My new Discover It card came in the mail this week, in very nice packaging.

And I might have to change my tune now.

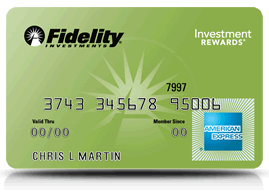

I’ve long heralded the Fidelity AMEX as the best cashback card.

But now I’ll refer to it as the best ongoing cashback card. Because, the 1st year at least, the Discover It has it beat by a mile.

I’ll still get great use out of the Discover It card the 2nd year, albeit much reduced.

The 1st year, this card is good for an easy $600, at least. And I’m even thinking this no annual fee card has the potential for over $1,000 back.