This topic came up a lot last night at the NYC Miles and Points Meetup, so I thought I’d do a post about it.

Lots of people were planning to use REDbird + points/miles credit cards to pay off large sums of debt, meet minimum spend requirements, and reach threshold bonuses offered by certain credit cards.

It’s an incredibly easy but effective idea.

Run all your bill payments through REDbird

REDbird lets you load up $5,000 per month – for free – using a points or miles credit card.

If you max that out for a year, that’s $60,000 run through a credit card.

My own personal example is my student loan. I’m so tired of it hanging over my head and I’m about ready to turn around and kick that sucker in the face – but I’m gonna get a free vacation out of it!

For roundness or whatever, let’s say you owe $50,000 to:

- Student loans

- Your car payment

- A mortgage

- Medical bills

- Credit cards

- Or any or company or even person

You can add any company as a payee on the REDbird website.

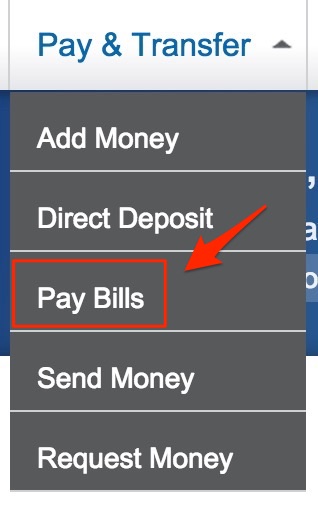

At the top of the site, hover over “Pay & Transfer” and a dropdown menu will appear.

From there, click “Add Payee” and get rockin’ and rollin’.

What you get out of it

BUT WHYYYY go through the extra steps of going to Target twice a month for a year just to run some money through REDbird?

Well, a few reasons.

- If you owe the money anyway, it’s a great way to earn more points and miles while making regular payments

- It will allow you to use a credit card (albeit in a roundabout way) to pay merchants that do not accept credit cards

- If the debt you owe accrues interest and you are paying it down aggressively, this is a great way to reduce your principal while earning points

Depending on what card you use, you can score a whole host of benefits for paying off your $50,000.

Here’s what you get if you use the:

- Barclaycard Arrival, it’s 100,000 points, worth $1,100+ in travel credits.

- Club Carlson Visa, it’s a whopping 250,000 points – easily enough for a lot of Club Carlson stays.

- Amex EveryDay Preferred, I get 75,000 points (assuming I get 1.5 points per dollar by meeting the 30 transactions per month)

- Fidelity Amex, I get an extra $1,000 added to my IRA, which could turn into much more in 30+ years.

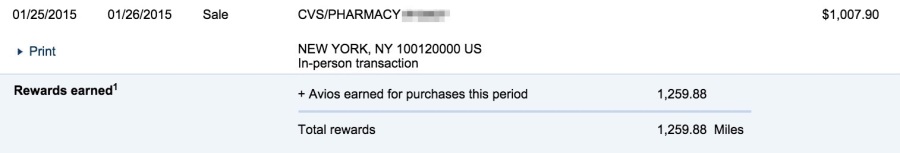

- Chase British Airways Visa, I get 62,500 Avios (at 1.25 points per dollar) PLUS the Companion Certificate for running $30,000 through the card – although it’s not as good of a deal as it used to be

A couple of other observations

If you wanted, you could open up a brand new credit card – one with a 0% APR intro period.

- The Amex EveryDay Preferred gives you 15 months with 0% APR (and I’d love to send you a referral for it)

- The Barclaycard Arrival Plus gives you 12 months with 0% APR

- The Chase Slate card would give you 15 months with 0% APR, too – and no transfer fees if you want to move another credit card’s balance over

But wait. Running your money through the REDbird would effectively let you move a credit card balance to a new card with 0% APR without a balance transfer fee, too. Just move it in pieces.

Every time you load the REDbird, use the new card and let it hold the balance for the 0% period, however long that may be. Then use REDbird’s bill pay to pay off the card that accrues interest – a bit of a back door approach, but worth it if you A). don’t have a big balance B). don’t want to deal with the transfer fees, or C). want to consolidate several balances from a few different cards into one.

Even if you don’t have an intro APR, you could also use this to transfer a balance from one card with a high APR to another one with a lower APR, like from 18% to 5%, or whatever – and save yourself a bit of money while earning points in the process. It all comes back to the points with this.

But it is also a financial tool – and as such, should be treated with care. If you use this wisely, if could fill your mileage account with points and put some cash back in your pocket, too.

With that, some caution

Don’t carry a balance on a credit card just to earn some points for paying off a large debt. Only do this if you were planning to go hard on an existing debt anyway – and you can pay your credit card balance off each month. That way, the points are truly free. Credit cards will almost always have a higher interest rate than a student loan or a mortgage – those are between 3-7% – while the premium cards we like start at around 13% and go up from there.

