Welp, the Marriott-Starwood merger looms nigh. On August 1st, 2018, we’ll all wake up and have a new program – with excellent deals through the end of 2018.

Also on that day is an event I’ve dubbed in my mind as “The Triplin’” – because everyone’s Starwood balance will increase by 3X!

So now’s the time to earn as much as possible to take advantage of redemption opportunities later this year.

In 2019, the new program will be dead to me. I’ve never liked Marriott hotels, and occasionally stay with Starwood. At that point, I’ll go back into my Hilton/Hyatt hole for as long as the water’s nice.

Ah, to be a fairweather traveler free agent.

5 months of great deals – under 2 months to earn with SPG card spending!

- Link: SPG program changes

I’m now done with the full spending requirement to earn 100,000 British Airways Avios points. And toyed with the idea of getting the Citi American Airlines small business card, which has an incredible sign-up bonus of 70,000 American Airlines miles after spending only $4,000 in the first 4 months from account opening.

But then I’m like… I should rack up the Starwood points while I can. So starting now, I’m using my Starwood cards for all my spending.

Every $1 you spend in non-bonus categories will turn into 3 points on August 1st, 2018. I currently have 40,000 Starwood points. And typically spend ~$10,000 per month on credit cards.

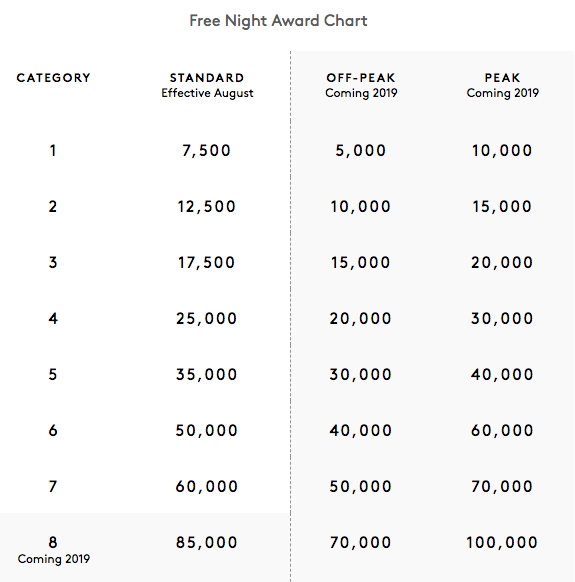

With the 40,000 points I have, plus 20,000 more points I could earn, I’d have 180,000 Marriott points on the first day of August. That’s enough for 3 free award nights at a Category 7 Marriott hotel – the highest category – for the remainder of 2018 (60,000 X 3 = 180,000).

Or, with the 5th night free on award stays, I could pay for 4 nights at a Category 5 hotel, and get 5 nights for 140,000 points and still have some left over. We don’t yet know how the categories will shake out, but Marriott gave a preview for hotels in Bali, Dubai, the Caribbean, New York, and Paris.

There will be some great deals with fall and winter – and now is prime time to scoop up as many Starwood points as you can before The Triplin’ in August!

Change your closing date!

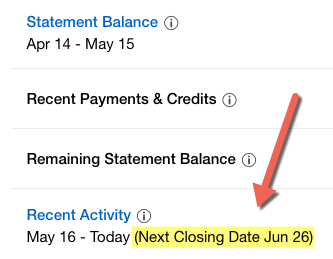

It would suck to spend big bucks on a card to find it closes mid-month and you’ve missed The Triplin’. So here’s what I recommend: change your closing date to the 26th or 27th of the month. Because it takes a few days for Amex to send the points to your Starwood account. Not the due date – the closing date. That’s the day a new billing cycle begins.

My closing date was the 15th. But I changed it to the 26th. That’ll give me 11 more days to make purchases and pay bills – and have points post in time to get The Triplin’.

I couldn’t find where to do this online. So I called the number on the back of my card and the phone agent updated it instantly.

If your due date is at the beginning or middle of the month, it would give you more time to spend next month.

And if it’s beyond the 26th or 27th, you might want to move it up a couple days to make sure your points post in time (there are 31 days in July).

Bottom line

I’m hedging bets on the upcoming Marriott-Starwood cards and switching all my spending to Starwood Amex cards for the next couple of months.

And, to maximize the window of opportunity, I recommend changing your closing date to the 26th or 27th of the month to account for the few days it takes for Amex to send points to Starwood.

On August 1st, 2018, whatever’s in your Starwood account will triple – so right now you’re earning 3X points per $1 spent in anticipation of that date, and 5 solid months of excellent award redemptions.

But, as of 2019, Marriott will be a relic in my eyes. Everyone hates on Hilton, but it works for me. And as long as Hyatt’s chart stays the same, I’ll continue to transfer Chase Ultimate Rewards points to stay free at their hotels. This is my last-ditch effort to stay at some nice Starwood hotels. Do or die, now or never.

Here’s hoping for a good Category 5 hotel for a 5-night stay (with the 5th night free!) later this year.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

My current payment due date for SPG is the 28th of each month and my statements don’t post till around the 3rd of the next month, and then it takes 1-2 full days for the points to show up in my SPG account.. So you’d have to have your payment due date on roughly the 20th to make sure your points post to your SPG account before Aug 1st.

Thanks for the reminder to change the due date.

Ja! It sounds like your due date is the 28th, but your closing date is the 1st or 2nd of the month. The payment due date is usually a few days before the closing date. If your closing date is the 26th, points should post on the 28th or 29th (according to my SPG activity with the SPG card).

But I’m conservative and don’t like to cut it close to the wire. For a closing date of the 26th, your payment due date would be the 22nd or 23rd. And those extra few days could help – remember it also takes a day or two for purchases to actually post to your account. I’ll do a lot of Plastiq payments on the 20th through 24th to be on the safe side and get that sweet 3X one last time. One more good redemption with this program then the way of the dodo (AKA Club Carlson).

So when is your payment due date, because that’s the only date you can actually change?

The agent let me change my closing date.

Oh sweet. Every time I talk tot hem they say I can only change the payment due date.

BTW I’m not getting emails for replies even though I have the box checked.

Spam folder?

Do points convert August 1 or 8? I’ve heard both days.

The phone agent told me August 1st, so I’m going with that. I haven’t seen the 8th anywhere.

I’m confused. I thought spending through 7/31 will be 1 Starpoint per dollar, spending on 8/1 and after will be 2 Marriott points per dollar. Statement close date shouldn’t matter?

Correct. But your balance will be tripled on 8/1. So everything you spend now is like getting 3X. If you change your closing date, the points you earn will get pushed to your SPG account and tripled on 8/1.

Man, you are a genius! So glad you posted this as my statement has been closing just after the beginning of the month. The site says you’re supposed to be able to do this online, but the option never shows for me. I did it fairly quickly via online chat. Thank you kindly!

Sidenote: sure do wish BA would fix the glitch where clicking the “notify me of follow-up comments by email” setting does nothing on NEW posts for some of us (yet we continue to receive emails for every new comment on subscribed posts before the bug began). I know you have nothing to do with this but I’m just posting here to let you know it hasn’t changed.

You’re welcome, Carl!

I will ask the BA people to look at that. Super annoying to keep checking back (although I’m glad you do, of course!).

I believe they already clarified that all spending through July 31st, regardless of closing date, will be honored at 3X

Ah, I didn’t know that! I still think I’d like to see the balance all triple on 8/1 though – will be kind of thrilling to see the bigger number that day lol. But I’m totally a nerd for things like that.

Thank you for the tip!

Thank you, I’m doing it via chat!

Awesome – I almost forgot chat is an option too!