AKA my first digest?

The Opportunity Cost of Being a Miles and Points Blogger via Miles for Family. This hit home for me in a big way. It’s why I try my best to keep blogging fun instead of a chore. I only write when I have something interesting to say. Otherwise, I keep my trapped closed. And that’s how I deal with generating new content. Must reiterate, if you like a blog, use their affiliate links if they have them, comment when you really love something, and interact with them. It’s the little things that make it all worth doing.

Via comments… There’s been some mud-slinging onto Million Mile Secrets and how they often don’t post the best links to credit card offers. A few thoughts about that… As always, do your due diligence. A quick Google search will in fact tell you the best offer. MMS has a mother-in-law rule where they lay out exactly how they try to give readers the best links, even if it doesn’t earn them anything. Finally, am I being naive here? Can anyone actually point out an instance where they’ve intentionally misled readers? I think it’s all hot air, and that they’ve actually done no wrong. Also see: The Opportunity Cost of Being a Miles and Points Blogger.

The Beginner’s Guide To Earning Airline Miles via BuzzFeed. I’ve been contracted to write a series of points & miles related articles for BuzzFeed Travel and this is the first one from the pipeline! It’s meant to be spread far and wide across the land, so feel free to share the link anywhere you see fit. Hopefully, it’s a good intro to this hobby, so send to your friends who are still putting everything on debit cards.

