Also see:

Welp, I finally did it. Got a new credit card to help pay down my student loans.

It’s an idea I floated before. But I didn’t bite because there have always been other cards I wanted instead. Plus, I like to save or invest money instead of throwing it toward student loans.

I’m constantly torn about taking a solid year to get rid of it, then I think… man, I could invest that. Or pay down my mortgage. Or just have it.

Ultimately, I think a hybrid approach is best: break everything down into buckets and work on each one a little at a time. Save a little, invest a little, use the rest for bills.

But I’ve decided to give myself a head start on the student loan bucket. Here’s why.

Lower principal means less interest

That’s the smoking gun right there. My student loan has a 6.75% interest rate (ouch). My investments return a little more than that. But that’s not guaranteed.

Paying down the student loan is guaranteed savings as opposed to non-guaranteed earnings.

My mortgage is 4%. Those are pretty much the only two big loans I have to repay. So it’s obvious to go after the one with the larger interest rate first.

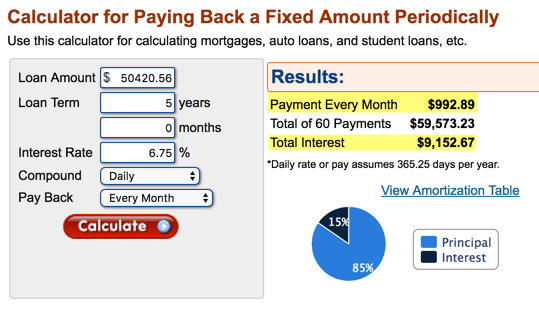

Right now, if I want the loans gone in 5 years, I’d have to pay ~$993 a month. And pay ~$9,153 in total interest.

In running the numbers, if I can eat into the principal by even $7,000, my monthly payment drops to ~$855 and the total interest paid goes down to ~$7,882.

That saves me ~$138 a month and reduces the interest by ~$1,271.

$138 x 60 (5 years of payments) is $8,280 saved. Of course, I’d have to pay back the $7,000, so it’s really like saving $1,280 but also still saving the $1,271 in interest payments, for a total of $2,551.

That’s pretty nice! Plus, I can pay back the $7,000 at my own pace if it has 0% APR and isn’t accruing interest of its own for a while.

Where the Citi Diamond Preferred comes in

- Link: Apply for Card Offers

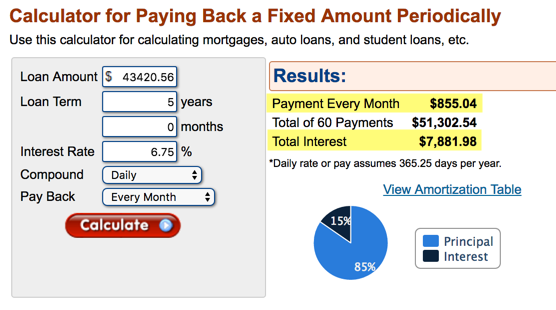

Citi has two cards with a 21-month 0% APR: Citi Diamond Preferred and Citi Simplicity.

On the surface the cards are the same. The only major difference is a 1% variation in the regular APR. Both have $0 annual fees.

However, something about the Simplicity card turned me off: “No late fees, no penalty rate.”

To me, that implies it’s intended to be a “training wheels” card, which could mean a lower credit line. I wanted a line of about $7,000 so I could get my loan payments below the $900 a month mark and get them paid in 5 years. For that reason, I applied for the Diamond Preferred card and was approved for a $2,000 limit.

However, with a quick call to Citi, I was able to move $5,000 from my Citi ThankYou Premier (which I never use any more with Chase Sapphire Reserve in the mix) to reach the $7,000 threshold I had in mind.

This is my 7th Citi card (the other 6 are Prestige, ThankYou Premier, AT&T Access More, 2 AA cards, and a Hilton Visa). So I think that was the reason for the initial low limit. But it all worked out.

And now I have a card that won’t gather a dime of interest until February 2019 – that’s awesome!

