They have a few daily flights on an A330 with lie-flats. Just in case you really need to nap for 45 minutes.

Good to know! Gosh, I hope to make that trip again one day. #travelgoals

And yeah, I could always nap – even for 45 mins! 😉

Hey Harlan, I’ve been contemplating this card too and it’s nice to see your perspective. Being in PDX, I’m looking to use Avios to get to Hawaii or Mexico on Alaska. I cancelled my 1st BA card over a year ago and got good use of the miles when they were still 4500 for short trips. I did just apply for my 2nd IHG and 1st Arrival+ so need to hit that spend 1st. Also debating the Cathay card as I am interested in trying the Biz or 1st from Vancouver to New York. That could be a fun transcon until JetBlue starts Mint from Seattle next year. I hope the Visa on Plastiq holds out so you can nail the min spend without breaking a sweat.

Using Avios for AS flights, especially West Coast flights to Hawaii, is a notoriously good deal. And you only have to deal with AS space and not AA – which tends to be MUCH better.

If you’re shooting for that CX flight I’d honestly recommend AS miles too instead of the Cathay card. But both would work – and you can transfer Citi TYP to Cathay if you need more.

I think the BA offer will be around for a little bit longer so hopefully you have some time to decide and see if it could fit into your plan. Fingers crossed on the Plastiq/Visa payments, too. I think it will – at least for a little while longer.

Thank you for commenting – it’s always so good to hear from you!

I’m embarrassed to admit that I forgot Cathay is an Alaska partner. That might actually work better. I do plan on transferring some TYP during the bonus as well. Thanks for the reminder!

Yeah of course! There’s a LOT to remember lol, I forget stuff all the time, too.

The Cathay card is good for a fast hit of Asia Miles but beyond that… not much else :/

Question, if you are putting one of your Air BnB rentals to meet the min spend on this card, what are you doing with your AT&T? Are you still rocking the 3X each month? My AF just came due and I am wondering if I should downgrade to the no AF ATT or keep milking the 3X for mortgage for as long as it posts.

Still gonna use the AT&T card for my mortgage because it’s a MasterCard. And yup, still rocking the 3X! I love that card so much. Keep getting the 3X as long as you can!

People make the points out to be so hard to use but that isn’t the case for me. My favorite uses on this flight is inside Japan and using the companion pass which was crazy expensive. Also no close in booking fee.

Yes! I also used Avios for a JAL flight from Osaka to Tokyo and remember award seats were wide open every day, with a choice of flights. Thank you for that reminder! And the no booking fee thing, too!