September is drifting past; Virgo season is over. Summer grass to fall leaves. I feel like I’ve been plugging away – and then I look at the numbers and I’ve actually slipped.

This month, I’m reminding myself that progress is slow and steady and every month won’t have big eye-popping gains. Plus, I’m getting three paychecks in October and anticipate that will help me get caught up. As cash-heavy as I’ve been, this month my stocks took a tumble.

Life was simple in September. It’s OK to feel stuck sometimes

I napped a lot. Continued meditating. Being so heavily invested in the stock market, I feel the fluctuations even more – especially now that I don’t own real estate any more.

And several things caught up with me: a big Costco run, a higher than expected phone bill, and a few nights out with friends now that restaurants are slowly re-opening here in Dallas. So while there wasn’t a lot of growth, I used money for the here-and-now.

With the election so close and headline news affecting the stock market, I didn’t realize any gains. But I’m still putting away 30% of my paycheck into my 401k and getting stocks at a discount. I do wish I’d saved more pure cash, though. That’s why these reflections are so helpful for planning each month.

September 2020 Freedom Update

I’m actually really nervous about the election this year. I’m certainly seeing the stock market react to the constant news cycles. Getting through October is going to require all of my ability. I’m having a hard time reconciling reality from news, and it’s kind of affecting me mentally. So there’s that going on.

But as mentioned, I’ll be getting three paychecks, so I can use two of them to:

- Pay down credit cards

- Make an additional auto loan payment

- Add some cash to savings

I should have an extra $3,000 to work with next month, so that’ll be my focus. I’ll also be adding $3,000 more to my 401k. It’s a bummer though, when you add money to your account and the next day, you’ve already lost some of it. :/

I tell myself: keep plugging away, plugging away. That’ll be my mantra in October.

Side note, is anyone else starting to feel nervous about all the news and November? It’s just this low-level anxiousness running at a baseline all the time these days.

Action items: make gains where possible

Ideally with my money next month, I’ll:

- Pay $1,000 toward credit cards

- Pay $1,000 toward auto loan

- Save $1,000 in “high-yield” savings

- Pay rent

And of course, I’ve got my 401k on auto-pay.

Guhhhh

Despite my efforts, market losses make progress seem… less impressive.

And of course, the stuff of like kept on coming. I allowed myself to shop and dine and splurge a little more than usual this month. I guess I figured, if it makes me happy now, go for it. Spending to make things feel better in the moment. Also the way my checks were timed this month was just really funky.

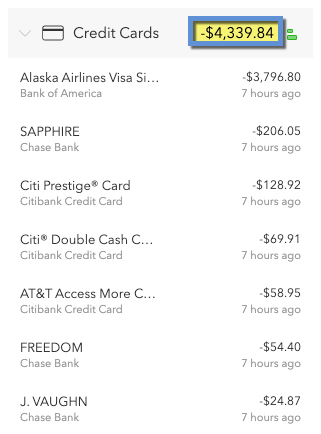

Note: that card with a ~$3,800 balance has a 0% APR until September 2021. So I’m not paying interest even though I’m carrying the balance – and still have a year to pay it off. The others I’ll pay off with my next check in early October.

Other losses

That feeling when you add $1,000 to your investments… and the next day it’s already worth less than that. And then having it lose more value all month. It doesn’t feel great.

I can’t with this year

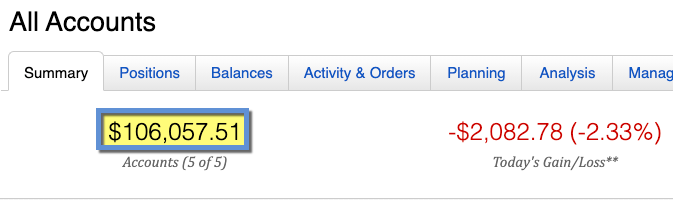

On September 2, I had ~$114,000 across all my accounts. On September 4 and 18, I added $1,000 each day.

And now, on the 23rd, my overall accounts are at ~$106,000. Aside from keeping head above water financially, I was kinda hoping my stocks would grow, or at least stay the same. I was hoping this would be progress I could measure in the other direction.

Oh god, what’s October gonna be like?

And I don’t expect October to be better. Which is why I’m planning to make gains and increase net worth by paying down debt and saving cash.