Effects and consequences

Once I make the initial student loan payment via Plastiq, I can immediately get on my new student loan plan to have them wiped in 5 years. And can invest or save the rest.

It still feels like throwing money into the toilet somehow, but at least I can start to see the end of it… forever. This also reinforces my commitment to finally kick this thing. I’m not thrilled about it. But I will try to stay on schedule as much as possible. And, I’m grateful for this head start.

I’m not worried about the impact on my credit report because my used to available credit ratio will still be very low.

I also found out if my student loans are “paid up” for at least a year it does not have to be included in my DTI (debt-to-income) ratio if I want to get a second mortgage on an investment property (!).

My current loans as-is are $543 per month. Even if the new card shows my monthly payment as $100 a month, that’s still much lower than what I have right now – and will make me a shoo-in for another mortgage approval.

Of course, I’ll still have to pay back that lingering $7,000. I’m fine with leaving it there until 2019 because there is literally nothing else I’d want to use this card for.

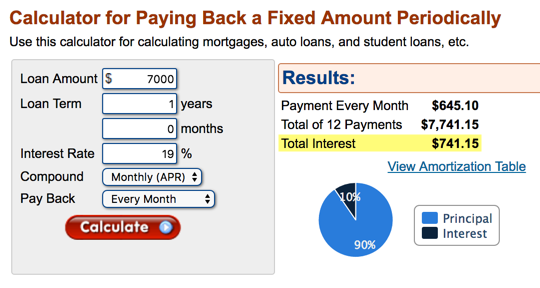

Even if I carried the balance beyond February 2019, for a year at a 19% interest rate, I’d still only pay ~$741 in interest – which is still much lower than the ~$1,271 I’d pay on my student loan.

So, in all ways, it seems like a total win. There’s no sign-up bonus on this card, but getting all these good side benefits and savings is worth it for me.

Plus, I can’t really get other cards any more anyway. Amex: nope. Chase: nope. Other Citi cards: nope. What else is left? An Alaska card every 45 days. 😉

Should you try this?

Who else would want to use a 0% APR card to pay down debt? Maybe to:

- Knock out the rest of a mortgage to get the deed in hand

- Get your current mortgage more than 20% paid if you want PMI to fall off

- Buy a car with a credit card and pay it back in 21 months

- Make a big home improvement

- Get a place ready to sell and pay the card down after closing

- Make a lump-sum payment toward something big, like a student loan 😉

Please carefully read this post about the potential effects this could have (read the comments too). And understand that credit cards are absolutely financial tools.

If you’re responsible and can handle paying it back, a 0% APR card can be a huge boost toward the next great thing in someone’s life. I’ve heard from friends they’ve used one at certain times to give themselves a nice, long, interest-free loan while they got other things together.

Bottom line

- Link: Apply for Card Offers

So that’s my plan. Get the Citi Diamond Preferred card and pay down my student loan. And also reduce my DTI for a potential second mortgage.

This is also the beginning of my firm commitment to finally, finally get the student loan paid off once and for all. The first step is a big payment toward the principal.

Are there holes in my plan? Any other side effects I should consider?

Have you used a 0% APR card to give yourself a boost along the way?

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

What investment returns almost 7% interest?

Dividends, I suppose? The US total stock market index fund, historically, for starters. 🙂

http://www.thesimpledollar.com/where-does-7-come-from-when-it-comes-to-long-term-stock-returns/

Dude my 401(k) is getting 20% returns right now, not even shitting you.

Total return maybe? Very few stocks pay 20% dividends. Even volatile stocks aren’t paying 7%. Well, some are, but it’s likely not sustainable for long. Most blue chip large cap dividend paying stocks will usually payout around 2.5-3% and probably lower with markets at all time highs. I’ve been trying to aim for 4% lately on dividend paying stocks, but that means waiting for stock prices to come down from outer space so I’ll likely be waiting on the sidelines for a while till things come back down to earth.