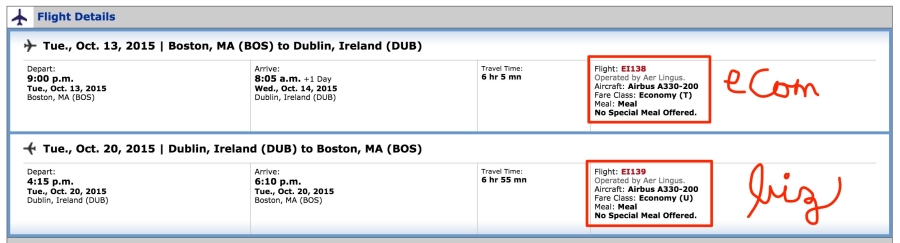

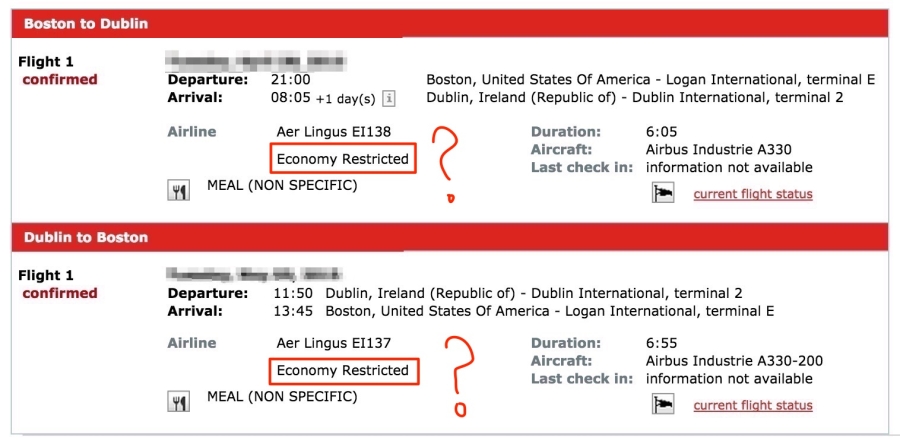

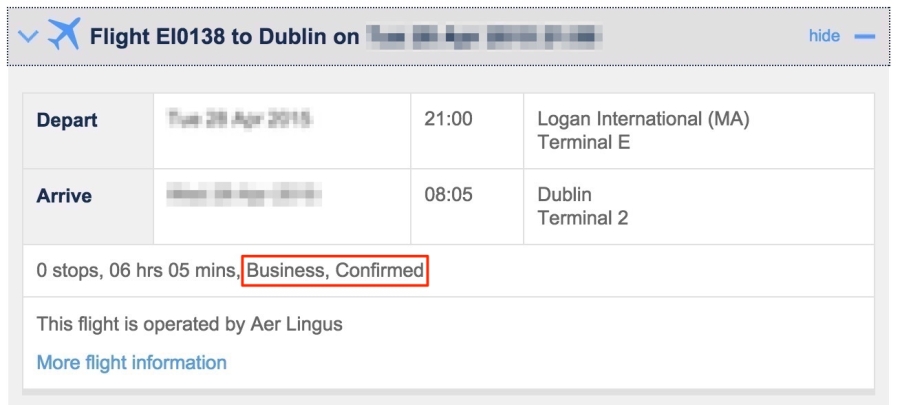

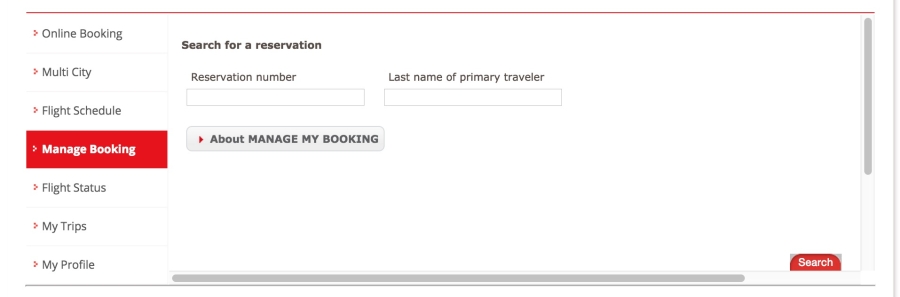

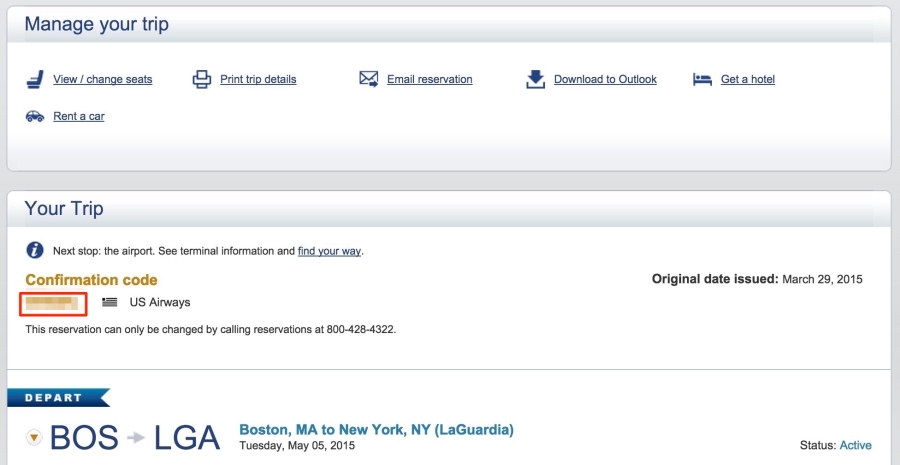

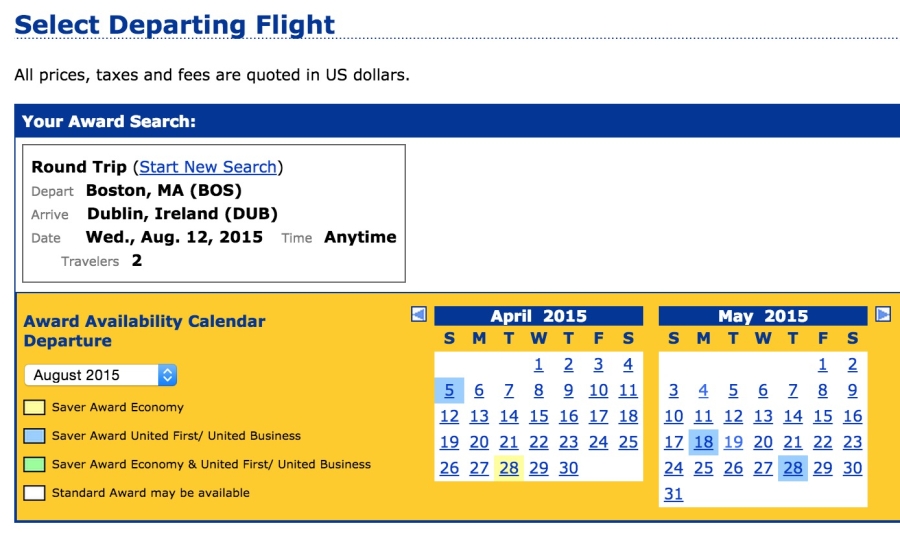

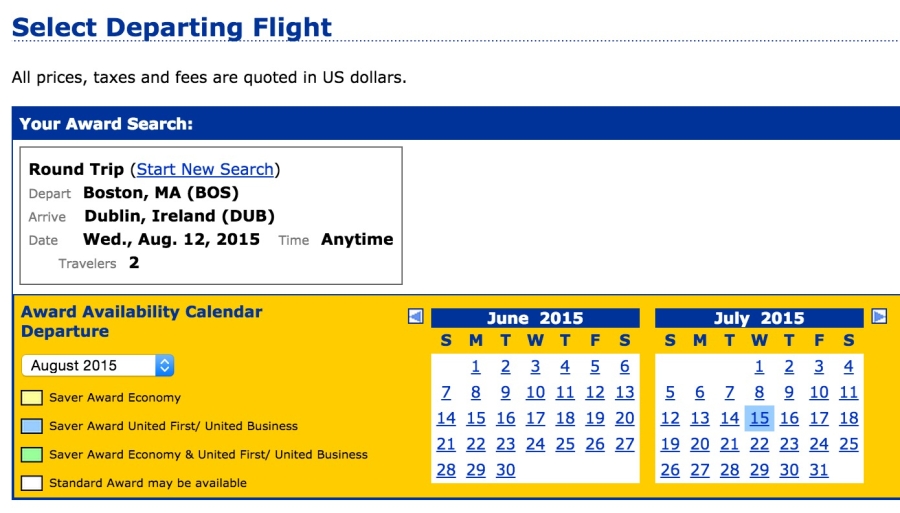

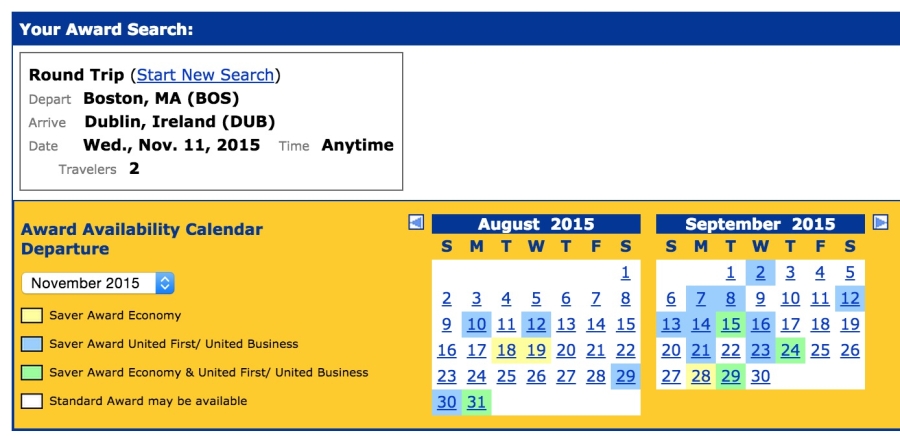

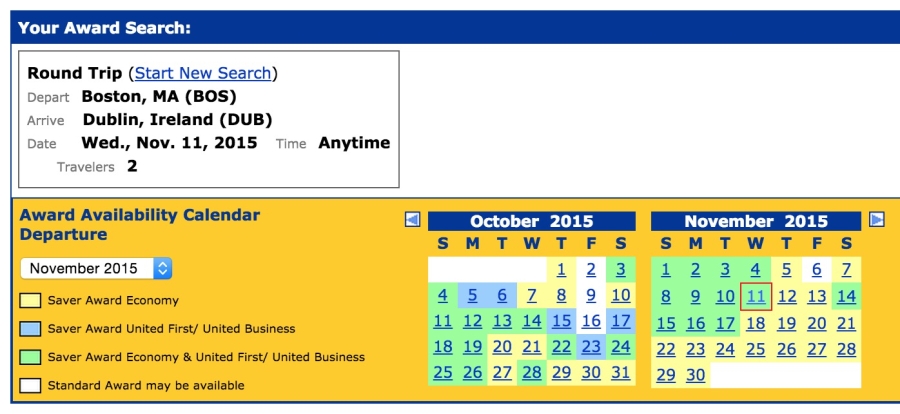

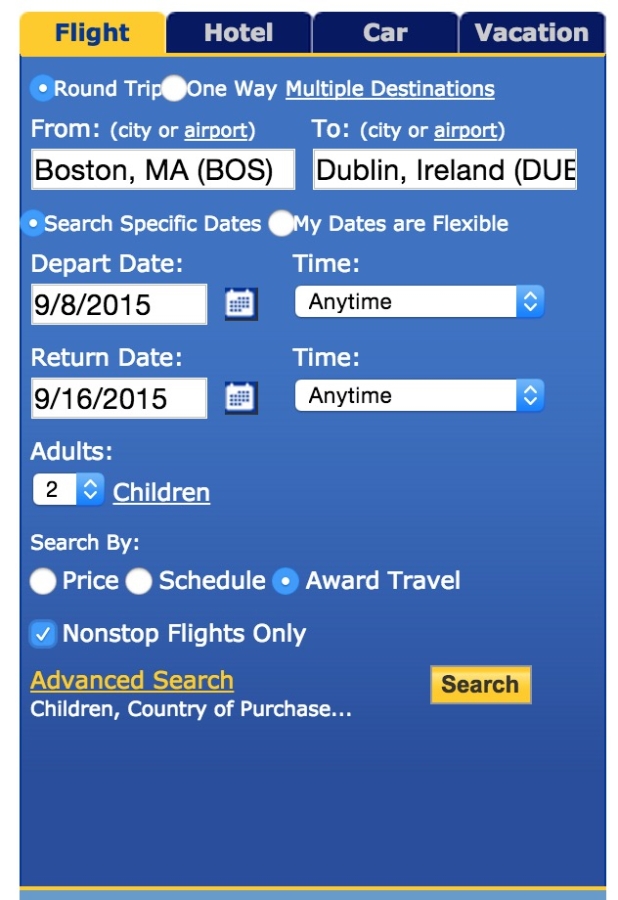

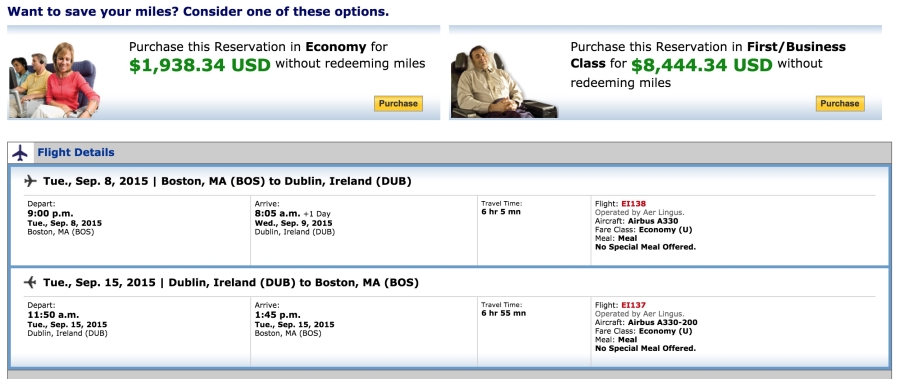

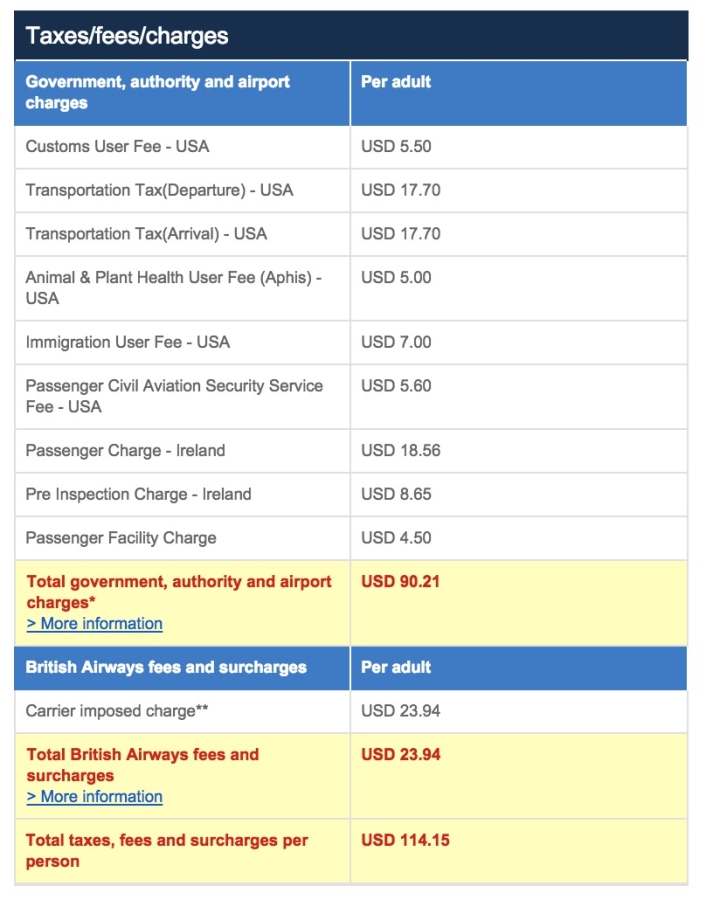

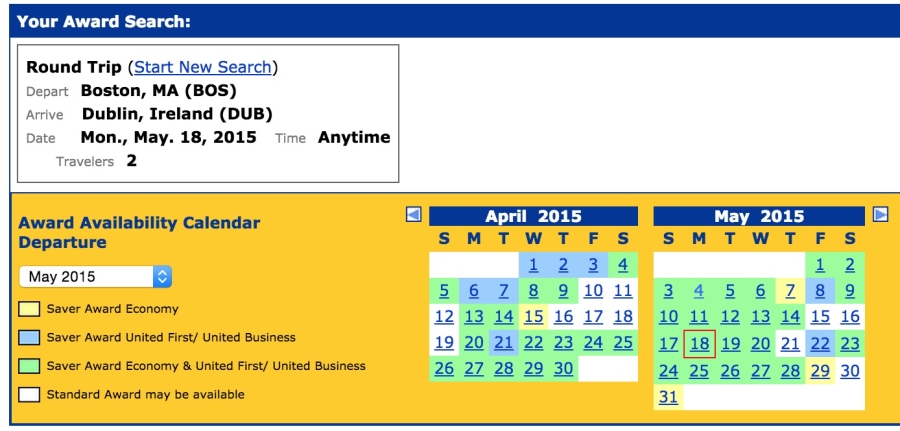

