Did you hear about the new travel jacket that’s blowing Kickstarter out of the water?

They only wanted to raise $20,000, but as of today, they’ve blown past the $1M mark.

…And I think I want one.

They start at $109 and go up from there.

It comes in 4 styles (and multiple colors) for men and women:

All of the styles look functional and comfortable. And the company is based in Chicago. Holla!

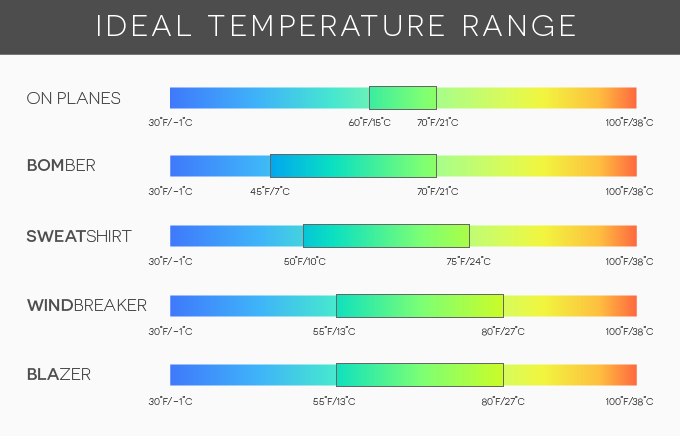

I think it’s interesting how they’ve chosen multiple types of fabric and recommend a style based on the temperature where it’s worn.

Of all the features, I think my favorites are the neck pillow and built-in gloves.

And with all the pockets, I could definitely bring along my coconut oil and apple cider vinegar. 🙂

Thought this was cool and wanted to share.

A little over $100… not a bad price, considering all the features.

But it seems like time’s running out if you wanna get one. And I can’t make up my mind!

On the fence.

Have you guys seen this jacket? Did you (or will you) get one?