So be careful here. Again, these are financial tools. And you can use them for good or for ill. If you use them to pay off a big balance here’s your reward:

- A history with the credit card and issuing bank of usage and repayment

- A higher credit score for paying off a debt

- A higher credit score for managing your credit responsibly

- A lot of points

- Psychological feeling of freedom from debt, which is priceless

Bottom line

Last night, I heard from people who are using this method to earn points while paying off car loans, their co-op maintenance and mortgages, and student loans (ahem, that last one would be me).

You don’t have to take it this far, of course. You could simply cycle your money through REDbird and get the points free and clear. This post is about intention. If you intend to pay something off anyway, with a little bit of effort you could have a few free flights, free hotel rooms, or just free money (which is reason enough, right?).

What I am most looking forward to is the feeling of being free from my large debt (and the feeling of travel). And I will continue to use PayPal My Cash cards to pay my rent.

Having the points will be nice, too. 😉

Does anyone else use REDbird in this way? Or do you simply do it for the points? Would love to hear how others are approaching this!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I am paying off the remaining balance on mortgage this year and running a bunch of the money through REDBird in the process. However, this really is pointless. since I could just be using the funds loaded to REDBird to pay off the credit cards used to load REDBird. I could then just pay the mortgage off directly from my checking account. Am I missing something here?

I’m guessing most people avoid that because one bank or another will catch and flag the activity of just “laundering” the money through the account without a clear and fair intention of using it for what it was created for. If that makes sense…

That is what I thought. Just wanted to make sure I wasn’t missing out on something more!

I’ll be in Maryland this weekend and will pick up two additional Redbird’s that I’ll manage for family members. That will give us four Redbird’s producing 200K of my favorite hotel points per month.

Great Post!

We really appreciate that you keep bringing attention on how easy it is to MS with Target – All kinds of pictures and instructions on how to manufacture spend large amounts for free with your Prepaid Redcard!

I brings me so much joy that you bloggers keep bring this to everybody’s attention, so everybody can MS their way to infinity.

I can’t wait for the day when I walk to Target and the registers are hard coded cash only for Redcards. I might even send you a thank you gift for this. 🙂

On a related point, I think I counted 10 posts from boardingarea bloggers this week regarding Target RC. Way to go and keep it up and hopefully CNN does a special on this soon!

Just wait until Ben and Gary get them…

Agree with Flip J. This is why we can’t have nice things. Bloggers like you ruin it.

I’ve not used Redbird so I am a newbie here. I am paying off a student loan with AES – American Education Service. They do not take credit cards. Is there a way to get payments to them through Redbird? Thanks.

Absolutely. My student loan company doesn’t take credit cards either (Mohela, they are). But they are listed as a payee on REDbird’s bill pay. I’m sure AES is too. After you load up REDbird, you just pay directly to AES through REDbird’s bill pay service. Awesome way to use CCs to pay student loans off!

I think Flip J needs a Kleenex…

Shane, yes I suppose i was too dramatic on my post, but I think I have a valid point behind my tears

It kinda sorta feels like there will always be one shining star option for credit card loads. This may be a huge bet but maybe a smart bet…. I think they do need a percentage of customers using their cards for MS or related reasons to make it worthwhile for all these offerings. This would be too deep of a dig but i wonder what the % demo would be on people that actually just like prepaid cards for real world use vs people that like it for the MS and related uses (i.e. paying bills that don’t necessarily take credit cards).

I also wonder if they’re actually concerned with the MS’ers or if they’re more concerned with the criminals that use these vehicles for fraud and that’s why cc loads eventually get shut down, not because of MS.

Does anyone know if or when Target will expand it to other states like Georgia where I live. I really want to use it as well since it seems so much easier than Bluebird and Serve. I have a Target Super Center 2 exits away and would totally prefer to go there a few times per month instead of Walmart. I want it now.

It will eventually, but they are only in certain locations so far. Here’s a link of all the locations you can get it so far: https://www.google.com/maps/d/u/0/viewer?mid=zaZeFBtuy5B8.kyYIaq26n5m4

Good luck!

So, you actually don’t even need a 0% card and you don’t need to move money around to avoid interest if you carry a balance (although being able to move a balance is helpful and I have done that with BB and RED quite a bit). Simply by using the money moved through RedCard, Bluebird, etc you can artificially pay the balance. If you have $3K in debt and you then charge $3K to your RedCard (making your balance $6K) and then use the $3K loaded to your RedCard to pay off the your new charge it will be seen as a $3K payment which has paid your balance for the month. Therefore even if you only have 1 credit card, but have a balance <$5K you can always avoid interest. I have used this in the past with BB and I have a friend who has been utilizing this for quite a while. I have actually been debating whether to write a post on this at my site (PointsMD.com).

VERY cool idea. Requires a bit of juggling, but maybe worth it to avoid paying interest.

Thank you for sharing!