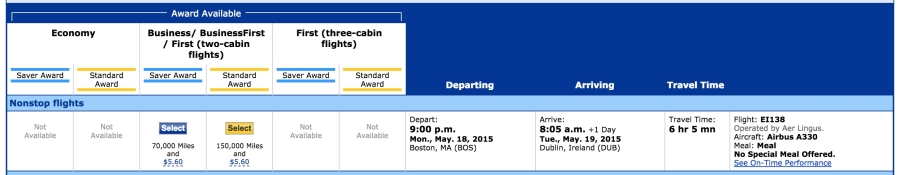

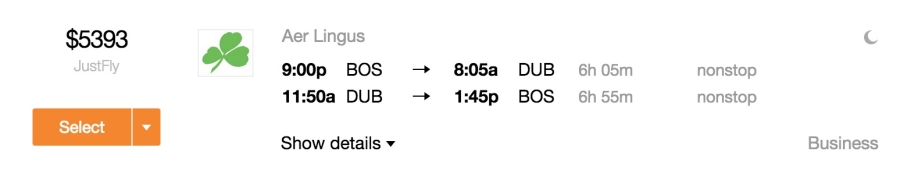

How to pick your Aer Lingus seats on an Avios booking via Points with a Crew. Useful info, and ties into my recent post about getting your Aer Lingus confirmation number from Royal Jordanian. And, as I get ready for Ireland, you may want to check Aer Lingus award space to have your own trip to the Emerald Isle.

Quick blogroll.

Want to express admiration for Rapid Travel Chai. Stefan has the right idea about things, and his passion for travel shows through to the surface in all of his posts. Aside from being a great writer and photographer, and an avid traveler, he’s a great guy. Highly recommend his blog.

Check out The Jetsetter’s Homestead, too. I’ve been having a blast interacting with Jennifer on Twitter. Also be sure to check out the rest of my Prior2Boarding crew. Lots of interesting tidbits scattered about, and a good rabbit hole to fall into if there ever was one.

One more to add: Doctor of Credit. Will has an awesome, thorough blog pertaining to the credit side of our hobby. A daily read and a mainstay on my feedly.

Gah, #MyTwitterLately is this odd mix of self-help quotes, lashing out, blog posts, and retweets (and general thirst, of course).

— Harlan Vaughn (@harlanvaughn) April 18, 2015

That wraps up my 1st “digest” – very cool. Kinda fun to post random thought in an unsorted order. I might have to do that more often.

Oh and one final note! If you are in NYC, please join us on the evening of April 22nd in the East Village for the Reach for the Miles meetup! Would love to meet new NYC peeps!