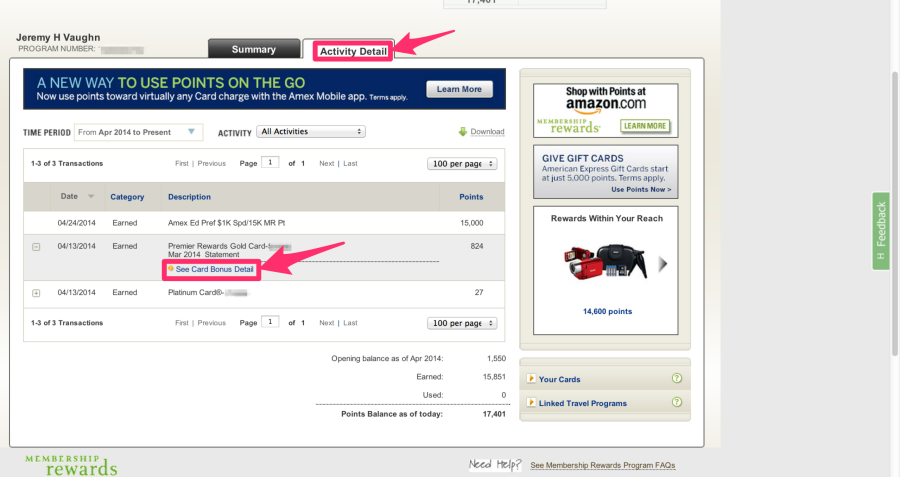

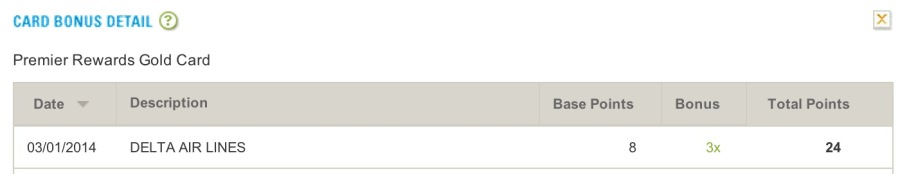

I wrote yesterday about the new ability to see category bonuses on the Amex website. I also wrote previously about a secret/hidden benefit of the PRG card – that online transactions were posting at 3 points per dollar. In introducing this new category bonus transparency, Amex revealed two things: 1) the unpublished 3x bonus was long-lived and 2) it is now gone.

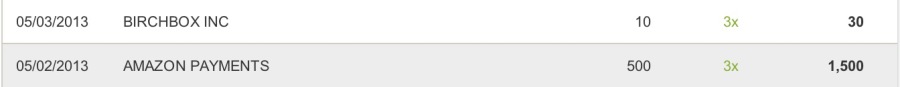

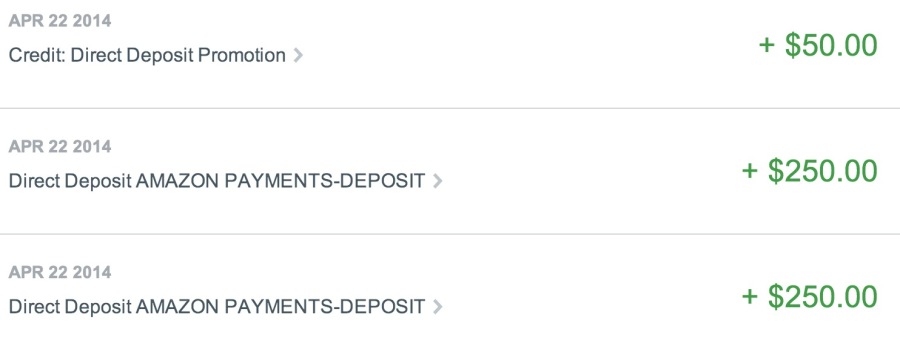

In the first photo, from May 2013, you can see that I had luck getting 3 Membership Rewards per dollar for all online transactions, including Amazon Payments. As you can imagine, this was a boon for my manufactured spending. I also got the 3x bonus for Birchbox, an online subscription service.

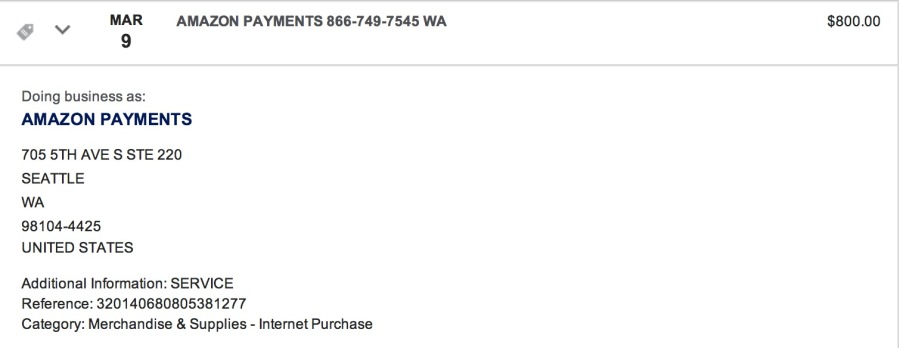

In the second photo, from March 2014, I got the standard 1 point per dollar – but it is coded as an internet purchase, NOT a cash advance, which is good to know – and it did earn me Membership Rewards points.

Bottom line

I was hanging on to the PRG card for this unpublished benefit. Now that it’s gone, and I have the EveryDay Preferred card, I have no use for this card any mre. And at $175 per year, it screams “cancel me.”

Going forward, I recommend the EveryDay Preferred card unless you know you’ll meet the $30,000 spending threshold to get the 15K Membership Rewards bonus. In all other cases, default to the EveryDay Preferred. You can read more of my analysis of these two cards in this post.

Having that bonus for online transactions was a good benefit. Now that category bonuses are visible on the website, it seems that this benefit has been removed.