I thought for a split second about changing my 401k allocation to 20% to help with this, but then decided… nah. I’m gonna stay the course. Between my 401k, IRA, and what I put into savings, I’m actually saving 40% to 50% of my overall income these days.

At 36, I’m making up for lost time AND trying to get ahead, so that feels like a good level for me now. The dream would be to nudge that closer to a 60% savings rate, but like I said: keep plugging away. Get that debt eliminated, a little at a time.

By the numbers

Let me say, it stung to turn some of those positives into negatives in the table below. I also see stagnation here, what with no progress on my car loan and very little cash saved.

BUT.

I also see several of my goals marked COMPLETE and realize that over the course of this year, I’ve actually come very far. I really do think this was just a funky month. Trying to find the positives here – there really are a lot when I think of it that way.

That’ll do

Plus, I’m still up ~$40,000 from when I started tracking in November 2019.

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| Credit cards | $4,340 | $3,853 | +$487 | $0 | |

| Mortgage | $0 | $0 | xx | $0 | COMPLETE! |

| Car | $3,888 | $3,888 | xx | $0 | |

| Roth IRA 2019 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| Roth IRA 2020 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| 401k | $18,772 | $17,206 | +$1,566 | As much as possible | |

| Overall investments | $106,058 | $108,491 | -$2,433 | As much as possible | |

| Savings | $30,126 | $30,101 | +$125 | $20,000 | COMPLETE! |

| Net worth in Personal Capital | $137,993 | $141,954 | -$3,961 | $500,000 | Track your net worth with Personal Capital |

Something about seeing it all in black and white is always such a rush/thrill/letdown. But there it is in cold daylight. And as they say: numbers never lie.

September 2020 Freedom update bottom line

This month finds my numbers down, but not for lack of trying. Is it a national mood? Is it just me? Did I try hard enough?

If the news and politics continue to impact the stock market, I don’t see myself making gains though I’ll continue to contribute 30% of my paycheck – three times in October!

Instead, I’ll focus on adding to the bottom line and boost net worth by paying off balances and saving cash.

I do have this sort of lingering nervousness about the election and all that. Paying attention doesn’t help. Neither does ignoring it.

So I’m just gonna keep my head down and keep plugging away.

Did anyone else have a tough month on the financial front? Are you feeling stressy because of the news? Best I can tell, there’s no shaking the feeling. We just have to let it pass – like weather. I’ll take these notes and use them to plan for a stronger report next month.

Take care and be safe out there. Thank you for reading! ✨

Just for a smile 🙂

Add me on Instagram to keep in touch between blog posts – I use it as a “micro-blog” for quick thoughts and stories.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

why don’t you tally the Equity in your home?

I used to. I had a condo here in Dallas that I sold back in June 2020. It had a terrible HOA and ended up being a terrible experience, but I’m keeping it on my scorecard for 2020 for the sake of tracking and completion. I’m renting an apartment now and not sure when/if I’ll buy another residence. Great question!

Remember these 3 words always, whatever the market does: Dollar. Cost. Averaging.

Trying so hard. I know it’s like buying stocks on sale, but it gets tough to go up and down so much. Thanks for the reminder! <3

People tend to forget the market gains and then feel bad about the eventual losses. Try not to feel too bad about what you have little control over.

Yes! I think I just assume that things are doing their thing in the background and then I pull up the numbers and I’m like… really? Hoping to turn a corner in several ways before the end of the year. Thank you for the reminder, Carl!

Do you have any favorite stocks? I became a member at the Motley Fool back in January and have been doing great. It has been a rough month though! 🙂

VTI and FSKAX for me! I don’t think I’ll get into individual stocks, options, and day-trading. That would make my brain melt lol

I do single stocks and it’s such a time suck for me, but I’m a control freak so it’s the way it is. If you’re planning to FIRE, at what age? You’re still young so plenty of time. Your savings rate is excellent, and without a boat anchor of a house you’re really sailing now. Love reading these, at least I get to live vicariously through you.

Remember it’s about the journey to FI and not necessarily the destination to FI. There will be ups and there will be downs but remember to enjoy the ride along the way.

Yesss – trying! Thank you for the encouragement! I think the combination of losses + media hype got to me this month. But wanted to post an update anyway so I can remember the good months AND the ones that were more challenging. Thanks again, Josh!

No need to worry so much. With Trump and four more years, it’ll be ok – each year better than the last! Cheers