Dividend yield on that Vanguard fund you mentioned is 1.78%, and return YTD is 5.76% but I don’t know if that includes dividends or not. Expense ratio is 0.16%. Vanguard offers many funds with even lower ERs of 0.05% which is incredibly low.

I’ve been researching Solo 401k accounts lately, and as it turns out I’ve been paying way too much in taxes since I could’ve been socking cash away in a Solo 401k to lower my tax burden by much more than a regular IRA. So for 2017 tax year I’ll pay a lot less in taxes to greedy Uncle Sam.

Total return over several years. I have a long way to go before I’m clued in to financial lingo. I’m still working on the travel stuff lol.

Yes to the Solo 401(k)! I have one with Vanguard and love it!

So yeah, my dilemma is should I feed that or take care of this loan? Any opinion either way?

Haha, yeah I’m still learning too. I opened a SEP a day before the tax deadline a few weeks ago so I could contribute for 2016 to lower my tax burden and that saved me around $900 in owed taxes. I’ll open a Solo 401k sometime soon so I can lower my taxes owed even more.

I still owe $7,500 on my student loans and I’ve been paying since 2006 or so. They seem to be never ending. Interest is really low at 3.75% so I’ve just been paying the minimums and investing the rest, but with markets at all time highs and dividends pushed down I wouldn’t be against paying off the student loan with a 0% 24month CC offer if I could find one. I hate debt so much, but I view student loans differently from conventional debt. I Just converted my Ink Plus to an Ink Cash, but I don’t know if the 0% for 12 months counts for conversions or only new accounts.

You have so many more income streams than I do, so I’m pretty limited right now. I need to find new income streams.

So long story short I’d pay down student debt with markets at all time highs right now. Things are destined to come back down to earth, but there’s no telling when that will happen.

Thanks as always for your insight. That’s what I’m thinking, too. Appreciate it.

The 0% on Ink Cash would be for new accounts only.

I hate debt too, all of it. It is/was a necessary evil. All I know is I want it *gone* ASAP. All of it.

About to fly to Brussels! I’ll post more once over the pond. 🙂

Oh snap, that’s today? Well have fun and enjoy your flight. If you have questions about cities shoot me an email.

Thank you! Just swigged down my pre-departure champagne and about to power off devices. I wrote this post in the Lufty lounge lol.

I’ll def be in touch!

But can you even get an Alaska card every 45 days? I read boa is getting tougher?

Reports on FT are that it is very hard to get a new personal card if you currently have one open. It’s possible to get a Biz card with a personal open though. Preferred members sometimes have better luck getting a 2nd card approved while holding a first. BOA has definitely tightened a lot from the days of getting a new card every few months. There are even some reports of BOA looking at your credit card history/use over the past 2 years to judge you as a customer.

I’m about to get another one I think. I’ll report back if I have any issues!

Wait … what mortgage company are you using that they don’t count your student loans if they are paid 1 year in advance for your DTI? I’m so over these stupid mortgage lenders and not understanding the basics of income driven repayment plans or any logic with student loans. None of my peers actually pay them back (they use IDR plans with PLSF, but the banks seem not to understand this and count 1% of the principal as the payment).

Quicken Loans. That’s what they said, anyway. It would be awesome if it worked out that way. Try them out though, I’ve heard good things from clients.

Regarding the $7000 and the 19% interest – I’m pretty sure that Citi (and all other credit cards with 0% interest promos) calculate interest based on when the amount was charged. If it’s not paid at the end of the promotion, the accrued interest is added to your account.

At the 21 month mark, it’s probably better to do a balance transfer to another card that’s running a promo. I always get balance transfer offers from Citi. Usually its a 3-5% fee and zero interest if paid within 12-18 months.

Ah, you’re right. So it would be more. Even still, I have no intention of giving them even a dime of interest. 😉

Thank you for catching that, for reading, and for commenting. I appreciate it!

🙂 You’re very welcome. I dont like paying interest either!

I love interest when it works in my favor lol. Compound interest is the 8th wonder of the world. 😉